The mainstream idea stating that money emerges spontaneously as a result of the interaction of atomised agents that, seeking for profit maximization, create it to overcome the inefficiencies of barter has been so powerfully embedded in the collective conscience that money existence is taken as natural as that of water or air. Money is simply out there. It existed before us and will still exist after we die. Taking social constructs -like money and capitalism- as natural is dangerous because it rules out the possibility of questioning the current state of affairs. As an emergent of the financialization, contemporary money incorporates a set of values and by accepting its use (do we have any choice?) we automatically become agents of the system — we reproduce its logic and thereby contribute to its perpetuation. Should we feel guilty about this? Not. We would rather propose to be proactive and creative to discover new forms and uses for money. A new money that puts our societies into a more sustainable growth path.

The money we use everyday is what is normally called legal tender. Legal tender is a medium of payment recognized to be valid for meeting any financial obligation. Being the payment of taxes an obligation to which all citizens are subject, States around the world enjoy the privilege of issuing the currencies we all need and therefore accept. For a long time, this privilege has been shared with banks, which are entitled to create money through the provision of credit. In order to increase their revenues, banks can make money more expensive by making it artificially scarce. This means money ends up being distributed following a criterion of private profit rather than social welfare — this is where the values of financialization enter the scene: There is never enough money where it is needed and too much where it harms the environment (Dunkley, 2017). Moreover the growing interconnectedness of financial systems renders an unstable global economy where, unlike any other period in history, most of us are increasingly subordinated to massive upheavals coming from the financial sphere.

In other words, owing to factors that go beyond the domain of local communities and sometimes even nations as a whole, there is not enough money and credit available to function as a means of exchange to boost economic activity and employment. Even though individuals have skills and capabilities, communities as a whole come to a standstill because their members do not have enough money to make production and exchanges happen. If people are unable to exchange their goods and services solely because of lacking the correct piece of paper, then there is clearly a requirement for them to be issuing their own paper (Dunkley, 2017). This is what complementary currencies offer.

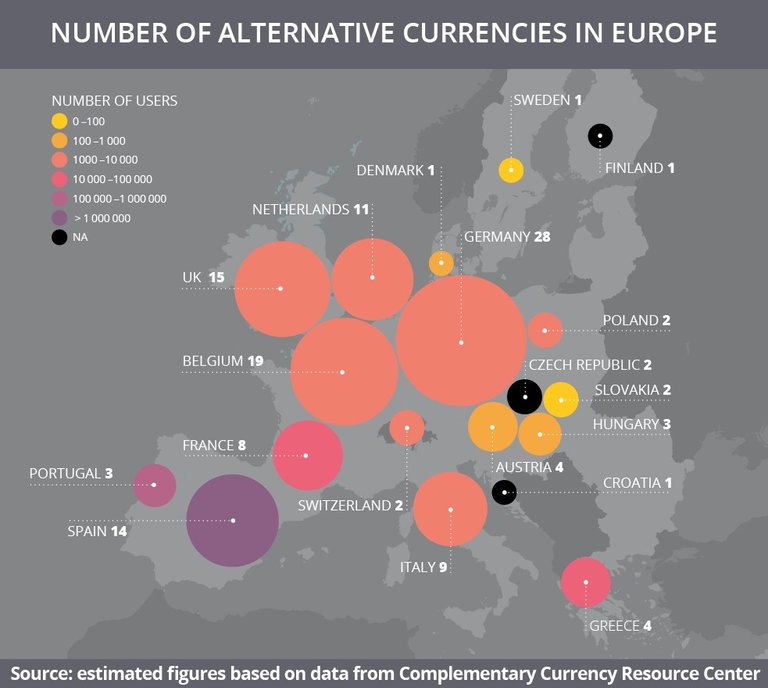

A complementary currency is an agreement within a community to accept as a medium of exchange a currency with no legal tender status. They are called “complementary” because their aim is not to replace the legal tender but to perform functions that the latter is not always able to deliver. These currencies are neither historically uncommon nor insignificant (Peacock, 2014; Graeber, 2011); however, most of the current ones have emerged and spread since the 1980s, mostly in Europe, the Americas, Oceania and Japan (Blanc and Fare, 2013). It is estimated that there are currently more than 4,000 currencies created by communities or local authorities around the globe (Lietaer and Dunne, 2013). Among these, some of the most successful and well-known systems include WIR (Switzerland), Sardex (Sardinia, Italy), SoNantes (Nantes, France), Banco Palmas (Fortaleza, Brazil) and Fureai Kippu (Japan). Types of complementary currencies can be defined according to their rules of issuance and circulation as well as the social actors involved, the most popular being Time Banks, Local Exchange Trading Systems, Commercial Credit Circuits, Convertible Local Currencies, etc.

Complementary currencies allow communities to protect and deepen their economic and social ties regardless of the ups and downs of the external environment. By providing a means of exchange that is accepted by every member as a legitimate way of paying for goods and services, these currencies can successfully connect idle resources with needs not met by conventional money (Kennedy, Lietaer and Rodgers, 2012). They facilitate the circulation of goods, services and labor where it is most needed and this is especially true in adverse contexts. For example, evidence shows that the circulation of WIR credits, the complementary currency issued by the WIR Bank in Switzerland, tends to increase in times of recession and lack of liquidity (Stodder, 2009). The same can be said about the Argentinean barter clubs, whose “créditos” reached enormous levels of circulation during the 1999–2003 period of crisis (Pearson, 2003).

In short, complementary currencies make possible exchanges and transactions that would otherwise be difficult. Individuals and enterprises who are unable to find customers for their services can eventually find them. They provide individuals and communities ways of empowering themselves by decentralizing and democratizing the control of credit, therefore creating exchange mechanisms independent of banks and governments (Grecco, 2018). Yet it should be highlighted that complementary currencies’ potential goes beyond providing an economic buffer against the upheavals of the external environment. As communities set the rules of issuance, circulation and destruction of their currencies in many possible ways, they effectively build a system capable of aligning the incentives of all individuals towards a common goal. In this sense, besides ensuring that the potential of individuals to exchange the product of their work can be realized, complementary currencies can help communities solve a wide range of problems — economic, social and environmental — which are not addressed by conventional money. The creation of parallel financial systems is the simplest application of a complementary currency. The universe of the problems that complementary currencies can help to tackle ranges from recycling to renewable energy production.

Despite their great potential, most complementary currency systems show a number of difficulties and cannot yet achieve high levels of utilization. On the one hand, these schemes usually lack reliable mechanisms to ensure safety and transparency in the administration of the currencies. To be successful, networks need a certain degree of trust among the participants that can only be achieved in small communities. As they grow, the strength of these bonds becomes threatened, and as a result, many communities decide to keep their currencies small to avoid failure. However, even when there is technology available to support systems with many members, the existence of a central administrator that guarantees the legitimacy of transactions seems unavoidable. As in traditional financial systems, the administrator receives the trust of users, and communities as a whole end up lacking the tools required for the audit and the government of the system.

In WABA.network we believe blockchain is the technology complementary currencies need to face their challenges and achieve a much needed scalability. Blockchain can enable all members of a community to see absolutely everything that happens on the system, tracking sources of imbalances or dishonest behaviors. But most importantly, the open, transparent and inviolable features of blockchain allow for the emergence of trustless complementary currencies, i.e. systems that work without requiring any trusted third-party in their operation (Dunkley, 2017). There is no need for all users to know each other or to trust a central administrator. Trust can in turn be based on reputation systems and the incorruptible records of the Blockchain. As a result, networks can scale without fear of losing reliability. This point is essential: The bigger a system is, the more sustainable it becomes because the supply of products is more diverse and the currency becomes easier to spend. A high number of participants implies more transactions and a more significant impact on communities.

But besides providing transparency, security and scalability, Blockchain’s decentralized nature allows for the successful design of governing structures aligned with the spirit of complementary currencies, namely, that power is built through consensus rather than through centralized actors, and that reputation is given by participation in the community rather than wealth. Specifically, blockchain-based smart contracts can be used to create sets of rules about the organization of communities and their currencies. These rules would be defined and agreed by all the members of a given community, and thanks to the structure of smart contracts, no one would have the power to change them unilaterally. It would also be guaranteed that rules are being observed at all times. Ultimately, blockchain provides the possibility of organizing a community and its own currency in such a way that the common will (however the community defines it) is being pursued at all times.

Precisely, the innovative contribution of WABA.network is the design of a complete platform which can be used by communities to fully design their complementary economic systems as well as their governing structure. Features can easily be customized according to the needs and the organizational structure of each community. Since the common will can change as the community evolves, the governing structure is flexible enough to be continuously shaped by the members of the community, thereby ensuring that it is always at the service of the people. All these features are programmed as a set of smart contracts in a code on the blockchain, thereby ensuring its transparency and inviolability. Based on the experience acquired by innumerable complementary currencies around the world, WABA.network is a solution to empower communities, that is, to give them the chance of taking full advantage of their capabilities as a whole in order to ensure that all individuals can choose and follow their own life plans.