Only when the tide goes out do you discover who’s been swimming naked, Warren Buffett famously quipped. A real-time financial example is unfolding in the bond this year, especially after yesterday’s jump in Treasury yields.

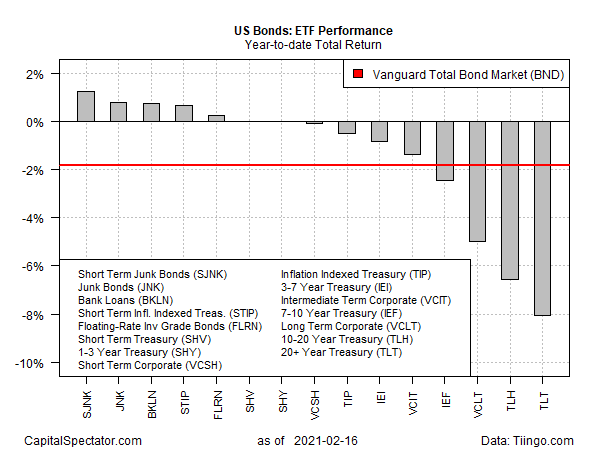

Last year’s widespread bull market in all corners of fixed income has given way to a bifurcated trend profile. Treasuries and investment-grade corporates are posting losses year to date through yesterday’s close (Feb. 16), based on a set of exchange traded funds. By contrast, a motely crew of junk bonds, bank loans, short-term inflation-indexed Treasuries and floating-rate bonds are enjoying gains so far in 2021.

The key variable that’s driving these results: rising interest rates. The reflation trade continues to post strong upside momentum. Consider the benchmark 10-year Treasury yield. After bottoming last August, this rate has been trending higher, jumping to 1.30% yesterday – close to a one-year high. That’s still low by historical standards, but the change in directional bias is conspicuous and is now on everyone’s radar.

US 10-Year Yield.  US 10-Year Yield.

US 10-Year Yield.

Higher rates generally translate into lower prices for bonds, but that’s not uniformly true for some corners of fixed income, at least not for the current year-to-date scorecard. The year-to-date winner at the moment: short-term junk bonds via SPDR® Bloomberg Barclays (LON:BARC) Short Term High Yield Bond ETF (NYSE:SJNK), which is ahead by 1.3% this year.

SJNK Daily Chart.  SJNK Daily Chart.

SJNK Daily Chart.

By contrast, long Treasuries have been crushed so far this year. Indeed, the deepest shade of red ink for our set of bond ETFs is i

Shares 20+ Year Treasury Bond ETF (NASDAQ:TLT), which has lost 8.1% year to date.

The U.S. bond market benchmark has suffered less, but the 1.8% loss for Vanguard Total Bond Market Index Fund ETF Shares (NASDAQ:BND) in 2021 is a reminder that broadly defined fixed-income beta is having a rough year.

Bond ETF Performance Chart.  Bond ETF Performance Chart.

Bond ETF Performance Chart.

The question for fixed-income investors is whether the early 2021 results are a signal for the year overall (and beyond)? The probabilities appear to be leaning in that direction, according to the 10-year/3-month Treasury yield curve. Based on this widely followed interest-rate spread, the upside potential for rates (driven by expectations that the economy will continue to recover) remains compelling. As Capital

Spectator.com discussed yesterday, now-casts for first-quarter GDP points to a modest pickup in economic growth and the yield curve is pricing in that outlook.

3-Month Yield.  3-Month Yield.

3-Month Yield.

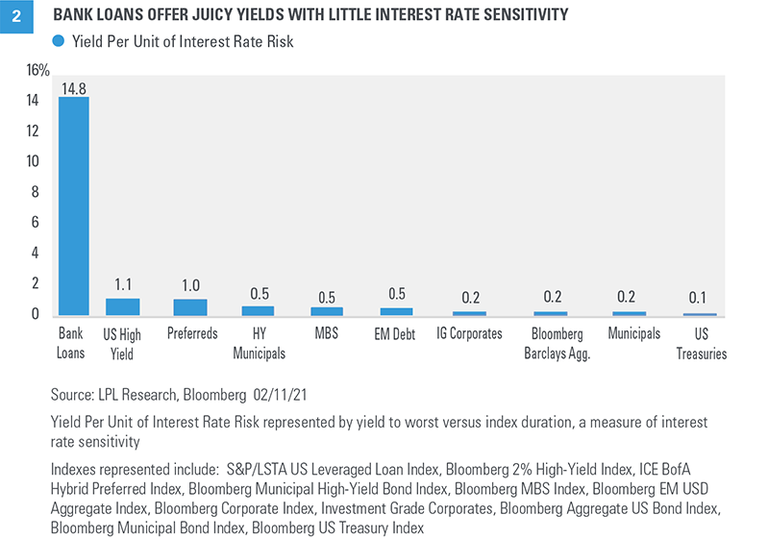

Navigating the bond market in the current environment promises to be challenging. But for investors looking for yield, bank loans are worth a closer look, advises LPL Financial (NASDAQ:LPLA). This corner of debt is “may be an attractive option due to the improving economic environment and limited rate sensitivity,” write LPL analysts Jeffrey Buchbinder and Lawrence Gillum this week. They advise that bank loans are “offering potential yields in the 4% range with extremely low interest rate sensitivity.” Estimating this slice of the debt market via yield per unit of risk (based on yield to worst versus index duration), bank loans rank as a favorable outlier in a rising interest-rate environment.

Bank Loans.  Bank Loans.

Bank Loans.

Invesco Senior Loan ETF (NYSE:BKLN), an ETF proxy for the bank loan market, has a 3.5% trailing 12-month yield, according to Morningstar. Although the realized payout is subject to change (as all trailing yields for funds are), the BKLN’s trailing rate is dramatically higher than the current 10-year Treasury’s 1.3%.

Perhaps more importantly, BKLN’s modest year-to-date gain in the current climate suggests that LPL’s estimate of “limited rate sensitivity” has empirical support.

Buchbinder and Lawrence Gillum warn that bank loans aren’t a silver bullet:

“It’s important to understand the trade-off between interest risk and credit risk. We know there is no such thing as a free lunch,” they note. “That additional income compensation comes with assuming credit risk (the risk of a default or credit downgrade) and the risk that prices drop sharply in a risk-off environment if demand suddenly dries up.”

But for the moment, BKLN (along with junk bonds and floating-rate bonds) are enjoying their moment in the sun.