Above we see that a likely wedge break to the upside seems possible in the next several days.

How much volume will accompany this? Along with price movement? Takes a better person than I to say, but we are headed into November/December. I think end of year months tend to be good for blockchain investments. If we rally into December, I am unsure if we're out of the woods, but this could certainly be the beginning of the bull market.

In prior instances when we faced a possible near-term rally, I was more certain it was not the beginning of a bull market. This one at least stands of the chance of being the beginning. It may not be, but at least we have hit a phase in the cryptocurrency market where a recovery is possible.

Possible Plays for November/December:

BTC... but how much will it really rally? Will it hit 8k even? Percentage wise, this is not amazing for crypto, though if it hits 8k, it could benefit other projects in market cap. increases.

Ripple / XRP

I like what I am seeing in XRP. I give it 60% to 80% odds, Ripple has a secondary move past the 50 cent mark it is currently at. And I would anticipate this move to get near 70 cents, up to possibly 1 USD. I would favor it moves like this, before it would see a retest of the lows. So before it hits 40 cents again (if ever), I would expect it to hit 70 cents first. I phrase it this way because putting hard timeframes on things can be difficult, but I would favor this type of move happens between now and the end of Jan 2019. Ripple chart may indicate the overall market bottom

Ripple's chart-strength here may signal the end of the declines in cryptocurrency. Often there are things like leading-indicators in markets such as certain investments, and Ripple may be acting as such for all of cryptocurrency, giving us a better indicator than BTC.

- EOS is looking good

For EOS, I am setting a target zone for Nov 2018 to Jan 2018 in the $7.50 to $16 range. This is a good one because it could be an easy 100% return in a 3 month time frame. The chart just has a lot of leeway to go higher before hitting resistance levels. It could see new ATH later in 2019.

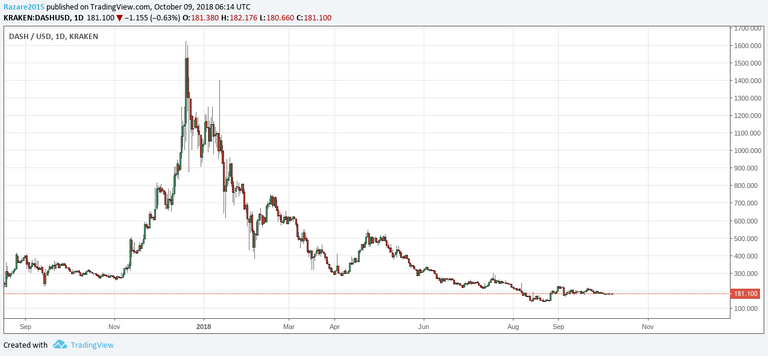

- DASH ??? I stopped researching this one because it just did amazing in 2017, and then also, most of my Dash funds were stolen. It's hard to keep promoting something that you first promoted when it was $20 and you watch it reach $1,400 and the whole way you are bullish. This all said, Dash has a great organizational budget, and keeps pushing forward with their strategy. I cannot fault their organizational goals, so they are worth doing more research to see the current situation for their cryptocurrency. In the near-term Dash's price may not do amazing, but long-term, they seem to be at a pivotal buy-level assuming their organization does not have any hidden issues. Assuming all is well after due-dilligence, their currency could reach something like 10 billion market cap very easily in the next 2 years. I don't see this one as a soonish play, but if crypto recovers, the soonish play may be okay.

Long-term investing is legitimately back on the table from what I am seeing. I would wade in carefully and strategically according to your personal strategies. My article here is not investment advice, just an approximation of what I think markets will be doing in the future.

Let's start making money again in crypto!!!!

Personally, I just bought some additional EOS to trade over a near-term timeframe of the next 3 months. This is apart from my regular holdings of EOS.

good work! we need some help in the "sentiment area"....(my latest.)

Good analysis @crypto-investor

Lets see can't wait to see what the trend will be like btc to the moon or down :D

XRP was a crap call specifically. I still favor it going up, but just shot right below the 40 cent mark in this dip to prove me wrong.

I'd watch the BTC prices over the next several days if you went long. If it looks like things aren't adding up for this rally, then we'll have to pull the plug if you went long. I'll watch what others are saying too.