BY CRYSTAL STRANGER, CO-FOUNDER, PEACOUNTS ON 6/20/2018 AT 5:30AM

Image By Liberty Pell

The price of Bitcoin took a hammering this past week, as fears that manipulation of the token Tether fueled unrealistic price gains in 2017 in both Bitcoin and Alt Coins. According to a paper published last Wednesday by John Griffin and Amin Shams, 50 percent of the gains in Bitcoin — over 2017 — were directly connected to the issuance of 2.5 billion worth of Tether, that may not have any amount of US dollars backing it. Still, during 2017, Bitcoin’s market cap increased from roughly $15 billion to $237 billion, and it is hard to imagine that, even if Tether had zero US dollars backing that $2.5 billion total valuation, that this would have equated to the $111 billion of gains in Bitcoin.

This seems like bad math to me.

This isn’t the first case of bad math in the cryptocurrency world. Frequently, statistics are manipulated to support all extremes of market positions. I recently heard a talk by Bart Smets, Co-Founder and COO of SwissCryp, at Bitcoinference in Brussels, Belgium, who said that if even just .01% of the fiat money supply goes into crypto, it would make a tremendous impact. Smets argued the world money supply is a total of $180 quintillion dollars (represented numerically as $180,000,000,000,000,000,000 — that’s 18 zeroes!); and if even just .0001% of this money entered the crypto market, it would equate to $180 trillion dollars in market cap.

The math part of my brain immediately jumped up and said “these figures are all wrong!”; the specific examples he gave were inaccurate from a statistical mathematics standpoint. $180 trillion is more than half the total amount of the global financial market, as calculated by Sanjeev Sanyal at Deutsch Bank in 2015, thus using the $180 quintillion example as a starting point seems absurd.

Since then my brain has been working non-stop on trying to find a formula that does work. Sanyal calculated that there are $294 trillion dollars in the world financial markets, and $127 trillion dollars just in the world stocks and bonds markets. If we believe that one percent of this will flow into the crypto market in the next rise, that is still $1.27 trillion dollars of new cash injection, which would represent more than a quadrupling of the current cryptocurrency market cap of $273 billion. I would say this more conservative estimate of cryptocurrency market growth is rather likely, perhaps as high as 2–5% of assets could move into cryptocurrencies once we have reasonable regulation.

Image By 99 Bitcoins

Definitely the time to buy is now!

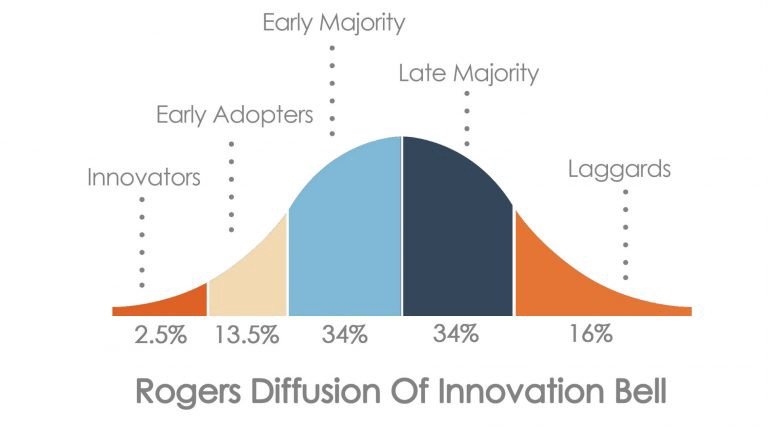

The question, though, is exactly when that institutional money will start to move into the crypto market. If you look at the Roger’s curve of technological adoption, right now we are at what is known as the “early adopters” phase of a widespread embrace of cryptocurrencies.

The barriers to investment are still relatively high. Many credit-card companies and banks do not allow cards to be used for purchases in crypto exchanges such as Coinbase. Deposits using fiat money can take five days or longer, and if the market is falling during that time while the funds are held, you can get stuck in at a loss, unable to move funds back into US dollars. Other countries have it easier. In Switzerland, you can add Bitcoin to your wallet at any train ticket kiosk. But in the US and most other countries worldwide, it is still so difficult that I doubt any substantial level of adoption has occurred at all.

Adoption by small investors, though, would only have a minor impact on the market. Still, this trickle of funds entering the market through pools and ICOs could potentially double the market cap from where it is now over the next few years. Especially as you consider the outflow from mining and staking operations. No, for there to be real gains in the cryptocurrency market, the funds from institutional investors must be able to flow freely into the market. And regulation must occur for this to happen.

There has been some regulation in small countries and in small ways. Indonesia just announced legislation declaring cryptocurrencies as commodities. A number of countries are competing for the most favorable ICO legislation. But in the US, we are far from having any reasonable legislation. And the same is true for the EU. The question, though, is not if regulation will happen, but when.

Whenever potential regulation is announced, it will likely be preceded by a sharp rise in the crypto market. Insiders will start buying before any announcement, and as such this will signal, at least to me, that we may be nearing a real shot at regulation.

Either way, this regulation will spell a real boom time for cryptocurrencies, especially as the market cap rises and there are more options for funds to be able to participate in the market at the levels of buys they make. It is not a huge stretch of the imagination to picture asset allocation schedules in the future, including a percentage held in cryptocurrency.

Raising of interest rates will also help drive more investors into the crypto market, and as the Federal Reserve announced recently that a fourth interest rate hike this year is possible, this is likely to make assets that are hedges against inflation more desirable. Bitcoin is an ultimate hedge against inflation as it is secure and the total circulation is limited. I won’t go so far as to call it digital gold, as I hate that failed analogy, but the eloquent algorithm it is based on does carry value as an inflationary hedge.

The math part of my brain immediately jumped up and said “these figures are all wrong!” — Crystal Stranger / Image by E-News

This entrance of institutional investors would easily spell a bigger chunk of the worldwide financial markets moving into crypto tokens. With a five percent movement into cryptocurrencies, this would be an increase in the market cap of twenty times. Of course you must consider that the way the market currently moves in concert with Alt Coins following the overall trend of Bitcoin will probably have ended by then. The Pareto Principle states that the top twenty percent of all companies create eighty percent of the wealth. Using this logic, we can determine it is likely that eighty percent of all ICOs issued will have worthless tokens within the next five years. This is already occurring as the website DeadCoins.com shows more than 800 tokens that are already deemed worthless. This means the remaining twenty percent of tokens will likely make up twenty times today’s market cap, leading to very substantial gains for some of today’s smaller tokens that can withstand the test of time.

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

More on ME 👇

If you have any questions please feel free to reach out! I’ll be here to answer them.

Website

Crystal Stranger, EA, author of The Small Business Tax Guide (Clear Advantage, 2014), wanted to help her tax clients who struggled when it came to bookkeeping. Looking to help entrepreneurs focus on business instead of finances, she co-founded PeaCounts, an automated accounting software using AI and blockchain. PeaCounts is tokenizing their payroll system using the token PEA with an ICO starting in July.