Assalamu Alaikum Dear Hive Friends Everyone’s To All Good Morning And Happy Everyday And Welcome.To Visit My Profile And Thanks To All Hive Friend’s For Your Big And Good Support Me And I Am Very Happy Everyday.And I Hope Yours Are Happy Too.

BTC Bitcoin price is rising again. But there are several factors affecting the crypto market, which could lead to a bad situation? First, the crypto market is highly volatile and volatile. The main reasons could be the salutation of the original property, the distressed policy, the unprofessionalism of construction and the mismatch between our conditions. Besides, our situation can be helpful in social and political changes, which can add more complexity?

A massive Bitcoin ($BTC) whale has amassed over $500 million worth of the flagship cryptocurrency since the beginning of the year, and their dollar-cost averaging strategy has seemingly been working as their unrealized profit now exceeds $126 million.

The price of Bitcoin has surged by more than 120% so far this year to now trade above the $37,000 mark, partly based on optimism surrounding the potential approval of BlackRock’s proposed iShares spot Bitcoin exchange-traded fund (ETF) by the U.S. Securities and Exchange Commission (SEC).

Earlier this year, after it was found that the ETF was listed on the Depository Trust & Clearing Corporation (DTCC), which provides post-trading, settlement, custody, and information services for Nasdaq, Bitcoin’s price surged as optimism grew, with analysts saying the listing is part of the process of launching an ETF.

As the price of BTC kept rising, a whale managed to accumulate 14,599 BTC at an average price of $28,071 per token. Given BTC’s current price level, they’re sitting on an unrealized profit of over $126 million according to on-chain analysis service Lookonchain.

Data from Bitinfocharts revealed that this whale’s wallet, empty until January 17 (coinciding with the BTC surge past $20,000), started filling rapidly. By early March, the whale had acquired almost 4,000 BTC, and following BlackRock’s filing, they more than doubled their holdings.

As CryptoGlobe reported, a recent report from Matrixport suggests that Bitcoin is now in its fifth bull cycle, and notably includes a BTC price prediction targeting $125,000 by the end of next year.

The report concludes that the “end of October 2022 was the perfect entry time” and that as momentum grows, “further gains are anticipated.” The firm recently analyzed the potential impact the approval of BlackRock’s spot Bitcoin exchange-traded fund (ETF) could have on the cryptocurrency space, suggesting BTC could surge to $56,000.

A spot Bitcoin ETF would provide a regulated and mainstream investment vehicle for investors to get exposure to Bitcoin without owning the cryptocurrency directly.

Featured image via Unsplash.

Disclaimer

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

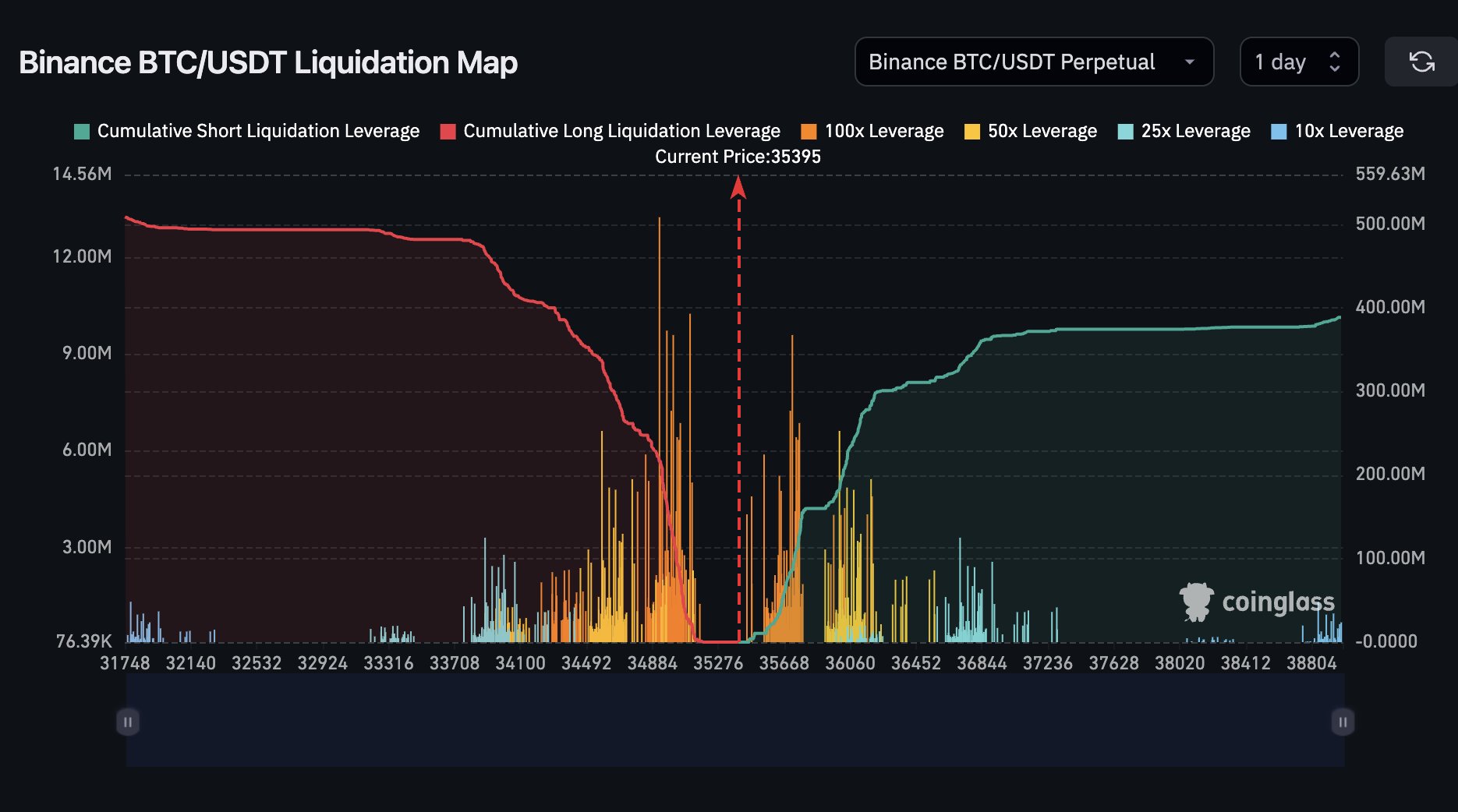

BTC/USDT perpetual swap liquidity chart. Source: Daan Crypto Trades/X

BTC/USDT perpetual swap liquidity chart. Source: Daan Crypto Trades/X

J.P. Morgan analysts, led by Nikolaos Panigirtzoglou, have expressed doubts about the sustainability of the current cryptocurrency market rally, as reported by The Block. Their research note, sent out to clients on November 8, points to two main factors influencing the market’s recent upswing.

Firstly, there’s anticipation of a U.S. spot bitcoin ETF approval. However, J.P. Morgan analysts are skeptical about this leading to a significant influx of new capital into the crypto markets. They suggest that the approval might result in a reallocation of existing investments from current Bitcoin products rather than attracting fresh capital. This skepticism is further supported by the limited interest in similar ETFs in Canada and Europe.

Secondly, the perceived defeat of the SEC in its legal cases against Ripple and Grayscale is considered a factor. Despite these apparent losses, J.P. Morgan analysts remain uncertain about any significant easing of crypto regulations in the U.S. They cite the unregulated nature of the crypto industry and the recent FTX fraud as reasons for continued regulatory caution.

Additionally, the analysts believe that the upcoming Bitcoin halving event in April/May 2024 is already factored into the current Bitcoin price, suggesting that the market has already priced in its potential impact.

Featured Image via Pixabay