This is something I pondered for a while. As I watch what is taking place in the mainstream, I am led to believe that the average person has no idea what is going on. This is by design since Wall Street could not behave in the manner they do if people were paying attention.

Personally, I am amazed they kept this thing propped up as long as they did. I figured 2019 would certainly be the year when recession hit. It is looking like that is going to be pushed out into 2020 at a minimum.

The economic collapse of a decade ago was a bad one. I feel the next one we see is going to be worse. The stock market is at an all time high with revenues essentially flat. We do not operate according to business cycles anymore but, instead, are on credit cycles. Stock buybacks using low interest rate money is what makes the numbers of most companies look attractive.

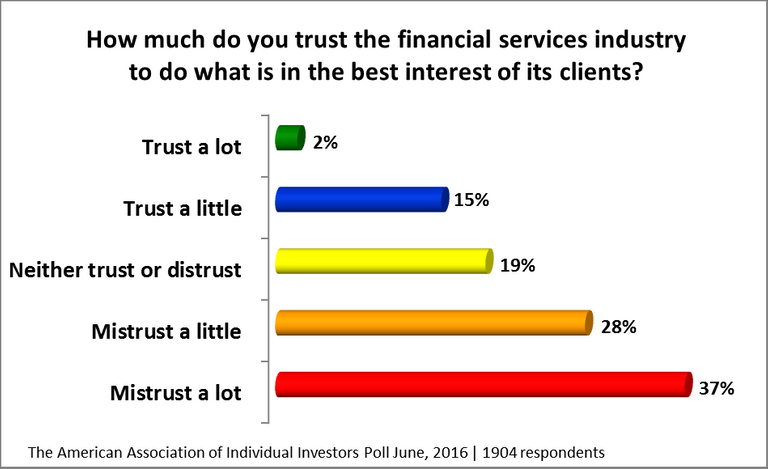

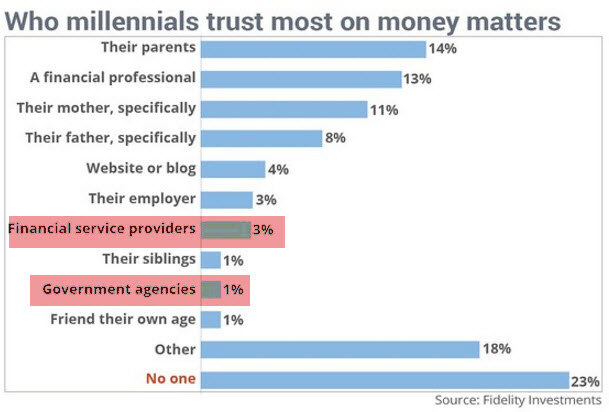

We saw a lasting effect from the last go around. Looking at a couple of charts, we see a very telling picture.

What can we derive from these charts?

To start, people do not trust Wall Street and the financial services industry. This is a logical conclusion since that industry, for the most part, does not consider the needs of its customers. Instead, they are just sheep who are led to slaughter.

The second thing is that the millennials are looking at things a lot differently. These are people who saw their parents, in the United States, lose their homes. What is important to note is this group started around 1980, meaning they are nearing 40. These people are about to enter their peak earning years yet have a distrust for Wall Street.

Which brings us to today.

If we are in for another financial crisis that rivals, or surpasses, that of a decade ago, what is different? In my view, we now have another option. Cryptocurrency and blockchain based developments are really kicking into gear. This provides an alternative to the traditional avenues of investment that was fatal to most people.

Obviously, markets are always subject to euphoria and crypto was no different. We saw a major run up at the end of 2017 that reversed course throughout 2018. There are a lot of people who are in the red on their cryptocurrency because of this. So, obviously, this is not without its risks either.

Most of us are aware of the fact there are serious issues with our economic and financial system. The reason that it persists is because people do not know there is an alternative out there. Cryptocurrency has a bad name thanks to the FUD and constant bashing of the MSM. Will that be the case when the traditional economic and financial assets start crashing?

Wall Street might end up being cryptocurrency's biggest ally. One thing about the bankers is they cannot help themselves. They will keep stealing, cheating, and robbing until there is nothing left. The fact they racked up a quarter of trillion in fines in the United States alone in the last decade shows their true colors.

It is important to look at things from a holistic level to grasp what is going on. If things do turn much worse in terms of the fundamental economics and markets crash due to that, we might well see crypto be the beneficiary of that.

People are desperate for an alternative. Sadly, they simply are not aware of one that exists. The next market crash could really aid in the adoption of this alternate vehicle.

If you found this article informative, please give an upvote and resteem.

Would be cool if we know the charts for generations before millenials to see the shift

You just planted 0.10 tree(s)!

We have planted already

7717.51 trees

out of 1,000,000

Let's save and restore Abongphen Highland Forest

in Cameroonian village Kedjom-Keku!

My Steem Power = 24615.58

Thanks a lot!

Thanks to @fuadsm Plant trees with @treeplanter and get paid for it! @martin.mikes coordinator of @kedjom-keku

Getting people to use it is the biggest problem now. Everybody who is in now is hodling or trading, but few are actually using it as currency. Regulators who said cryptocurrency is a "stock" have done damage to the currency dimension of this asset which causes it to freeze up and makes it less useful. If crypto is to become established, it should follow the same general course that the weed industry took.

However, the next bull cycle will begin to change this. As more and more people have crypto, more will use it as a medium of exchange. At the same time, the more people pile in, the more stable the price action gets, which decreases volatility. People hate spending when volatility can ruin your purchasing power, but will be more incentivized to spend as it stabilizes.

I'm expecting a return to where we were around spring 2017 by summer 2020 and by early 2021 a parabolic breakout well beyond past all time highs.

Hi taskmaster

Nice post @taskmaster4450, I agree the Wall St business model is about to get disrupted big time, with asset and share tokenisation.

Check out what we are doing at Relex sometime.

We have started to crowd fund actual real estate development projects and community infrastructure projects in different parts of the world and are also offering investments in Canadian based Woodfine LP Units which allow for crypto to be exchanged for real estate assets on the Relexcapital platform.

https://www.relex.io https://www.relexcapital.com

I really think it will...

I don't know if investors/banks will take up Bitcoin as a digital gold (it has a lot of benefits to gold, but is obviously prone to higher volatility... but I do expect we'll see more people on Steem as lots of people try and earn themselves more money to pay off their bills.

I'd expect the overall cryptocurrency market to drop off a bit as people pull their spare money out... or get scared when others do so... but I imagine blockchains like Steem that create tokens daily will actually increase in activity.

I am a bit nervous about it all... but I'm also wildly curious to see how it all plays out.

Thank you so much for participating in the Partiko Delegation Plan Round 1! We really appreciate your support! As part of the delegation benefits, we just gave you a 3.00% upvote! Together, let’s change the world!

Ha, when I saw the first image (the one that shows up as a thumbnail), I thought this must be a poll on Steem.

Turns out everybody feels pretty much the same way about financial institutions and their services...

Posted using Steeve, an AI-powered Steem interface

Hi @taskmaster4450!

Your UA account score is currently 6.249 which ranks you at #236 across all Steem accounts.

Your rank has not changed in the last three days.Your post was upvoted by @steem-ua, new Steem dApp, using UserAuthority for algorithmic post curation!

In our last Algorithmic Curation Round, consisting of 325 contributions, your post is ranked at #11.

Evaluation of your UA score:

Feel free to join our @steem-ua Discord server

The US tax cuts in 2018 helped extend the growth further along but also inflated the debt bubble even more as the cuts have not paid for themselves and probably will not. The lack of tools for stimulus when the economy contracts will be an ugly reminder of the how much is backing fiat.

Posted using Partiko iOS