CRYPTOCOIN INSURANCE: Project Overview

Trading on the cryptocurrency market has already passed several development stages: from the first centralized exchanges where there were almost no volumes up to several hundred exchanges where the leaders have a turnover that exceeds one billion dollars a day. Recently the US Securities and Exchange Commission has authorized trading of Bitcoin futures at the largest US stock exchanges.

Why hasn't such stock exchange been created on the cryptocurrency market yet? There are a number of reasons that will be considered below.

Merely the players that form this demand cannot find the appropriate instrument they need, first of all, for insuring risks. For example, a client pays insurance in the amount of 0.1 Bitcoin for the deposit in the amount of 3 Bitcoins. If the price decreases by 15% within 3 days, he gets the right to get the insurance in the amount of the deposit fall - 0.45 Bitcoins.

In case of the insurance event, CRYPTOCOIN INSURANCE pays the client the insurance from the previously obtained insurances. If there has been no insurance event, the insurance paid by the client will be the company's income. In order not to confuse a huge number of clients who do not understand and do not want to deal with options, CRYPTOCOIN INSURANCE has created a two-in-one solution:

- CRYPTOCOIN INSURANCE launches the world's first option cryptocurrency exchange. It allows Traders and hedge funds conclude deals on purchase and sale of stock options.

- CRYPTOCOIN INSURANCE creates an insurance company, places options in the insurance that is understandable for everyone, and hedges its risks on the option exchange.

The exchange will start operating with 5 cryptocurrencies that have the maximum market. Furthermore, as the demand and turnover increase, the exchange will add other cryptocurrencies. CRYPTOCOIN INSURANCE sells both Bitcoin or Ethereum growth and fall insurance. Thus, it hedges its risk.

Today CRYPTOCOIN INSURANCE has no competitors and occupies the entire market. No competition in the market allows maintaining a significant margin on the level of 20%. CRYPTOCOIN INSURANCE repackages and sells/buys its own risk as options on its own exchange.

CRYPTOCOIN INSURANCE: CCIN Token

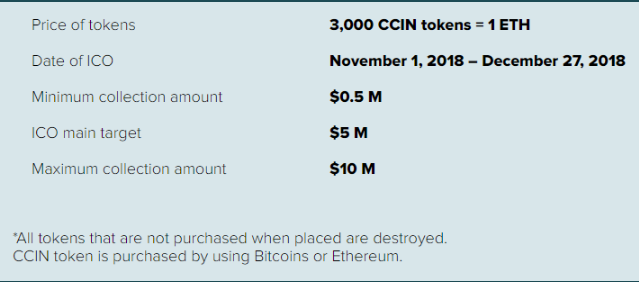

CCIN tokens will be placed during the ICO. Their total number is strictly fixed. The fixed number of CCIN tokens guarantees their buyers the increase in their value as the exchange earnings grow. Tokens will be introduced to the cryptocurrency exchanges within 30 days after the end of the ICO.

The Company has developed a simple and understandable model for the increase in the CCIN token value. 30% of each commission obtained by the option exchange will be directed to the liquidity fund. Within the next month CRYPTOCOIN INSURANCE sends these funds to purchase CCIN tokens from the market and burns them.

The promise to buy tokens from the future profits cannot be transparent. In case of CRYPTOCOIN INSURANCE tokens, investors know exactly that each option purchase/sell transaction generates the cash flow used to buy tokens.

If the turnover is $50 million per day, the commission for both sides of the transaction will be $500,000 or $15 million a month. 30% of this amount or $5 million are sent monthly to buy CCIN tokens from the market

For more information, you can visit the following links:

WEBSITE: https://ccin.io/

WHITEPAPER: https://ccin.io/doc/Whitepapereng.pdf

ANN TREAD: https://bitcointalk.org/index.php?topic=4948618

BOUNTY THREAD: https://bitcointalk.org/index.php?topic=4969375.0

TWITTER: https://twitter.com/ccin_official

FACEBOOK: https://web.facebook.com/ccinofficial/

TELEGRAM: https://t.me/ccin_official

Author: Binar Bumi

Bitcointalk Username: binar234

Bitcointalk Profile Link: https://bitcointalk.org/index.php?action=profile;u=2053245

ETH Address: 0x573E9730fe386661F91D9189A0330ce577df0175