.png)

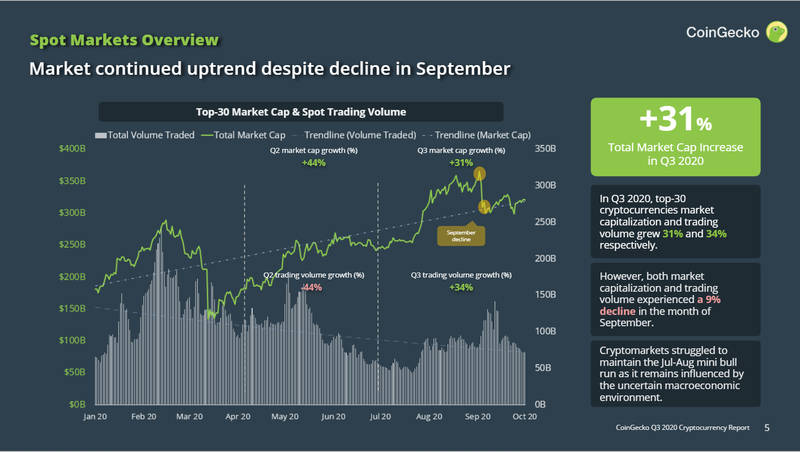

Other than the minor dip in mid-September, we have seen a continuous uptrend in the total crypto market cap since the March crash. Bitcoin’s volatility continues to show a strong correlation with the traditional S&P 500 (SPX) index.

In Q3, we also saw several new decentralized exchanges springing up and gaining popularity, fueled by the much-hyped yield farming trend kick-started by Compound in June.

There is much to unpack in the CoinGecko Q3 2020 Quarterly Cryptocurrency Report.

Here are some of the main highlights:

Market Capitalization continued to grow amidst September uncertainties

In Q3, the crypto markets experienced positive growth of +31% in market capitalization and +34% in trading volume.

However, towards the end of Q3, market uncertainties reinjected fear into the markets and trimmed Q3 gains.

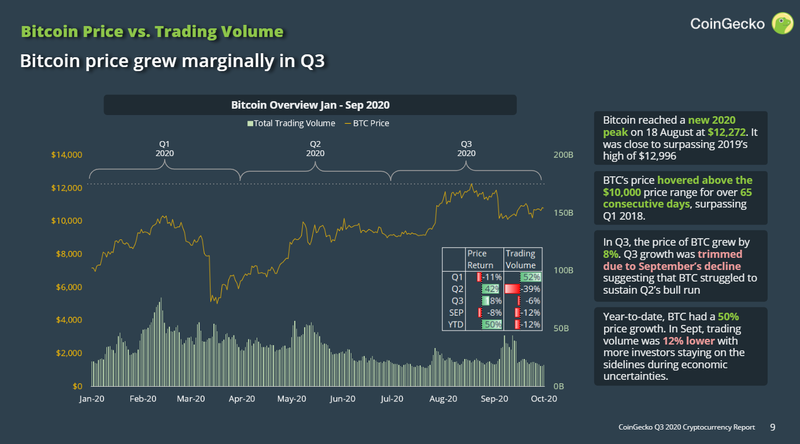

The price of bitcoin grew, reaching a new peak at $12,272

We are seeing a record-breaking period for Bitcoin (BTC) with Bitcoin staying above the $10,000 benchmark for a sustained period of time, currently tallying at 65 consecutive days by the end of Q3 and counting.

Q3 also saw the price of Bitcoin reaching a new peak at $12,272. However, the faltering trading volume suggests that investors may be staying on the sidelines.

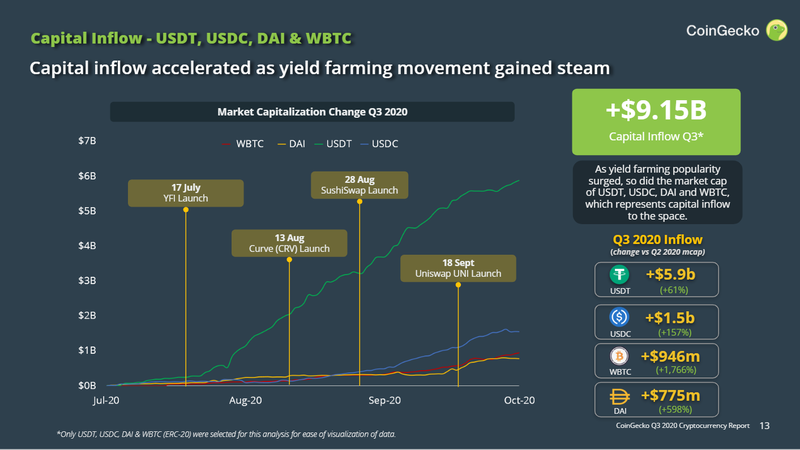

Over $9 billion capital inflow in this quarter due to yield farming movement

Q3 2020 was likely the period of time where capital inflow to the Ethereum (ETH) blockchain is at its largest to-date since inception.

Impressively, over $9 billion flowed into the space in this quarter alone, with Tether (USDT) accounting for nearly two-thirds of the total inflow.

Towards the end of Q3, it appears that the capital inflow has slowed down slightly due to reduced yield farming returns.

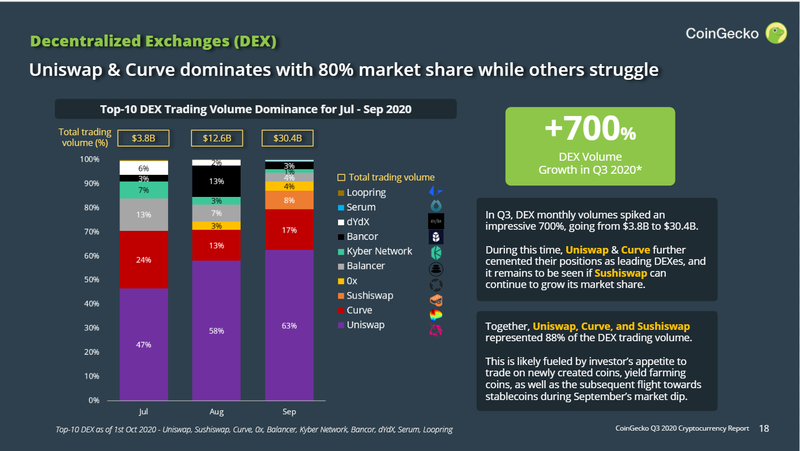

Uniswap strengthens its dominance of the DEX market

In Q3, the DeFi & yield farming hype pushed trading volumes on decentralized exchanges up to new highs. Monthly trading volumes reached a 700% increase.

Throughout this period, Uniswap & Curve both remained as the dominant trading avenues.

Sushiswap (which is a fork of Uniswap), managed to grab up to 8% of market share, but it remains to be seen if it can continue to innovate.

Like what you see? Sign up to our newsletter for daily crypto updates and follow us on Twitter (@coingecko) for alpha leaks!