My first impression is that COLU could be a good idea, and even it might be a serious ICO. However there are are many issues not explained in the site.

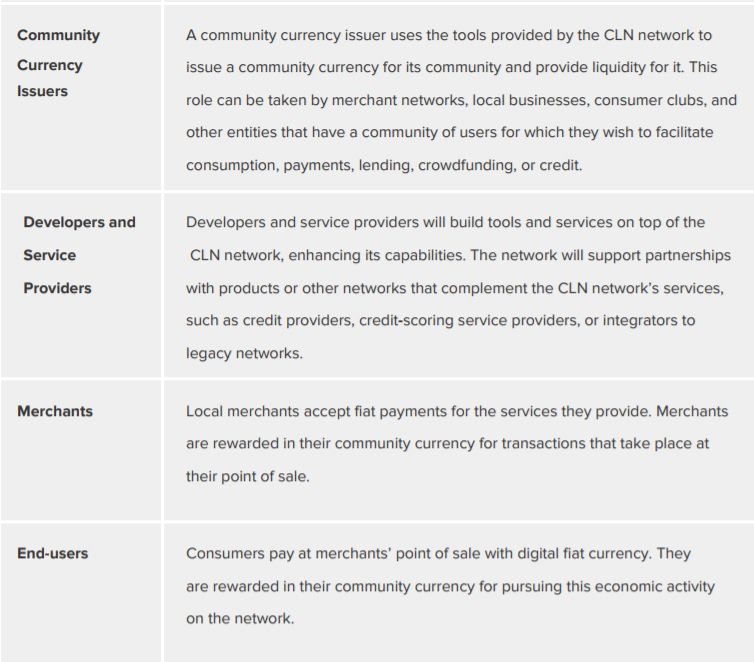

The objective is for communities to issue local currencies as an incentive to local business. However it seems quite a complicated scheme for merchants and users to adopt it. For example:

"As part of the issuance process the issuer locks a certain amount of CLN in an automatic

market-making contract. The lock-in of CLNs releases a portion of community currency

tokens to the issuer and establishes an “issuance price” for the community currency.

That is, the amount of CLNs locked in by the issuer determines the initial value of the

local community, measured by the product of the amount of circulating tokens and the

issuance price. From this point onwards, this price evolves according to the flow of

trades sent by anyone to the market making contract. If the issuer chooses not to lock

any CLNs in the reserve of the market making contract, the issuance price is set to zero

and all community currency tokens are locked in the contract initially, implying a starting

value of zero to the community. Any appreciation in value from this point onwards will be

as a result of demand for the community currency, paid for in CLNs."

Who could be issuers? and the gateways?

And then, multiple currencies and a CLN token above them? Would the value of CLN depend on the new currencies issued? The business model is not explained clearly in the whitepaper.

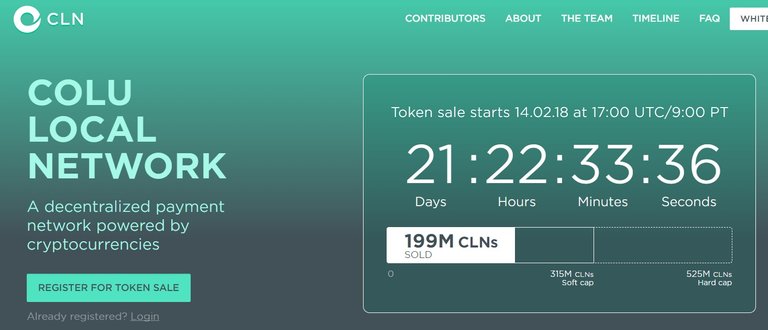

It will be interesting to follow this project, but participating in the ICO? I do not know...

Follow me back