TOKENOMICS: A Case Study With The $CROWNS Token

How demand and supply dynamics affect the price of $CROWNS

According to Jean-Baptiste - a literal french economist and a businessman "Demand and supply are the opposite extremes of the beam, whence depend on the scale of dearness and cheapness; the price is the point of equilibrium, where the momentum of the one ceases, and that of the other begins."

supply and demands for crowns tokens designed by @empato365

Demand and supply are the foundational pillars of economics and they play a dominant role in the economics of utility tokens (tokenomics) and affect the present and future price of the token. This case study with the CROWNS token provides a framework for projecting future demand and price for utility tokens.

Tokenomics is a nascent and rapidly evolving concept. I encourage investors to make well-considered and well-informed decisions and ensure they all read this article to clarify.

understanding the tokenomics of crowns - designed by @empato365

understanding the tokenomics of crowns - designed by @empato365

Seascape Network is a new gaming platform centered around the DeFi and NFT economies. The team uses gamification, DeFi, and NFTs to build an incentivized ecosystem for crypto gamers, developers, and influencers. Their official token is Crowns, which goes by the ticker CWS / pCWS, and is designed to incentivize all key stakeholders within the network. Seascape's main aim is to build a gaming platform that allows developers to publish high-quality games while also enabling users to earn Crowns and NFTs for their time spent playing.

UTILITY TOKENS - A CAPITAL STRUCTURE BREAK-THROUGH

Traditionally, debt and equity (bonds and stocks) are the two main avenues entrepreneurs use to raise capital for their enterprise. Cash flows (interest payments) are largely predetermined in debt investing. On the other hand, equities give the investor exposure to cash flows (via dividends) and future demand for the products or services offered by the enterprise (as rising earnings lead to price appreciation). Although there have been several variants like convertible bonds, preferred equity, etc., over the years, the debt and equity-based capital structure have existed for a long time. For context, stocks have been trading for over 400 years. The first recorded IPO (initial public offering, not to be confused with ICO, initial coin offering) occurred in 1602 when the Dutch East India Company offered its shares to the public.

Bitcoin, and several other crypto projects that have followed, expand the capital structure by removing cash flows from the equation, thus providing pure exposure to the growth of the project. The projects are funded with the expectation that the demand for the services provided by the project will rise in the future, and that will lead to a rise in the price of the native token.

PRESENT INTRINSIC VALUE OF THE SEASCAPE PROJECT - $CROWNS

Market cap measures the present economic value of a project that investors collectively agree upon; it's the product of the number of tokens in circulation, and the price of each token.

(CROWNS) Market Cap = Circulating Supply * (CROWNS) Token Price

It is important to separate the concepts of maximum supply from circulating supply at this point. CROWNS has a fixed MAXIMUM SUPPLY of ~10 million tokens, of which ~1.209 million are currently in circulation. It's the number of tokens in circulating supply that affects the market cap of a project. The MAXIMUM supply of CROWN tokens is fixed and will not change, and that qualifies it to become a deflationary asset class. On the other hand, the circulating supply will be determined by the economic forces and trading activities in the market.

Holding the present value (current market cap) of the seascape project constant, we can imply that token price and circulating supply are inversely related. In other words, an increase in supply will result in a drop in token price, and a reduction in supply will boost the price.

Token Price = (1 / Circulating Supply) * Market Cap

FUTURE VALUE OF THE SEASCAPE PROJECT

The future value of the seascape project can be determined by projecting any changes in the circulating supply and the price of the token.

Future Price: Holding supply constant, the price of the token is driven by the value the seascape project adds through its products and services, and the overall crypto market performance - as the crypto asset class grows, the beta of the asset class will affect prices of all tokens including the CROWN tokens.

Change in Token Price ~CROWNS Value Added + Crypto Beta

Future Supply: The future supply of the CROWNS token is affected by the number of new tokens released for gaming on the seascape network, covering costs, and the number of tokens staked or consumed thereby removing them from the circulating supply.

Future Supply = Current Supply + Tokens Released - Tokens Staked or Consumed

Tokens Released: Tokens are released into the circulating supply to cover the cost of building games on the seascape platform - compensation, technology services, legal fees are some of the key components.

Many of these costs are denominated in fiat currency, so the higher the price of the CROWN tokens, the fewer the tokens that need to be issued to cover costs.

Tokens Staked or Consumed: Seascape is building a gaming network that supports DeFi and NFT economies that will create opportunities for staking and spending when participating in the network. When users of the Seascape network stake tokens, the tokens continue to be owned by them but not longer circulate in the open market. On the other hand, when users spend tokens on a gaming service, the tokens are returned to the seascape network and can potentially be taken out of the circulating supply. Staking or spending does not result in the burning of any tokens, and the maximum supply remains fixed.

TOKEN DISTRIBUTION

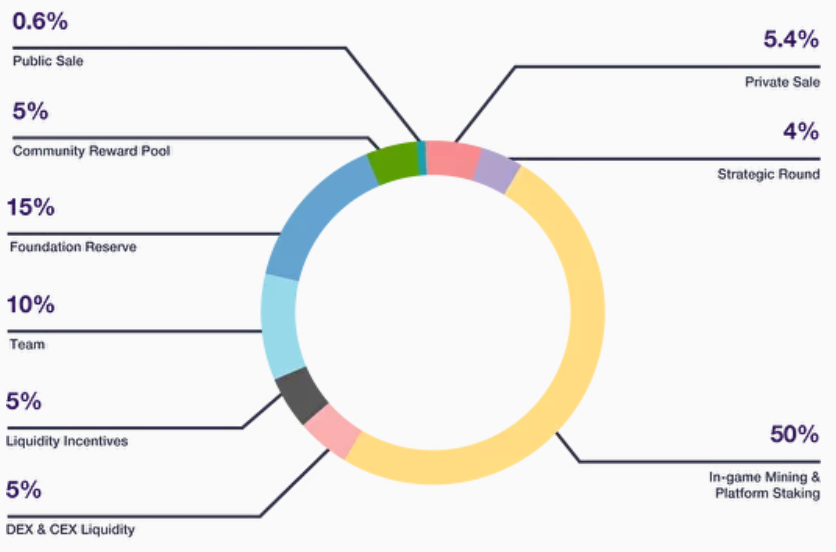

$CROWNS token distribution.

It is clearly indicated on the infographic that 50% of the $CROWNS token distribution goes into the in-game mining and platform staking. 10% goes to the seascape foundation reserve and 10% to the team working towards the coming soon success of this great project. 5% each respectively goes to the liquidity incentives, community reward pool, and DEX &CEX liquidity which makes up 15% in total, and this also a very good thing to do.

Like all other DeFi projects, Seascape's Tokenomics is based on a system of locking and releasing, to generate a stable and growth-oriented flow throughout the ecosystem. This growth is facilitated by incentivized play and development. There are a total of 10 million Crowns available for circulation, a deliberately small number. The chart below shows Seascape's Token distribution.

WHAT DOES THIS MEAN TO INVESTORS?

A big opportunity! For a cryptocurrency to have a similar supply like Bitcoin, it could be classified as a GEM or a digital gold as the case may be. Bitcoin only has a maximum supply of 21Million coins compared to crowns which have only 10M tokens and that is less than half of the maximum supply of bitcoin.

The price is the point of equilibrium, as the French economist Jean-Baptiste Say correctly observed. The direction and momentum of the price are determined by the value added by seascapes games, products, and services, any changes to the circulating supply of the token, and the overall crypto market performance (crypto beta). Seascape is building products and services that will increase user adoption, and drive demand for the CROWNS token. With all the intrinsic value that CROWN tokens do have as potentials, one can be confident that demand for the broader crypto asset class and commitment demonstrated by several projects like seascape will positively influence crypto beta in the long run.

Where to Get Crowns on Ethereum

- Uniswap

- Bitmax

- MXC

Where do Get Crowns on BSC

- BakerySwap

- PancakeSwap

- WOWSwap

- Bitmax

- ValueDefi

Get Scapes, Seascape’s original NFTs here

- OpeanSea

- Treasureland

- BakerySwap