Create the blockchain of title

After the discussion about the theory of token creation and the various possiblities of token issuance this article offers you 14 software solutions to create a customized ledger on top of existing blockchains (meta coins) and a variety of other solutions (sidechains, smart contracts and DApps).

Tokens are tracking title over something valuable. The goal of tokenization is to define a value standard that is easier and safer to handle than conventional trade in goods. In commodity and foreign exchange trading, one of the key values is 'shiftability': The fast and flawless transfer of assets. Cryptographic tokens allow the conception of a competitive asset market. The purpose of this market is to provide optimal, free floating currencies or goods that act as a medium of exchange. It should provide accurate information about the provenance and property. The market's price discovery will signal the willingness of the public to hold the competing currency. To keep the value of the coin stable the issuer can adjust the market supply. If the commodity equivalent of such a currency is about to decrease the issuer would need to change the composition of the basket or adjust the money supply to the change in demand.

Token features

In a broader sense, asset tokens can be understood as a unit of account that an organization creates to manage its business model and distribute the benefits to all its stakeholders. The following parameters must be observed when creating and issuing tokens:

| Parameter | Design |

|---|---|

| Software system | The choice of the underlying ledger technology or blockchain will determine how smoothly the transaction can be used as a fungible or non-fungible payment unit. |

| Fee / toll | The token can be used as a fee to enable the use of a platform or the execution of smart contracts. A fee system can also act as a deposit, e.g. as a punishment for misconduct or as an anti-spam fee. |

| Value exchange | A company can accept tokens in the form of a voucher in exchange for a product, a service or a membership (waiting list). There are three distinct exchange systems: closed (can't be exchanged into other currencies), unilateral (not redeemable after purchase) and bilateral (redeemable at any time). |

| Privileges | Non-fungible tokens can be a digital proof of purchase or ownership, possibly even linked to a share of a company. |

| Organisational structure | Depending on whether it is a Distributed Collaborative Organization (DAO) or a centralized business structure, different legal conditions apply. In theory, the legal enforceability of DAOs does not exist. |

| Cash flow | The tokens can be used as tips, automated reallocation, as a deposit or to pay dividends. |

| Convertion logic | Buy back guarantee, fixed to a given exchange rate, free floating on exchanges. |

| Technical features | With the use of software clients, functions such as voting rights can be programmed into the tokens. In addition, technical attributes such as divisibility or demurrage can be defined at protocol level. |

Legal framework

Both investors and issuers need to know whether or not their project is considered a regulated security. If the token is associated with a share of a traditional company and pays dividends, it is very likely that regulators will conclude that the token is a security and thus a possible violation of national securities laws.

As a token issuer, it is important to comply with the legal requirements of the country in which the token is issued. In addition, it should be considered that certain investor protection rights apply to investors in some countries. Many governments have already published guidelines for ICOs. Switzerland has declared itself in favour of crypto currencies as follows:

- Utility tokens remain uncontrolled.

- Currency tokens (from bilateral exchange systems) must comply with anti-money laundering laws.

- Asset tokens or security tokens (such as derivatives and shares) are definitely securities and must comply with the provisions of the Investment Act (FINMA, not amended).

However, it is unclear how one can undoubtedly determine whether a token falls under the classification of utility, currency or asset.

The most common way to prove whether a particular token needs to be regulated as a security token is the Howey test:

- It is an investment.

- One expects profits from the investment.

- The money is invested in a conventional company.

- Every profit results from the efforts of a promoter or a third party.

How to govern the issuance of your token

As described before, counterparty gives you distinct possibilities to create tokens. However, if you want to issue thousands of non-fungible tokens this is costly while spamming the market. Rare Pepes has issued their 33rd series of trading cards. Technically, every trading card is their own currency in the 'pepesphere'. If you want to issue a proof-of-ownership token that stands for a unique non-divisible object The PEPEPIZA token is the best example of what you don't seek for:

ASSET NAME: PEPEPIZZA

AMOUNT ISSUED: 1

Scaling Collectables

If you rather looking for a token ecosystem where you can create a massive amount of distinct non-fungible tokens in a cheaper way, then you should check out the other possible solutions.

Uses cases can be artwork, pharmaceuticals, precious metals & minerals, and high value consumer products.

To run an Ethereum contract transaction fees are usually cheaper than with Counterparty. Maybe we will see the Lightning Network working soon, so there will be a chance for scaling counterparty assets though. Crowd Machine tries to lower fees with performance optimization and cheaper data distribution via p2p cloud servers.

Data management for collectables

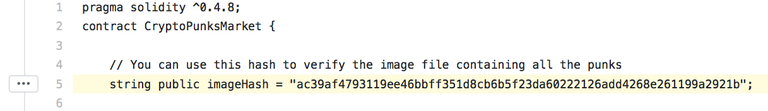

To make every token non-fungible, there need to be an unequivocal proof of its underlying asset. The hashed information of the digital or physical assets need to be included in the token contract or to be linked to each token ID or opcode. For physical assets, a serial code needs to be proven by a trustful auditor before it can be hashed and written into the token contract.

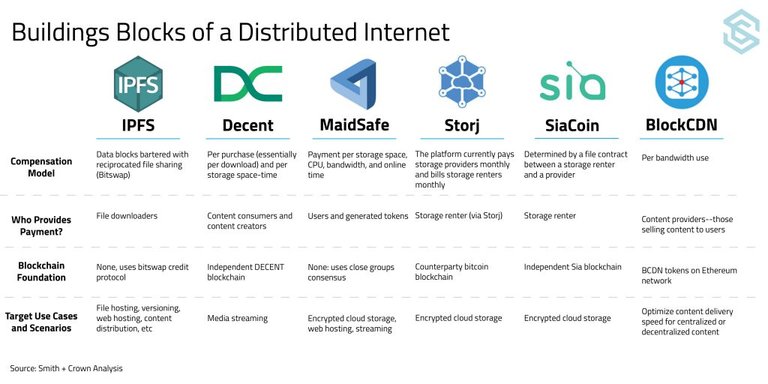

For more security and decentralization it may be wise to store the files or metadata on a distributed file system like IPFS or Swarm. For instance, DTube uses IPFS to store their videos decentralized by sharing ipfsstore

learn more about IPFS + Ethereum

Other data storage solutions are BitTorrent clients like [tribler.org(]https://www.tribler.org) and vTorrent or decentralized p2p cloud server technology like Sia, Minebox, MaidSafe, Filecoin and Storj.

Learn more about distributed file systems in this TEDtalk by IPFS creator Juan Benet.

Asset vaulting

Usually assets were held as a deposit in custodian vaults, lockers or warehouses. A third party auditor performs a complete audit of each asset regularly. After physical examination is completed, the auditor submits a record in the registry or ledger that hereby custodians' escrow funds can be unlocked.

If the token owner is not the possessor of the physical asset it is a bailment or it needs to come with a storage contract.

In UK law), a bailment is a duty without the need of a contract. The bailee intends the physical control of the assets that are linked to the NFTs.

In most other countries, a storage contract (Wertlagervertrag (DE) / Hinterlegungsvertrag (CH) / Storage account agreement (US) ) is mandatory.

For other use cases, such as equities and ETF tokens it's even more complicated as it will be regulated in most countries.

Introduction of the 14 working software solutions

The following solutions are public, private and/or consortial blockchains that use smart contracts, sidechains and coloring schemes to enable isuer issued tokens. Please note that solutions based on other blockchain technologies than Bitcoin and Ethereum could turn out to be a scam.

Disclaimer: There's no guarantee that company or user issued tokens have any value at all. Be careful with asset trading! Token issuance is easy, so be aware of fake tokens claiming to be a 1:1 peg with Bitcoin etc.

1.Ethereum, digital assets with an embedded hash code of the composite file written into a smart contract

Type: Smart Contract (e.g. ERC-20 or ERC-721), public blockchain

CryptoPunks used an 852 KB composite image stored on their own servers to verify the integrity of their unique characters.

2.Counterparty.io and xchain.io

Type: meta coin, public blockchains (BTC, BCH, MONA)

The PEPEPIZZA token has been created with Counterparty and explored through xchain.

Type: meta coin, public blockchain (BTC)

Type: meta coin, public blockchain (BTC)

In the omni explorer there are more than 300 asset tokens to display.

Type: colored coin, public blockchain (BTC)

Type: smart contract engine, public / consortial blockchain

Queries are how you read data from the ledger. This data is stored as a series of key-value pairs.

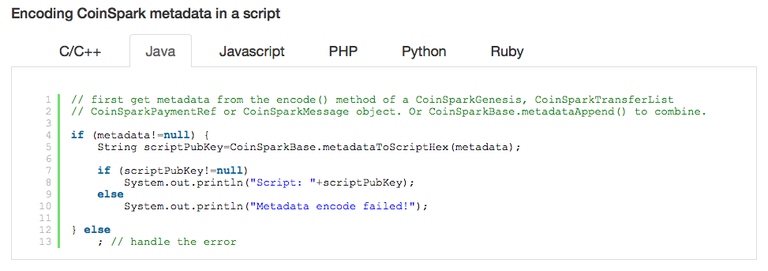

Type: colored coin (BTC) that is developed by Coinprism's (Open Assets Protocol)

Openchain uses a hierarchy of accounts, similar to a file system. This adds a lot of interesting management options that systems like Bitcoin don’t have.

8.JSON linked data format

Type: protocol on multiple blockchains for anchoring timestamp files and verifiy assets using tieron.com and chainpoint.org.

Use Tierion’s API and tools to anchor a permanent, timestamp proof of your data in the blockchain.

9.Waves

Type: sidechains with custom built blockchain

One of the core elements of the Waves platform is its decentralised exchange (DEX).

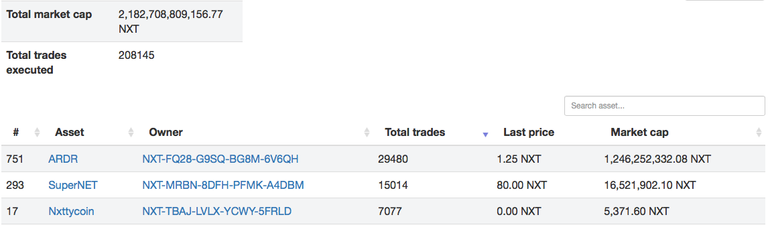

10.NXT multi-asset platform with order book

Type: sidechains with custom built blockchain

11.BitShares 2.0 multi asset platform

Type: tokens on custom built blockchain

High performance blockchain technology is necessary for cryptocurrencies and smart contract platforms to provide a viable alternative to existing financial platforms.

12.Multichain

Type: custom built blockchain (as a user)

MultiChain helps organizations to build and deploy blockchain applications with speed.

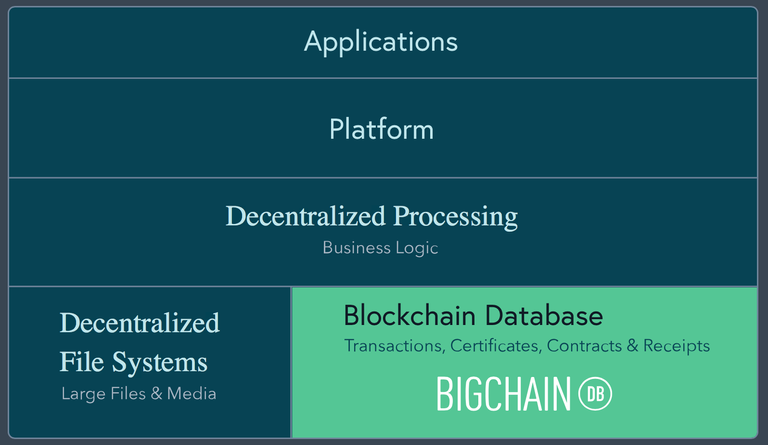

13.BigchainDB database with sharding and 'Crypto-Conditions'

Type: consortial blockchain

BigchainDB is a blockchain database that complements existing platforms, processing and file systems.

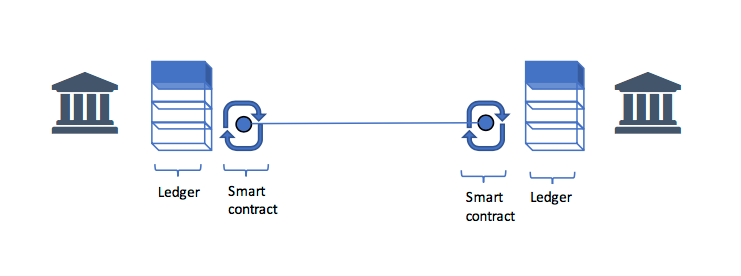

14.Corda

Type: smart contract, transaction semantics for private / consortial blockchains

Corda created an operating environment with assurance of record immutability and provenance. The smart contract encapsulates the business logic of a transaction. It transacts on items stored on the ledgers of parties to the transaction.

| Token Ecosystem | Development | Usability | Flexibility | Scalability |

|---|---|---|---|---|

| Ethereum | - | ++ | ++ | - |

| Counterparty | ++ | o | o | +* |

| Coinspark | + | o | + | +* |

| Omnilayer | + | ++ | ++ | +* |

| Coloredcoins | + | + | o | +* |

| Hyperledger | -- | - | ++ | ++ |

| Openchain | - | ++ | ++ | o* |

| JSON linked data format | - | ++ | ++ | - |

| NXT | ++ | - | - | ++ |

| Waves | - | o | + | + |

| Bitshares 2.0 | ++ | - | - | ++ |

| Multichain | -- | ++ | ++ | + |

| BigchainDB | - | ++ | ++ | - |

| Corda | -- | - | ++ | ++ |

*could potentially scale very well if the Lightning Network works in a flawless and secure manner.

Not in the list:

- Lisk is a public blockchain. They announced sidechains and DApps. However, the service isn't ready yet.

- ChromaWayis colored coin (BTC) / consortial blockchain.

A new architecture, the consortium database, combines the power and flexibility of mature database systems with the secure collaboration and disruptive potential of blockchain.

Chain, skuchain, Chronicled and Verisart aren't in the list as they just give limited access. There is no practical way to proof if the service works or is trustful enough. If anybody used it before I would appreciate any information!

Do you rather want to start a project with a fungible token?

Just another social experiment? Utility tokens for local projects or communities could be the next big step. Here's a list with services that enable an easy token creation process.

Colu (CLN) creates local currencies

Monegraph registers digital artwork

Ascribe certificate Of authenticity of artworks

Tokit.io Artist crowdfunding with fungible ERC20 tokens. The platform was launched by SingularDTV:

By using launchpad to offer a portion of these tokens to the public, creators are in actuality offering their fans ownership of a portion of their art. Fans still support project creation, but now it's a mutually beneficial relationship between audience and artist.

Paradigm shift in music biz: The hip-hop/funk/dubstep artist Gramatik raised $9M by minting his GRMTK Token.

Ongoing art projects

Kevin Abosch created the IAMA coin that represent 100 physical artworks. The noted photographers issued 10 million ERC-20 tokens.

The SCARAP experiment claimed an artwork in form of an Counterparty asset called the SCARAP token.

"SCARAB is not attached to a physical work of art or digital object because the cryptocurrency itself is the art, chosen by the artist to be, act, and represent the linguistic term of what an artwork is.

Why this article?

A lot of finance-based services go better without a blockchain. There are many reasons why integrating the blockchain is a stupid idea (but a good marketing trick).

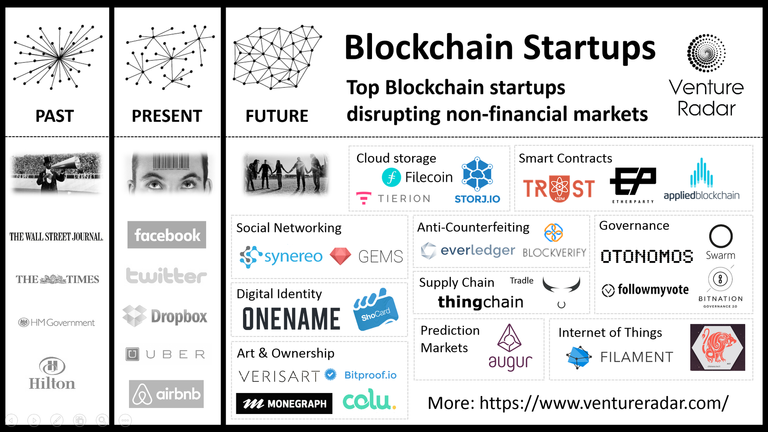

But in fact, blockchain technology is more than just a financial service.

Commodities, Certificates, dears, licences, originality verification, ownership identity, shares/bonds and voting rights can be shared with this technology.

Digital assets on blockchains could prove effective both in established financial services (e.g., for securities) and on emerging consumer-to-consumer and IoT markets. In the latter case, digital assets could be used in a variety of applications, including innovative financial services (e.g., crowdfunding, charity, peer-to-peer lending), smart property, digital subscription/access, and event tickets.

Source: Digital Assets on Public Blockchains, White Paper

Google wasn't the first search engine, and Facebook wasn't the first social network - they were the best ones. Same with smart contracts and ÐApp engines: We cannot know if Ethereum, NEO, Qtum, Lisk or Tezos will make the race.

The game industry could experience a disruptive evolution when those NFT get widely accepted, third-party game devs could kickstart their products that build on existing token series. The synergy of cross-collaboration and the support from networks of token holders could empower creatives to vivid art projects that the world had never seen before.

About the author

I wrote a scientific paper about token creation and I am currently about to launch my own token projects.

With courtesy of Vaultoro.com, the first bitcoin gold exchange, I was able to provide the community with this overview.

This was the last issue of the series Fungible Assets vs Collectables.

Here you can find Part 1 and Part 2.

Thank you for this insightful piece!