FIRMO

WHAT IS FIRMO ALL ABOUT?

Firmo is aimed at developing and building facility which is capable of designing and executing financial smart contract. Firmo increases the development of a decentralized economy by introducing secure and automated financial transaction without the involvement of third parties. Firmo is expected to be secure, unbiased, trustless and transparent to the finance world. Firmo makes use of firmolang which is used by developers to build financial tools which has been previously available to only the traditional and non-decentralized economy assets classes like the derivatives.

WHAT ARE THE FIRMO DERIVATIVES?

The Firmo derivatives provide opportunities for individuals to secure a price point over a specific period of time. These derivatives are more useful to businesses which require a particular material whose prices may either increase or decrease. These derivatives are commonly used by traders who assume there may be rise in the value of a specific material as a result they are able to secure the price point and gain from the differences between the prices.

What is the problem caused by lack of financial tool?

The finance instrument plays a necessary role in the finance world today. The users have been able to take part in their company’s affairs by buying token, due to the inaccessibility of the financial tool the prices determined by the buy and sell order.

SOLUTION TO THE LACK OF FINANCIAL TOOL PROVIDED BY FIRMO

Firmo solves the problem faced by smart contract through the financial tool provided by Firmo known as firmolang which will facilitate the cryptocurrencies space to enable it to develop modern financial tool and also to easily apply them in existing ethereum project. Firmolang is simple and secure it is also capable of having tool for proof of assistance at compile-time this is one of the best ways to provide secure code.

Firmolang makes use of security features from airplanes and from application whose properties are domain, specific and formally verified. Observation has been made that 45% of smart contract are being bugged causing them to be vulnerable to threats, when threats are being faced by building smart contract a technology that is backed up by large network of nodes, finding solution to the problem is a complicated governance process.

WHAT IS FIRMO PROTOCOL?

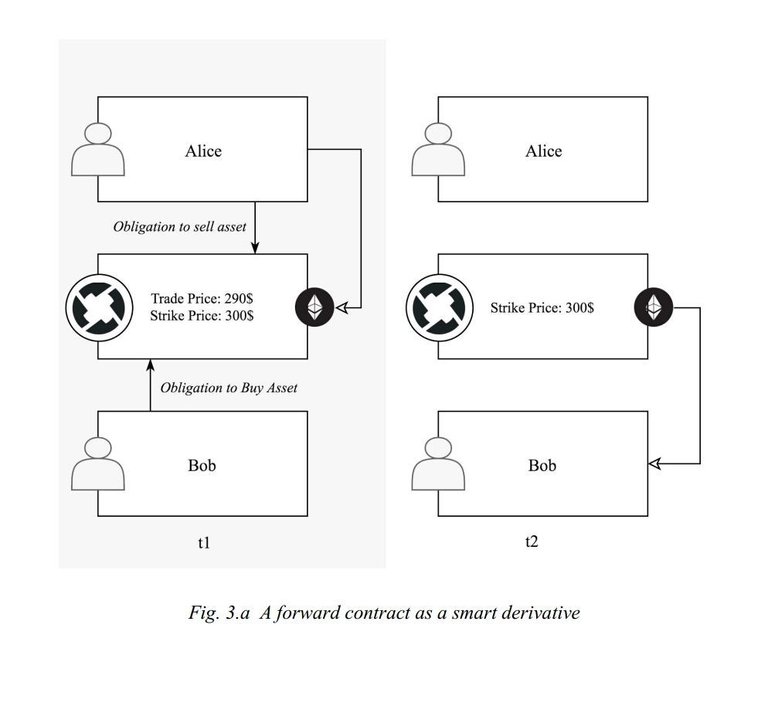

Firmo protocol gives users the ability to make use of financial smart contract offfering product but not limited to forward contract also future contract, loan options and a financial derivative in which two parties agree to exchange one stream of cash flow against another stream. Firmo protocol is made to operate with various selection of external liquidity providers and exchanges.

Smart derivatives are not selective which enables them to be traded on any floor of the exchange, with this introduction Firmo is evolving the crypto market.

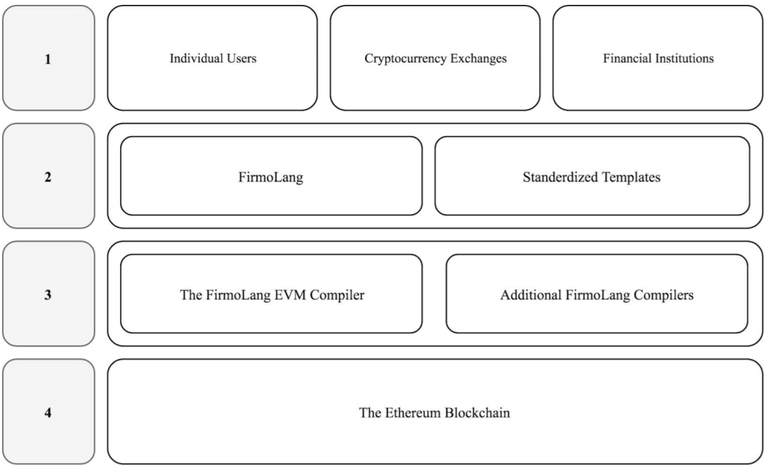

The Firmo protocol stack

The Firmo protocol enable businesses and individual users to create automated smart derivatives making use of a specified domain programming language known as the firmolang. Smart derivatives and smart contract are compiled to the ethereum virtual machine.

The Firmo protocol are divided into four groups which are listed below:

• Individual users

• Firmolang

• The Firmolang EVM (Ethereum Virtual Machine)

• Ethereum blockchain

Further explanation on the Firmo protocol groups

INDIVIDUAL USERS-Individual users are third parties in the secondary financial market.

CRYPTO CURRENCY EXCHANGES- they provide their customers with secure derivatives and act as clearing institution for smart contract.

FINANCIAL INSTITUTION- the financial institution can reduce the cost occurring from clearing and settlement of smart contract by applying the Firmo protocol.

The smart contract offers two solutions for user to engage with the protocol such as;

1.deployment of template contracts

Partnering exchanges as well as other platforms will offer template contract written in Firmolang. In some cases this might be future contracts, peer to peer loan or even prediction markets.

2.deployment of customized contract

User can create their own unique smart contract this is achieved by navigating the console in user interface.

Steps involved

The Firmo guide build contain the following steps:

Step 1

Target User/Group- These are the groups for which the financial contract which is written has been designed for.

Step2

Custom/pre-set: These are the standard specific code chosen from the library or custom code which can be implemented.

Step3

Compilation: The code are applied in the ethereum Blockchain thereby allowing a tokenised project already in place to use the new developed instruments.

Community use cases

This describes the instances where the Firmo protocol can be used, it involves how exchanges and service Provider improve their services to user base. Two cases are described here known as the following:

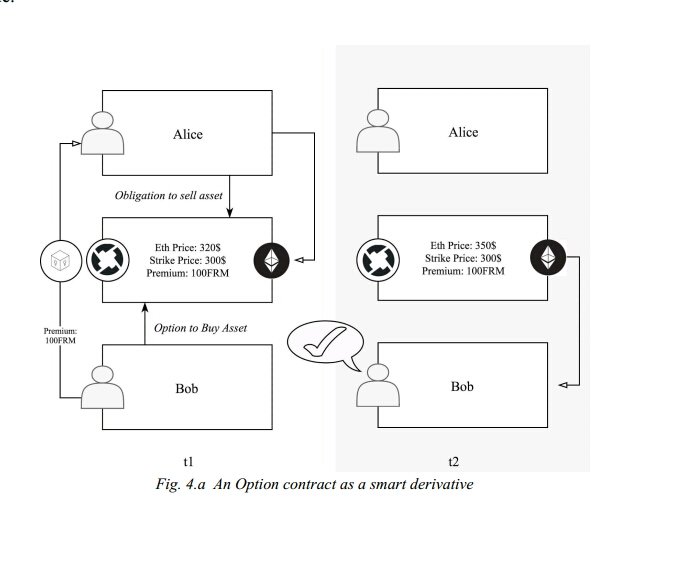

- The European Vanilla option

- Vanilla interest rate swap

The European vanilla option

This option give the buyer the ability to buy an asset at price which is predetermined. The buyer pay a premium when the counter parties to the transaction engage in call option known as the smart contract the buyer pays the seller a premium which is according to the assumed value in t2, the buyer can also trade the smart contract in the exchange at an additional premium. When the price of the underlying asset is not appreciation above the premium or initial price then the derivative automatically close the position unless further instructions are given.

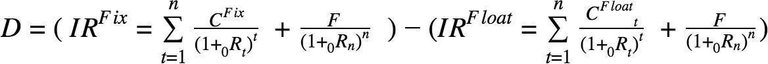

Vanilla Interest rate swap

This is a financial instrument which enables the borrower and lender to exchange interest rates paid on a nominal value. The different values between the two interest rate can be swapped according to the various maturity period. This is expressed below as:

Collateral accounts and margins

The Firmo protocol is an intermediary service which provides the third party application with secure facilities to carry out financial smart contract or any Blockchain that uses scripting languages. This development will enable the Firmo facilities to contract each other. The disintermediation will prevent traditional clearing and settlement process done in the traditional financial market. Firmo will proceed without little or no collateral also known as zero coverage or margins.

Data feeds and oracle integrations

External data feed causes smart derivatives, external data feed such as price in the exchange are used to form future predictions in the market. The external data feed are settled to external oracle partnership.

Proof of authenticity with oracle

The Firmo protocol is expected to proof it authenticity. The legitimacy of the centralized platforms are great concern to exchange market which makes them susceptible to verification by protocols. To solve the problem of the non sequential series of even in a deterministic series of event. Users will be required to provide retroactive proof that the decisive data is authentic.

References

FIRMO website : https://www.firmo.network/

FIRMO technical paper: https://www.firmo.network/resources/FIRMO_TechnicalPaper.pdf

FIRMO 2018