If you're new to Bitcoin, the correction in the middle of January probably came as a shock. People might have filled your head with half-truths such as "the supply has an upper limit, so it will always increase in price." People were telling you this is something new and unstoppable, that the dollar was crashing against BTC, that it was the dawning of a new era, that BTC was a gift from the heavens. Bitcoin is a gift from the heavens in many ways, but not as they expected.

The price can go down, and it was probably a sharp lesson for some - many lessons for the wise. Others will decide to exit the market completely, giving up on investment or speculation altogether, guzzling their Miller Lites and trying to forget the time they risked too much. Don't let that be you. If once you were blinded by greed, don't now be blinded by heartbreak.

Lesson 1: Keep your ear to the ground

Listen to the hype

When you read about people mortgaging their homes to buy BTC, you will know. When they say it's inevitable that it will go up, you'll know that it's inevitable that it will go down. When people new to the market make predictions about short term market activity, telling you that BTC will return to 50% market dominance within a week or that all of the money that flooded out will now flood back in, that tells you that it's hyped. Nobody knows the future; be wary of anyone with specific short term predictions. Ask for their reasoning, and question it, respectfully.

Pay attention to your own emotions

When you start to feel the excitement of multiplying your money by 120%, 150% or even doubling it, pay attention. If you are feeling the excitement then you can be sure that others are also feeling it, and they're most likely feeling it even more than you are, considering you've lived through at least one correction. Your own belly can be your guide in these times, as long as you're aware that you are part of a larger process.

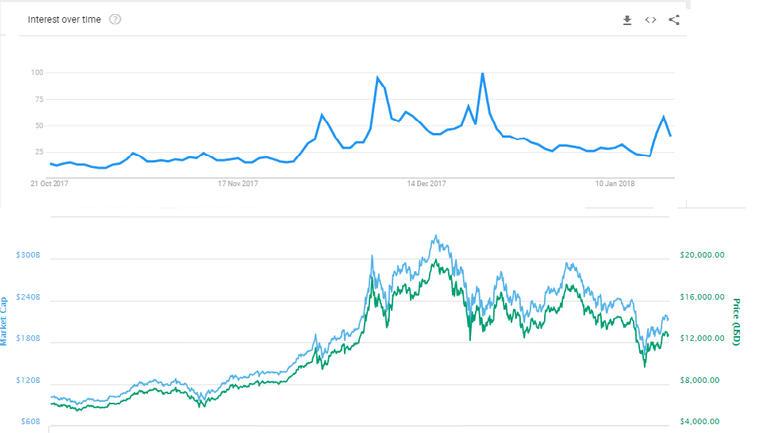

Look at Google Trends

Google Trends can give us a feel for market sentiment. Compare the graph in Bitcoin's market cap to Google searches for "Bitcoin". In this case, we can see that public interest in Bitcoin started to dwindle around the 23rd of December, and didn't return until after the crash on January 16th, even as the Bitcoin price spiked on December 27th and January 6th. Some might call this a "dead cat bounce".

I should note that I didn't notice this divergence until after the crash, and I wouldn't count on it as a reliable indicator of future price action. Nonetheless, it is a valuable tool for bringing the big picture into focus.

Also compare the Google trends "cryptocurrency" chart to the total crypto market cap.

Lesson 2: Make the most of the boring months

As Bitcoin raced towards $200 in March 2013, I scrambled to get dollars into my Neteller wallet so I could buy some bitcoin. I had been aware of it for more than a year, but I had only bought $20 worth just to play around with it. Now that the price had taken off, and the media was talking about it, I felt the fear. What if the best case scenario is true, I thought, what if it really was going to shoot up to thousands of dollars? I obviously had to buy some right at that moment so I didn't miss out.

I did manage to buy some 1.5 BTC at the time, and I also sent some curt emails to Neteller about their service. I made several key mistakes then: I hadn't prepared my channels of purchase; I was rude to the staff; I bought at an all time high; even though I had an idea of long-term value, I bought based on the fear of missing out; and, more importantly, I forgot about it for the next few months when the hype died down.

After making this mistake a couple of times, when a bear market set in around February 2014, I had made my decision. I kept buying when the price and attention was low, even as it went right down from $1000 to $200, I kept investing my money, my time and energy in studying this market.

After a bull run and a correction, it's normal for media to focus on other things. If your attention is easily diverted, you too will be focused on other things. Be resolute. If something is appealing or interesting to you, it is worth researching or exercising regardless of fads and lapses of attention. What fills your heart is always valuable, and in this case, the delightful truth is that your passion and your wallet can be aligned. Whatever happens, in any sphere, don't let the headlines print over the subtle letters written in your soul.

Lesson 3: Know thyself; know your risk profile

It's a rude awakening to see that 25% of your investment has vanished, and at that moment, just like when a flipped coin is in the air, you really know your true desires. Then, you might know that you've invested too much.

One question I like to ask new investors and speculators is, have you ever sat down at a card table and had $1.000 worth of chips in front of you? Most people never have, and they don't know the kind of emotional roller-coaster it can be to have that much money on the line. Can you stay calm when there's that much money at stake, when a wrong move could mean that you lose this month's rent? Can you even remember to breathe deeply? And if you can settle yourself a little, can you make the right decision despite the adrenalin pumping through your veins?

When your experiences are pushed further than you had expected, you will learn things about yourself, a little or a lot. A little knowledge can be a dangerous thing. Learn a lot.

Lesson 4: Look for long-term value

When I first bought Bitcoin, I already had an idea of the vision. I saw how the technology paralleled Napster and BitTorrent in key ways, and I put together the pieces about how those protocols had disrupted the music and movie industries, reducing the power of established interests, changing our ideas about copyrights, putting pressure on the industry to better serve their customers, and allowing independent artists and filmmakers to rise. I imagined what Bitcoin could do to banks, central banks, and governments, and I liked what I saw.

In Australia, the effect of that pressure is arriving, with regulators and the banking industry suddenly deciding that it's a good idea to make bank transfers take minutes, rather than days. In countries like Zimbabwe and Argentina where the national currency has failed, repeatedly, we can see how these new currencies present the possibility of prosperity for the marginalised, literally changing the destiny of millions. Soon enough, governments will be more accountable, and their hunger for war will be curbed.

If you weren't aware of the potential of Bitcoin and its grandchildren, you might have just entered because you thought it was cool, or a way to make a quick buck. Quick bucks don't last; ideas and ideals do. When a gush of wind comes, leaves float away while roots stay firm. Dig deep in your research; plant soundly your roots in fertile ground.

I recommend the brilliant speeches of Andreas Antonopoulos to get an idea of the dream of digital currency, starting with this speech from November 2013:

Conclusion: See the unseen

When I played cards at the casino 7 days a week, obsessed with poker, some people looked down on me. They assumed that, because I was a gambler, I always lost money and I had somehow deluded myself into thinking that it was a profitable actiivity. They didn't know the odds of making a flush with one card to come, or that I could see the face, dress and mannerisms of a man I'd never met and have an immediate idea of whether he was a player or a punter. They didn't know that one situation implied the existence of 100 or 1000 similar situations, and my ability to make the right decision and lose in that situation indicated my long-term profitability. They didn't know; they couldn't know.

If you're determined enough, and loud enough, people will question your sanity as well, if you buy when others sell, sell when others buy, and hold when all seems hopeless. If you combine your knowledge with imagination and intellect, you will see what others cannot. You will see the subtle , the hinted at, the potential not yet realised. What is mysterious and unexpected to others will seem a natural progression. You will see the future.

Disclaimer: Nothing in this post is intended as financial advice. I don't want to tell you what to do with your money; I don't know what you should do with your money. All I'm doing is presenting my own reasoning for my decisions past and future.

Awesome post. I've never been good at poker, but I've been investing small amounts of money for over a decade, and I've learned to listen to my gut but to not always follow it. When my gut tells me something, I use that as a cue to assess my original strategy. Has something changed fundamentally about the investment that I didn't know about when I bought? If not, hold. If yes, sell and cut my losses.

Honestly, I've always had a harder time selling than holding for whatever reason. But during my crypto investing days it's been awful difficult to not sell. I have some rather lofty long term price targets for the cryptos I'm invested in, so when I double or triple my money it's almost intolerable continuing to hold. It goes against everything I've learned about investing, but with this one it works.

Thanks for the excellent comment.

Yes, an important thing to remember about crypto is, this is a market where you can get in at the very beginning of a project. Many times, even before they have a working product, before anybody even has a tangible reason to believe in it. If the product comes then naturally the coin is worth much much more than it was in the beginning. Previously it was only very rich people who had the opportunity to get in so early. So it's weird compared to common stocks, but no so weird when it's put into perspective.

Of course, there's nothing wrong with taking some profits or rolling them into another project, even if you think your first speculation will go much higher.

I took note of the people who tried to warn me off bitcoin, despite not bothering to learn about it.

Happily I ignored them then; I've made a point of ignoring them now, and look forward to continuing to ignore them in future.

Some sound knowledge shared here, serving as a timely reminder to anyone prone to panic!

If people do their research, understand how blockchains work, and then try to figure out how this tech will impact various key industries (and even the whole economic system!) then the value proposition of crypto becomes clear.

However, such shifts are are not going to happen overnight, and it must be remembered that the crypto market is still in its infancy. There are a lot of unseen twists and turns still to come. The crazy run-up in the last few months should be considered an anomaly born of speculation.

In my opinion, anyone looking to make a 'quick buck' out of crypto is doing it wrong - better to put your fiat into a few strong projects and write that money off for 3-5 years. Once the tech matures and adoption picks up, then true value will be revealed, and the early adopters will be rewarded for their strong hands!

I have learned a lot about bitcoin during this 3 months. I thing i will always remember is that i would never buy it in the months of december and never sell in the month of January. Instead i will be doing vice versa.

I would always advice new investors to invest only a part of their saving into bitcoin.

Yes..correct.

It is one of the good idea of Comparing the Cryptocurrencies market to Google trends.

It will show the tentative picture.

Keep doing good work @churdtzu

Thanks for the Pingu!

that was a beautiful analogy. love that last paragraph <3

Diversified..while you can.

wow nice blogg

Good post. Nice information. Amazing!

Just HODL! :)

Those are valuable words from an experienced trader if you like to be called that.

Someone who has seen and survived a ample market corrections. Always good to get in early.

Buy Low Sell High ... too easy! LOL - knowing where to get in and more importantly where to get out if you're wrong is the key.

Right off the bat, I just had to say that I love the title you have with "Crypto Crash Lessons." I consider myself fairly new to investing in this asset class but one thing you mentioned that resonates with me is your first lesson. Buying the rumors and selling the news is possibly the best way to make the most of your research and also capitalize on other realizing the promise a project presents. This goes hand in hand with your second part of your first lesson in leaving emotions outside of investing. Seeing huge returns is a sign to take some profit, like taking out your initial investment for sure. I see cryptocurrency having an immense value, lining up perfectly with your last lesson. Blockchain technology and the universal problems many of the coins or solving are mindblowing and I see the long-term overall value being huge!

thanks for sharing!

I had a little BTC early on,, then got some more as it rose,, then thought it was continuing to rise and bought again when it was around 19000,,, then a month later it was at 10000 hahaha. . .

so here I am, waiting and holding. . .

i liked your comparison to the google search trends..

Well, it is kind of simple, if we stay well inform and go along with the things that are happening now, and not sit on the coins like mother hens waiting something to hatch, we hardly can make a big mistake, and it takes time to get in touch with all of this.

I will reference this to my group, it will definitely help.

Very helpful and insightful article. Thanks for the energy you put into this! KUTGW (keep up the good work) ;)

That's nice, you are well loaded, informative, with Bitcoin we keep going higher. Thanks for sharing such an educative post, do have time to check my blogs, together we keep moving higher.

Awesome advice, thank you! :)

a lot of emotional investing goes on especially in crypto

don't sell your Honda in hopes of a Lambo unless you can easily afford to lose the Honda stuffs