In the disruptive world created by the blockchain technology, it has come to be that many projects would facilitate their fundraising on the Distributed Ledger Technology (DLT). The Initial Coin Offering (ICO) and the Initial Exchange Offering (IEO) have become standardized medium for raising funds for cryptocurrency and blockchain projects.

Haven played their parts for many years, the ball has once more, been played into the court of another fundraising mechanism called “Initial Model Offering.” In this article, you will learn all there is to raising funds for cryptocurrency and blockchain projects using this model.

- Guaranteed Listing on IMO Exchange

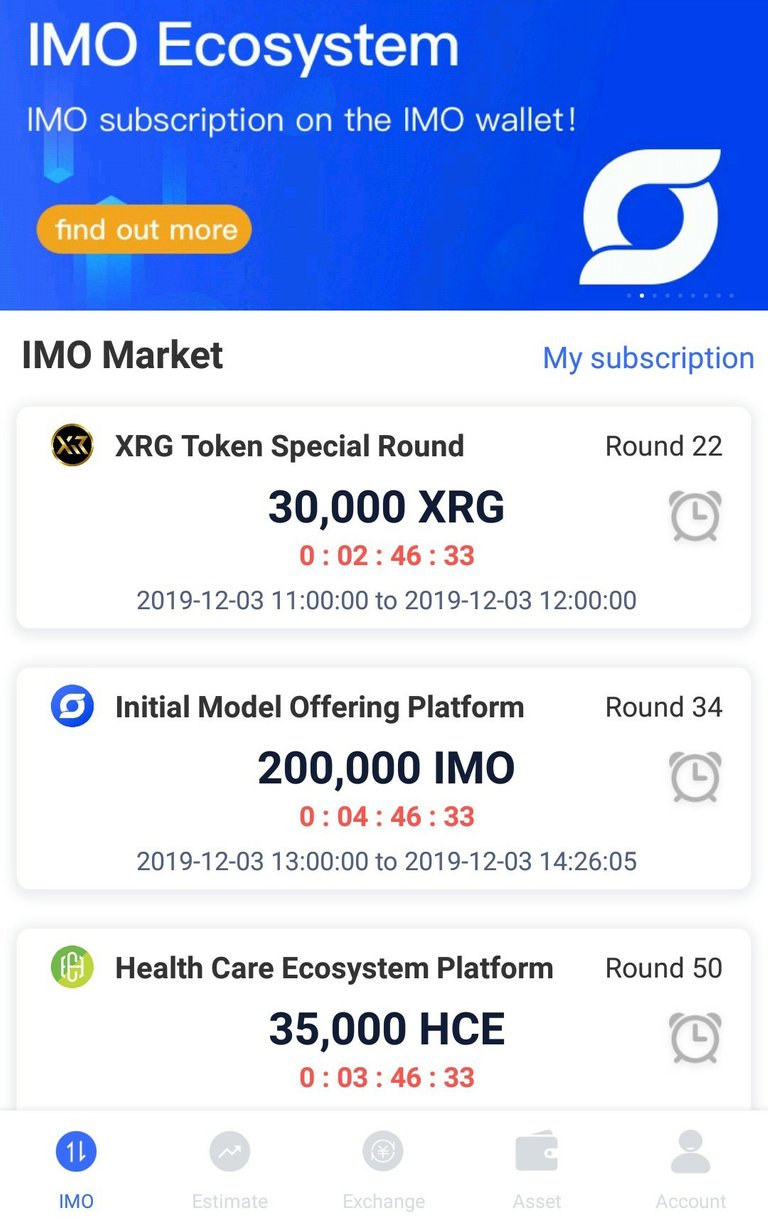

It is important to point out that Initial Model Offering (IMO) isn’t just a new approach or method of raising funds. Instead, it aims more at bolstering the chances of such projects and their investors to make profits. That is highlighted in the interoperability that exists between the fundraising platform (IMO) and the built-in digital asset trading platform – the IMO cryptocurrency exchange.

The importance of this is that immediately the projects are rounding up their fundraisers, their native digital assets/tokens will be listed immediately on the IMO Exchange. The move is imperative because at the end of the fundraisers, such projects tend to wait for a longer period before their tokens can be added to the digital asset trading platforms/cryptocurrency exchanges. Moreover, it helps to save more money, because only a few funds will be spent to gat listed on the IMO Exchange.

- Maximum Purchase Amount

Can you picture what will happen if only a few investors dictate what happens in any market? The obvious clue is that such a market will not only be manipulated by a few, but is also susceptible to be swayed at either side by the few that control it. Such has been the case in the ICO and IEO fundraising formats, whereby investors with enough money to control continue buying more digital assets, thereby leaving the other non-financially buoyant investors to grapple their way through the market.

It is now the dawn of a new era as Initial Model Offering (IMO) allows the investors to have a maximum amount they can invest. Ideally, investors and IMO participants are allowed to buy as much as $1,000 worth of digital assets on each pre-sale. Such a maximum purchase cap ensures that every investor buys as much tokens and digital assets as the others do.

On the other hand, IMO is yet to specify if the maximum pre-sale purchase limit is binding on one account of investors or extends to all the accounts used by the same investor within the pre-sale period.

- Longer Pre-Sale Period

IMO also made positive impacts in the duration of the fundraisers, the investments and the pre-sale period. With the new formation, pre-sales of digital assets will continue until a total timeframe of a year elapses. The projects can also be broken down in segments of three months until they are completed.

Conclusion

Now that you’ve known how Initial Model Offering (IMO) is changing the status quo in the burgeoning world of cryptocurrency and blockchain, you may now want to be among the early investors that would be a part of this growing fundraising platform since it has more robust features for crowdfunding. Definitely it will be beneficial to start-ups and investors alike.

Do visit the useful project links below for this outstanding project

🌐 website

💬 Telegram

🐧 Twitter

🔄 Register

writer's info

Bitcointalk username: deodivine1

Profile URL : https://bitcointalk.org/index.php?action=profile;u=1390292