If bankers were pro-bitcoin, I would be worried. The thing about the loud talking mouths that shit on crypto is, they have no repercussions. Jamie Dimon can say bitcoin is a scam and fraud, then take it back a few months later.

These big-time investors will say one thing and do another. The thing is these companies need to list their moves publicly, so when they get into crypto, they create a splash. The trick is to distract you from the splash with a loud noise. If it is legal, you better fucking believe these entities are going to take advantage. The big players know the retail investors, the ones with 9-5 jobs and families don't have time to research crypto. Most retail investors delegate their research to the big players. "Oh, Warren Buffet is calling bitcoin a scam?" - Must be, end of discussion for that person. Little do they know Warren Buffet owns banks and funds that are buying up risk in crypto, same for Dimon.

Why am I so confident in my investments? This is my "job" - most of my time goes to researching and making connections. This is what I do; Buffet can't tell me shit.

This Year Alone:

Goldman BallSachs plans crypto operations.

Coinbase starts bitcoin custody service.

ICE (parent company to THE fucking NYSE) announces Bakkt. (A company focused on the development of a regulated platform where people can buy and sell cryptocurrencies)

Not to mention all the big companies around the world like SBI investing 100's of millions into crypto infrastructure.

But hey, it's all going to zero, right?

I am sure there were plenty of horse-drawn carriage investors that thought trains were stupid and dangerous. And I'm sure there were some shithole rich people saying trains were shitty and to keep buying up horses. The peons kept listening to the rich and kept buying horses. Meanwhile, train tracks were being built all around the world.

Look at this gem I found:

"Fearful reactions to new technology are age-old and have even picked up speed alongside our rate of innovation. Critics of early Steem-spewing locomotives, for example, thought “that women’s bodies were not designed to go at 50 miles an hour,” and worried that “[female passengers’] uteruses would fly out of [their] bodies as they were accelerated to that speed”—which, for the record, they did and will not.* Others suspected that any human body might simply melt at high speeds."

The only thing that melted was the demand for horses after the train Steemrolled the transportation business.

"As automobiles gained traction in the early 1900s, they were seen by many as noisy, erratic “devil wagons” that women—thought to be prone to fainting, physical weakness, and out-of-the-blue bouts of hysteria—wouldn’t be able to control by themselves and shouldn’t be allowed to drive."

Devil wagons obviously would fail, I mean horses were given to us by God, cars are just unnatural.

Of course, when computers were starting to come up, everyone with a soapbox spoke their minds and gave financial advice, rekting people out of fortunes.

The Internet Was No Different.

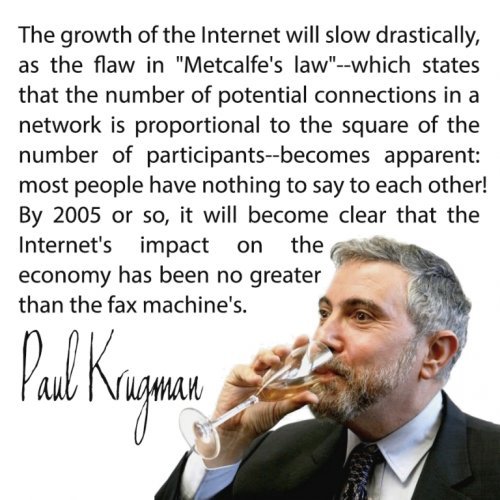

Paul Krugman is a fucking award-winning economist. Whatever award he won is invalid now, you don't simply get to fuck up a prediction this bad and still be considered an expert. You don't stich a nose on someone's ass by accident and get to call yourself a doctor, some things are one and done.

The point I am trying to make is some things take just a hint of imagination. The internet is this decentralized place; no one owns the internet. Now, this decentralized internet has a decentralized form of money/value. Open source, immutable, censorship resistant protocols that require zero trust and deliver every time. Bitcoin has never been hacked, this form of protection is invaluable in a world where no data is truly safe, that of course unless it's on the blockchain.

And just like when the net first started, and people cried out that public internet would be an abomination of porn and drug traffickers, and that "intranets," - closed, closely monitored systems that were highly centralized were the future. Here we are again, at the same crossroads, same shit different toilet. We have people crying out that open source money is only for criminals and will never work and only closed, closely monitored systems which are highly centralized will win. Meanwhile, the same people saying this are the same people setting up pick-ax stands outside the proverbial crypto goldmines, laying the train tracks down for the crypto Steem engine that will Steemroll the traditional fiat world as we know it today. Fiat is a big fat horse, and crypto is a highly sophisticated Steem engine, the two merely can't compete.

While the tracks are being laid all around us, and the prominent rich banker people are screaming from their soapboxes that crypto is a scam and fiat is the only thing that will survive, you have to ask yourself, is this deja vu all over again?

Let's not forget why bitcoin why invented in the first place: "The Times 03/Jan/2009 Chancellor on the brink of second bailout for banks." This title was quoted and embedded into the very first transaction ever to be included in the new Bitcoin blockchain (Genesis Block), by Satoshi Nakamoto.

Fast forward almost ten years:

Venezuela resorted to desperate measures to arrest an economic collapse on Monday, lopping five zeros off the bolivar, devaluing it by ninety-five percent and tying it to an obscure state-run cryptocurrency.

The cost of a loaf of bread in Zimbabwe in 2018:

And you think because you live in places like the USA that you will be immune to fiat hyperinflation by central banks? Well, you're wrong, it is just slower bleeding out.

"If you put a frog in hot water, the frog will jump out. If you put a frog in room temperature water and slowly heat it up, the frog will sit in the water until it's boiled alive. "

- Achieving financial freedom isn't always about working hard, sometimes it's about having the right mindset at the right time.

I leave you with this:

Governments that have a monopoly of the money supply, throughout history, without exception, have all failed in dramatic fashion. Power corrupts, and absolute power corrupts absolutely. Until the day, we as a human species can have a decentralized, censorship, borderless means of transferring value, war, economic depression, world hunger and a host of many, many problems will always sustain. We as a human species have the power. FUCKING OPT OUT, The numbers are what matter, wake people up, wake everyone up to the illusion that is freedom in a fiat world. The more people that opt out of the old system, and opt in the new decentralized system, the quicker the old system dies.

Nice analogy with the train and horses. It's true what you say. The big players always tell the common folk the opposite of what is true.

And yes Paul Krugman lost all credibility with that moronic prediction :)

Sweet meme!

Thanks @dhenz.

That is a "Steem" train. ;-)

Yes :)

Excellent post, @dhenz.

Not much can be added on top of it, besides this:

We need more of these on Steemit.

Pure motivation to work harder in the silence of the storm.

And honestly, it's not even motivation. It's the pure logical realisation that Crypto is still no-where near it's end-potential. Like the internet in '97 or Amazon in '99.

Whoever is in crypto to make profits in the short-term, def. possible, but the real value will come when investments are made in projects with the right fundamentals, looking at Amazon in '99.

Welcome to DMV !!

I highly agree with this statement @therealwolf. Let’s continue to put our heads down and work at this Steem thing 💪🏻

Posted using Partiko iOS

Truer words than this were never spoken today on steemit. This post is a gem, but these words just strike at the heart of the mania surrounding the crypto. Dimon and Buffet probably planned the negative publicity to catalyze the downtrend so that they could buy cheap.

The power of opting out of this scam economy is staring us right in our faces but like the frog, most will stay in till they boil.

A nice refresher on what this is all about. Easy to forget that there are still those in the community who don't have this knowledge, no doubt extremely valuable content for them.

Awesome post! you really put things in perspective here, and I think that’s the key if you want to be successful long term in the crypto market.

This is a perfect example why history is so important, because like you explain, it’s basically dejavu seeing the reactions from uneducated ( or manipulative bankers).

We have seen tremendous spotlight on the crypto market starting last year, but much like the it bubble it was a bit early both for projects and for the market to adopt. Soon we will catch up and we will have much more people actually using crypto as opposed to only speculating in it for investment.

Superb @dhenz,

I think it is doning on the world that fiat is failing us, because I saw In a news recently were the U. N was complaining about a cash economy been the cause of some countries economic problems.

All the more reason I believe in cryptos and when you see people criticizing innovation it just tells you that the innovation is real because it seems to be a partner of real innovation: criticism.

“Goldman BallSachs” 😂😂😂

Posted using Partiko iOS

nothing much to add, I think this is also a big part of why a lot of us are here on steem.

We believe in crypto and blockchain and we are sure that crypto will not make the uterus of women fly out or even melt them...

It might make women go into hysterics if they realise the true value of cryptocurrencies (men as well though)

Fiat is not dead yet and it will put up a mighty struggle but in the end crypto will democratise a lot of things in this world

Don't buy crypto ...ITS A SCAM..this guy will convince you in under 30 secs

haha love this vid

That's all good but don't get scammed by this crypto thing..!!

What about that time when it went all the way to around 20k........ Then it crashed. alll the way down to $5800. Damnit, I didn't gain enough 1000s of percent on my investment.

Hehe.. People have gotten so spoiled with the ridiculous ROI that they've lost perspective.

yeah man..its all a big scam

Excellent post buddy.

Very cool approach 👍

Thanks bud.

👍

btw NYSE put in one of the early funding in coinbase > NYSE > ICE > Blackrock/vanguard (then goes around owning each other) 'they' already have their hands in one way or another.

poloniex > circle > goldman

nice quote on the frog. It's slow bleed that go under the radar that make it hard for ppl to detect, also in trading/chart, creating that lingering hope

ty for the info.

I remember when people used to laugh at me using the internet. Apple was a risky investment at times though. It took a couple of decades to get going. Hopefully we wont have to wait that long.

Psychical infrastructure takes much longer to build then software. Example: It took decades to lay down the train tracks, but it can take a year or two to make a better train.

The internet was the tracks we needed to build a badass Steem train ;)

Very insightful post. Holding a contrarian view works most of the time, and it will work for crypto as well. The banks and most centralized establishments fear crypto because their livelihood is being threatened. Until they have paved a way out (in this case, building their own crypto infrastructure), they will keep bashing crypto. The faster the technology develops, the more these establishments need to downplay crypto. Because they are running out of time :)

Posted using Partiko Android

Yup, that Paul Krugman fucked up big time! Also about helping the fiat illusion, the way I see it, it might take some time as most people I meet are still believing the FUDS being spread. Although luckily, lately I've been saying serious discussions by even our African governments and newspapers. Coz even though there is still some bit of FUD, there is not as much animosity as a few months ago. And we're in bear markets so ... Moon soon? lol

Cheers for the rich history and perspective!

I've been saying the same thing since 2015 when I first spent the time to sit down and learn how Bitcoin worked. It is amazing to see the pattern of the social love/hate for cryptocurrency ebb and flow. With each flow of love the highs get higher. I am surprised to see STEEM back to where it was before last year's run up but I only started to watch STEEM over the past year. I'm excited to see what currencies are around in 2020 and how much they are all worth.

See you on the moon <3

I think that is what is most likely scenario but what our main focus needs to be is to make sure that we are not stuck with one particular option. I say that keep your options OPEN and that’s where I like options like DNAtix, as it is kind of revolutionary thing and really makes one feel comfort to do with their concept and everything. It is without any doubt into my list of options to REALLY REALLY go with! https://www.dnatix.com/

Insightful article. I add that patience is a precious commodity and too rare in this world. Lots of even the crpto believers lack the capacity to endure a storm. And for people who have been fooled by expert propaganda, well they have been fooled. The top guys and experts that downplay crypto have huge investment in it secretly. Its just that the rise of crypto is threatening the system that made them rich.

just like spring. the harder you press, the higher it bounce.

Very nice observations. I love your outlook and enthusiasm on this topic and life.

hah!

It will certainly rebound in a big. I have no doubt about it. It is the future of money transactions.

You notice that most governments are pretty passive when it comes to crypto. They see the opportunity as well. The next phase after institutional money/custody is government reserves. Some smaller governments have already expressed interest in putting a percentage into crypto.

The banks are not pro-bitcoin as much as pro making money. To them, cryptocurrency is just another asset class. That is how they approach it.

With this blockchain, I truly believe we pose a serious threat to the banking system. We are seeing up a new financial system.