On Tuesday, 23rd, local time, James Faucette and other Morgan Stanley analysts released a report irritating, the market has not fully cashed in the good news that Qualcomm reached a patent dispute settlement with Apple last week. They raised Qualcomm's target price from $55 to $95, an increase of nearly 73%.

On Tuesday, 23rd, local time, James Faucette and other Morgan Stanley analysts released a report irritating, the market has not fully cashed in the good news that Qualcomm reached a patent dispute settlement with Apple last week. They raised Qualcomm's target price from $55 to $95, an increase of nearly 73%.

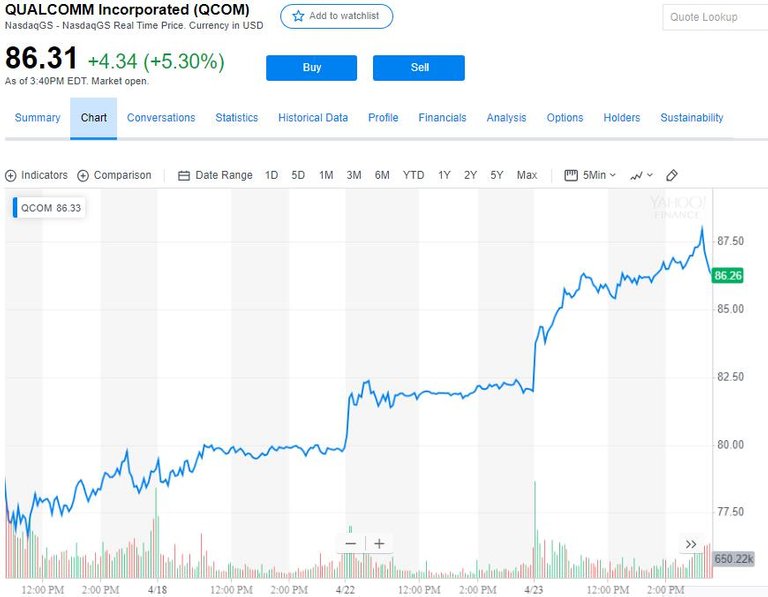

Wall Street found that this means that Morgan Stanley expects Qualcomm to rise another 15% from its highest level in nearly 20 years last week. After the settlement with Apple last Tuesday, Qualcomm's share price soared 23% at the close, last week's intraday Qualcomm rose 17%, once rose to 82.52 US dollars, the highest since January 3, 2000, the largest cumulative two days The increase was over 40%.

Morgan Stanley analysts said that Apple's reconciliation framework is very consistent with what they had expected, but what surprised them was that Apple chose to reconcile it now. They had expected that Apple would wait and see if the court would give I have brought more bargaining chips.

Another reason Morgan Stanley is optimistic about Qualcomm is that they believe that Qualcomm is the "key enabler" of 5G networks, and Qualcomm's control of 5G modems is also a reason for Apple's settlement. Because Apple expects to release the 5G iPhone in 2020. They expect Qualcomm to have the potential to become the world's largest semiconductor company.

On Tuesday, Morgan Stanley's report released, Qualcomm's share price further higher, once rose to 87.96 US dollars, the highest since January 3, 2000, the largest increase in the day reached 7.3%, as of the update, fell back to 87 Below the dollar, it is still expected to hit a new high in more than 19 years.

Apple is willing to pay billions of dollars in price and solve the mystery in 5G

Last Tuesday, Apple and Qualcomm announced that they would abandon all legal proceedings at the global level and reached a six-year global patent license agreement, which took effect on April 1 this year and has a two-year extension option. Apple will pay Qualcomm a one-time payment, and the two companies have reached a multi-year chipset supply agreement, but the exact amount is unknown.

The analysis pointed out that the two parties reached a global patent license agreement for at least six years, indicating that Apple will once again pay Qualcomm a royalty. More importantly, the two companies have reached a "multi-year chipset supply agreement", which indicates that Apple's future iPhone may re-enable Qualcomm's modem chip, and Apple may launch 5G phones earlier than expected.

Since then, UBS analyst Timothy Arcuri estimated that Apple's settlement fees for Qualcomm are expected to be between $5 billion and $6 billion, and the new licensing fees agreed by Apple and Qualcomm are about $8-9 per unit, which is higher than Qualcomm's previous setting. The $5 bottom line is also higher than Apple’s previous $7.5 license fee per phone.

Wall Street's member-only article " Apple Qualcomm's $30 billion settlement: Sword refers to Huawei's 5G, Intel's brutal cannon fodder " commented that Qualcomm shareholders need to thank Huawei.

"In the 5G era, not only Apple and Qualcomm needed alliances, but even Trump was encouraging to invest resources. This is a war that cannot be lost (to Huawei)."

It is worth mentioning that after Apple and Qualcomm reconciled, Intel immediately announced that it will withdraw from the mobile phone baseband business, and will focus on 5g network and data center business, and the two largest competitors, Xilinx, coincided with Huawei at the end of last year. Cooperation.

Another Wall Street member's exclusive article " 5G track opened, reconciliation for Apple has to be, then patent hooligan Qualcomm? "Summary, from the perspective of commercial competition, this is a commercial war without a loser.

It not only perfectly interprets the "Nash Equilibrium" in game theory, but also the greatest embodiment of the balance of interests between the two sides. Or before the opening of the 5G track, for Apple, this is a choice that has to be made for it; for Qualcomm, this is also a choice that benefits more than harm.

The article believes that for Intel, this is also a timely stop loss. A number of financial institutions have expressed optimism about Intel's exit from the 5G mobile phone chip market, thinking that this can reduce Intel's cost by at least $1 billion, and with reduced capital expenditures, Intel's cash flow will increase by at least $2 billion.