BZx is the first fully decentralized, peer-to-peer margin funding and trading protocol. bZx is a protocol that can be integrated into the current exchange infrastructure. Exchanges and relays are incentivized by fees denominated in the bZx protocol token (BZX) to offer decentralized margin lending and margin trading services. Assets are valued and liquidated via competing oracle providers. By decoupling the valuation and liquidation of assets from the protocol, the oracle marketplace approach allows competition to drive the oracle provider fee to its marginal cost while encouraging experimentation and flexibility.

BZn have 3 components :

1.bZx.js Library- The bZx.js library is a promise-based asynchronous javaScript library that contains all the functions needed to interact with bZx smart contracts on-chain. Developers will be able to use this software to easily integrate and develop for the bZx protocol. Relays and exchanges will be able to use it to build an interface for margin lending and trading on bZX thereby providing value-added services to their customers.

2.bZx Portal- The portal is a web based decentralized application that serves as a frontend to the bZx protocol and utilizes the bZx library which serve as a one-stop shop for individuals looking for interaction with the protocol for margin lending and trading.

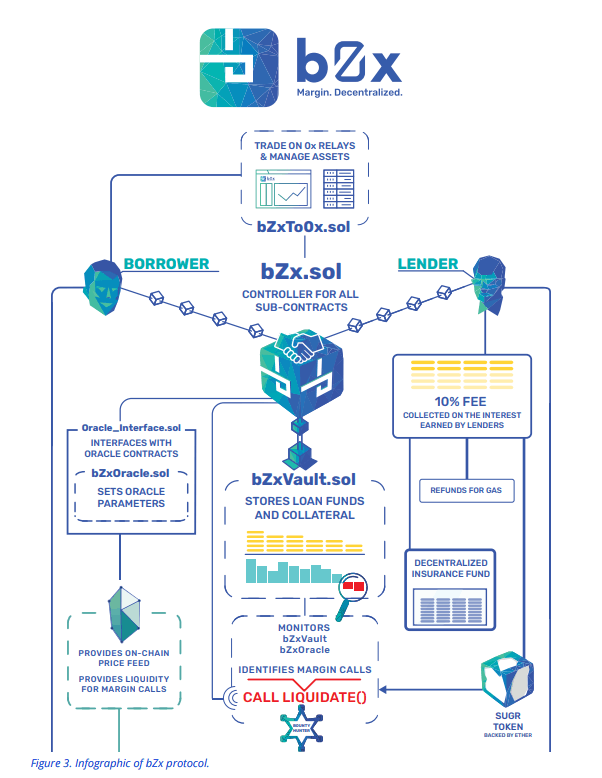

3.bZx Smart Contracts- The bZx protocol is a series of smart contracts that facilitate in-chain margin lending, and the opening, monitoring and liquidation of ERC20 token trades.for all state changing transactions with bZx is the bZx.sol smart contract. This acts as acontroller of other sub-contracts that make up the various parts of the protocol, including bZxVault.sol, bZxTo0x.sol, and the custom Oracle contracts for trade management.

bZxVault.sol: An escrow contract for storing ether and tokens not involved in active trades.

bZxTo0x.sol: An interface for taking trades using the 0x Exchange contract. The contract can be easily upgraded later if ZeroEx makes breaking changes to their on-chain exchange.

Oracle_Interface.sol: An interface provided as a starting point for developing custom Oracle contracts that interact with the bZx protocol and make up the oracle marketplace. An inheriting contract must implement all provided function declarations to work properly with bZx. Though funds are escrowed in the bZxVault, trades are escrowed by the oracle, meaning the oracle and not the bZx protocol has sole discretion to withdraw or liquidate the funds within the constraints of the protocol logic.

How exacly works?

Initialization

• Lender calls approve function authorizing bZx to move the loan token and BZRX token.

• Trader calls approve function authorizing bZx to move the collateral, interest, and BZRX token.

• Both lenders and traders can serve as maker or taker of a loan order.

Execution

- The maker creates an order object using the bZx Portal or via a relay.

- The order object is signed with maker’s private key to ensure the order cannot be altered.

- The maker broadcasts the order object to relay or intended recipient via an arbitrary medium.

- The taker intercepts the signed order object, presenting it to the bZx contract while passing parameters specifying the collateral token and quantity of the token to be borrowed, if not previously specified by the maker of the order.

- The bZx contract verifies the maker’s ECDSA signature, the order parameters, and the order expiration, before moving the loan token and required collateral token to escrow in bZxVault.

Website: https://b0x.network/

Whitepaper: https://b0x.network/pdfs/bZx_white_paper.pdf

Telegram: https://t.me/b0xNet

Twitter: https://twitter.com/b0xNet

bounty0x username:juv3ntus11

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://b0x.network/pdfs/bZx_white_paper.pdf