Courtesy:Invictus Capital

Hello everyone! It's another post on one of my series: Shilling Sunday! This time, I'm not going to shill about an existing project or token, but and ongoing ICO that ends up on the last day of May!

I am a fan of index funds and hedge funds, so I figured out I'll invest in a tokenized hedge fund that invests in blockchain projects. Now, participating in ICOs are a bit of a hassle, since you need to do yourself the research to avoid scam ICOs and those who have no future value. The cryptocurrency market has listed over 1400 different tokens, excluding those who aren't listed on coinmarketcap.

The fundamental attributes of blockchain technology are being leveraged in profound new ways, changing how our society operates, disrupting old conventions, and creating new possibilities.

-The Hyperion Fund Whitepaper

Source

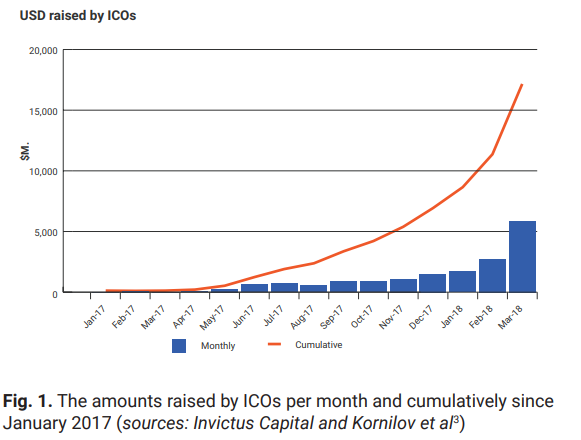

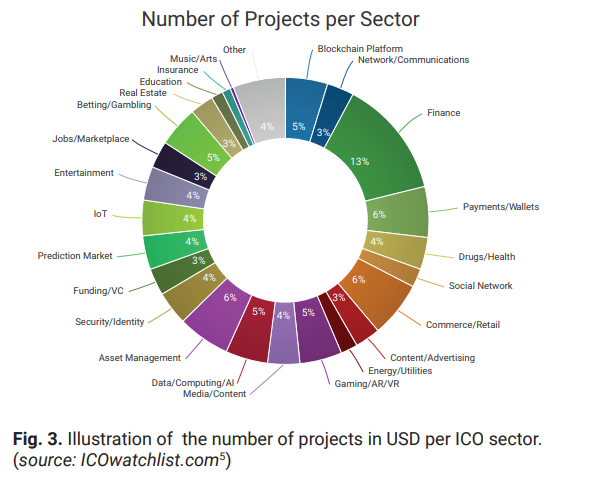

Blockchain technology is slowly and steadily going towards mass applications in different industries. Oftentimes, it is called the the web 3.0. More and more old and new companies find applications of this newfound technology. These companies find a way to fund their projects by launching an initial coin offering (ICO) where they start a crowdfunding. The investors, looking for profits invest in good projects and flip some of their earnings to find new ones. The main problem is how do we find good projects that are worth giving our money, and be secure that the companies are worth our investments?

Honestly, when I started participating in ICOs, I just find the hype. It's rather a hit-or-miss. I have invested in more than 5 ICOs, which three are considered a flop, but the other two I have invested gave me 5x and 20x at the time I sold all of my holdings. Currently, I have some others that I am still waiting until their ICOs are over, or their product has been launched. I also have participated in a couple of airdrops, which gave me decent free money. Once their unlocked, I can finally slowly buy the things that I want to invest for long term.

The Hyperion Fund

Source

If you haven't heard of Invictus Capital, they are a team of engineers and scientists, which are one of the pioneers in blockchain investments. They are the ones who launched the ICO for the Crypto-20 Index fund.

Now, they are launching a tokenized investment fund called the Hyperion Fund. The Hyperion Fund is a closed-end, tokenized venture capital fund designed to provide token holders with diversified exposure to the returns, and risks of early stage investing in the blockchain economy.

Source

The fund is used to participate in investing in Simple Agreements for Future Tokens(SAFTs), private and public pre-sales and ICOs. The fund is not used for investments in existing projects or currently listed coins and tokens.

The advantage of this for investors, specially the small ones like me, is they can be fully diversified on participating in ICOs with a small fund. The investors can do less or even no research at all to find other ICOs that are worth looking at, since it will be the Hyperion team that will do the hard part. One great perk also is these micro investors will be able to enjoy the private and public pre-sale discounts on the projects that the Hyperion fund is invested, therefore maximizing the potential returns on investments.

The IHF Token

The ICO participants will receive a tokenized asset when they participate. The value of the IHF token is

directly represented by the holdings and investments of the Fund. Once the holdings and investments of the Fund has reached a value of $30M, as determined by Invictus Capital, Hyperion will buy and-burn IHF tokens to the value of 50% of the returns realized quarterly. The Fund collects a 12.5% performance fee, based on the returns that the fund will give.

The tokens could also be bought and sold to the open market once the ICO is finished. The token's price have no significant bonuses to the early participants, unlike other ICOs that often result on dumping of the price of these tokens, when they are released in public.

The buy-back and burn

Buy-and-burns eliminate the eligibility and technical drawbacks of dividends by increasing token value for all that hold them. Tax is also made easier to manage by allowing self determination of payout amount and timing.

Instead of paying out dividends to investors when the value of the fund increases, the team opted on a buy-back and burn option when the funds. But why? They have explained it on their whitepaper and public posts. One great factor is for tax eligibility.

When dividends are paid, these are subject for taxation depending on the investor's jurisdiction. Thus they must 'realize' these gains to be able to pay their taxes on time. This also adds to the complexity of calculating one's tax payment due to the nature of dividend payments.

Another would be the price action. Mostly, when tokens pay the dividends, the prices of the said token would often decrease in theory because some value have left the fund. However, the buy-back and burn would provide further value since the underlying asset is rebalanced to go back to its original total capitalization, while the total supply has decreased. Therefore the Adjusted Net Asset Value(ANAV) of the token increases.

At the time of this writing, they have raised more than $10 M with about 4000 backers. The hard cap of the project is $15 M. If you're interested in investing, you can visit their website at https://invictuscapital.com/.

Sources:

Website

Medium

Whitepaper

Interested in trading and haven't traded yet? Try Binance. They trade STEEM too!

Not on Binance? Try Kucoin!

(Please always check the url and don't get phished!)

Feeling ballsy and wanna do leverage? BitMEX allows up to 100x! Don't get burned though, or else the bot will quote your order.

Disclaimer: All information found here, including any ideas, opinions, views, or cryptocurrency picks, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. I am not your financial advisor. Please don't sue me if you follow my picks and lose money. I may or may not have received compensation in writing about these picks. I may or may not own the cryptocurrencies featured herein and this should not be considered as an investment signal, but for information, education and entertainment purposes only.

You have a minor misspelling in the following sentence:

It should be received instead of recieved.