Hello guys! It's the time of the week again! Markets are pretty stabilizing, and I figured I'd concentrate in blogging for now, since I believe I earn more on Steemit but I'll still monitor the portfolio, and I might add some when I get more funds. But as of now, I'd keep the series going and I'll talk about anything that's related to finance and investments.

Hedging: Reducing Risks

limit or qualify (something) by conditions or exceptions.

Hedging is ultimately popular for portfolio managers and investors. Cryptocurrency is one of the most volatile assets to be traded, and therefore risks are really high. It could either make one a fortune, or make him go broke and be dependent of food stamps. It's the reality. We all have seen Bitcoin's glory when it rose up to $20,000 and now, we are experiencing an ultimate drop from it's high. Crypto is 20x faster and 20x more ruthless than the ordinary stock market. It should be a main concern that one would hedge and not go all in on crypto

But what really is hedging? Hedging is the method which a trader or investor mitigate risks by investing in something that is opposite in correlation with his investment(s). Hedging is actually similar with 'insurance'.

Source

For example, I have a house( just an example because I don't have one). I live in a really crowded neighborhood that I believe if a fire starts on them, my house would be more likely included and I'd end up homeless. I've decided to get a fire insurance. This can reduce my risk of going homeless once my house gets on fire. I'd get something and can rebuild myself once it happens.

In the crypto market, we can hedge by investing in inversely correlated tokens or coins. One example will be 'shorting' Bitcoin or buying Tether. Even holding some USD in your bank account is considered hedging. You're not totally exposing yourself in crypto. If crypto drops, you have minimized your exposure by your dollar holdings.

Another way is trading derivatives. In the platform BitMEX, hedging is often used. It offers Bitcoin-dollar inverse perpetual swaps and 6-month futures. There are also other cryptocurrencies that are being traded there. They offer up to 100x leverage, which if used properly, will protect your entire crypto portfolio in cases of huge drops in the whole crypto economy.

How to Hedge

For example, I believe that the current prices of BTC will go up, so I'll take a long position, or I'll buy BTC. A few hours later, BTC goes up about $300, I will open up a short position on the futures. Now, I have just secured profits from the difference between my initial entry price and my hedge short position.

They key on hedging, is to find the correct entries for the price. Doing this incorrectly, might not secure your profits, but even increases your losses. Specially, when trading on swaps, you'll pay a certain percent of your position for the funding fees.

There are different ways to hedge, another would be shorting altcoins, instead of shorting BTC futures. We might have noticed that some alts follow the movement of BTC and some would bleed out everytime BTC rallies, even up or down.

There is no one way in hedging, the same with trading. The key is to lock in profits, because unrealized profits aren't really profits until they are realized. Never count your eggs before they hatch.

The Portfolio

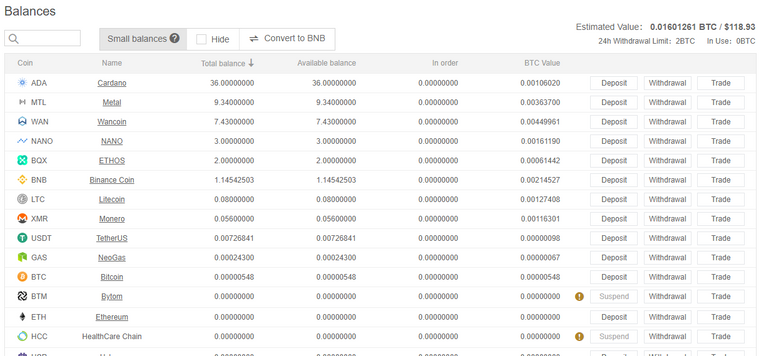

I haven't done any trades this week. I've even haven't logged in my Binance account until today. I plan to add some BTC once I have available funds. My other coins aren't that liquid, and most are still not back to the prices which I bought them. But here's an update on how much my balance is right now.

Here's my weekly progress in this series:

Initial investment = 0.01 BTC/$68 (estimate)

Previous week value = 0.01609224 BTC / $119.48

Current week value = 0.01601261 BTC / $118.93

Weekly Gains = -0.49% / -0.46%

Total Gains = 60.12% / 74.90%

Interested in trading and haven't traded yet? Try Binance. They trade STEEM too!

You can buy some altcoins not listed on Binance at Kucoin!(Please always check the url and don't get phished!)

Feeling ballsy and wanna do leverage? BitMEX allows up to 100x! Don't get burned though, or else the bot will quote your order.

Wanna try Options Trading? Spectre.ai offers options trading with traditional currencies using the Ethereum blockchain! You can try the demo too!

Disclaimer: All information found here, including any ideas, opinions, views, or cryptocurrency picks, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as an investment signal or a personal investment advice. I am not your financial advisor. Please don't sue me if you follow my picks, ideas and information. Just please.

Missed the previous weeks? Here's the list

Week 1 | Week 6

Week 2 | Week 7

Week 3

Week 4

Week 5

Banner made from bannersnack.com

Resources: Tradingview

Coins mentioned in post: