White paper April 29, 2017

The problem:

No country today has a national currency built on the new digital-cryptographic-blockchain. This innovative architecture is a prerequisite to engaging with blockchain economic activity which is nascent but burgeoning at the present time.

Blockchain technology, among other things, allows a currency to expand its capabilities beyond what we currently understand a currency to be i.e. a mechanism to transfer intrinsic value. Fiat-based currencies are the incumbent format. Although fiat is now mostly digitised, its architecture is not cryptographic by design, thus rendering it largely unusable within these new emerging economies.

The native state of a cryptographic blockchain currency is in cryptographic digital format; it does not have a physical equivalent as fiat does. This white paper is an overview explaining why this currency is different, why it is needed and how to implement it.

Preamble:

There is growing recognition within the fintech (financial technology) community that emerging cryptographic blockchain currencies will be a major disruptive technology. They can be permissioned or permissionless.

Permissionless means they can be created and used without-permission or restriction and they do not recognise borders. They are freely available to any citizen from any country. They’re normally publicly issued with a fixed supply and/or with a predictable inflation rate. No bank or government will have had a hand in issuing them; nor do they control them. Paradoxically permissionless currencies hold real value, albeit unofficially.

A permissioned currency is normally issued and controlled by a government or bank and used by that nation for economic activity. All fiat currencies are permissioned currencies. Currently there is no permissioned cryptographic blockchain currency issued by any government anywhere in the world.

One of the purposes of this paper is to position blockchain cryptographic currencies as the next logical step in the evolution of money.

Blockchain cryptographic currencies, in the broader sense i.e. permissioned or permissionless is a nascent yet powerful new technology which very few people are yet aware of. With a permissionless blockchain currency, any person, group or company can now create their own digitally secure currency-type token to transfer value within and across borders. One of the advantages of cryptographic architecture is that it offers unbreakable anti-counterfeiting security along with the ability to firmly fix the monetary supply. This means no individual or government has the ability to arbitrarily tamper with it. It can be changed only through consensus by the majority of its users. This is in contrast to the current permissioned fiat system where additional money creation can and is arbitrarily created by less than one tenth of one percent of its users i.e. the banking industry and government regulators. The vast majority of users within the fiat system have been indirectly shut out of the process that determines when and how much additional money should be created. Monetary creation more recently renamed quantitative easing has the effect of directly devaluing all currency in circulation and all savings held by individuals.

There is a growing concern for the health of the world’s financial system due to high levels of unprecedented quantitative easing taking place throughout the world today. This has exacerbated an era of protracted low interest rates and historic high levels of debt. In the West, the poor and middle-classes are bearing the brunt of the effects of quantitative easing. Interest rates paid on savings or earnings held in bank accounts are at historical lows, and in real terms are returning negative capital growth. Savers and earners are experiencing the devaluation effect as their money purchases less and less of fundamental asset and service necessities like housing, education and health. For this group of citizens, this reality will become a very powerful incentive to move surplus earnings or savings away from a highly devaluing fiat system and into a permissionless blockchain currency that offers a fixed, stable monetary supply.

What exactly is a blockchain currency?

Broadly speaking, the architecture of a blockchain currency is based on digital cryptography. This makes it secure when transferring over the internet. Digital fiat architecture is not cryptographic, making it unsecure to use over the internet.

Digital blockchain currencies have an important commonality with physical fiat cash. When I take a physical $20 note out of my physical wallet or a digitised $20 blockchain currency out of my digital wallet, and transfer it to you, both our wallet balances are updated immediately without an intermediary being involved i.e. no bank. In both cases your balance rises by $20 and mine declines by $20. This type of simple person-to-person value-transfer and simultaneous balance-update with physical fiat currency or digital blockchain currency is impossible with digital fiat currency. Digital fiat must have a bank to act as intermediary between us. It is the bank that actually makes the transfer between us and it is the bank that updates each of our bank balances (usually overnight).

So as to remove all doubt, a physical fiat currency and a digital blockchain currency do not require a bank to act as intermediary when transferring to someone else. This is a powerful, yet unobvious concept to grasp. The ramifications of this statement of fact is far reaching, yet little understood by the average person.

The problem with fiat:

Fiat currency has a quasi-symbiotic relationship around ownership and control, shared between a government and banks. It is a marriage of convenience rather than one of choice. Regulation and oversight is supposed to be controlled by government, but in this marriage, an unhealthy imbalance has grown over time that has put the banking industry in a much stronger position as to how money is created and controlled. This imbalance in power has come into existence as a result of new levels of modern debt issuance. Most developed and all undeveloped countries are in some measure deeply indebted to the banking industry, whether the debt be government or private. Total worldwide debt levels are now so high it is unlikely to ever be repaid. When you owe a bank a lot of money they have much more control over how things should be run.

Physical fiat was digitised with the invention of the computer and before the invention of the internet. Digitised fiat consists of two parts the digital currency itself, and the digital infrastructure used to move it around. Before the internet, the banking institution created this digital system to enable their users (every bank account holder) to transfer value between each other. It’s a proprietary closed system (in other words it does not use or currently need the internet). There are no competitors and every user must have a bank account. We all have no option but to use this system. Lack of competition has allowed it to become antiquated, with very little innovation to improve its overall functionality. It is expensive to keep it going, and without genuine competition, price gouging is suspected on the fees charged to users for just about every aspect of its use.

The fiat system is also filled with friction. For example, it’s slow and very expensive to perform international remittances. There are fees to convert the currency and then more fees to send that currency on. It can take anything from 3-5 business days to receive an international payment. Payment-associated transactions like credit cards and PayPal also attract expensive fees.

A state change is upon us:

The blockchain currency has arisen with the ubiquitous penetration of the internet and its ownerless yet persistent state (always on). The internet has grown and emerged as the predominant superhighway to transfer all types of digital information. Physical postal-service mail was the first major industry that was disrupted by this new superhighway due to the invention of email. Today, most legacy infrastructure that supports telephony, radio, movies and television has been disrupted to some degree. These industries are shifting ever larger parts of their data transmission over to the internet because an ever-growing number of their users are using the internet as the preferred portal to access their digital data requirements. Private siloed and permissioned legacy infrastructures are in rapid decline. With the invention of the blockchain, transfer-of-value directly over the internet is now possible. The banking industry’s siloed fiat system is perhaps the last and most important private legacy infrastructure to be disrupted by the internet.

With the blockchain, being willing to incur a “cross-border payment” while suffering up to a 5-day wait becomes as unthinkable as sending a “cross-border email” that is expected to take 5 days to arrive.

Blockchain currency conversions are relatively frictionless and virtually instantaneous (less than 1 hour in most cases), and transactions fees (if any) are also considerably lower. Paying an expensive fee to send your blockchain payment locally or internationally makes about as much sense as paying a fee to your internet provider to send an email locally or internationally.

The internet has thoroughly penetrated the fabric of modern society for all things digital, one of the most notable being ecommerce. From around 1995 the demand from users to participate in commerce via the internet grew exponentially, and this in turned forced the banking industry to bring their private siloed system closer to the new superhighway in an effort to meet its users’ ever-growing demands for digital convenience via the internet. This has now expanded to include online banking and payment systems (Visa/MasterCard). However, it is important to note the fiat banking system plugs into or sits on top of the internet. It is still separate and is unable to integrate in a safe and secure way with the internet the way a blockchain currency does.

So today the fiat system has a competitor that has the potential to genuinely disrupt its singular monopoly. Blockchain technology has become a game-changer. We are no longer forced to use only government/banker-issued fiat currency to store value; nor are we forced to use the banking system to transfer it. We can now store our value in a public decentralised currency (a blockchain currency) and use a public decentralised system (the internet) to transfer it to others.

The current state of blockchain currencies:

Cryptographic blockchain currencies are at a very nascent stage. They are not a separate technology to the internet, but rather a major enhancement or upgrade to the internet’s ongoing evolution. Cryptographic blockchain currencies therefore inherit the genetic or core fundamentals of the internet right down to the protocol level. Arguably, the most important of these attributes is the decentralised state of the internet. The internet is the rails that a blockchain currency is transferred around on. It is not owned by the banks or controlled by a government. This means high fees are unlikely to be ever charged since a “level playing field” or a “neutral worldwide rails system” is now in place. This is a similar state of affairs to when Skype was created. International phone calls through Skype suddenly became very cheap or free. As a direct result, toll call charges from incumbent Telcos plummeted all around the world. The Telcos’ siloed telephone system faced extinction. They had to lower prices to compete with services being offered by the likes of Skype to stay in business. And it was the ownerless state of the internet as the underlying rail system that brought this about.

There are only permissionless (non-government/bank) blockchain currencies in existence today. The first permissionless blockchain currency was Bitcoin, created in 2009. It was a technological experiment that has been highly successful and has proved that currency movements over the internet can be safely and securely performed without a banking system. It comes with a fixed money supply of 21 million coins, and it’s the resultant scarcity this creates that makes it extremely valuable. One bitcoin at time of writing is worth around $1300 USD. No government, dictatorship or banking institution was involved in its creation or deployment. Its value is autonomous and is derived solely from what its users believe it is worth. There are now over 500 permissionless blockchain currencies available today.

Permissionless currencies are only one (and the first) product that a blockchain can be used for. They can also be used in other new and innovative ways not possible with fiat. Micro payments, escrow, and multi-signature transactions are some examples where blockchain currencies are far superior. In addition, there are other functionalities not specific to finance that are possible using blockchains and which are much more secure and unforgeable, such as proof of identity (like a passport), ownership transference (like vehicles and homes), and democratic voting systems. Hundreds of non-currency blockchain products are being worked on now and many thousands more are likely in the future. However these developments are outside the scope of this paper.

Why a government should support this technological innovation:

Blockchain products and new economic communities are under development. They can be accessed or used only via a blockchain cryptographic currency. Currently there is no permissioned or government-created one. Electronic fiat is unusable within these environments because its architecture is not cryptographic. It must be converted to a currency that is cryptographic before its intrinsic value can be utilised. On this basis alone, a risk for government is the economic exclusion of fiat in these new economies. Users will be forced to sidestep the fiat system for no other reason than these new economies can only function or be used with a currency that has cryptography built into its design i.e. a blockchain currency. To ensure a country’s national currency remains relevant to these emerging new economies, its currency must be made available in a blockchain format.

In the near future, it is this author’s view that most countries will need to convert at least part of their fiat currency over to a blockchain architecture. This means two different architectures for the same currency for example, NZ dollar fiat and NZ dollar blockchain. It is simply a matter of when a government recognises that electronic value-transference will be moved (in part or wholly) to the internet, thus breaking away from the current banking industry’s siloed fiat system. It also means the beginnings of the disintermediation of banks since blockchain currencies do not require them. A tough reality that the banking institutions are currently grappling with.

Bitcoin has proven that creating or digitising a currency (or digitising a value asset) to store value is no longer the privileged purview of banking consortiums or even governments. Permissioned systems based on fiat is not the future. Total domination of currency creation and value transference by the banking industry and governments is ending.

Why this technological innovation will grow with or without government sanction:

Once the blockchain becomes the accepted standardised architecture for currencies, some governments and banks will be unable to surreptitiously devalue their currency without serious repercussions from its users because those users can easily abandon it as a store of value. This in effect is what we have now, albeit nascent. Citizens who live in economies like Brazil, India and Greece are now storing a growing percentage of their savings in non-government-created cryptographic currencies in the knowledge that it’s secure (it cannot be arbitrarily confiscated and access cannot be shut down), it will maintain its value much better than the official fiat currency, 24-hour access is guaranteed via their mobile phones, and it can be moved to any location in the world that has internet access. Their wealth will easily follow them wherever they go. Being a refugee will no longer necessarily mean you have no access to your savings irrespective of the country that takes them in.

Blockchain currencies will enable users to exchange and hold their savings in many different currencies (permissioned or permissionless) with very little friction. Sending and simultaneously switching one type of currency to another will be as seamless as sending an email from an Apple Mac, Android phone, Windows PC etc. to any other device anywhere in the world.

This new technology – as was the case for the internet in the early days – will be largely ignored by everyone until suddenly we all find ourselves using and relying on it in our daily lives.

The architecture of a solution:

In the future, it is likely that a mix of fiat and blockchain currencies will coexist for a time. Governments and the banking industry will create and control the official fiat and the official permissioned blockchain national currency, while permissionless blockchain currencies (or currency-like tokens) will be created by various members of the public (worldwide) to achieve or enhance their specific economic goals.

There are blockchain solutions suitable for permissioned government-issued cryptographic currencies. These solutions will enable governments to safely move or exchange at least some portion of their fiat currency over to a blockchain architecture to enable its constituents to use blockchain products and participate in blockchain economies which would be impossible with fiat currencies. A government can issue a regulated permissioned currency with all of the architectural advantages of a cryptographic blockchain. There is no requirement for it to be decentralised as is the state with a permissionless blockchain currency. Deciding what features and safeguards a permissioned cryptographic currency should have embedded into its protocol is the more relevant question.

Several first-world central banks have been experimenting with a form of blockchain currency using distributed ledger technology (DLT) for example Canada, Britain and Japan. However they have restricted that usage largely to streamlining interbank financial activities. As important as this is, there should also be a focus to cater directly to end users who want to actively engage in localised economic blockchain activity within the real economy (non-financial). Governments should lead the way and be the conduit to lay down the initial infrastructure for their citizens.

This proposal focuses on first-step distribution being offered directly to the public. The distribution, in all probability, will be taken up via “software developers”, who will require a cryptographic currency to deliver cryptographic blockchain solutions. Such solutions would promise better efficiency within current business models which rely on a high degree of human intervention (for example international money transmittance). These solutions will also drive out friction in antiquated legacy systems and create new forms of value transference not yet thought of. This would enable a meaningful assessment of real-world demand and also allow innovation to be driven directly by the needs of users. Currently, software developers are forced to use permissionless cryptographic tokens/currencies to deliver these products. There would be no need for this if a permissioned government blockchain currency was available.

Any cursory investigation by world governments will confirm the burgeoning wall-to-wall projects underway in this sector. Literally billions of dollars are being invested into this ecosystem. None of these dollars are going into a government-permissioned cryptographic currency. A controlled and measurable pathway is required to apply a blockchain architecture to the national currency. It needs to be done with the buy-in of key stakeholders namely, the government, the banking industry and individual citizens.

This paper provides a starting point as a way forward for the adoption of a cryptographic currency as the correct or better mode of transport to transfer value.

Simply put, an orderly and safe process is needed to introduce a government-issued and controlled cryptographic currency. It would operate in parallel with the fiat system. The key is to implement it with demonstrable incentives to accommodate the key stakeholders. The process would also need to demonstrate low or negligible instability risk to the current financial system.

Specifically a modified CAB (centralised autonomous blockchain) would be created.

The proposal:

For the purposes of this proposal I would suggest a country like New Zealand (of which I am a national) would be good candidate. It is a small, first-world economy with a sound and relatively open financial system and would be well suited for such an experiment.

The government, in effect, owns one bank called KiwiBank. In partnership with this central bank the foundation for this proposal is already in place.

The central bank of New Zealand could create a limited quantity of cryptographic currency that would be available for use in parallel with the national fiat currency. Kiwibank would control the initial release of this new currency into the system. This would insure KYC (know your customer) legal requirements and AML (anti money laundering) regulations are met. Kiwibank would in effect provide the on/off ramp into and out of the NZ cryptographic dollar from the NZ fiat dollar.

Since there is no physical note or coin for the new cryptographic currency, converting fiat to cryptographic would be digital only via Kiwibank customers. Customers of Kiwibank would convert monies from their digital fiat bank account and transfer it to a smart-phone digital wallet, using an APP (via Google’s ‘Play Store’). An internal ledger would be created and maintained by Kiwibank for auditing purposes. The government would then know with whom and when the coins were converted.

A Federated Server (or servers) owned and controlled by key stakeholders would be responsible for running the blockchain ledger. The coin would be a New Zealand digital cryptographic dollar (NZCD) and would carry the same value and rights as a New Zealand digital fiat dollar (NZD), backed by the full faith and credit of the New Zealand government).

The initial users who convert their fiat to cryptographic would most probably be software code developers who want to create new blockchain applications for blockchain economies that are accessible only with a cryptographic currency. They would convert their current digital fiat dollars for digital cryptographic dollars. When a new-use application, solution or asset is created, the wider community would then need to convert their fiat dollars for cryptographic dollars to use the new application and participate in the new economy created.

Security and Control:

Strong controls can be built into a government-permissioned blockchain currency, together with highly transparent visibility. Regulatory compliance rules could be built in if required, for example:

• Freezing the contents of any funds held in any wallet due to criminal activity.

• Automated deduction of any funds held in any wallet i.e. outstanding fines (currently forced on employers to collect).

• Automatic freezing or confiscation of any funds used on any blacklisted markets.

• Automatic recall of funds transferred or used outside a specific geographical location (national or international).

In effect, highly advanced controls can be programmed into a cryptographic blockchain currency that is not possible within a fiat system. Cryptographic currencies offer control and flexibility well beyond what a fiat currency is capable of. Lawful activity can be programmed in and unlawful activity can be programmed out.

How? (Basic technical overview):

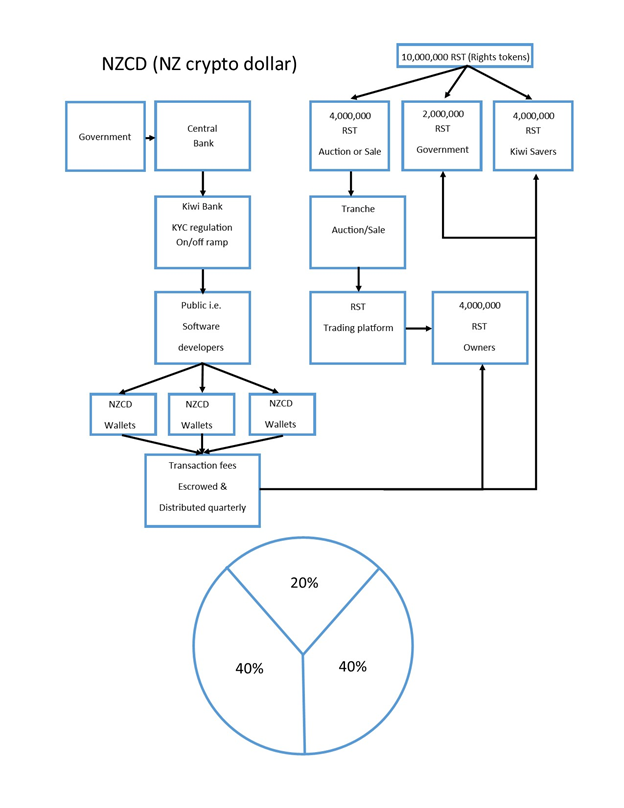

In essence two cryptographic currency tokens would be created. Firstly, a rights token (RST) and secondly a cryptographic currency i.e. a New Zealand cryptographic dollar (NZCD). Both tokens would be created via central-bank/government and would have a symbiotic relationship with each other. The rights token would be tradable, that is to say it would be tradable for legal tender (NZCD) but in itself it would not be legal tender. It would be similar to a share certificate of a company in this respect.

The rights token would receive a dividend from the usage of NZCD. A transaction fee would be deducted and held in escrow each time NZCD was transferred from one entity’s wallet to another to purchase goods and services. This function would be programmed into the blockchain currency and would be automated. For example, the fee could be say 0.1% per transaction (or something set well below any current fiat system fee). Every quarter, transaction fees would be autonomously distributed to all RST token holders on a pro-rata basis at set intervals based on the number of RSTs they own.

RST token:

The purpose of an RST is to incentivise and enable key stakeholder participation. It is a new form of ROI (return on investment) for the banking industry. All key stakeholders would benefit from ownership of RSTs. RST ownership could be made transferable or tradeable to qualifying entities or persons and be made divisible to say 8 decimal placings. The 8 decimal placings (the unofficial standard for cryptocurrencies) provides significant depth for a coin to expand its fungibility and allows the token to be highly divisible. Continual price-discovery through market forces would price the token’s actual market value. The initial distribution of RSTs would or could be distributed via a crowd sale to key stakeholders i.e. the banking industry, governments, individuals or other entities.

A very basic example of how this could be implemented is as follows:

An initial 10 million RST could be created with a portion then held for auction or for sale. A simple split of the tokens could be:

• 2 million held for government or used as incentives for other entities like developers and maintainers of the system.

• 4 million held and distributed to all KiwiSaver participants or held in escrow for every Kiwi citizen (KiwiSaver).

• 4 million set aside for auction or sale to banks and private New Zealand investors, either all at once or in tranches over time.

NZCD dollar:

As little as $1,000,000 dollars could initially be issued. With the above-mentioned built-in safeguards, this level of seed-cryptographic currency would have a negligible impact on the economy. It would allow New Zealand program developers immediate access to start building out new products and economies. As and when demand rose, further NZCDs could be issued.

Incentive for the government:

There are a number of incentives for a government to move into this space sooner rather than later. Investment opportunities, economic growth and first-mover advantage are some of them.

In 2015 a record 1 billion dollars’ worth of venture capital was invested into this space, up from 347 million in 2014. Estimates for 2016 are forecast at 5-10 billion dollars. There is more investment being channelled into this space than during the comparative early days of the internet. All of it is virtually walled out by the fiat system. Currently, the only way in or out is via unregulated international private cryptographic coin exchanges. This comes with a high level of friction and risk, which in effect has reduced the cross-border investment primarily to early VC adopters.

Governments would have two clear advantages over other institutions when introducing their own cryptographic currency. The first is legitimacy and the second is immediate stability in line with the national fiat currency. Most permissionless currencies do not have these advantages.

In any event, cryptographic currencies are here to stay. It would be much better for a government, looking forward, to introduce their own cryptographic national currency. This would allow software developers to build out or imbed new emerging cryptographic economies with the nation’s own cryptographic currency.

Key Terms:

Rights Token (RST): RSTs reward the owner with transaction fees collected on the system. A reward-based return for any transactional volume will be generated through the use of NZCD Tokens. RST Token ownership would be made transferable or tradeable to qualifying entities or persons and could be divisible to 8 decimal placings.

New Zealand Cryptographic Token (NZCD): An NZCD token represents 1 New Zealand dollar. NZCDs are kept in digital wallets. A set amount would initially be created and grown over time. They have a symbiotic relationship to the RST tokens.

Federated Server (closed system): Servers that run and secure the blockchain. Owned and run by a combination of key stakeholders, banks, a central bank and the government.

ICO: Initial coin offering. A fundraising option to purchase RST tokens.

Crowd sale: Another fundraising option. A crowd sale is used to allow stakeholders to purchase RSTs. Proceeds would be used to fund the system, incentivise stakeholders and attract appropriate developers.

Price per RST:

Example: if the crowd sale concludes with a total value of NZ$1,000,000,000 raised, the tokens will be valued at $1,000,000,000/10,000,000 = NZ$100.00 per 1.00000000 RST.

1 RST rewards the holder with transaction fees from NZ cryptographic dollar tokens (NZCDs) on the blockchain at 1 / 10,000,000 of all transaction fees every quarter. As an example transaction fees of NZCD could be set at say 0.1%.

Scenario 1: NZ$1,000 transaction volume per day:

The transaction fees collected would be $1,000 * 365 days = 365,000 / 10,000,000 RST tokens. So annual fees collected would be $365 NZCD and distributed pro rata at 0.00003650 cents per 1.00000000 RST held.

Scenario 2: NZ$10,000,000 transaction volume per day:

The transaction fees collected would be $10,000,000 * 365 days = 3,650,000,000 / 10,000,000 RST tokens. So annual fees collected would be $3,650,000 NZCD and distributed pro rata at 0.365 cents per 1.00000000 RST held.

Scenario 3: NZ$100,000,000 transaction volume per day:

The transaction fees collected would be $100,000,000 * 365 days = 365,000 / 10,000,000 RST tokens. So annual fees collected would be $36,500,000 NZCD and distributed pro rata at $3.65 per 1.00000000 RST held.

About the author:

Monty Kirkman is an artist and small business owner. He currently runs a small manufacturing business producing glass art giftware in Whangarei New Zealand www.maoriboy.com

As a keen technologist, in 2013 he discovered the underlying technology called ‘the blockchain’. He became fascinated by the very real disruption this technology will bring to all forms of industry.

One of his aims is to raise awareness to the small business community to prepare themselves for this emerging technology.

Cool! I follow you.

Congratulations @monty-kirkman! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!