INTRODUCTING

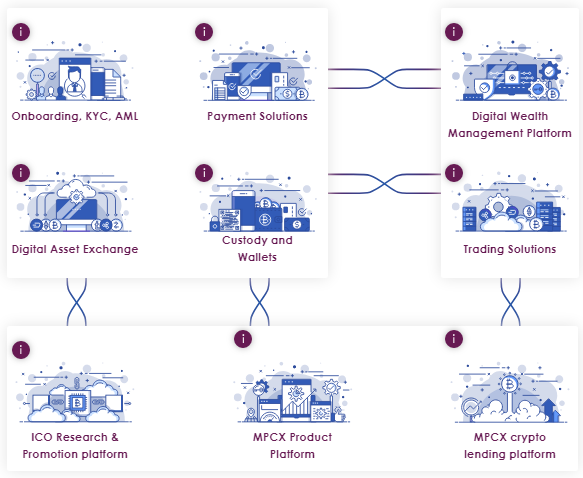

MPCX is a digital blockchain driven financial services platform. Our long term aim is to aggregate all crypto financial services into one place. MPCX is designed to service entities’ and individual’s needs in the areas of digital wealth management, cryptocurrency exchange and trading, digital banking, crypto research and ICO promotion, and crypto lending.

In the short-term, MPCX will create a blockchain driven decentralized ecosystem to manage innovative investors’ portfolios of crypto assets. In light of the current market situation with a huge demand for and a very limited supply of financial management solutions we decided to create the MPCX Platform to service the market opportunities.

MPCX has a significant competitive advantage in that its team and founders together have over 45 years of experience within finance. The resultant expertise and client relationships give MPCX the opportunity to offer unique products tailored to our clients.

The platform is designed to service entities' and individual's needs in the areas of digital wealth management, cryptocurrency exchange and trading, digital banking, crypto research and ICO promotion, and crypto lending.

Stage 1

The digital wealth management platformStage 2

The cryptocurrency exchangeStage 3

the digital banking and regulated wealth management platforms

MOTIVATION FOR LAUNCHING AN ICO

It is very important to be passionate and to have a dream. We believe that financial services should be as transparent as possible and designed to help people to achieve their wealth goals. The FinTech community proposes solutions for many different problems, however when it comes to crypto related assets there are few solutions available and this fact is a concern for early crypto adopters.

We believe there is powerful disruptive potential with blockchain technology and the ICO represents an innovative ways of raising capital. We want to lead by example and support the disruptive use case. To boost our project's development, we have decided to seek support from members of the Blockchain and Crypto communities who share our vision. That is why we decided to fund the development of the MPCX Platform through issuing XDMC tokens that will be used to pay for platform services and participate in platform development.

Our ICO will have several stages including one pre ICO round, to raise funds for MPCX platform development.

During the pre ICO round, the XDMC token will be distributed with the maximum discount of all funding rounds.

MPCX solution

At the end of the third stage of the development of the MPCX Platform we will have implemented the following ecosystem:

Our solution will be based on the Ethereum Blockchain and has the potential to significantly disrupt the banking and wealth management landscape. Fully digital solutions will make it possible for clients from the mass and mass affluent segments to recieve for the first time high quality crypto trading and wealth management services.

MPCX’s MVP and Beta Platform Technical Implementation Process

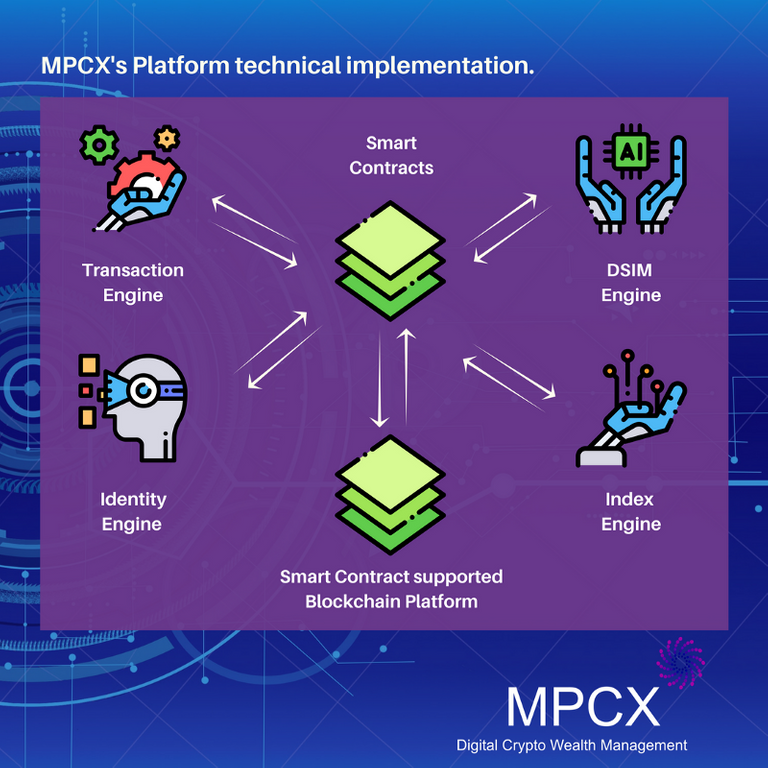

The MPCX platform will consist of several components, which we regard as engines, as illustrated in the following figure. The platform will be built on top of a smart contract supported public blockchain platform, such as Ethereum, which already provides a pseudonymous identity functionality. However, to ensure accountability, the identity of each entity (actor) within the MPCX platform will be properly verified through a rigorous KYC (Know Your Customer) process. Then, each of these physical identities will be anchored with a corresponding virtual pseudonymous identity facilitated by the underlying blockchain platform. This will be accomplished by creating an Identity Engine within the MPCX platform. The core functionalities of such an engine will be built in-house. However, for the beta platform, to allow our clients to get access to our products early-on we might utilize services from existing e-KYC providers and then replace them with in-house created solution later on.

The MPCX platform will consist of several smart-contracts serving different purposes. In particular, the components of the platforms will mostly interact with the underlying blockchain using the corresponding smart-contract. How we develop the smart-contracts will depend on the blockchain platform. For example, where we will use Ethereum our smart-contracts will be written using the Solidity programming language.

The Index Engine will be responsible for calculating the three crypto indices mentioned in the whitepaper. Since the price of crypto-currencies are extremely volatile, each of these crypto indices will be refreshed in real time by the Index Engine. For this, the Index Engine will communicate continuously real-time prices of different crypto-currencies from major cryptoexchanges. The retrieved prices will then be analyzed using different mechanisms to identify the best quotes within a period of time, which then can be utilized to update the portfolio of the crypto-indices.

The Digital Smart Investment Mandate (DSIM) Engine is responsible for providing the DSIM service of the platform. We will create a chatbot, acting as the Roboadvisor, to interact with clients. Such a chatbot will be developed using Artificial Intelligence (AI) mechanisms. We are in conversation with a few commercial chatbots to be used at the beta stage whilst our in-house solution is being created. This will allow us to deploy the DSIM service to clients earlier.

The clients of the MPCX platform will utilize the XDMC tokens to pay for services inside the platform. These tokens will be handled by a smart-contract and will be forwarded within the MPCX Platform between other smart-contracts belonging to the different components of the MPCX platform. The Transaction Engine will facilitate the flow of tokens between the smart -contracts of different components.

It is to be noted that the figure above only highlights the core components of the platform. There will be other different components, for example a report generation engine, which were skipped for brevity at this point.

Considering that the KYC and AI chatbot service in the beginning will be created using an e-KYC provider and a financial chatbot service provider, we will still need to hire at least three experienced Ethereum /blockchain developers for writing the smart-contracts as well as developing DApps (Decentralised Applications), two experienced software engineers with machine learning/AI experiences, an iOS/Android developer to release an app for iPhone/Android, and a UI/UX developer for the web. Then we will expand the team gradually. We believe, with this team in place, we can develop the first iteration of the two products in around 8 months.

We are planning to start MVP’s technical implementation very soon and release our MVP before the first ICO Round in July 2018. This should increase the level of trust among our community. The platform’s beta version release is scheduled for 8 months after the MVP release.

MARKET OPPORTUNITY

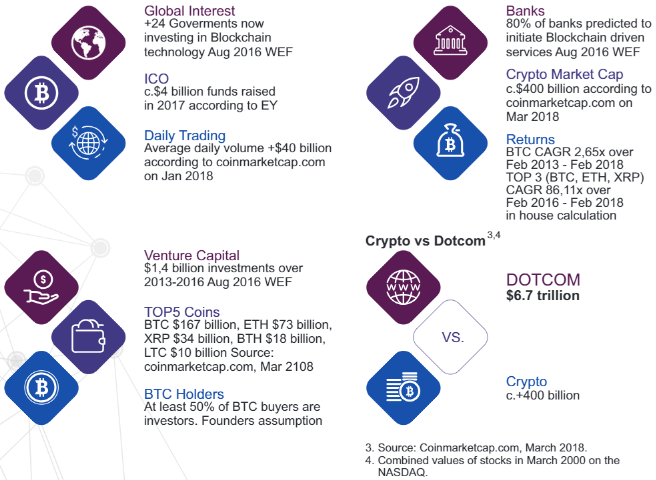

The enormous development of the blockchain technology has created a vast number of new investment opportunities. Crypto markets operate 24/7 and offer huge potential for growth. A growing number of initial coin offerings have led to more than 1 500 new coins. Many ordinary people have built significant wealth through investing in ICOs, sometimes achieving returns of in the region of thousands of percent.

The graphics below show our analysis of the market:

The capitalisation of crypto markets currently stands at c. $400 billion. An additional $ 200 billion of assets may benefit from a comprehensive digital wealth mangement solutions as a result of problems in the traditional asset and wealth management industries. This means that the total market opportunity is c. $600 billion, and this market is still growing exponentially.

ROADMAP

To achieve our strategic goal of disrupting and changing the financial industry, we have developed an ambitious business plan which we intend to realize in three stages.

In this document we provide a detailed explanation of the first stage which relates to technologies and our Pre ICO use of funds. Detailed explanations related to the first ICO round, second and third stages will be provided in advance of the respective rounds.

First Stage: Digital Wealth Management (DWM) Platform

Second Stage: MPCX Cryptocurrency exchange and Trading

Third Stage: MPCX Banking, Regulated Wealth Management and P2P Crypto lending

In the beginning of our development we will aggregate all of our capacities and dedicate all of our time to offer solutions for innovative investors who already live life in a digital system. Our unique products will be created to provide services of the highest quality in digital wealth management (DWM).

THE XDMC TOKEN DESCRIPTION

The XDMC Token will be a functional tool for using the MPCX Platform. XDMC Tokens will be used to pay for the services inside the platform. Once the XDMC Token becomes liquid and popular, it will be used as the internal currency for our banking services.

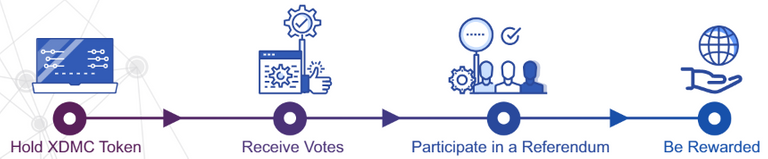

At MPCX we believe that crowd wisdom is a part of a new reality where each individual can contribute to the mutual wellbeing of a community and be fairly rewarded for that contribution.

Many economists and researchers have observed that the so called generations Gen X and Millennials are increasingly interested in crowd solutions and using them in their lives.

In many cases, group outcomes are better than any personal outcome. We strongly believe that “crowd wisdom” will help us to create our platform to serve the best interests of our community. In this way XDMC Token holders will have the opportunity to participate in the development of the network.

How does an XDMC referendum work?

Rewarding XDMC Token holders

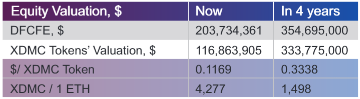

In addition to to returns derived from the appreciation of the tokens due to popularization and increasing number of MPCX users, we propose to reward our community on a regular basis by allocating 50% of the platform’s returns to a systematic buyback program of XDMC Tokens directly from holders and crypto exchanges. Part of the bought-back XDMC Tokens will be burned, thereby organically decreasing the XDMC token supply and the remainder of the bought-back tokens will be subject to three-month selling restrictions. Regular buybacks will set the best practice of rewarding XDMC Holders. We intend to monitor emerging industry practices to discover new direct ways of rewarding our community. The XDMC token can be purchased during the ICO or on the exchanges after the first ICO round.

MPCX FINANCIALS

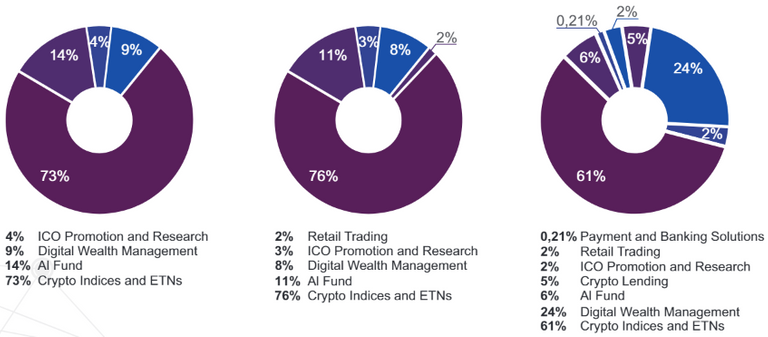

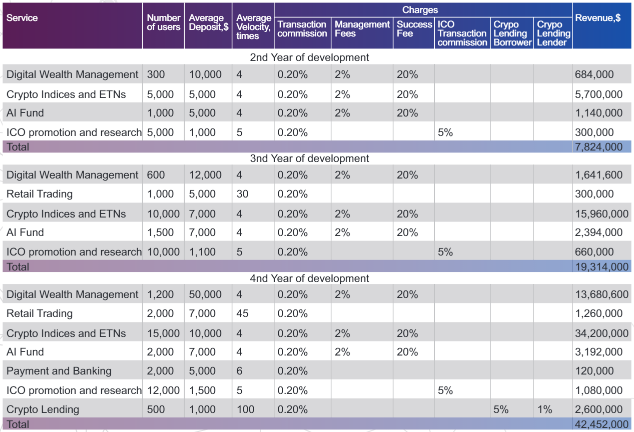

Our revenue model is clear and straightforward. Our main categories of revenue stream are depicted below. Forecasted revenue sources in the second, third and fourth years respectively:

We are already in conversation with several large potential clients. Our extensive experience in finance and wealth management means that we are confident in our abilities to meet these milestones successfully.

Revenue forecasts

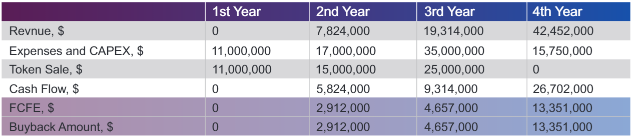

Cash Flow Forecast

Valuation of XDMC Token Forecast:

For more information please visit at:

WEBSITE

TELEGRAM

FACEBOOK

TWITTER

ANN THREAD

Author: AdutJ

BITCOINTALK

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/@mpcxplatform/mpcxs-mvp-and-beta-platform-technical-implementation-process-c3370efd3b61