Hey folks,

It's been a while, but I'm back. This time with some friends. I will have them post their own introduceyourself posts later but lets just say that we plan on being way more active in the Steemit community from here on out. My friend Austin is a whiz with tradition equity management and will be helping me with technical analyses while I try to point out the bigger market picture.

Austin:

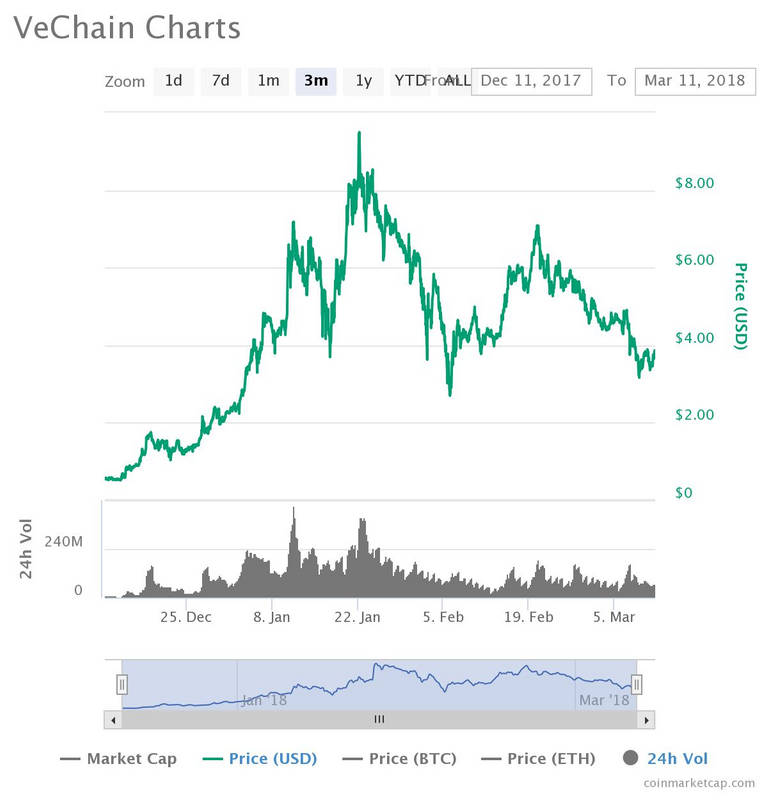

On Jan 22nd of this year, you can see that Vechain went parabolic to hit an all time high of $9.45. This concluded an unprecedented run since the release of its ICO in August 2017. The run to $9.45 started around $0.30 in early December which represents a 3,050% increase in just over two months.

At the peek, volume was nearly 400 million in a single trading day. However, after the coin hit $9.45, volume began to drop significantly in the coming days. Momentum began to fade as overbought levels were hit and sustained. On February 6th, the coin hit its bottom and reached a low of $2.98 with volume around 110 million. 110 million in volume at this times represents about a 20% increase compared to the average volume in the 10 previous trading days.

This signals that oversold levels had been reached, and we received a bounce off the short term bottom. The bounce on that day was substantial enough to last until February 22nd when $7.07 was reached. Volume was close to 200 million which was the highest single day volume since January. Again, the coin sees overbought levels, and experiences a sell-off. With the current price being around $3.70, it is time to watch prices and volume closely. It remains to be seen if volume over the next 14 trading days can be sustained.

If you’re a believer in the coin, it is a great time to invest. A solid entry point would be around $3.52. At this price, the downside risk is around 12% depending upon your stop loss. Anything under 3$ and I would expect the coin to make new lows (and who knows how low that could be). Anything above that, and the ensuing bounce could represent another 300+% increase relative to the coins current cap price. (Volume is represented within a 24 hour window).

Jacob:

With an attractive list of growing partnerships, Vechain has recent rebranded to VeThor, with the VEN symbol being replaced by VET. It it an interesting project, utilizing a PoS method to secure their unique blockchain which focuses on the safe storage of information through Dapps in a wide variety of industries. The blockchain is powered by Thor Power, which will be referred to as TP for concision. TP provides the "gas" that powers the network similar to the NEO/GAS relationship. While I won't delve into the VeThor project in great detail here, on March 6th the company announced an addition to their planned node requirements.

The Vechain foundation has pledged an addition 50 million VET from the VeThor Foundation from its large 22% of total tokens. The tokens will be used to help incentive early network supporters to hold VET for the PoS model. This is great news for people looking to run a node. The X node status which must be locked in by March 20th, will make staking VeThor significantly more profitable for token holders. It can only be granted by holding a minimum of 6,000 Vethor in an ECR20 compatible wallet (MEW, Geth/Parity, etc.) and users are able to upgrade to greater nodes with higher returns. I will post a follow up article later on the profitability of a VeThor node. This will help "lock up" 50 million additional VeThor which will greatly reduce the circulating supply and help pressure further appreciation in the future.

More details here:

https://medium.com/@vechainofficial/vechain-x-series-6b77b746b4b2

I will post more later on the expected profitability of an X node later in the week when the screen shot has been taken but for now, it is looking like an attractive entry price for a potentially profitable endeavor.

Thanks, to coinmarketcap.com for the lovely graphs and as always DYOR

Sincerely,

Cryptolads

Note: This does not constitute as as investment advice. Always do your own research. Our team currently owns/plan to own VeTHor/TP. Please feel free to contact me with any questions.