DCC is the blockchain network is installing the distributed banking system and making the system feasible. This will store the decentralized data in the decentralized hands where the Distributed Credit Chain will store the non-reputable evidence to provide them into the data generations with accuracy. This will start with the application for data with the individual verification and will generate report through the data institution to get back to the return report.

DIV System

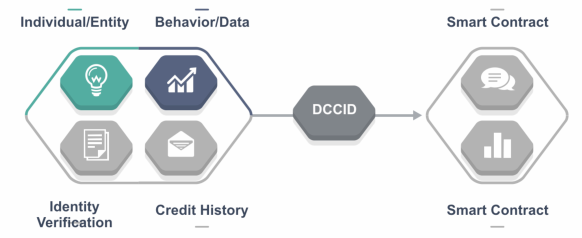

The DIV framework is enabling DCC changing the centralized management for the credit reporting the decentralized agencies by the individual ownership for the fundamental altering the original landscape with the personal credit reporting the system is maintained for the centralized credit information system to the country and region.

The mechanism integrates for the credit records for different countries, region and in different languages under the recognition of DCCID. This creates a platform not interfering with a sensitive data interacting with the countless decentralized individuals for participating in the institutions. This will make a decentralized and dependent credit reporting system with the ability to serve individuals or institutions around the world providing the business scenario by the requirements of credit data.

Data Entry

.png)

The blockchain based lending business connects with data entry helping an open source framework for Submitting Data Validation or SDV by the lending institutions for an easy with an input for the user’s data to the existing for the risk control system. It is continuously updating the data parsing and verification with the template of libraries according to the data provider in the DCC market.

It might have the entry after the data of the user gets into the framework. SDV is generating the entry for the data and it will be used for the risk control system based on the digital signature by the submission of data digest for the DCCID by the validation of data and it has been verified due to the submission by the owner and not being altered.

Lending Process

DCC suggested for the lending institutions using the chain data maintaining the lending process. The users will have the applications for loan and can be submitted for the chain directly by the user through the signature for lending institution obtaining the entry data through the SDV and updates by the approval for the result to the corresponding order.

Credit Report

The credit report for the blockchain based lending report through the contracts on DCR of Distributed Credit Report and this will generate for the list of credit history index in the DCC system. It records every individual for the entire life cycle with a status from the application for loans from the review of loans, repayment, overdue loans, collection and bad debt. The index will have the list alongside with the plaintext data from the actual loan contract held by the individual constitutes by the user’s credit history report in DCC system. This also has the embodiment to return the data to the individual by DCC system.

The records of DCR will have the borrowers and lenders to hold the plaintext data with the index list. The record index is shared for the blockchain recording the little value to the third parties. The mechanism assures the sharing of data among the lending institutions happening on the premise of protecting privacy.

Website : http://dcc.finance/

Whitepaper : http://dcc.finance/file/DCCwhitepaper.pdf

Twitter : https://twitter.com/DccOfficial2018/

Facebook : https://www.facebook.com/DccOfficial2018/

Telegram : https://t.me/DccOfficial