Ethereum, Bitcoin, and the aggregated crypto market have declined. They break below a key support level that the buyers defended antecedently. It appears that ETH could be in a good position to see even further downside in the days and weeks ahead.

One technical indicator is predicting that it will dip to $200 before it is able to earn any notable buying pressure. This could lead to catalyze a far-reaching downtrend and break below a key support level.

Prior to the selloff, Ethereum, Bitcoin, and the aggregated crypto market had been in a consolidation phase that lasted for many weeks. It is of significance to note that buyers have still defended several key levels. Nonetheless, the overnight decline seen by most major cryptocurrencies led them to shatter the lower boundaries of these consolidation channels.

The crypto was previously showing some signs of ETH’s vast strength. Nevertheless, its dependence on Bitcoin made it prone to weakness.

Ethereum declines along with the entire crypto market; key support fast approaches

Ethereum is trading down under 6% at the price of $222.65. It has been showing some sharp signs of weakness throughout the past 12 hours. ETH has also slumped by over 2% against its Bitcoin trading.

This latest slump forced it below $230 – the level that set the lower boundary of its previous trading range. It appears that this weakness will continue further in the near-term.

One expert explicates that it is an important level for ETH to maintain above $215. This happens to be around the point at which it was finding notable resistance throughout most of May – as shown in the chart below.

Image Courtesy of Cold Blooded Shiller. Chart from TradingView

Could ETH soon reel towards $200?

There is one salient technical indicator that suggests Ethereum is braced to post a notable decline in the days and weeks ahead.

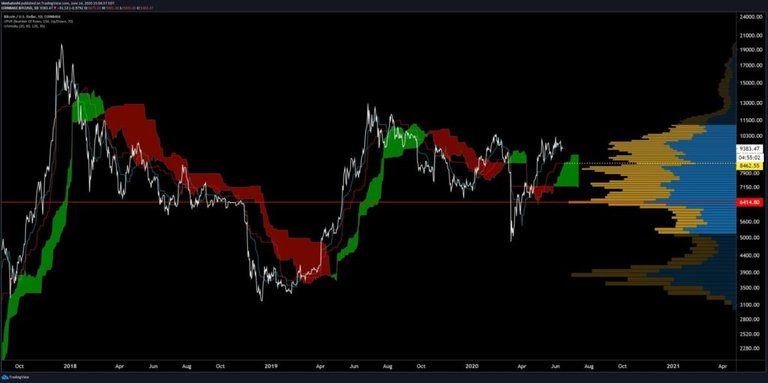

Another respected analyst spoke about this technical indicator in a recent tweet. He explained that it shows ETH is likely to reel towards $200 before finding any notable support, while also showing that Bitcoin could soon hit $8,500.

“BTC and ETH Cloud pretty clear on targets here. 8.5 and 200. Another way to think of this: HH less probable than retrace/mean reversion,” he articulated while referencing to the chart below.

Image Courtesy of Josh Olszewicz. Chart from TradingView

The course of Ethereum in the days ahead should give significant perception into just how much technical damage was done by its recent price decline.

Posted from my blog with SteemPress : https://whaleagent.club/ethereum-likely-to-crash-towards-200-as-overnight-selloff-shakes-market-structure/

Source

Plagiarism is the copying & pasting of others work without giving credit to the original author or artist. Plagiarized posts are considered fraud and violate the intellectual property rights of the original creator.

Fraud is discouraged by the community and may result in the account being Blacklisted.

If you believe this comment is in error, please contact us in #appeals in Discord.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://thebitcoinnews.com/ethereum-likely-to-dive-towards-200-as-overnight-selloff-rattles-market-structure/