A solid Crypto trading strategy can generate significant profits, but it is easy to get lost chasing 10x returns, overtrading or making panic moves which are financially and emotionally expensive.

I based my Crypto strategy on cautious optimism, as such my goal is steady growth (relatively speaking) while accepting and enjoying big rallies when they happen. This cautious approach has delivered +1,350% growth (as of 29th Sep ’17) and is designed around four key pillars:

- Buy and hold stable growth coins for the medium to long-term

- Take punts on small and interesting coins which have significant growth opportunity.

- Rebalance my portfolio based on tiered investments

- Take money off the table, 5% for each 25% up

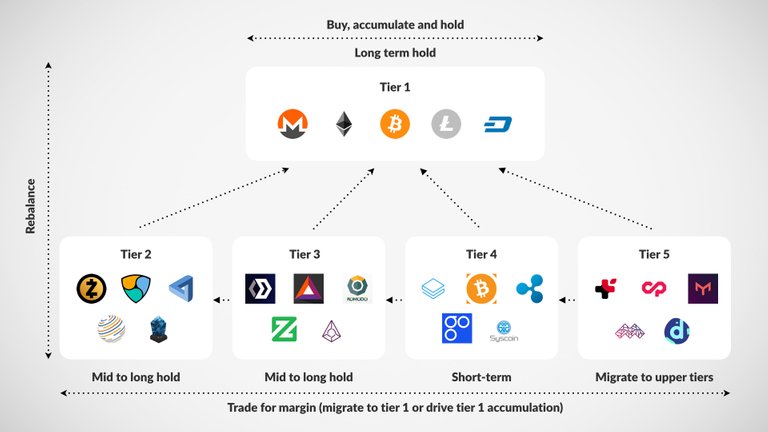

When buying coins to hold I place them in one of 5 tiers of investment based on criteria such as market cap and price stability, and I trade in and out based on price movements.

When China banned Bitcoin, I liquidated 40% of my portfolio which was pretty much the entirety of my 3rd, 4th and 5th tiers and the majority of my 2nd tier. As the market has recovered I have been looking to start building up my lower tier investments, but as we are in a bubble, things are happening which makes holding a vast and diverse portfolio quite difficult:

- Fast moving regulatory news and rumours

- Prominent naysayers like Jamie Dimon spreading FUD

- The relentless release of new ICOs

- Market and coin manipulation

The market is moving differently from when I started this strategy, coins which historically demonstrated stable growth are now dropping or stagnating as money appears to flood into new coins delivering good, short-term returns.

I am particularly frustrated by good projects being neglected by investors as new shiny ICOs come to market. Due to both speculation and manipulation, coins are entering the top 100 market cap charts that are way behind the progress of older projects. This is making it harder to invest in projects based on fundamentals.

It is evident that many coins and tokens are opportunities to manipulate the market and investors. The volatile movements of some of these coins might be ideal for day traders, but as a long-term investor, this is what I am trying to avoid. My investments must either be early in a project or in a coin which demonstrates some level of stability over an extended period.

As an example of what I am avoiding, I previously called out the suspicious trading around Hshare in my Daily Crypto Update on August 29th, where Hshare came out of nowhere to join the $1bn club, despite only entering the market on August 20th. At its peak, it was valued at $43.17, and a few days ago it was $6.02, a drop of +86% in a month. Have no doubt, people are making a lot of money off these price movements, and there are people getting rekt.

Alongside Hshare there are many other new entries into the top 150 which I haven’t been aware of before, and I am not sure how many of them will be here in 3–5 years. The relentless number of coins pumps and ICOs is suffocating the market, and as such, I am adjusting my strategy.

I believe in Crypto and the financial/technical revolution we are going through, but I keep asking myself the following questions:

- In 3–5 years which of these projects will exist with any meaningful value?

- How many different currencies/privacy currencies do we need?

- How many different protocols will the market support?

- Which utility tokens can be economically supported?

My guess is very few, and the winners will not just be the one with the best technical argument. It will come down to the following:

- Time in market

- Trust

- Ecosystem

- Brand

- Features

There may be new alternatives to Bitcoin which are technically better, and there may be a better smart contract platform than Ethereum, so what? Bitcoin and Ethereum aren’t going anywhere, and their ecosystems are too big to dislodge.

First mover advantage means a lot.

Therefore my strategy is to ensure that when the inevitable bloodbath happens, I am positioned as best as possible with my investments to come out on the right side.

As such I am now focusing my efforts as follows:

- Identify, buy, hold and accumulate those coins which will be leading the market in 3–5 years (Tier 1)

- Invest in other coins which have the potential to be here in 3–5 years time

- Trade other coins for margin to accumulate more tier 1 coins

- Consider shorter-term investments in fast-moving projects

- Adjust my fiat position based on bullish/bearish position

I am primarily interested in currencies; I feel like as Crypto expands then these have the highest potential upside as anyone can you use them while tokens are still to be economically tested.

Choosing investments

The sheer number of unnecessary projects is drowning the market, having a dramatic impact on trading. I like to find good projects, invest for the medium to long-term and exit with a margin but it feels that we are just being swamped with endless new projects which swing up, people make money, exit and swing down.

I am now only going to invest in coins and projects I fundamentally believe in and will not be trading anything just because TA says it will go up. I am putting my money behind those projects that I think will exist in 5 years time.

I want to invest in the:

- Leading cryptocurrencies

- Leading privacy currencies

- Leading protocol projects

- Compelling utility tokens

- Investment vehicles

As such my category of investments is as follows:

- Currencies/privacy currencies

- Protocols

- B2C and B2B applications

- Investment vehicles

And for each of the above, I will have specific criteria about whether I will invest or not. I will provide information on how I will be researching, measuring these projects in the future.

Long-Term Buy, Hold and Accumulate

I will be readjusting my tiered investment criteria and trading as follows. Note that stable growth implies that the coin price grows with the market.

Tier 1 — Stable Growth Coins

The projects I believe will exist in 3–5 years, lead the market and demonstrate stable growth. They will usually be +$1bn and top 10 by market cap. My goal is to buy into these and accumulate more coins and tokens. Below I use Bitcoin as the example.

Tier 2 — Developing Stable Growth Coins

Projects I believe have the chance of becoming tier 1 projects, they will usually be +$200m, top 25 by market cap and demonstrate stable growth. My goal is to hold onto these until either they become tier 1 projects or if they fail, trade out based on TA to accumulate more Tier 1 coins and tokens.

Tier 3 — Emerging Stable Growth Coins

These are projects which I believe have the potential to grow through the tiers; they will usually be +$50m, top 75 by market cap and demonstrate stable growth. I will trade for growth and monitor for stability.

Tiers 4 — Volatile Short-Term Investments

These are volatile projects which I trade for margin and monitor for stability. These will be new projects with a potential upside or older volatile coins which are oversold. My goal is to trade in the short term to accumulate tier 1 coins.

Tier 5 — Speculative Investments

These are small speculative investments in small projects. They will usually be usually -$25m and outside of the top 75 by market cap. I will look to invest early and hold long.

Conclusion

My primary focus is, therefore, to grow my tier 1 portfolio, both regarding the projects which are considered members and the volume of coins I own. The goal of all other tiers is to either monitor projects that may become tier 1 or to trade for profit to accumulate more tier 1 coins.

An important thing right now is to demonstrate patience, something I discussed on my Vlog previously. While the market moves sideways and reacts to the numerous FUD stories and government regulation updates, it will remain to be seen how this strategy plays out. Right now my portfolio is heavily weighted towards my tier 1 coins, semi indexing the market which is something I am comfortable with right now.