Chainlink An Investment Worthwhile

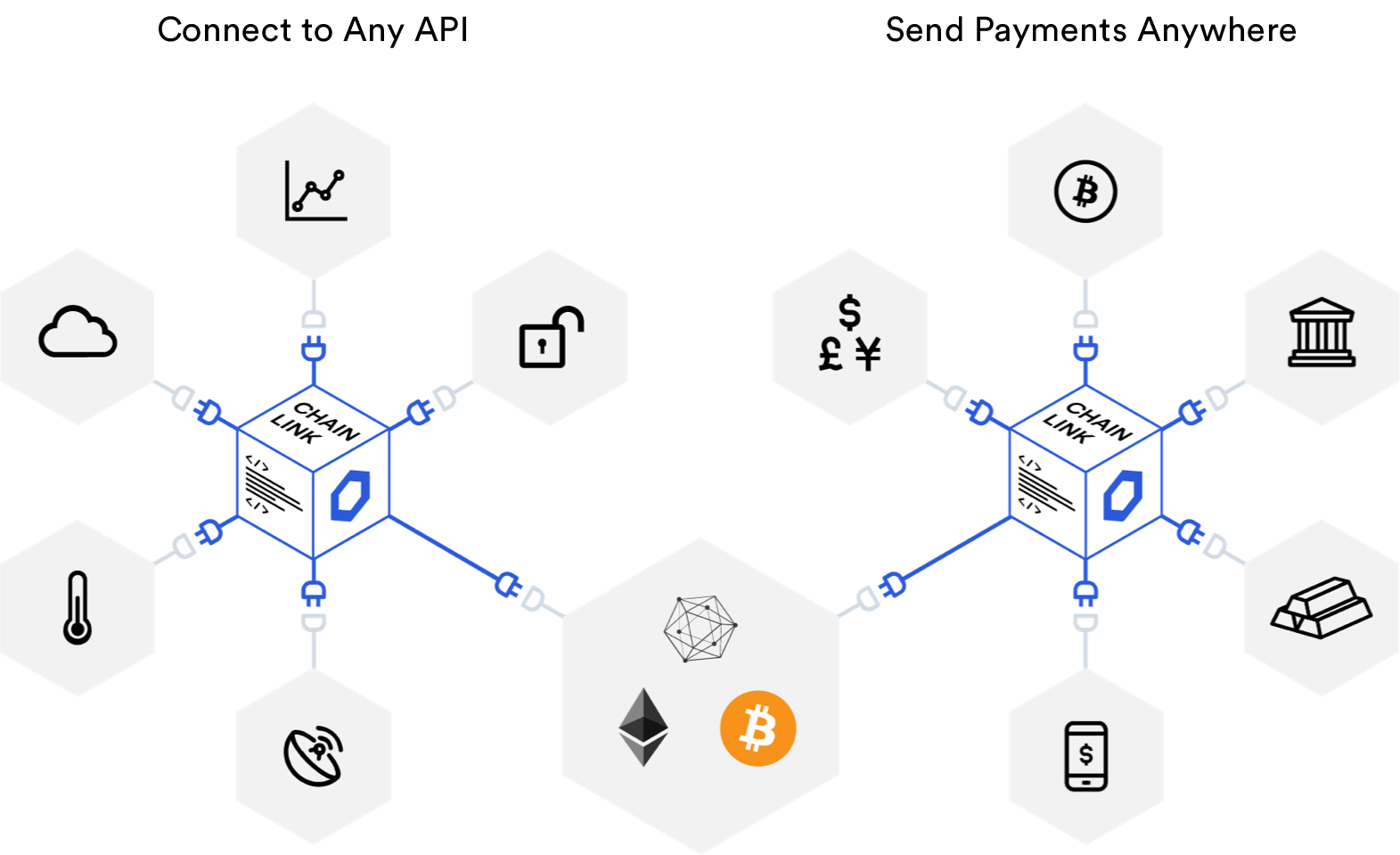

If we take a look at the entire blockchain industry, it is striking that smart contracts play a particularly important role in the use of blockchains. Blockchain platforms such as Ethereum, Tezos, or EOS in particular enable the development and execution of intelligent contracts. These programmable contracts allow fraud-proof contracts to be concluded. However, the required data must also be imported securely onto the corresponding blockchain and exported after the smart contract has been executed - this is where LINK is used.

Despite this unique business model, however, it can be seen that Chainlink also addresses a competitive market. Nevertheless, Chainlink is doing well and continues to push its own Oracle business. In contrast to the competition, Chainlink does not need any sidechains to transfer the required data to the target blockchain. Rather, the oracles represent a type of agent that is used to check and aggregate the data. With the help of smart contracts, the data is then transferred to the blockchain.

Important partnerships

This approach is also well received on the market. The Society for Worldwide Interbank Financial Telecommunication (SWIFT) is one of the users of the service. SWIFT uses the solution to validate current card balances and thus to approve or reject card payments. Working with Alphabet has also brought Chainlink into public focus and accelerated growth. However, the developers also work with other projects such as Web3, Hedera, Polkadot, or QuarkChain. Due to the solid and promising technology, Chainlink is likely to win more partnerships in the future.

Use cases for LINK - especially in the DeFi sector

A closer look at Chainlink shows that the blockchain can already cover numerous applications. However, technology is only at the beginning of its development, so we should see numerous extensions in the coming years. After all, use in almost any industry is conceivable. We assume that smart contracts can optimize numerous everyday tasks. Established tasks such as monitoring raw material or bond prices, analyzing weather data, or checking cloud services are also potential applications.

Especially the DeFi sector, i.e. decentralized finance, uses the Chainlink infrastructure to a rapidly increasing extent. Numerous DeFi Apps (DApps) use, for example, Chainlink's decentralized prices as a basis for building financial applications. Since DeFi is considered one of the hottest topics in the industry, Chainlink will inevitably follow the success of the DeFi sector. Here we see the greatest potential for long-term growth and a real benefit of the coin for Chainlink.

Coinbase effect - all relevant exchanges list LINK

On June 28, 2019, Coinbase listed the LINK token on its trading platform. Within a very short space of time, the cryptocurrency saw a rapid price increase. This effect is also known as the coinbase effect. Experience shows that a listing on Coinbase leads to rising prices for coins and tokens. The reason for this is the increasing demand for cryptocurrencies - Coinbase is one of the largest trading platforms on the market. However, it is difficult to predict what effect the listing will have on the long-term development of the token.

In the meantime, other major stock exchanges have also followed and have also listed LINK as a trading couple. Binance, for example, is one of the largest crypto exchanges. Only recently, the Gemini LINK exchange, licensed in the United States, also started trading, a milestone for recognition in the crypto world.

What do the experts say?

The consensus of experts' opinions makes it clear that the interoperability of blockchains with classic Fiat money systems is a key success factor for adaptation. Chainlink's business model is at the heart of this assumption. In addition, many market observers see the collaborations with Google, SWIFT, Hedera, Polkadot, Ethereum Classic Labs, Chiliz, and ICON as a strong growth factor.

The strong presence in the DeFi sector, as the basis for decentralized applications (DApps), is a key growth driver for Chainlink. Almost every DApp uses the decentralized price feeds from LINK.

In the future, even more, important collaborations could follow, which should then spur the course even further. However, the cooperations not only have a short-term impact, but they also contribute to further growth in the long term.

Many experts also value Chainlink's flexibility. For example, LINK is considered the proprietary token, but the protocol is developed in such a way that other data can be seamlessly integrated without any problems. Experts also call this blockchain-agnostic. However, the LINK token is very functional and enables the payment of node operators, the execution of calculations, or the formatting of data.

Conclusion on the LINK forecast

Based on the consensus of the different forecasts, it becomes clear that LINK is currently one of the most interesting cryptocurrencies. The rapid recovery after the market crash also shows that investors trust in further positive development.

In particular, analysts expect prices to rise so that the previous high could also be overcome in the future. The integration into almost every DApp worldwide represents a strong growth case.

References:

https://chain.link/features/

https://blockonomi.com/chainlink-guide/

https://decrypt.co/resources/what-is-chainlink