Martin Armstrong wrote:

Illinois to Impose 1% Property Tax on Top of Everything Annually for 30 Years

In Illinois is a State that should just commit suicide and be emerged into surrounding states. It is following the EXACT pattern as the fall of the city of Rome itself. Constantine the Great moved the Roman capital from Rome to Constantinople around 330AD. Rome lost its status as corruption and taxes rose. More and more people just walked away from their property for there was NO BID.

The value of real estate went to ZERO!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! Beware!!!!!!!!!!!!!!!!!!!! History repeats!!!!!!!!!!!!!!!!!!

Property values are already collapsing in Illinois. The Pension Crisis is worldwide, but Illinois is leading the charge.

[…]

There is absolutely no hope whatsoever of fixing this problem of a pension crisis in Illinois and every solution, like the current one from the Chicago Federal Reserve and its proposed 1% on property annually for the next 30 years, will fail in the end. The state has COLAs which insanely increase state employees’ yearly pensions by an automatic 3% annually, regardless of the inflation rate.

[…]

Any reader in that state or who has family in that state had better put your property up for sale NOW and get out of town while you still can. Hopefully, a fool has just entered the housing market and its time to get out if you can get a bid.

[…]

For now, the Fed’s proposal is that homeowners with houses worth $250,000 would pay an additional $2,500 per year in property taxes. Illinois already has a net migration out of the state. That means property values will DECLINE and the tax burden will increase on those left behind. [Meaning that they have to increase taxes even more to compensate for the declining property valuations in feedback loop spiral into the abyss] Property taxes in the 3.5-5% level will devastate home values. The average person cannot afford those types of taxes on top of sales taxes, incomes taxes (state & federal) and expect to have any kind of reasonable life.

If you can’t pay the property tax, then they confiscate your home and sell it for taxes at whatever price it brings. Just have a friend who bought two houses that were valued at $70,000 each for tax records for $7,000 for BOTH! They do not care what property brings as long as they get their tax.

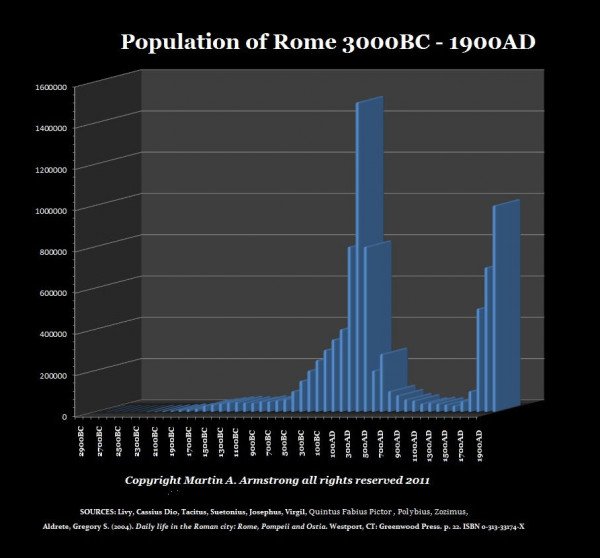

History repeats because human nature never changes. Rome fell, we all know that. However, when you plot the actual population of Rome, what emerges is a very interesting and a stark reality that applies to Illinois. As taxes and corruption expanded, people could no longer afford to live there and they were forced to just walk away from their homes.