Lendxcoin (Xcoin) is a sort of advanced trade connected out P2P advances through an online system that depends on the Blockchain stage through an insightful contract. Lendxcoin will interface the advances and credits of individuals around the globe with no home loan. which decreases working expenses and entangled strategies contrasted with conventional banks. The Lendxcoin stage enables borrowers and banks to deal with the credit and the desire for financing costs without anyone else.

The activity procedure of the P2P framework

Shared loaning Introduction An online distributed loaning stage enables borrowers and moneylenders to associate together by means of online system, which decreases working expenses and entangled strategies contrasted with conventional banks. The stage permits borrowers and moneylenders can deal with the advance and desire for loan fees without anyone else.

Portrayal of the procedure of support in the P2P Lending framework.

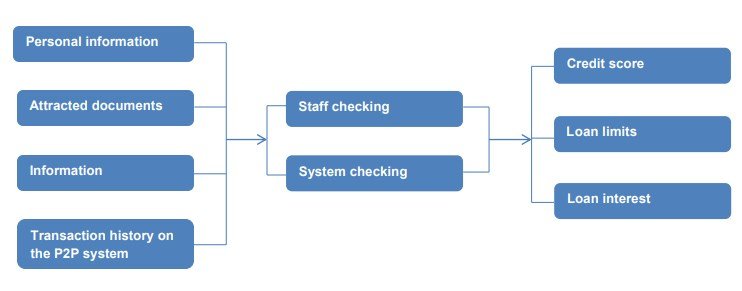

With the end goal to partake in the framework, moneylenders and borrowers should open a record on the framework first, round out the essential data, including: Personal information Verification documents And different conditions and necessities of the system Once checked by staff and the framework, banks and borrowers can make an advance contract on the framework. With the end goal to loan, It is mandatory to have Xcoin. Clients utilize this Xcoin to loan, obtain and get intrigue

To the P2P framework

In the wake of getting the "Credit Request" and every confirmed record, the framework will audit the application by two structures: Staff specifically survey (connected for borrowers)

• Staff will check individual data, work data, wage and pulled in archives of borrowers. Calculation for approval

• Algorithm display for auto-endorsement on the framework, gathering information sources: Customer data

In light of the aftereffects of endorsement of staff and the calculation, the framework will give the last outcomes on the client's credit and after that set up the advance in general framework.