More and more technical projects are turning to a 'token sale', 'TGE' or 'ICO' as a way of raising funds, rather than going the traditional venture capital route. And there's no doubt that most people who are 'investing' in and ICO are hoping to profit out of it. Merely by using the word investing, the project is advertising an opportunity to profit, sometimes the SEC forbids except for assets registered and licensed as securities, which to date, no ICO has done with the SEC anyways.

The problem is that most projects today are creating a token as an 'excuse' and as a way of raising funds. The token isn't integral to their business model. It's very much possible for a project to be involved in the crypto space without ever having to go through a token sale or having their own 'token' at all - I know, big surprise.

One of the core aspects I consider of utmost importance when looking at any project, is what's referred to as 'cryptoeconomics' or their cryptoeconomic model. If the project doesn't have a solid cryptoeconomic model, I will avoid touching it with a 10 foot pole.

What Makes Good Cryptoeconomics?

Great questions! I'm glad you asked. In my opinion, it comes down to a few important criterion.

1. Does the token actually need to exist?

2. Is there intrinsic value?

3. Is there both incentive to hold AND incentive to use?

4. Is it integral to the business?

5. Are there proper incentives & penalties to incentivize use and deincentivize mis-use?

6. Has the token been distributed and allocated fairly and reasonably?

Cryptoeconomics Behind XYO Network

In my opinion, XYO Network passes this test with flying colors. Token economics are briefly talked about in their whitepaper, but they also have a greenpaper dedicated to token economics and the business surrounding them - something all projects should have in my opinion, but almost none do!

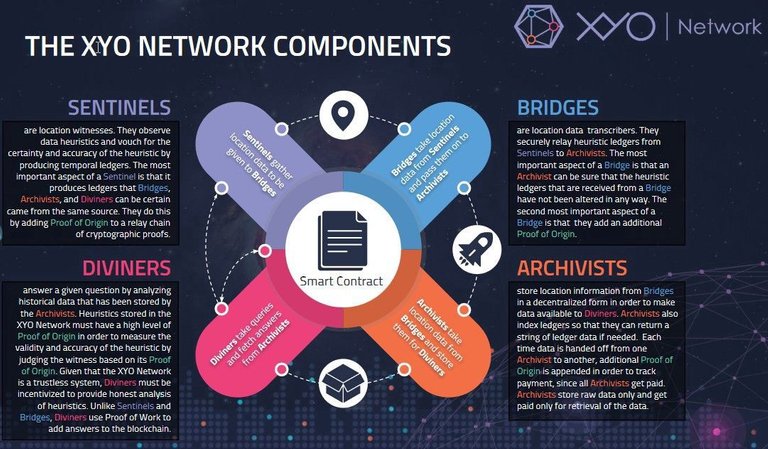

Before I dig into the cryptoeconomics, take some time to familiarize yourself with the four main components of the XY Oracle Network.

1. Yes, XY Findables, the company behind XYO Network, appears to actually have a need for this token. Their token is used as a sort of 'gas'; a payment mechanism between the components involved in XYO's ecosystem. It's not practical for them to use a different coin or token like Ethereum, because demand for location data will fluctuate from time to time, and they need to incentivize location data requests at 'off-peak' times. Also, utilizing non-XYO tokens would require the company & all other individuals involved to purchase the coin (such as ETH) upfront, which would be a very expensive endeavour given that they already have 1 million devices on their network!

2. Similar to the first one, yes there is intrinsic value with this token as it's an essential payment mechanism between the components in the XY Ecosystem.

3. As XY Findables noted in their whitepaper, the problem many projects have is that too many people want to hold the token, rather than actually use it. The way their ecosystem is set up, developers are bound to have to pay small amounts of XYO tokens all the time to the Sentinels, which ends up getting passed onto the other components in the XYO ecosystem. It's likely the token will be actively used here, not just held. At the same time, there is an incentive to hold here since over the long term, it's not likely to decline in value.

4. Do to the decentralized nature of the XY oracle network, use of a token is integral to their business case as a payment mechanism between the various components. It's really not feasible for them to use fiat currency or even other cryptocurrency given the trustless & decentralized nature of their ecosystem.

5. Yes, there are incentives and penalties. Diviners are incentivized to aggregate the most accurate data for example, and the one that does the best job, as determined by the network, gets rewarded, a little bit like miners do with cryptocurrency, obviously with a lot of differences here though.

6. XYO intends to use 40% of proceeds to help grow the XYO network via marketing and strategic partnerships. 35% is allocated for engineering & R & D. 15% is allocated for ongoing operations. The remainder is allocated for overhead and supporting other projects. In my experience, this allocation is prudent and reasonable. The one thing they don't publicize in their whitepaper or green paper, is what percentage of the total supply they're allocating to the team, advisors, the token sale, private sale/seed investors, & the company itself, and should not all tokens be sold during their ICO, do these groups still keep the same amount of token or does it decrease proportionally. This is something that should be present on their documentation, but it is not.

Overall, a solid project with sound cryptoeconomic fundamentals.

Let me know your thoughts below!

ICO's I tend to buy into projects that has a team that has been working already for a few years on the project pre-ICO, and the project must already have their app developed, or block chain feature in developmentstage, so it will definitely be hit and not a miss.

💋💋Upvote and Follow💋💋

🇮🇩🇮🇩I'm Newbie🇮🇩🇮🇩

👍👍Roll back to You👍👍

💱💱Build Friendships For Finance💱💱

@anggajai1419