Cryptocurrencies are a classic two-sided market, also known as a platform market.

Two-sided markets are economic platforms that have two distinct user groups that provide the other with network benefits. For example, auction markets are two-sided. You require sellers that offer goods, and buyers that wish to purchase the goods. Sellers will prefer a large number of buyers while buyers will prefer a large number of sellers. Separate user groups effect the other group positively. This kind of mechanism is called a positive cross-side network effect.

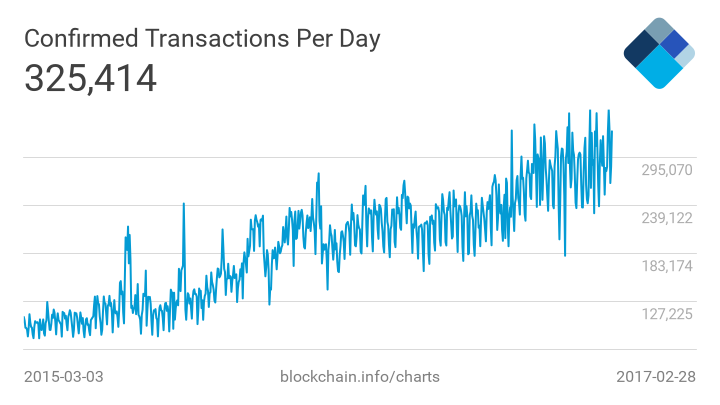

Similar to a marketplace platform, cryptocurrencies also require the on-boarding of both the merchants and consumers. Merchants have to accept the coin and consumers to have the coin. However, cryptocurrencies face a collective problem : growth is slow on either side.

Slow growth in two-sided markets is nothing new. These markets are notoriously difficult to get started. Although once they pass a certain threshold their hold on the market is extremely difficult to overtake. We can see this through the resilience of marketplaces like Craigslist and software platforms like Windows or Linux.

Credit cards are another example of a two-sided market which faced a similar problem. Before 1958 there were no general credit cards that were accepted by a large enough number of merchants. This meant consumers didn’t really have any incentive to use one a bank had issued. To solve the chicken or the egg problem, Bank of America decided to send 60,000 credit cards to the residents of Fresno, California at once.

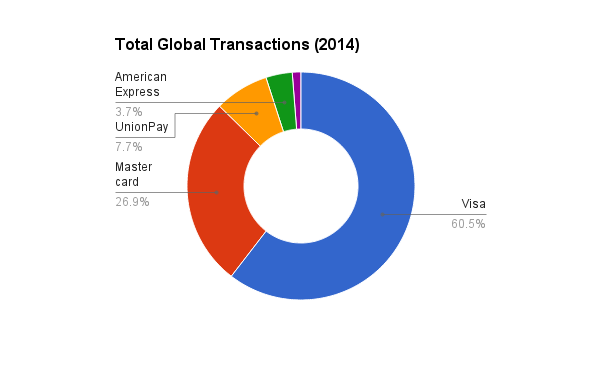

Due to the rapid adoption rates of consumers as well as merchants, within a month one million cards were sent out. This is now referred to as the “Fresno Drop”. The Bank of America credit card eventually became Visa and continues to dominate the credit card market to this day.

In two-sided markets, the platform provider must optimize the price levels, price structures, and investment strategies to kick-start market. Only then, can the platform get both parties on board. Bank of America decided to strategically subsidize the consumer side first, which was crucial in catalyzing the adoption of credit cards.

Cryptocurrencies have one more aspect that increases the complexity of achieving network effects. The supplier of the platform is not centralized. The supplier of the platform on which merchants and consumers interact, is decentralized. This makes it difficult to agree on developing strategies to develop the ecosystem as whole and eventually just leads to a free-for-all of short term incentives.

BOScoin aims to overcome these issues through the Congress Network and the Commons Budget. The Congress Network is a decision making body within the BOScoin network. Anyone can offer a proposal requesting changes or funds from the Commons Budget. And node operators, who each have one vote, democratically vote on which proposal to accept.

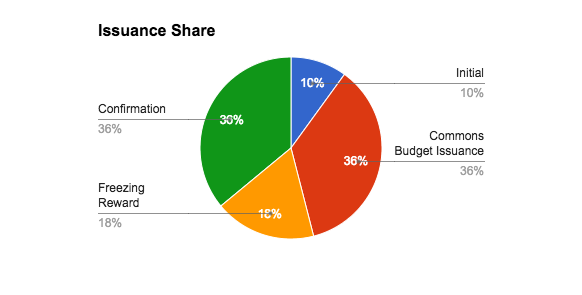

BOScoin was deliberately designed to distribute a large percentage of the rewards to the Commons Budget.

Out of the total 5 billion BOS that are issued, 1.8 billion BOS are issued to the Commons Budget. When converted to the ICO price, the Commons Budget is worth roughly 13.8 million US dollars. The BOScoin team set aside these funds not only to sustain the development of system, but also attract new users that will bring value into the ecosystem.

In the next post I will cover the details on how the proposal system works.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/boscoin/the-commons-budget-part-1-a718c857b008

Good Job!!