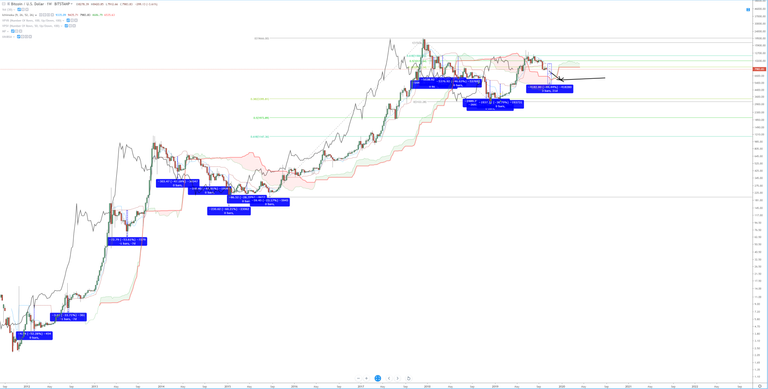

The Ichimoku system can help identify short term maximum moves. I call the measure of these extremes the ‘Max Mean.’

One of the biggest problems and unknowns that all traders investors face are just a simple fact of financial markets – and life in general: we don’t know how high or low prices will go. In technical analysis, we have a significant number of tools and resources that can help us determine high probability setups for a rough idea of where these critical highs and lows may be located — the accuracy of finding highs and lows increases when multiple unrelated forms of analysis are used.

Using Ichimoku To Find Highs and Lows

I’ve written numerous articles detailing the many useful and positive trading opportunities that the Ichimoku system can provide. I believe it is one of the single most significant trading systems ever developed and when utilized correctly, it is a very profitable system. But beyond the trading benefits of the Ichimoku system, it is also a powerful analytical tool. The word, ‘Kinko’ in Ichikmoku Kino Hyo means ‘balance.’ The ideal of balance and equilibrium is one of the hallmark attributes of Japanese analysis. And within the Ichimoku system, the Kijun-Sen represents the definition of equilibrium. There is a reason it is often referred to as a dynamic 50% Fibonacci ratio. One of the great discoveries I’ve found with the Kijun-Sen is that it is very good at placing limits on how far price can move. If you go through a chart past and find the most significant moves away from the Kijun-Sen, you will often find there is a particular average that price will move before reverting to the Kijun-Sen. That value is what I call the ‘Max Mean.’ I have done this with Bitcoin’s weekly chart and measured the biggest swings below the Kijun-Sen. The list below represents the lowest swing lows below the Kijun-Sen on the weekly chart. Because of the nature of Bitcoins’ massive rise in value over a short period, I used percentage moves.

Feb 13 2012 -52.28% Aug 13 2012 -33.71% July 8 2013 -53.61% April 7 2014 -47.18%

Sep 29 2014 -41.91% Jan 12 2015 -60.21% Apr 20 2015 -28.70% Aug 24 2015 -23.17%

Feb 5 2018 -47.91% Mar 26 2018 -46.29% Jan 18 2018 -46.63% Nov 19 2018 -41.74%

Dec 10 2018 -46.32% Feb 4 2019 -36.79%

As you can probably see, Bitcoin faces a tremendous amount of nearly -50% losses. If I add the total percentage numbers together, I get 616.45. Divide that by 16, and we get 44, the ‘Max Mean.’ If we project -44.44% lower from the current position of the weekly Kijun-Sen, we understand the price level of 5229.73. There is only one value area of importance from that projection, and that is the bottom of the Kumo (Senkou Span A). To me, one piece of technical support is not adequate to predict or forecast. A more accurate and predictable level would be the same value area I’ve been discussing for the past few weeks: 6400 to 6800. Three key price levels would indicate powerful support at these levels, and they are:

High volume node at 6400.

Top of the Kumo, Senkou Span B at 6550.

50% Fibonacci extension at 6627.10, 61.8% Fibonacci extension at 6389.88.

If price were to travel down to one or all three of those price levels, what would the percentage move below this week’s Kijun-Sen be? -32.27%, well within the norms of a big move below the Kijun-Sen.

Thanks for the TA!

Posted using Partiko iOS