China started out as one of the biggest influencers on the price of Bitcoin. Through pushing and pulling, they used to have a lot of control over whether it was going up or down. As time has gone on, however, their power has been slowly fading away, and the most recent Chinese news with regards to ICOs serves as further proof.

2014 – The Ban and Unban Waves

In 2014, China sent shockwaves through the cryptocurrency markets — especially Bitcoin — by making weekly news posts stating that they were banning the cryptos, followed by unbanning them. The news of bans were causing the price to crash as investors pulled out, while news of its unbanning saw them shoot right back up as people bought back in. After a month or so of this, however, it started to lose its impact, such that the news no longer affected the price in a grand scale, and it eventually went away altogether.

Crackdown on Leverage-Based Exchanges

Next came a crackdown on Chinese exchanges — especially those that allow trading on leverage. While it did have a short-term effect, it was somewhat quickly negated. That said, it was one of the biggest things in Bitcoin’s history, in that it lowered the maximum margins from 100x to 10x in most cases, significantly decreasing the volume of trades. It was expected to be detrimental to Bitcoin’s price, but proved to have almost no effect even in the medium-term.

Miners Come Next

After the exchanges were hit with new regulation, miners were put under major scrutiny. At this point, the goal was to ensure that none of the mining companies (cloud mining) were running Ponzi schemes and that they not only had actual mining farms going, but that they were as large as they claimed to be. This one had pretty much no effect on the price of Bitcoin, but that’s largely because it wasn’t expected to — the only way it could have been a negative thing was if many of the more known farms were facades for Ponzis. Luckily, this proved not to be the case.

An Attack on ICOs

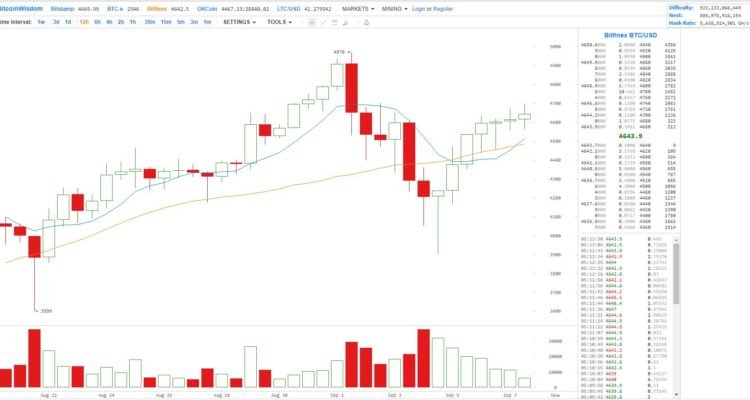

The latest attack from the Chinese government has come in the form of taking down and penalizing ICOs (Initial Coin Offerings). In this case, the government has decided that they are essentially securities, requiring all currently running ones to return all investments to investors and past ones to pay heavy penalties and face harsh punishments on a retroactive basis. News of this made Bitcoin plummet heavily, down $700 in a day. Just a couple days later, however, and it has already rebounded close to its all-time high, proving that even this wasn’t enough to hold it back.

Power Loss and the Future

It’s getting hard to tell whether the Chinese government is still attempting to manipulate the markets or if it is simply trying to protect people of its country. At this point, however, it is clear that they’ve exhausted pretty much every angle for regulating cryptocurrencies aside from straight up banning them for good. But the best takeaway from all of this is simply that despite being a big part of the market, China’s decisions — whether for good or bad — are proving beyond a doubt that even a country that large has very little control over the direction of Bitcoin and other cryptocurrencies.

There seems to be a lot of hype both positive and negative... Wether by governments or large investors or even scaremongering media types the markets ripple but the waves resume. In the wake of the movement it can reveal those that make the catch.

yeah it can be taken both ways. Government is legitimizing crypto, or government is cracking down. just to hype speculators up and down and price swings to benefit those manipulating the headlines or at least the savvy traders, you're right

I hope

I know. been in this game for 5 years

Everything is in red

we were overdue for a significant correction, this is normal

Maybe this is China's way for getting back at us for the missile defense system in South Korea. They told South Korea that it's a security threat but they deployed it anyways, and now China is stopping some trade with them.