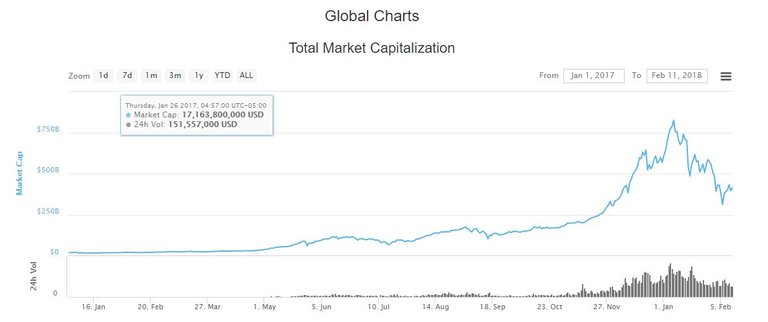

Cryptocurrency has been getting a lot of media attention recently!

This new media attention is in part due to the insane price increases for coins like Bitcoin and Ethereum in 2017, but also due to the fact that many banks, financial institutions, and individuals are looking at cryptocurrency as a new investment platform.

With all of the new media attention focused on cryptocurrency, what I would like to call “average joe” investors are beginning to flood the market. I am not using that term “average joe” in a derogatory way, in fact, it is great that more people are becoming interested in the blockchain and cryptocurrency space, and I would argue that adoption and awareness by the common person is necessary for the success of the blockchain space as a whole. In response to this influx of new investors, I decided to make this guide on building a cryptocurrency portfolio. Don’t worry if you are new to investing or cryptocurrency, I will be trying to make this as painless as possible.

Disclaimer:

Before I get started here, I want to say that I am not a financial advisor so always do your own research and make your own decisions before investing any money. Cryptocurrency is a risky asset to hold, and huge price fluctuations are common, so it is really important to be strong willed and stick to your decisions if you want to get into this market. With that disclaimer out of the way, I want to point out that although cryptocurrency is more risky than say the stock market, the potential returns are much greater, so it fits the matra “risk vs reward” perfectly.

How much should you buy/invest?

Because everyone’s situation is different, it is hard to say off the bat, but I will give you some guiding principles to help you decide for yourself. First of all, I would not recommend putting all of your investable assets into cryptocurrency no matter what your situation is. Because the cryptocurrency market is so volatile, the price swings up and down without much explanation. If you are new to investing in general, or are just new to the crypto markets, this extreme market volatility can be extremely emotional. Even as someone who has been in the market for a while, these market swings cause me a bit of anxiety.

Before you decide what percentage of your money you want to invest in cryptocurrency, you should take a hard look at yourself in the mirror and honestly question your ability to stick to your decisions in a falling market. If you think you have what it takes, or more likely, are just greedy enough to want in on the action despite your better judgement, you should decide how much of your assets you want to put into the market.

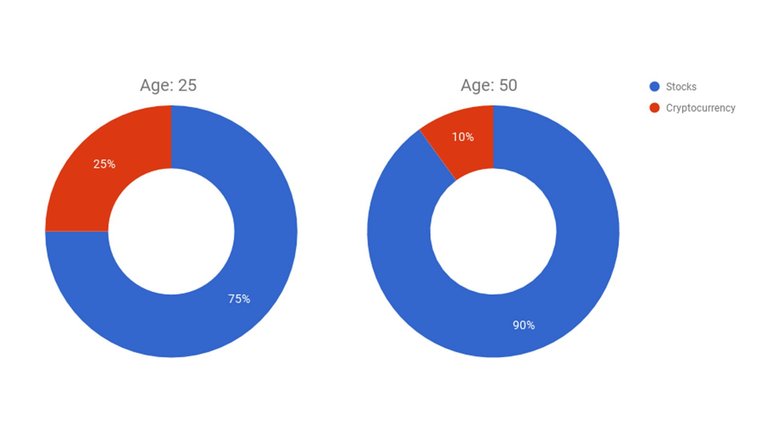

As a guiding principle, the younger you are and the less money you have, the more you can afford to take risks. I am 21, and I have about 50% of all my assets in the cryptocurrency markets. This is definitely an upper limit in terms of the percentage I would recommend. To be honest, I am probably over exposed to the cryptocurrency markets, and I would feel much more comfortable having about 25% of my assets in cryptocurrency. If you are much older or have much more money in your portfolio, I would recommend putting a much more modest percentage into the crypto markets. Anything over 5-10% of investable assets would be irresponsible, especially without a lot of research into the space.

The graphs above show the distributions I just mentioned. The first is the younger or riskier portfolio, where 25% of all investable assets are in the crypto space. The second is the much less risky portfolio, where 10% of all investable assets are in crypto. I put ages above the graphs as a general guideline, as you get older and more risk averse, you should move less of your money into the crypto space. If you don’t fit into these two age buckets, don’t worry, you can approximate what percentage is right for you with these two graphs.

Which coins should you buy?

Unfortunately, at this time there is no index fund for cryptocurrency, although that may change in the near future. If there is an index fund for cryptocurrency by the time you read this, that would be the best bet. For now, if you want to get into the crypto markets, you have to buy individual coins. You may have heard about this new, hot, cheap coin that is sure to be the next Bitcoin from your shady uncle, but forget about it. Picking individual coins rarely works out well, so I have three different ways to distribute your money in the crypto market.

.png)

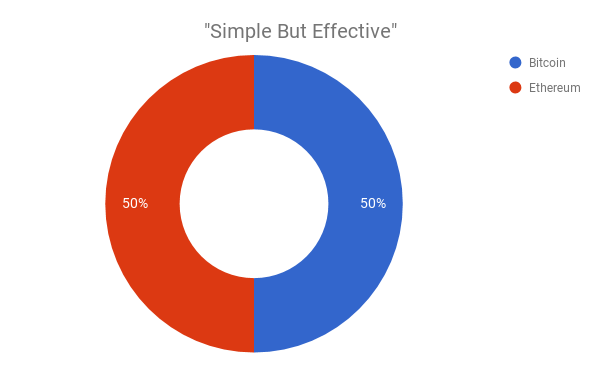

The first distribution is what I call the “simple but effective” portfolio. It is 50% Bitcoin, 50% Ethereum. These are the two coins in the market that have the highest market cap right now, so they are probably the most stable, in terms of price. Bitcoin was the first ever cryptocurrency and has been around since 2008. Ethereum has only been around since 2014, but many people consider it to be Bitcoin 2.0. Many other companies and startups in the blockchain space rely on Ethereum, so it is highly regarded in the community. If you still have reservations about investing in it, look up any video of the founder Vitalik Buterin explaining what the project is, he is wicked smart. The “simple but effective” portfolio probably won’t get 1000% returns every year, but, in the long term, you won’t be upset to hold some Bitcoin and Ethereum.

.png)

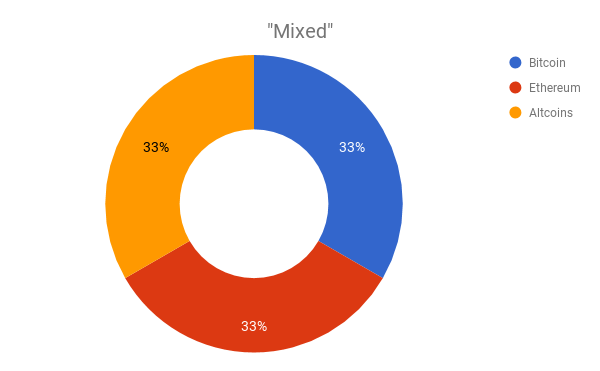

The second distribution is what I call the “mixed” portfolio. In addition to Bitcoin and Etheruem, the portfolio has some funds allocated to altcoins or other coins. It is 33% Bitcoin, 33% Ethereum, and 33% altcoins. This 33% for altcoins can be distributed amongst up to three different coins, the trick here is that you have to do research on your own and decide which coins are promising. I have other videos on my channel describing how to value these coins, so I am not going to cover it in detail here, but it is worth noting that altcoins are even more risky than Bitcoin and Ethereum but can massively outperform them in the market. If you do not have the time or do not want to spend the energy researching coins, this is probably not the distribution for you.

.png)

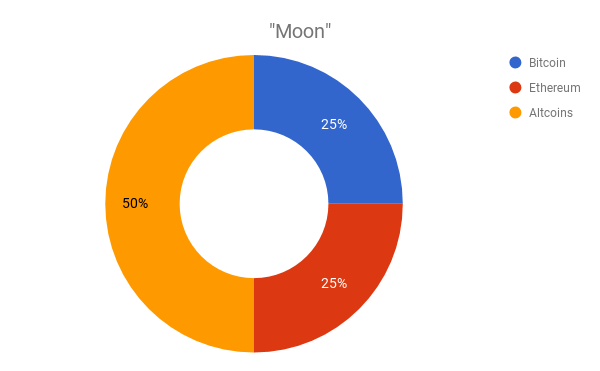

The final distribution is what I call the “moon” portfolio. If you are not familiar with the crypto space, the name of the portfolio is a bit of an inside joke. A common attitude on altcoins in cryptocurrency forums and discussion boards is “to the moon” ie people are holding these coins with the hopes that they “moon” or the price goes up by several multiples. This portfolio is fondly named “moon” because most of the money is allocated toward altcoins. This portfolio is 25% Bitcoin, 25% Ethereum, and 50% altcoins. Again, I would not recommend putting any less than 10% of your portfolio into any one coin as it becomes too much to manage and keep up with, so for this portfolio you should not split the 50% into any more than 5 altcoins. This is the closest distribution to my current portfolio, but again I am young and not risk averse.

I do hope that this gave you some useful information for making your own financial decisions. If you want to get into the crypto markets, I recommend using Coinbase for purchasing Bitcoin and Etheruem. If you want to buy altcoins, the process is a bit more involved. I recommend buying Ethereum on Coinbase and then transfering that money to a secondary exchange which has the coin you want to buy. At this exchange you can then exchange your Ethereum with the altcoin or altcoins of your choice. If you need a tutorial on this process, I recommend looking a few up on YouTube. If you still don’t feel comfortable with the process, then you should probably stick with the “simple but effective” portfolio and stick to buying Bitcoin and Ethereum on Coinbase.

Thank you guys so much for reading!

If you want to see more cryptocurrency articles/videos like this, be sure to follow me on Steem and check out my other videos on my channel! Have a great day!

@originalworks

Hey Josh, another super video. You certainly have a few years on me and I can't help feeling your future looks rather bright, I sincerely hope so. I have a leaning towards Ethereum, but fortunately only a small investment (which is down about 25% in a few weeks), but I am hodling for the longer term.

Would love your take on This post if you get an opportunity to view it...

Many thank for your informed post.