Introduction

Hey Guys/Gals, so today I will be discussing another exciting finance ICO. Smart Valour will be a “decentralised marketplace for tokenized alternative Investments”. Now, for those of you who are going to ask me questions across my various channels on this project, Yes, it is another Securities platform. I have made the effort to inform you all that securities will fall under stricter regulations than a lot of the utility token ICOs which swarm the markets today. For those of you following my work, you will note however that I have a vision of a decentralised world; such a world could not exist if financial markets remain in the centralised system. I have spoken about the benefits of blockchain technology time and time again, most technology companies and financial institutions see this and are heavily invested in research and development. Don’t get me wrong, we are a long way off mass adoption, but imagine reading this article in years from now and wishing you had of acted. The cryptocurrency space is about getting an early seat at the table for these amazing new projects entering the market, don’t be pressured by market instability, I personally could not tell you the price of bitcoin today, I deleted my Delta app months ago and just spend my time researching these days, I am in this for the long haul.

What is Smart Valor

According to Smart Valor, (2018), the word “Smart” refers to “smart contracts” and “Valor” to “securities”, in Switzerland. This is a clever title, I just wanted to throw that out there. The company “Smart Valor AG” is a Swiss company founded in 2017 (Valor, 2018). They focus on providing access to current cryptocurrency/non-securitised tokens and will provide a platform for asset-based security tokens, once regulation allows, according to their whitepaper. As we all know by now, global assets will have to switch to blockchain technology at some stage, the benefits of doing so are too great to ignore. What I like about this project is the 37 full-time team members, spread across 3 European offices and it has already been nominated as a “top 10 European tech start-up in 2018 by Forbes” (Smart Valor, 2018).

I am so happy that this is a Swiss company, as many of you may or may not be aware, Switzerland is one of the most crypto friendly countries in the world and the Swiss financial regulator has even created “ICO guidelines”, as described in the whitepaper. Hughes, (2018) states that Smart Valor “has become one of the few blockchain groups to win approval to operate in the Swiss financial market” to date. This is the ideal team and location to make this a success.

Vision

To keep it simple the Smart Valor vision to give everybody equal access to digital assets and tokenised real-world assets, in a borderless and truly decentralised fashion. This is what I am here for, what about you?

Pain point

Pain Point

As with any “decentralised project”, the pain point is centralisation. All of them try to solve this problem, however, as you all know, this decentralised space is not entirely safe just yet. Billions have been lost to hacks in the crypto space, as pointed out in the whitepaper. Also, another pain point is the usability of current crypto platforms/exchanges, they require a lot of tech knowledge, I still remember trying to learn how to use MEW, and I’m still unsure!

Smart Valor, (2018), state that they wish to break down the barriers which exist in the centralised world; which is access to alternative investments such as real estate, venture capital and equity in companies (Smart Valor, 2018). Currently, only the top tier of investors has access to these, which is an injustice we all experience.

Smart Valor also describe the inefficiencies of existing financial systems across the world today, which allow the wealthy to grow richer at the cost of the average man/woman. Likewise, many of these assets require extensive “paper trails” to transfer amongst investors, an expensive and cumbersome process. Often is the case a lot of “illiquid” assets cannot be fractionally divided and thus excluded in trade, according to the whitepaper.

Solution

Blockchain technology is the solution here and in particular the tokenisation of assets classes. I am not going to go into detail on the benefits of blockchain technology here if you a regular reader of my work you will see why the technology will prevail. Smart Valor will provide the means to transfer traditional share registry’s to blockchain alternatives thus bringing the advantages of decentralisation and smart contract technology to the forefront of the way business is conducted and shares recorded. It will revolutionise and reinvent private baking also, according to WITS ZEN, (2018). Check out my previous work where I discussed a similar solution in great detail, to explain this n more detail.

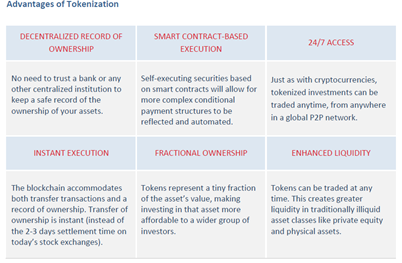

Tokenisation of assets is something I have touched on in some of my work, and one which is becoming a real trend in my work lately as I realise the potential of this market. I have seen that the future is “tokenisation” within the blockchain space. This refers to the transfer of value from traditionally “illiquid assets” such as real estate, shares etc… and represents this value in the token form. Smart Valor, (2018) state tokenisation “is the representation of rights to an asset through cryptographic tokens issued on the blockchain”. The advantages of tokenisation are summed up pretty well in the below image.

Source: Smart Valor, (2018)

Potential markets

The potential markets of Smart Valor are too large in scale to quantify in my opinion, each source leads to differing figures. However, it is easy to comprehend some of the potential segments of the financial markets it can target, such as:

- Private equity and venture capital: These are considered very high barrier to entry markets and are seen as very illiquid due to bonding requirements etc…These represent over 1/3 of alternative investments, according to Smart Valor, (2018) so the potential to tokenise would open trillions of dollars of opportunity and make them more liquid investment vehicles, open to more investors.

- Real estate and other non-fungible assets: Smart Valor, (2018) claim that the value of real estate is 3 times the global annual GDP, a staggering statistic as it would value the market near 217 trillion dollars. This can be extended to other similar asset classes.

- Intellectual property rights and other intangible assets: This would be a real contender for tokenisation in my opinion.

- Patents: Another hugely valuable market.

- Art: The art markets are worth billions also, which is a huge potential market.

- Rare metals: This would open markets such as gold and silver and other forms of metal to tokenisation and trillions of investment liquidity.

- Direct investment: This would allow normal investors access to investment opportunities in new start-ups, a very tough process in the centralised systems we have today.

- Currency backed tokens: See below.

Tokenised Swiss Franc (CHFT)- A real currency backed token

I have to admit, this is one of the reasons I am writing this article. Smart Valor, (2018) state that this currency may one day replace USD as the stable backed currency in the world, if you consider that USD lost 77% of its value in reaction to CHF, it is no wonder Switzerland is a safe haven for money. The Smart Valor bank (in progress) will issue the tokenised swiss franc once licencing is obtained. If this occurs this would give this project a first mover advantage, creating the first truly backed stable coin in the crypto sphere. This is enormous guys, this will replace tether in a heartbeat because the Swiss Franc will back it and comply with all legal and regulatory protocols. From what I can understand; it will work via KYC/AML procedures, requiring holders to deposit real Swiss franc in return for CHFt. I may cover this more when more details arise.

Smart Valor, (2018) state in their whitepaper that they will take each of these potential markets as separate entities and tackle them one at a time, ensuring they follow all regulatory approvals/procedures for each class, to enable full tokenisation one day. I believe that Smart Valor will only have to take a small percentage of each of these” market classes” to show that decentralisation is here. I believe that the day of securitised tokens is near and these markets are ripe for the taking.

The Valor Platform

Source: (Future-processing.com, 2018)

Smart Valor, (2018) state that the purpose of “Valor Platform” is to allow for online investments across existing crypto tokens (non-securitised) and asset back tokens (securities). This platform will be fully operated via smart contracts. They will make the process of investing easy for all and it will be more secure than existing exchanges/platforms in the space.

As with many similar projects, Smart Valor is providing the infrastructure needed for Security tokens first, whilst regulations are being developed for this space, however, they will build liquidity via trading of non-securitised tokens first. Please consider that Smart Valor has already received “Financial Intermediary status” in Switzerland, which is a giant leap forward in becoming ready for security trading, as described by Smart Valor, (2018) in their whitepaper. This puts them, leagues, ahead of their competition. This platform is planned to handle “equity in young companies, crypto funds, real estate, venture capital, and private equity” (Smart Valor, 2018).

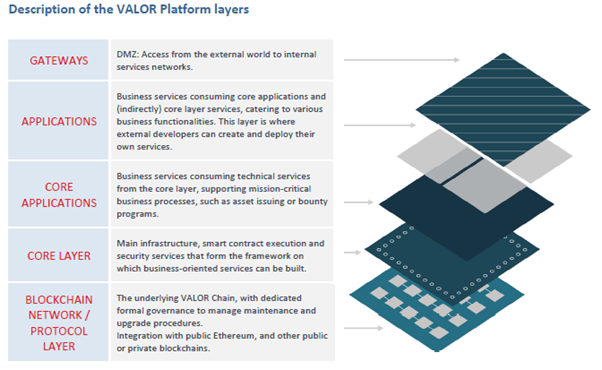

The platform architecture

The platform has been designed in specific layers, as outlined in the image below from the whitepaper.

Source: Smart Valor, (2018)

I love the structure of this platform, particularly the fact that they will let external developers develop their own services within the ecosystem. Overall the platform will comprise of a lot of functions/services, the main ones being:

- ICO platform/tokenisation engine

- Governance and voting engine

- Marketplaces

- Authentication capability

- Portfolio management

- Rewards/bounty programmes

- Licensed exchange

- Secure custody services for crypto assets

To ensure users gain the best of this platform, it will conform to that of a “hybrid platform”, essentially meaning it is both a centralised platform offering decentralised services. The key advantage of this is liquidity and better scalability. They state the first use of decentralised trading will be “auctions of less liquid assets” (Smart Valor, 2018).

Their platform rollout plan

Smart Valor, state they wish to attract both investors and asset issuers in a 2-pronged approach.

Investors comprise of traditional investors (long-term), crypto investors (seeking access to securities) and institutional investors (large funds), the platform will cater for all of these investor’s in terms of access to new digital assets, be cheaper than most alternative platforms and will open up new investment opportunities to the wider community.

On the other side, Assets issuers (private companies, funds, developers etc…) can offer their products to investors. These asset issuers gain access to “tokenisation” (described above), which allows them to open up new markets in a fully compliant Valor platform. It also allows gives them access to escrow/custody of funds services and allows them to avail of an inbuilt banking functionality. Smart Valor, (2018) give assurance that parties will need to go through “clearing processes” before utilising many of these features, which aids security.

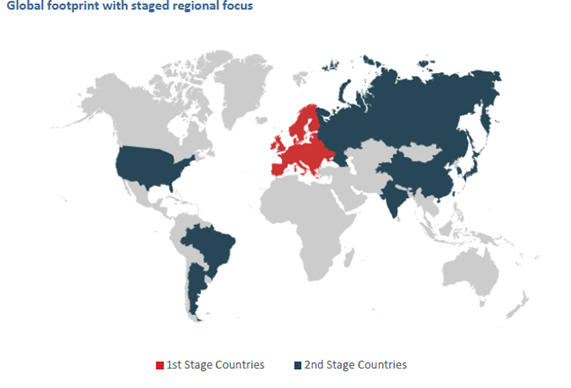

Source: Smart Valor, (2018)

The image above shows that they will target the EU first before rolling the platform out to crypto friendly countries who hold market shares of the target assets classes they are after (discussed previously). Smart Valor, (2018) state in their whitepaper that about 120 trillion dollars of their target market exists within these secondary countries.

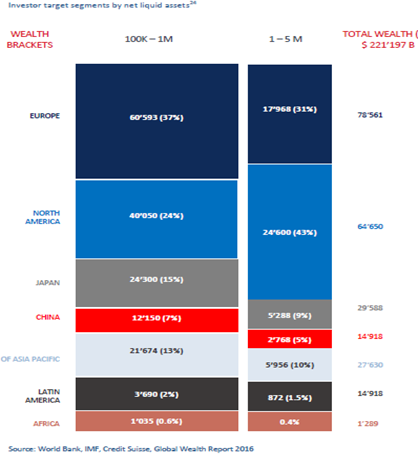

Source: Smart Valor, (2018)

This image just reaffirms their launch plan. They will capture the majority of their target markets within this rollout plan. Smart Valor, (2018) further state that they will focus on investors “of net liquid assets of between 100 thousand and 5 million dollars”, thus opening up huge potential markets across the world and also wish to focus on digital assets markets as they see ICOs blending into more familiar IPO structures over the coming years via tokenisation (discussed above). They state that if they captured only a 20% market share in Europe this could open up close to 234 million dollars in profits in 2-3 years’ time. Now I am not one for predictions so I will exclude this from my conclusions at the end, but I just wanted to add this to show the confidence of this team.

I love the fact that Smart Valor will bring these 2 ends of the spectrum together under one roof, allowing the transfer of wealth between parties in one easy to use platform. What is more is that they elude to the “wider contributors of the platform” consisting of various service providers who are dispersed globally. To sum it up the “Valor Network” comprises of all “Investors” and “Assets Issuers” combined with “Service Providers” and “Community Contributors”; all driven via the Valor Token. Both service providers and community contributors are essential to this platform and are rewarded for their participation.

The marketplace within the Valor platform is another exciting aspect to this platform, contributors can for example vote for listings and write reviews; this is an example given within the whitepaper to show that the platform will be more than just an “exchange between investors and asset issuers. This platform will be a fully functioning ecosystem and marketplace, fluid in design and in vision.

The Valor protocol

I find this aspect to Valor very interesting. As per their whitepaper, they state the problem with security tokens is modelling them like existing securities, considering all KYC and AML regulations, price discovery, investor suitability, governance/consensus, and functions such as dividend payments, voting etc…. This is where the Valor protocol comes in. They are essentially a set of smart contracts which mimic what would occur in the centralised fashion, thus bringing full decentralisation and automation to the process. This is the easiest way to describe this protocol, I am also conscious of the fact that they may release a technical whitepaper to describe this in detail, so I won’t say too much.

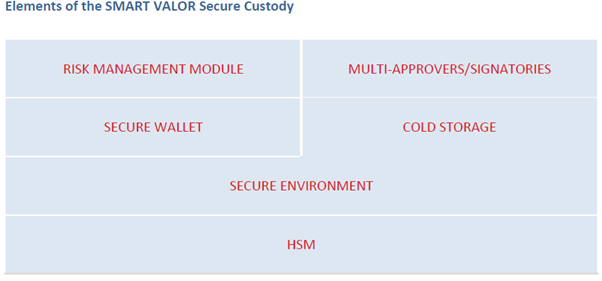

Security

As can be seen from the below image, Smart Valor are extremely security conscious and have developed this platform to conform to the best practices available to them.

Source: Smart Valor, (2018)

If a platform like this will ever succeed and considering the huge financial markets it is targeting, security needs to be a core development criteria. The masses won’t come to this space until we clean up the security issues plaguing the space. I am glad to see they have partnered with Ledger to ensure that all funds will be secure from the outset and welcome their promise to continued development in the wallet and assets custody space. We need the security and reliability of the banking structures within the cryptocurrency space.

Regulatory approach

Smart Valor, (2018) state that their approach is “not to apply for approval but to work with regulatory bodies/authorities to shape the frameworks required”; this should show you how dedicated this team is. Just on a side note, in the whitepaper, they state that the CEO/Co-founder of Smart Valor was responsible in shaping the regulatory challenges which faced “Xapo”- one of the worlds largest bitcoin custodians today. She worked with the Swiss financial regulator to achieve this, according to the whitepaper. This all gives me great confidence in the project.

What is more, is that they will seek regulatory approval before they launch their platform, to showcase their commitment to bringing security and regulation to the crypto sphere, I cannot think of many more projects willing to do this.

Smart Valor already have the approval to operate as a financial intermediary in Switzerland, a feat to be applauded. This allows them to offer crypto, payment and utility tokens on their platform already. They have also pursued a banking licence in “Liechtenstein” to speed up the process of gaining approval across the EU. I love that they are doing this, as it will facilitate a seamless platform in terms of linking crypto and bank accounts, without the fear of closure, which is often seen today. This will also be used to aid service providers, which is a key competitive advantage, according to the whitepaper. Smart Valor, (2018) believe they will gain the regulatory framework needed to accommodate the distribution of security tokens starting in the EU and working outwards.

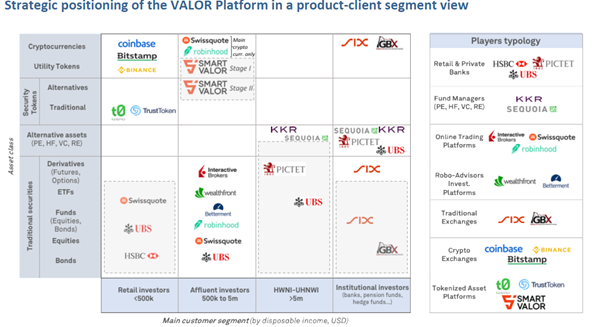

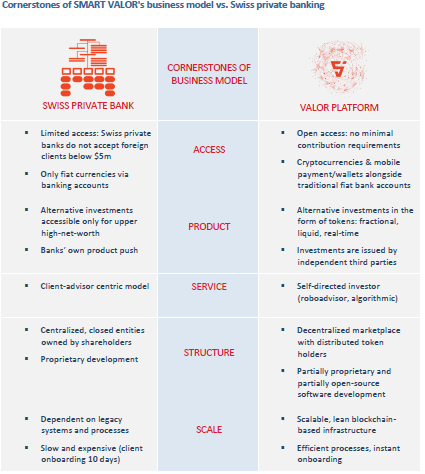

What they offer over their competition

What is great about Smart Valor is that it is one of a select few projects entering the “tokenisation of real-world assets” area. I have spoken about others before, but I have to admit Smart Valor really impresses me. I strongly believe that these markets are so large that the first to the table will gain huge market shares. Smart Valor, in my opinion, has one of the strongest platforms and will do very well in this space. I feel Smart Valor is further along in its regulatory approval process than any other and the fact they are based in Switzerland (crypto friendly) and comprises of a huge European team, makes me extremely optimistic as to this platform’s success over any competition in the space. For those of you who are unaware, Smart Valor, (2018) state that Switzerland is a top 5 global banking centre and holds over ¼ of global offshore assets (4 trillion USD).

Source: Smart Valor, (2018)

The above image taken from the whitepaper shows exactly where the platform sits in the context of its global competition, across various asset classes. I love the way they are positioning themselves away from crypto exchanges and traditional banks and focusing on a wealth management model. As seen in the below image they state that they are “challengers” to existing financial institutions such as “Swiss banks” who are some of the most profitable banks on the planet.

Source: Smart Valor, (2018)

This above comparison is striking because it shows the power of decentralisation and a good vision combined. If Smart Valor can just gain a % of this market this will be a huge success, in time I see it consuming a huge %, but that is just my opinion. They also claim that they offer more than other cryptocurrency incumbents such as polymath, GBX etc… I believe they do but will leave you to make your own conclusions on this matter.

Token Economics

Source: Sales Invest, (2018)

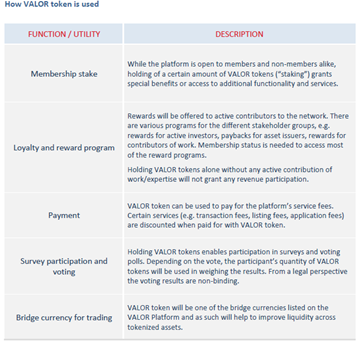

As with all projects I review, the token economics need to be sound, for me to consider investing. Smart Valor ticks the box in this regard also. Smart Valor, (2018) state themselves that their goal is to scale as quickly as possible and gain liquidity, as should be to the foremost goal of any marketplace. The Valor token provides the “utility” functions of incentivisation on the platform and acts as the internal currency token, it effectively runs the entire platform. Valor is an ERC-20 token.

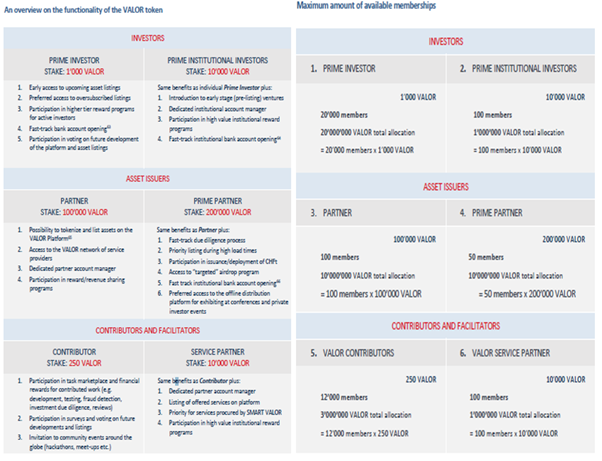

When you consider that this platform will comprise of investors, asset issuers, facilitators and contributors, it is easy to conceive that this token will do well. The image below, taken from the whitepaper showcases the stakeholders which will need to acquire the Valor token in order to use/participate on the platform.

Source: Smart Valor, (2018)

Source: Smart Valor, (2018)

As can be seen from the above image, the Valor token will be required for a lot of uses within the platform. I love that they will allow the Valor token to trade on other platforms/exchanges in order to improve liquidity. I think this is a wise move. The token has a great use case within the platform, I feel it will “knit” all the stakeholders shown above pretty well and provide a sound economic model within the ecosystem. The "staking" capability of the token will give great benefits to investors, asset issuers and contributors/facilitators alike. They state in the whitepaper that other utility functions will come about once the network grows and security tokenise arrive on the scene, it will be interesting to keep an eye out for this.

Also, memberships are possible within the platform, these are “obtained” from staking Valor tokens or simply by holding Valor tokens in your wallet. Likewise, participation in rewards programmes requires staking of tokens. I believe the minimum membership length is 12 months, and tokens are returned after this period if you wish, according to the whitepaper. I believe this will bring stability to the token, I love staking mechanisms within platforms.

The below image shows the staking mechanisms open to different stakeholder groups and the number of memberships available at each level (based on staked tokens), these memberships will become a rarity I believe due to their limited supply.

Source: Smart Valor, (2018)

Also, it would be wise to keep an eye out for CHFt (discussed above) when it is announced because this will tie in with this membership mechanism. As per the image above “prime partners” will gain access to CHFt by staking 200k tokens. As I mentioned earlier, this is one of the aspects of this project which has me writing this article. I truly believe the value of this membership will never be as low as it is when this platform launches, I can see a huge demand for it and a high price in years to come.

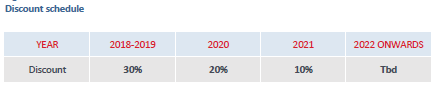

Furthermore, the Valor token is used as a means of payment on the platform. This opens users to large discounts as can be seen on the reducing scale below. This will further drive demand for the token. Do keep in mind that this discount is in comparison to paying in other currencies. This model should ensure stakeholders use the Valor token for payments on the platform.

Source: Smart Valor, (2018)

This platform will raise revenue through listing fees, transaction fees, custody fees, service fees and commission fees (via network partners), according to Smart Valor, (2018). They also state they will utilise online and offline distribution channels, allow cross-platform transactions via “atomic swaps” (users use their wallets to partake in investment opportunities on other platforms) and also give access to traditional 3rd party channels such as banks etc…

I also like that they will have an in-built loyalty and rewards programme to entice stakeholders to the Valor token further. This token is central to the operation of the platform and a requirement to obtain by all stakeholders for the huge benefits it brings. I feel Valor is a prime example of the correct way to implement a utility token, a true circular token economy as described by Smart Valor, (2018). Also, once their stable coin CHFt launches this will render this platform leagues ahead of anything else on offer in my opinion.

Token Sale

- Token symbol: Valor

- Platform: ERC-20

- Token type: Utility/Payment

- Total supply: 100 million Valor

- Tokens for sale: 45 million Valor

- Token price: 1:1 Valor: Swiss franc (1.01 USD)

- Hard cap: 45 million Valor

- Soft cap: 3 million (already reached)

- Unsold tokens: Burned

- ICO start: Oct 1st 2018

- ICO finish: Dec 31st 2018 (strict end date)

- Token distribution: 30 days after sale-circa end Jan 2019

Distribution of tokens

Source: Smart Valor, (2018)

I really like this distribution model, it shows both fairness to investors and incentivises employees/team members. If you consider all the above 76% of tokens will find their way to investors, according to Smart Valor, (2018). I also love the way in which they handle the 19% of tokens given to team members/employees, salaries are partially paid in the Valor token, which is only “redeemable” after a 12 month-cliff period, after which quarterly payments will be made over a 3-year vesting schedule, this will incentivise long-term retention of staff.

Other important aspects to consider are:

- Pre-sale 1st round (2 million tokens) Oct 2017: Investors had an 81% bonus but with a 1-year lock-up.

- Pre-sale 2nd round (5 million tokens) April 2018: Investors had a 50% bonus but with a 6-month lockup, other slight bonuses for higher contributions were also seen here.

- Pre-sale round 3 (up to 8 million tokens) Sept/Oct 2018: Investors received a 35% Bonus with other slight bonuses for higher contributions.

Use of funds after the ICO

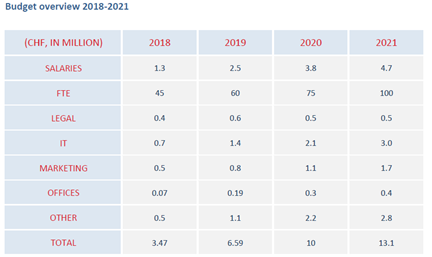

Source: Smart Valor, (2018)

I am happy to see this capital spread over a 4-year period, which aligns well with the roadmap in a subsequent section below. In the whitepaper, they state that obtaining financial licences in Switzerland and Liechtenstein will be vital and they need to increase their workforce from 37-45 by the end of this year. They aim to have 100 staff at Full Time Equivalent (FTE). This shows how invested they are in this platform.

Team

I will not discuss the team in detail here, as you all know I tend to never really talk about the team in much detail. I am a believer that if the vision is correct then the team can make it work. Smart Valor has an outstanding team compromising of 45 people by the end of this year, all of which have extensive experience across software development, financial industries, marketing and legal/compliance sectors. Please check out the whitepaper for a write up of 7 of their main core team. They also have some pretty impressive advisors, 11 of which are written about in the whitepaper. The partnerships which are ongoing at present are as equally impressive.

I feel that the combination of skills and experience that make up this team make it an all-star project. I also love the fact that they have a partnership with ledger already and are a member of the Ethereum Alliance.

Roadmap

According to Smart Valor, (2018) this platform will be rolled out in 5 phases:

- Phase 1: Q2 2017-Q1 2018: Is complete, and comprised of the foundation of the project, preparing their financial intermediary status and development of the prototype in full. They also completed some private pre-sales (1.5 million CHF) and have been created partnerships and promoted the platform.

- Phase 2: Q2 2018-Q3 2018: Is complete and comprised of establishing the strong team, obtaining financial intermediary status as mentioned above, banking licence application in Liechtenstein and preparation of a security dealer application. It also included core platform development, further partnerships, and completion of their second pre-sale (3.3million CHF).

- Phase 3: Q4 2018-Q1 2019: This encompasses the launch of platform /listing of the Valor token and trading of existing cryptocurrencies on the platform. They also hope to create their custody solution (ledger) and finish banking/OTF applications. This is also the phase in which the ICO will be completed.

- Phase 4: Q2 2019-Q4 2019: By the end of 2019 they will have 75 team members, a banking licence, be listing/trading security tokens and have a fully functional platform.

- Phase 5: 2020 onwards: Growth of the platform into the securities trading arena and global expansion.

My view on this roadmap

I am extremely impressed with what this team has achieved to date, they are providing us with a chance to enter this project at ICO phase after a lot of the work is already complete. They have already completed 2 pre-sale rounds successfully and have a working prototype, they have fulfilled a lot of their roadmap already.

Smart Valor, (2018) state in their whitepaper that their prototype was made available in March 2018, which allows users to operate the platform and see how it will operate once fully developed. If you are interested, you can check out their demo videos and whitepaper which shows it, I will link the whitepaper in the further reading section below for your convenience., it’s pretty cool. How many projects do you know of who offer this before an ICO? I can only think of a select few.

Conclusion

I hope that this long review of Smart Valor is as fascinating to you as it was for me researching and writing about it. Smart Valor is a Gem ICO in the cryptocurrency sphere. Their platform, in my opinion, will be at the forefront of the revolution into the decentralised securities arena, in which real-world assets can be catered for and traded on the blockchain. Smart Valor is an example of a team of outstanding professionals, realising a potential and designing a platform which will tailor itself to the needs of “Investors, Assets Issuers, Contributors and Facilitators alike”, to ensure all stakeholders get the best out of this new era. If you are a regular reader of my work you will see that I am pretty optimistic that this will be the direction in which this market takes over the coming years. I am a strong believer that platforms like Smart Valor, will be the go-to platforms/ecosystems when this era begins.

In their own words, Smart Valor will aim to give every human their basic right to make their own decisions about money and investments, across all economies, utilising blockchain technology and tokenisation of real-world assets to do it. Gone will be the days of monetary control measures and inflation we so often see in the centralised world; decentralised ledger technology is the key to progress for humanity. Smart Valor, (2018) use the example of investors buying “securitised tokens” in seconds compared to the days it would take in the traditional sense via banks, central registry’s, settlement/clearing houses etc…Consider also that this financial market is worth trillions and trillions of dollars!

The fact that Smart Valor comprises of such highly skilled team members and advisors and is aiding in the development of a framework for regulations in the space gives me huge confidence in this project. I will be particularly interested to see how the development of their “first real currency backed token-CHFt” does, I will be following this closely. The Swiss franc is one of the most stable currencies in the world, much more so than USD, I believe that the Smart Valor platform will be in full operation by the time this comes to fruition, which will be a perfect marriage of technologies and innovations to render this platform a not to miss opportunity for those who like to get early seats at the table. Truly remarkable!

Final word

Lastly guys, I just want to stipulate to you that you should not take any of this as investment advice. I am not a financial advisor and urge you all to do your own research when considering any investment, this space can be very unforgiving and is very speculative in nature. Never follow somebody blindly; my job is to showcase projects I see with real potential, that is all. I hope you enjoyed this article and I will aim to find the next amazing project in due course. I thank you all for your support and ask for you to share my work. I would be more than happy to discuss any questions you may have in the comments section.

Additional reading

- Smart Valor Whitepaper: https://smartvalor.com/register-whitepaper/

- Smart Valor Website: https://smartvalor.com/

- Smart Valor Linked In: https://www.linkedin.com/company/smartvalor/

- Smart Valor Facebook: https://www.facebook.com/smartvalorinc/

- Smart Valor YouTube: https://www.youtube.com/channel/UCSK5WoSzaAKhv3FoZc1Ibfg?sub_confirmation=1

- Smart Valor Twitter: https://twitter.com/@smartvalorinc

- Smart Valor Medium: https://medium.com/smart-valor

- Smart Valor Bitcointalk (Bounty): https://bitcointalk.org/index.php?topic=5047601,0

- Smart Valor Telegram: https://t.me/valor_network

References

- Future-processing.com. (2018). [online] Available at: https://www.future-processing.com/client/smart-valor/ [Accessed 17 Oct. 2018].

- Hughes, B. (2018). Swiss blockchain firm Smart Valor wins regulator's approval. [online] U.S. Available at: https://www.reuters.com/article/us-swiss-blockchain-smartvalor/swiss-blockchain-firm-smart-valor-wins-regulators-approval-idUSKCN1LL17R [Accessed 17 Oct. 2018].

- SmartValor. (2018). SMART VALOR - A revolution in global investment | Blockchain-based VALOR Platform. [online] Available at: https://smartvalor.com/ [Accessed 17 Oct. 2018].

- Sales invest. (2018). Investments. [online] Available at: http://www.salesinvest.se/partners-1/ [Accessed 17 Oct. 2018].

- Valor, S. (2018). Smart Valor Officially Accepted as a Financial Intermediary. [online] Medium. Available at: https://medium.com/smart-valor/smart-valor-announces-launch-of-the-first-global-marketplace-for-tokenized-alternative-investments-d6ce05dc34a9 [Accessed 17 Oct. 2018].

- WITS ZEN. (2018). Seven Blockchain Startups To Watch. [online] Available at: http://www.witszen.com/seven-blockchain-startups-to-watch/ [Accessed 17 Oct. 2018].

Nice work!! I like it.

Thank you my friend -it is a great project