All the digital currencies in the market are still deep in the red. Bitcoin (BTC) is yet to recover, and it’s still struggling to break over the $4,000 level.

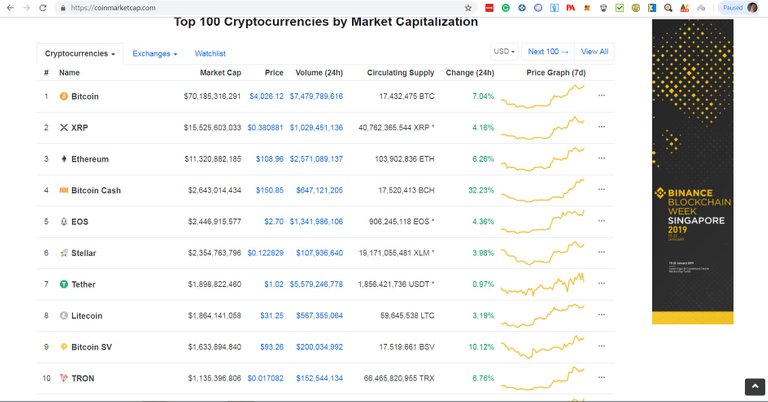

Today Almost all of the Top Coins are in green light, but do you think it will be the start of Bull? or it's a trap of a bear?

After literally months of waiting, a cryptocurrency market bounces forward and the majority of cryptos started to gain double figures on the day with a $10 billion injection pumps crypto markets.

While Bitcoin could potentially rebound to $4,000 to $5,000 in the weeks to come, a cryptocurrency trader with an online alias “The Crypto Dog” emphasized that the macro trend still remains bearish.

The trader added that the current trend reversal will likely not lead to an all-time high and that most rallies could fail in the short-term.

Analysts, enthusiast, and industry figures have very diverging opinions and bitcoin price predictions for both long and short-term. Expect a lot more price fluctuations in the interim. It’s going to be a bumpy ride getting to wherever Bitcoin is headed by the year’s end.

John McAfee, Bitcoin supporter and founder of the popular McAfee antivirus software, is being very positive about Bitcoin. He predicted that Bitcoin price will hit $1 million by 2020 following last year’s prediction of $7000 which was well surpassed.

Known for his disparaging remarks against Bitcoin, a former chief economist at the International Monetary Fund’s (IMF) Kenneth Rogoff has poured icy water on hopes of Bitcoin making it to the moon. “I think Bitcoin will be worth a tiny fraction of what it is now if we’re headed out 10 years from now…I would see $100 as being a lot more likely than $100,000.” – Kenneth

One of the popular Winkelvoss twins, Cameron Winklevoss recently said that he could easily see the price of BTC go up 40% someday. This year maybe? Not likely. The twin said he and his brother were taking longer outlook, 10 to 20 years. “Bitcoin is actually fixed in supply so it’s better than scarce … it sort of equals a better gold across the board. We think regardless of the price moves in the last few weeks, it’s still a very underappreciated asset.”

Last month, Llew Classen made a bold statement to reassure Bitcoin believers that the cryptocurrency is on the right track –specifically, on track to reach the $40,000 mark. Though his outlook for some altcoin holders was not very encouraging, he made it clear that as something new, cryptocurrency will be as risky as it is exciting.

In 2014 with bitcoin at only $413, popular VC, Tim Draper predicted bitcoin to reach $10,000 in three years. This was fulfilled a month earlier than he predicated earning him a reputation among crypto fans. He said he expected the Bitcoin to continue its growth in an interview with Bloomberg last year. Tim Draper has made successful bets with Tesla, Skype, and Twitter in the past.

At this stage, bitcoin and cryptocurrencies will be greatly affected by speculations. Even small developments in governments, traditional will likely affect prices. Most say the fluctuations are normal and wouldn’t affect the longer term outlook.

LONG-TERM OUTLOOK

Experts would prefer to make predictions over a longer period. It is more common to have bitcoin price predictions for 2020 or a 10 to 20-year outlook. While the current reality may suggest some gloom, it’s worth remembering that the heights achieved last year came amidst similar corrections along the way.

THE MOST IMPORTANT RULE OF INVESTING

Crypto investments are new and super-risky. Remember ethereum founder saying that cryptos are so risky the prizes might actually drop to zero. Well, that doesn’t seem practical but the message was clear. Do not invest your life savings in bitcoin or cryptocurrencies generally. Just like John Draper noted, you still need to buy stuff in fiat. So while bitcoin will likely worth a lot more in the future, it’s advisable to invest just as much as one can afford to lose.