Without money, people have to give away some goods in exchange for any they receive. This system, known as barter, was the earliest form of trade. it still has its uses today. A certain amount of barter is sometimes written into East-West trade agreements because Soviet bloc countries are often short of the ‘hard' currencies which the West recognises as being of value. Nevertheless, barter is extremely limiting. Some goods perish easily and are difficult to transport. And if someone requires, say, eggs, and has only sacks of corn, then he has to find a person with eggs who wants corn. in addition, large objects are often not divisible. A cart seller, faced with a buyer's offer of 12 sacks of corn, may not need so much grain. But he has nothing to give but a whole cart.

Because of these difficulties, general items such as beads, salt or cattle have often become convenient means of exchangeein other words, money.

By around 2000 BC metal, which was attractive and durable, had become a means of exchange in the Middle East. By the 7th century BC bronze was being cast in China into miniature knives or spades, each assigned the value of the real equivalent.

The forerunners of modern coins first appeared in Lydia, in what is now eastern Turkey, between 690 and 650 BC. They were crudely cast slugs of electrum, a natural alloy of gold and silver found locally. Their value depended on their weight.

Paper Money

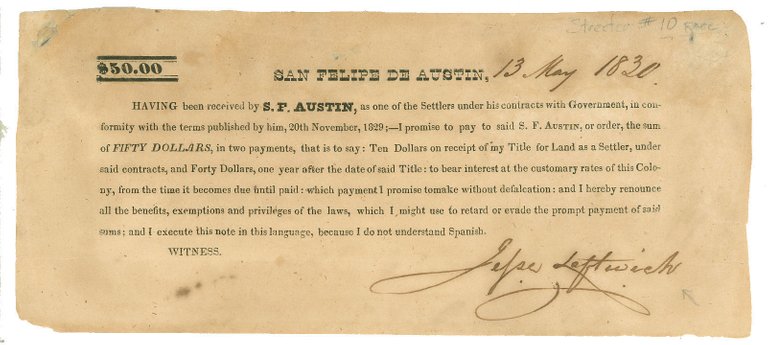

The use of paper money is believed to have started in China between the 7th and 9th centUries AD, to overcome shortages of coins. in Europe in medieval times, letters of credit, effectively personal banknotes-were exchanged between businessmen who knew and trusted each other. Later, a practice grew in which goldsmiths gave receipts for gold left in their charge, and these receipts were exchanged as money. During the 18th and 19th centuries, first private bankers, then central banks, took over this role. They issued notes, each of which was a ‘promise to pay': words that still appear on many banknotes. Until 1931 ”when many countries. including Britain. went off the Gold Standard.

The holders of banknotes were usually entitled, in theory, to demand from the issuing bank that the notes should be redeemed in gold. Since then, however. notes have resumed the status of primitive beadsva means of exchange which has value only because the paper is trusted.

This process has been taken a step further by the use of cheques and credit cards. Both are essentially ‘promises to pay', backed by the person signing the cheque or guaranteed, within limits, by a bank or credit-card company. More recently still, in much of the developed world, electronic accounting has begun to replace notes and coins altogether. Instead. the transaction takes place only on a computer screen with not a trace of metal or paper.

LINKS TO IMAGES:

http://www.yourmoney.com/investing/why-does-my-fund-manager-hold-cash-2/

https://www.google.co.uk/amp/s/online.kitco.com/amp/sell/536/Buy-Back-Misc-Pure-Gold-Coin-995-536

http://blog.oxforddictionaries.com/2014/08/bread-cheese-dough-come-mean-money/