This is the first time I heard about "Marhaba DeFi", a DeFi ecosystem that aims to be Shariah compliance. There are many religions in this World, for example in the west there are mostly Christians, in Asia there are Buddhism and Hinduism, and in the middle east there are Jews and Islam. Shariah is the legal practice derived from the teachings of Islamic religion based on its holy book "Quran" and the Prophets and its Muslim people way of life "Hadith". Unless you have many Muslim communities in your area, you probably do not know that there are Muslims who refuse to use banking services because some of them believed to be unlawful practice based on the Islamic teachings. In my country Indonesia, more Shariah Banks are emerging which is different from the traditional banks. The difference is that they abide by the Shariah Law which is believed by many Muslims that they are lawful banks. Then it is not strange to find some Muslims reject most DeFi ecosystem just like they reject the traditional banks because they are not Shariah compliance. This may result in DeFi to never receive some Muslim customers. "Marhaba DeFi" envision on bringing a “Muslim also” platform. "Marhaba" in Arabic means “Welcome”, to welcome not only Muslim users but everyone else as well.

General Information in DeFi

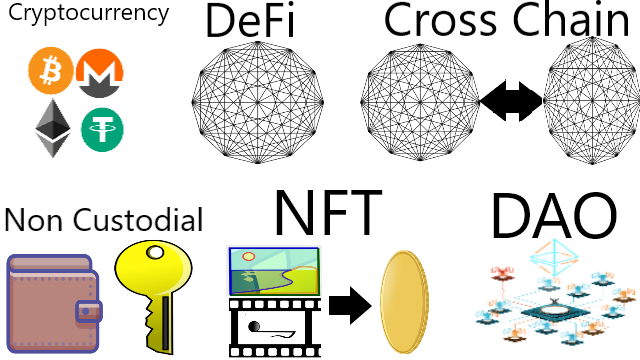

For users who are new in DeFi space especially those who are new in the crypto space as whole may not be able to distinguish the uniqueness offered by "Marhaba DeFi". When I read their Lite Paper and White Paper, I found many information that are not exclusive to Shariah practice but general to the whole DeFi space. Cryptocurrency and the rest of its technology are "neutral" as they are only financial technologies (FinTech). It is how they are used what matters to people. Just like how the Internet is neutral, it is what contents inside the Internet that matters. Therefore, I will list them here for you to know so that you can focus in the most important things and avoid embarrassing yourself for being amazed in things that are actually common:

- Open Cryptocurrency: a financial technology based on cryptographic technology known as the blockchain and distributed system to create a transaction system that is open, transparent, and borderless that cannot be tampered and censored without the need of intermediaries. Information are recorded as it is free from modification and manipulation which ideally to remain truthful. The information are safe guarded by many volunteer nodes where anyone can join.

- DeFi: stands for decentralized finance opposed to centralized finance controlled by a central entity where if they grew too powerful they will tend to corrupt in power. DeFi aims to equally distribute its power equally to all participating nodes in the world where their job is only to validate contracts between merchants and customers. They cannot deceive, manipulate, and especially prevent anyone from participating, just like how the free market should me.

- Non Custodial: means full control of your own assets. Traditional banks are custodial where they are holding your assets for you and if they wish, they freeze your account anytime. Having assets in your non-custodial wallet means nobody else other than you can access your assets, not even the highest authority. Your assets are truly your own.

- Multiple and Cross Chain: there are many other smart chains today other than the first Ethereum. Multi chain means support of many chains. Cross chain means interoperability between many different chains.

- DAO: stands for decentralized autonomous organization where an organization is fully democratic where anyone can get stakes and vote for decisions of its future.

- NFT: stands for non-fungible tokens which is a unique token of ownership of any kind of assets. For example, ownerships of arts, video game assets, and documents.

Major Shariah Compliance Believes

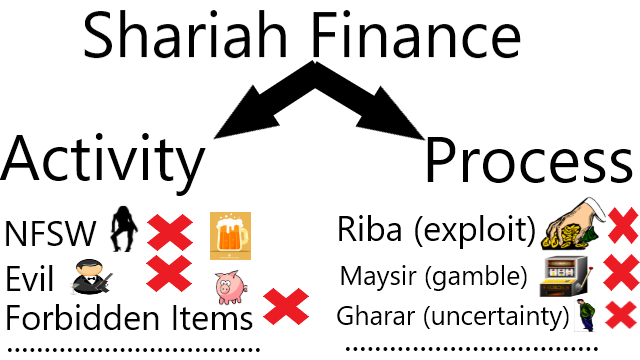

DeFi is only a technology which is neutral. Next is how people use this technology. Out of all the lengthy description by Marhaba DeFi ends in one final question. Is their usage of DeFi Shariah compliance? To learn their concept about Shariah is to read their Shariah Concept Paper and to evaluate, we need to reference from the Quran and Hadith. I think it is too much for average people like us to absorb all those information. Instead, I will just pass on the words of many Muslims I met regarding why they refused to use banking.

- Business Matter/Activity: even though we do not directly commit an unlawful and even if we do not have the intention to do so, many Muslims believe that we will still be responsible if the bank we entrust our money to uses them for unlawful activities with full intention. Even if we are unaware of the unlawful activities but we must take effort to initially investigate whether the business conducted by the banks are unlawful or not because many believe we will still be held some responsibility for our carelessness (to lazy to ask questions of where the fund goes) and even more so if we intentionally remain ignorant. For example, many believe that we will also sinned if the bank we entrust our money uses them for funding:

- gambling, stealing, and other greedy activities

- oppressive and destructive activities

- money laundering and corruption

- pornography, prostitutions, and other similar adultery activities

- producing and distributing unlawful food, beverage, and other items such as pork, alcohol, and weapon of mass destruction

- rituals that bluntly attacks the religion such as satanic ritual

- etc.

- Business Mechanism/Process: below are popular examples among Muslims who reject using banking services of unlawful mechanism or process:

- Riba: is an Arabic word that can be roughly translated as "usury", or unjust, exploitative gains made in trade or business under Islamic law. Simply they said to me that "interest rates are unlawful" and especially worse "fixed interest rate". It is forbidden to lend others asset and ask more for return. Simply it is forbidden to lend $100 and ask to return $101 ($1 interest), it is forbidden to lend 2 portion of food and ask 3 portion of food in return. However, "profit sharing" is okay! For example, lending $1000 to a shop owner for capital and the shop owner made $1300 (profit $300), it is lawful to receive $1150 as long as the intention is profit sharing. Traditional banks confiscates assets when a loan taker fails to pay their debt while Shariah banks cannot do that and must face the loss together with the loan taker.

- Maysir: which is gambling, excess speculation, or anything else that the winner's profit is obtained from the loser's loss or simply a situation where the loser business must give money to the winner is forbidden.

- Gharar: which is excess uncertainty such as the less transparent reserve ratio. Do you know that when a bank have minimum 10% reserve ratio, they can use 90% of the fund you deposit without your knowledge? With open blockchain technology, all transactions can be open and transparent.

If there are no Shariah banks in their regions, some Muslims decides not to use banking at all. Why do some Muslims only uses Shariah banks? Because Shariah banks have full intention to be Shariah compliance which is the same as bearing most of the responsibility of its customers. If at some points Shariah banks commit unlawful practice, the customers will almost not be held responsible because they did all they can to make sure the banks they are using are Shariah compliance. The same goes to financial service providers in DeFi, some Muslims are afraid that they will be held accountable for using services that may potentially involves unlawful activities. Therefore, Marhaba DeFi aims to be a financial service provider in DeFi to be Shariah compliance. Just that declaration will bring confidence in many Muslims to use their services.

Upcoming Products Worth Mentioning

All non custodial technologies are just technologies which are neutral. For example, a non custodial wallet does not need to be Shariah compliance because they function just like our personal wallet in our pocket and not being held by a bank or exchange to be used for their businesses. However, the marketplace and their financial activities do need to be Shariah compliance:

- Their exchange whether centralized or decentralized must not list unlawful assets such as cryptocurrencies related to gambling, adultery, hate, etc.

- Their NFT market place must not list unlawful contents such as nudes and other not safe for work (NSFW).

- Their launchpad should review and decline unlawful startups.

- Their services must not based on interest rate but based on profit sharing.

- It is recommended to open their identities along with transparent transactions and I saw their corporation to be BLOCKCHAIN GARAGE SOLUTIONS PTY LTD, a corporation registered in Australia and their team have Linkedln profile account.

- Finally, they should encourage positive activities such as zakat payment (donation in Islam) through DeFi.

Disclaimer

The information I wrote above are less facts but more to opinions of Muslim people I heard from. The correct information will always be in the "Quran" and "Hadith". However, my argument is still valid because in business, the truth actually does not matter and what matters is the believes of the people. If Muslims believes them to be unlawful even if they are actually okay after detailed review of the "Quran" and "Hadith", they will stay away from it. Also, not all Muslims are the same, I met many Muslims with different level of strictness, for example there are those who totally avoids alcohol, those who are okay with alcohol to some degree such as being used as medicines, and those who are okay drinking alcohol as long they do not get drunk. Finally, this article is originally Published on https://www.publish0x.com/0fajarpurnama0/do-you-know-that-some-muslims-view-banks-and-defi-as-unlawfu-xwwmvyv?a=4oeEw0Yb0B&tid=publish0xcontest to enter the #MRHBDeFiExplained Writing Contest.

Mirrors

- https://www.publish0x.com/0fajarpurnama0/do-you-know-that-some-muslims-view-banks-and-defi-as-unlawfu-xwwmvyv?a=4oeEw0Yb0B&tid=hive

- https://0darkking0.blogspot.com/2021/11/do-you-know-that-some-muslims-view.html

- https://0fajarpurnama0.medium.com/do-you-know-that-some-muslims-view-banks-and-defi-as-unlawful-what-about-marhaba-defi-11f553894bdd

- https://0fajarpurnama0.github.io/cryptocurrency/2021/11/22/marhaba-defi

- https://hicc.cs.kumamoto-u.ac.jp/~fajar/cryptocurrency/marhaba-defi

- https://0fajarpurnama0.wixsite.com/0fajarpurnama0/post/do-you-know-that-some-muslims-view-banks-and-defi-as-unlawful-what-about-marhaba-defi

- http://0fajarpurnama0.weebly.com/blog/do-you-know-that-some-muslims-view-banks-and-defi-as-unlawful-what-about-marhaba-defi

- https://read.cash/@FajarPurnama/do-you-know-that-some-muslims-view-banks-and-defi-as-unlawful-what-about-marhaba-defi-bf6d2831

- https://www.loop.markets/do-you-know-that-some-muslims-view-banks-and-defi-as-unlawful-what-about-marhaba-defi/