What is this?

Doing your taxes sucks. The only thing worse is doing your crypto taxes. But, with this guide, you should be able to push through and get them done.

This is a guide to doing your taxes using Bitcoin.Tax or similar software. There are tons of guides on tax law, but this guide tells you how to enter them. It covers all the complexity involved with trading NFTs in addition to your vanilla digital currencies. It covers Ethereum transactions as examples, but the same concepts can be used with any blockchain taxes. It is written with the USA tax code in mind, but almost every idea here applies to any tax code. It makes one large assumption which is that NFTs are being treated as property (same as ETH or BTC).

It is not an overview of tax law and does not offer suggestions on how to handle any tax laws or forms. It was written with the user in mind, knowing you will be looking to solve a specific issue and is thus based on economy of words and will not waste your time. Each word has value and was written with purpose. That also means the humor is dry, very dry.

The burden placed on you as a trader of crypto cannot be downplayed and may be overlooked by newcomers in the space. The government has no mercy on individuals who are not up to speed, but thankfully I have no tolerance for their lack of guidance – and created this for the community.

Who is this aimed at?

This is for anyone who is interesting in doing their crypto taxes or wants to see what the process looks like.

It is specifically tailored to deal with the unique problems that traders of NFT (non-fungible tokens) will experience.

Why did you write it?

Crypto taxes are a 365-day exercise and if you do not understand the steps involved you will find yourself lacking necessary information come Tax Day.

It is near impossible to accurately do crypto taxes without a guide. The software companies do their best, but most cannot track all the information needed to accurately enter complicated crypto taxes. Tax professionals are also just learning this technology and you can waste lots of money trying to solve these issues with them. Doing Your Own Research and understanding how these can be done on your own is a powerful tool.

OK, let’s get this over with!

What will it cover?

- What to track and what to leave to software

- Every step for using Bitcoin.Tax

- Complicated issues explained

- Tips and tricks

What will I need?

Bitcoin.Tax or similar software

Optional: CoinTracker.io

Optional: CryptoTaxAudit.com

What to track and what to leave to software

Track the following information throughout the year on a locked spreadsheet that includes the date, description, currency used, and price.

- Wallet addresses

- Cryptocollectible / NFT purchases and sales including email records

- Mining income transactions

- Fiat to crypto purchase transactions including NFTs

- Transactions that are hard to distinguish (DEX transactions, crypto purchases for tangible goods, etc)

- Exchange and wallet software used

- Exchange transactions with withdrawal fees, if possible

- Gifts or donations

- Tokens swaps

- Claimed airdrops

Simple transactions such as transfers will be easy to determine at the end of the year as will any airdrops that you may have received. The software will not always help you if you did not keep records of the things listed above.

Every step for Using Bitcoin.Tax

Use these steps and reference the sections below needed. You can switch up the order, but no step should be skipped.

Visit Bitcoin.Tax and create an account. Ensure you get a plan that is big enough for your needs.

Add your wallets using the Addresses tab. Any wallets that cannot be added will have their transactions added manually.

Upload all exchange and on-ramp trades.

On the Addresses tab, click Transactions next to each wallet address to see a list of all transactions.

Review transactions one wallet at a time, starting with the earliest transaction first.

Compare the transactions shown in Bitcoin.Tax to what you see on the transactions tab on EtherScan. The transactions show on Bitcoin.Tax do not represent all the transactions you will need to enter. See the complicated issues section for more details.

Click on each transaction individually in Bitcoin.Tax and add them using the drop-down menu on the right. I recommend adding every transaction one tab at a time from EtherScan using this method:

Transactions tab – Review and approve matching currency trades. Skip any transactions involving the transfer of an NFT. Add any zero value transactions’ fees on the spend tab.

Internal Transactions – Review for any sales of NFTs you may have made.

ERC20/721 Token Txns – Review for any purchases of NFTs.Manually add transactions using steps 6-7 for any wallet that you could not add to the Addresses tab while ensuring you are not adding duplicates.

Review Trades tab for any transactions with a “!” warning symbol and notate them for later. You need to review the date in question to determine if a mistake was made or a buy came before you were shown to receive the currency to afford it. I recommend doing this often. It is usually an incorrect time stamp on a transaction.

Manually add missing transactions to the Trading, Income, and Spending tabs. This includes mining income, gifts, Defi interest ala Celsius, Lolli, token swaps, and airdrops.

Add any sales made in private or transactions from second layers such as LOOM or MATIC.

Use the Calculate tab to select your tax preferences. Lock it.

Review your trades tab for any obvious mistakes.

Produce reports and review each document for accuracy. Cost basis is sometimes missing from coins that did not have a price for the software to reference.

Upload documents into tax software such as TurboTax.

Complicated Issues Explained

1. Adding Low Value Transactions

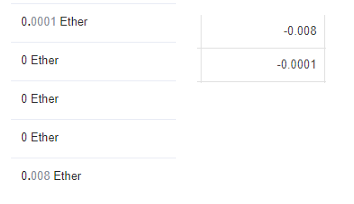

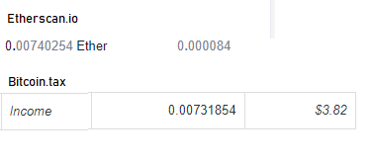

Issue: Bitcoin.Tax does not show low value transactions on the Addresses tab.

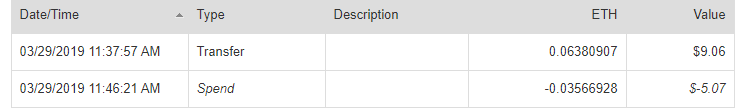

The list on the left is EtherScan, on the right is Bitcoin.Tax. Notice that the transactions showing with a value of 0 in EtherScan are not picked up by Bitcoin.Tax in the Addresses transaction list.

Solution: Manually enter these transactions. Most will go under spending.

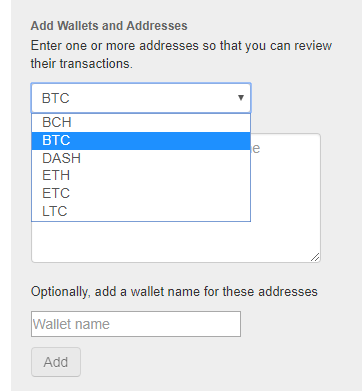

2. Adding Altcoin Wallets

Issue: Bitcoin.Tax supports a limited number of wallet types including only BTC, BCH, DASH, ETH, ETC, and LTC.

Solution: Manually enter any transactions from these wallets using a CSV upload.

3. Adding Exchange Withdrawal Fees

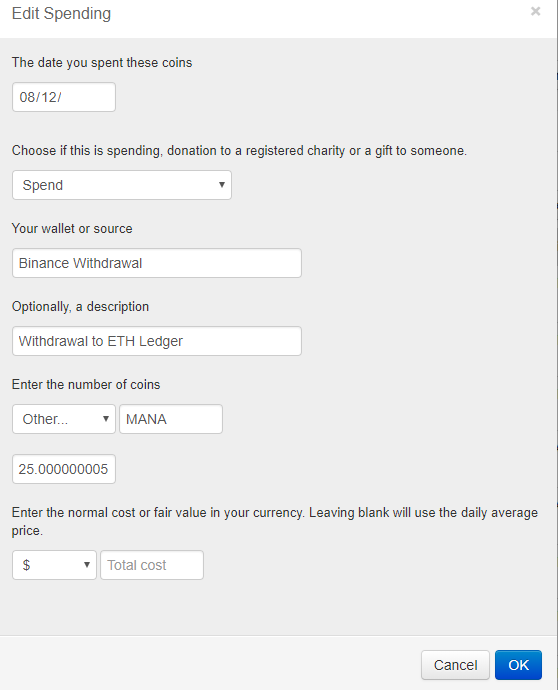

Issue: Bitcoin.Tax does not calculate your exchange withdrawal fees automatically.

Solution: This could be provided by the exchange records. If not, the most accurate way to determine the fee amount is by visiting each exchange and reviewing your withdrawals to compare the amount transferred to you with the amount withdrawn. Enter manually as a spend.

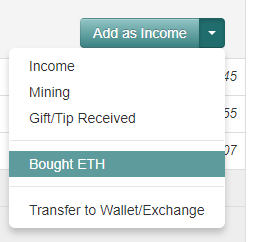

4. Wallet to Wallet Transfers Show as Income

Issue: Bitcoin.Tax will show some transfers into your wallet from exchanges or other wallets as Income instead of as a Transfer.

Solution: Click on the transaction and click add as Transfer to Wallet/Exchange. If this was a purchase using fiat you can also choose bought “Currency.”

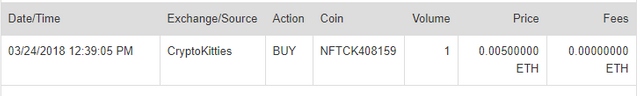

5. Cryptocollectible / NFT Buys and Sells Show as Spends

Issue: Bitcoin.Tax does not know when a transaction includes an ERC token / cryptocollectible and only records the amount transferred, not the NFT transfer itself.

Solution: Manually add your cryptocollectible transactions.

Add any fees spent using a product or service as Spends (Ex: breeding in CryptoKitties).

Add either a Buy or Sell on the Trading tab corresponding to every ERC-721 purchase and sale, but not both. Give your ERC-721 a unique Coin Symbol representing where it came from and its ID number and enter the quantity as one (ex. NFTCK123). Do not add these transactions from the Address tab in bitcoin.Tax or you will have duplicate transactions.

6. Removing Transactions

Issue: Transactions cannot be removed once added under the Addresses tab.

Solution: Find the transaction under Trading, Income, or Spending and delete it using the “X.” Navigate back to the Addresses tab and you will be able to edit the entry once again.

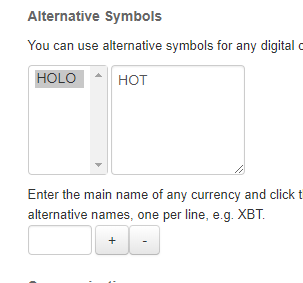

7. Adding Token Swaps

Issue: If a token has a swap and only the name changed, you may be left with a coin that shows a value of zero.

Solution: Bitcoin.Tax has a guide on token swaps on their system. If the value does not change from the swap, you can add the two token names as alternative symbols.

8. Adding Missing Cost Basis

Issue: When you review your Capital Gains Report and Closing Position Report in Bitcoin.Tax you may come across entries where the value shows as zero.

Solution: Lookup a value at market close for the token and add the information to your transaction in the software and redo your reports. Not every entry with a zero value is incorrect so you will need to compare the transactions to ensure it is a mistake.

9. Matching Mysterious NFT Transactions

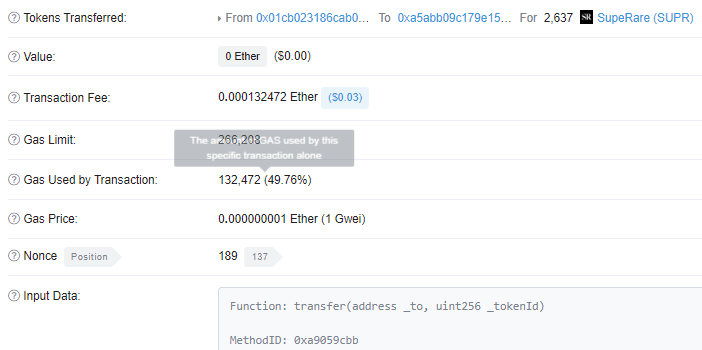

Issue: Certain EtherScan transactions can be difficult to interpret.

Solution: If you run into a transaction you do not recognize, try to match that transaction up to a transfer of a token or an internal transaction. Sometimes the two transactions can appear completely different yet be related by date/time.

Let us go over an example here:

The Spend here needs to be added to Bitcoin.Tax.

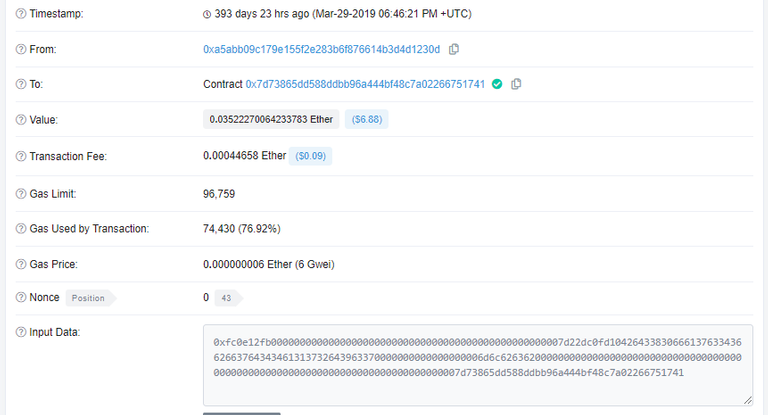

Looking at EtherScan gives little information.

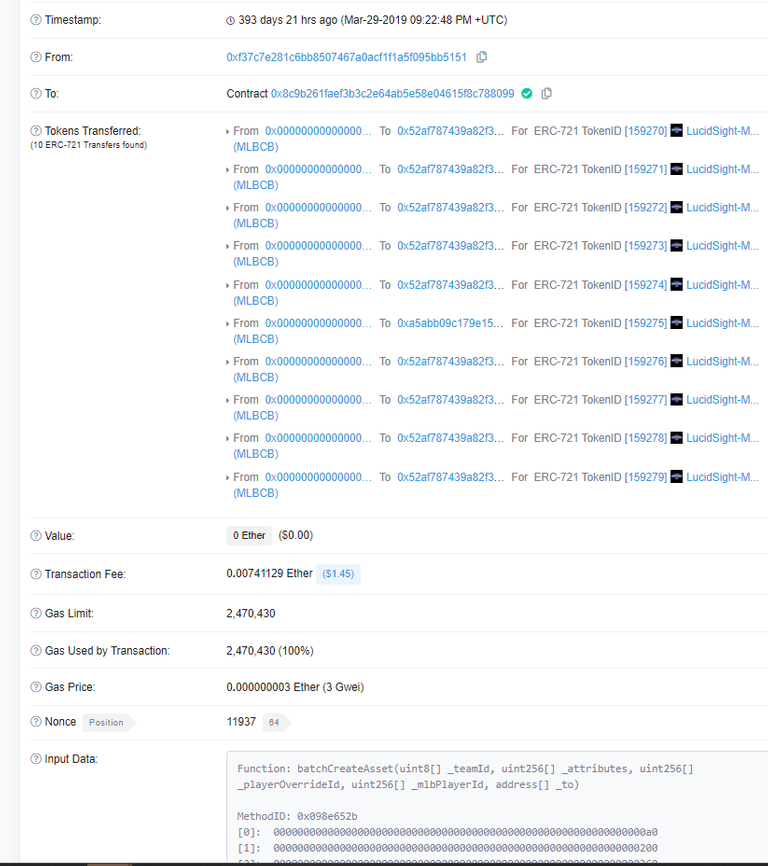

The ERC-721 tab shows the only other transaction on that day was a transfer of a token three hours after the initial transaction out occurred.

Checking notes, MLB Crypto currency was purchased, accounting for the outgoing spend of .035 ETH followed by an inbound transfer of an NFT from the purchase of a figure on their marketplace. It is added as a BUY of NFTMLBC159274 for .035ETH.

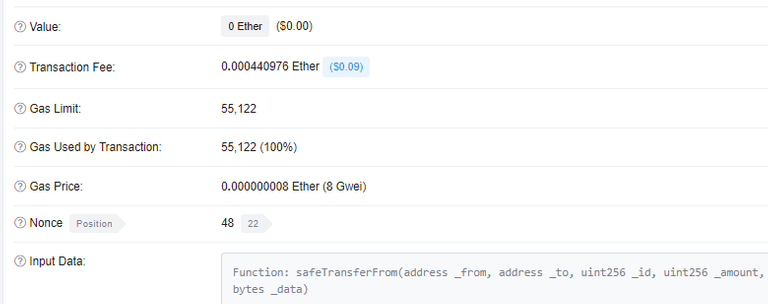

10. Matching up Bids with Transfers

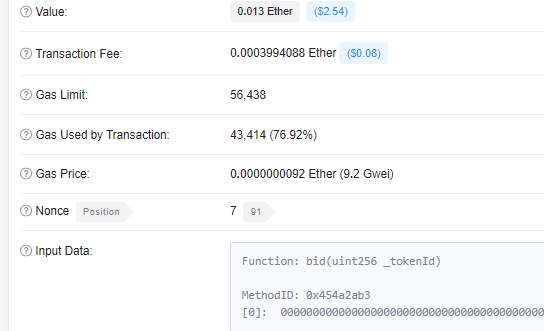

Issue: Bids show as spends.

Solution: Determine if the bid resulted in a purchase by referring to token transfers and transactions.

11. Ignoring EtherScan Red Question Marks

Issue: Transactions on EtherScan show with a red question mark.

Solution: These transactions failed and can be skipped after review.

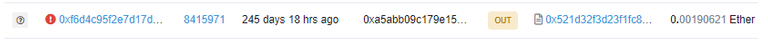

12. Adding 0x Input Transactions

Issue: Transactions show as having an input data of “0x.”

Solution: These are added as transfers between two accounts. They are sometimes purchases of currency from an on-ramp such as Coinbase.

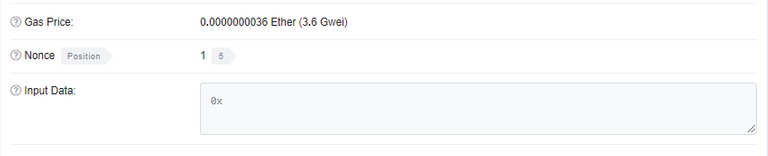

13. Adding SafeTransferFrom Transactions

Issue: Some transactions show as having an input data of “SafeTransferFrom” and are not added automatically.

Solution: These are added as transfers between accounts, usually resulting from a transfer between a second layer such as LOOM and the ETH base chain.

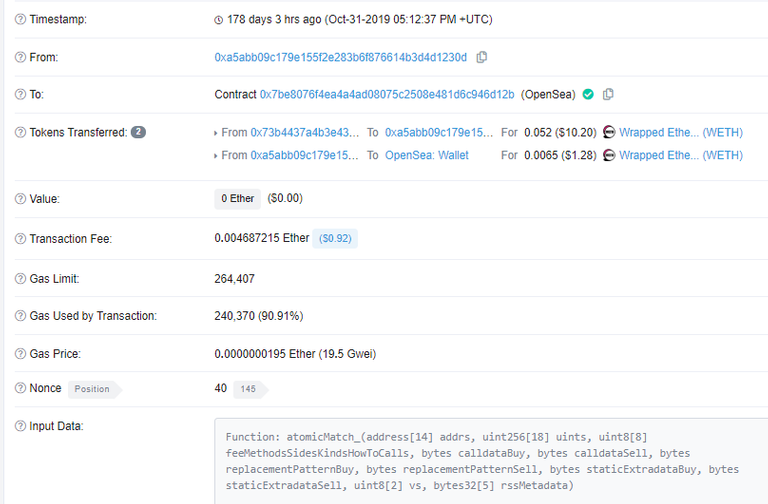

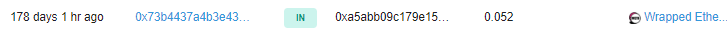

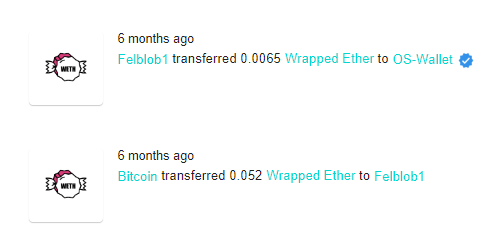

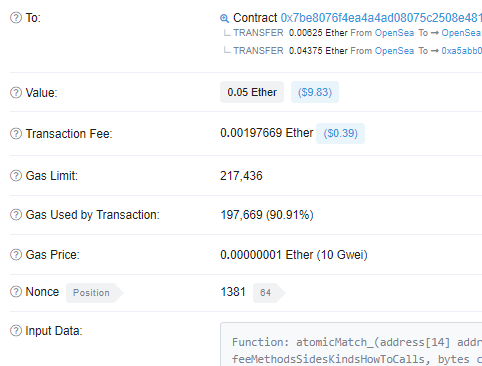

14. Adding WETH NFT Purchases

Issue: WETH NFT purchases are difficult to interpret and are not added automatically.

Solution: Review token transfers.

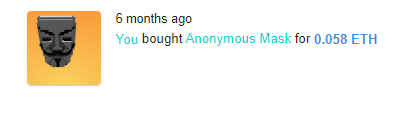

Then confirm the transaction by looking on OpenSea.

Add a BUY for the NFT and the transaction fee as .0065.

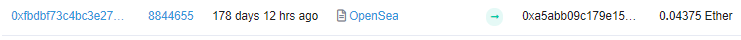

15. Adding NFT Sales from Internal Transactions

Issue: Some NFT sales do not show in transactions and are not added automatically.

Solution: Review internal transactions to find a matching transaction.

OpenSea can confirm the transaction occurred.

Add the transaction as a SELL.

16. Adding NFT Buys Shown as AtomicMatch

Issue: NFT purchases can be difficult to interpret and are not added automatically.

Solution: Reference OpenSea to confirm the transaction occurred. Add as a BUY. Review internal transactions, if needed

TIPS AND TRICKS

Backup your Bitcoin.Tax data often.

Download all available data from Bitcoin.Tax, not just the tax reports. You may need them for a different software product in the future.

Review your 8949 for duplicate or odd transactions. Compare them to your Bitcoin.Tax data before making any corrections.

Ensure that the date and time between EtherScan and your software transactions match, EtherScan does not default to your time zone.

Exchanges close, grab your records often. These services closed this year and would have been inaccessible without logs: Coinexchange.io, COSS, Cryptopia, Cryptobridge, Poloniex (restricted).

EtherScan and Bitcoin.Tax have CSV options. Use them when adding bulk transactions.

Ensure that you fill out any FINCEN forms that may be needed. Anyone who used an exchange likely needs to indicate so on Schedule B and if you held over $10,000 in a foreign exchange, likely needs to fill out additional FINCEN forms. I do not want to see anyone get arrested or fined.

Sign up for CryptoTaxAudit.com, purchase their video on entering taxes into TurboTax and include their form 8275 – it could be the most important information in your return. Use the health checkup they provide to ensure you are filling out your taxes correctly. This step is optional, but highly recommended.

Use CoinTracker.io as a reference. They are the most advanced NFT tax software and recently added support for internal transactions. They also have a great tax law guide found here.

Consider saving (or converting to a stablecoin) 20-30% of every transaction, and earn interest on it through Defi or Celsius. You may not know what the cost basis of the currency you are selling is, and storing away this amount can save your from doing the math throughout the year.

Wrap Up

There is no pretending that doing your crypto taxes is easy and the added complexity of trading NFTs is significant. The market today puts users of crypto in a tough position where someone who traded a small amount of monetary value can find themselves in a situation where the only tax professionals who will review their return will charge more than their entire portfolio. As tax software slowly improves, I hope that my guide will becomes less of a tool for completing taxes and more of a reference when you need to solve a specific issue. The guide has grown by nearly 50% since first being publishing even though little new guidance or solutions have come to pass.

The next edition will include details on how one can organize and better prepare throughout the year, including ways to earn a safe return on fiat stashed away for taxes as well as templates for recording your daily transactions.

Thank you for reading my guide and may the IRS have mercy on your crypto loving heart.

Notice: I do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. This is just the opinion of one DApp gamer and blockchain enthusiast. Cryptocollectibles / NFTs are probably treated as property but may be treated as collectibles in the future. Using this guide assumes they are being treated as property. Use your own opinion when you use this guide.

Contact Author:Discord/Twitter/Cent/Medium: @Felblob

Website: www.felblob.com

Donate: Felblob.eth / 0xe76be7aA51D89CcC42425c2DC1A1A26eEB0944Db

Property of Felblob 5/2/2020. Please ask permission before reusing – I will say yes.

Lord have mercy

Ever at the mercy of not-so-well-intentioned regulations.

Wow, that’s allot... oh well, I just claimed the 1099’s I got from a couple of exchanges, the rest is really none of their business. Taxation is theft.

Taxation is theft. Learn to harvest losses at the end of the year and stick it back to the IRS. This is to show the complexity that they assume you will not unravel and will then use against you. Do not give them a reason or way.