This is the perfect example of why you never sell an investment that is losing money.

Everytime you sell, someone is buying and you have to keep in mind that this other person might know something you don't.

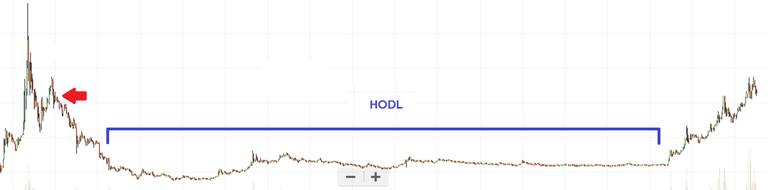

This chart is the chart of Bitcoin Cash from August 3rd to August 19 2017.

As you can see from the red arrow I bought it at $ 700. Few minutes later the market started to crash to $ 300. That's a loss of 50% +. But guess what? I did not sell. I refused to sell. When you don't sell, you don't create a loss

The blue line show the holding period. I waited about 15 days before any change happened. To day the price of Bitcoin Cash is arround $ 900.

Will I sell? Not yet, I think it will go up. And guess what? If it crashes again, i'll just hold and wait again.

In my books you can sell an investment (at lost) in only 2 situations.

The coin/investment is going to shit.

For example, a company is going for bankruptcy & the banks are pulling out the loans.

The market discovered that the coin is a scam, the coin is now useless, the coin has no future.You think you can do better

If you think you can sell the investment and buy an other coin that will give you a higher ROI, then you should sell because the money sitting in the lossing investment is capital that you are not using to it's fullest. Unfortunately this is why people lose money. They think they can regain the lost value by selling and investing in a new coin, but that rarely happens. While this situation might be good for some, in general it is rarely the way to go.

simple in theory, how would you have done in 1987 and 2008?