Anyone investing in the Altcoin space has been incredibly concerned over the past few weeks due to the profound shocks we're feeling as the valuation of a number of currencies has dropped anywhere from 10%-80% from their ATH (All Time High) early in June. And yes, for those of us who started investing during the rise in June are seeing our holdings drop in value. Nothing has been spared except for Litecoin and Dash which have been setting new ATHs recently.

With that said, let's at least try to understand what's been going on and if this is a sign of gloom and doom, or just another crazy month in the Cryptocurrency space by looking at some historical and current information.

(2013-2014) The First Altcoin Boom saw 20x Gains

Using history to understand what CAN happen (not what will happen) let's see what happened doing the 2013 Boom. The Altcoin sector was just at $100M in total market cap at the time. Considering how many coins we have today sitting over $100M in market cap each, it's crazy to think the entire space was at that level not long ago.

As we can see from the chart, the entire Altcoin space experienced a 20x growth within a matter of 1 month, which then went on a violent ride until finally settling down at $500M in total market cap value 1 year later.

Those who purchased at the top saw their holdings drop by at least 75%. Consider Litecoin. It recently reached over $50 setting a new ATH... but it had actually hit $50 way back in November 2013 before dropping to near obscurity and gradually moving back up to around $4 until the beginning of 2017.

BUT! From the beginning of the boom until the end of the bust a year later the altcoin space actually grew 5X from $100M to $500M. And, that's part of the lesson we have to take away from every major cycle in a growth market. It lands back down, yes, but at higher levels than it was before the boom upwards.

(2013-2016) Altcoins Capped under $2B for 3 Years

Between 2013 and 2016 the Altcoin space (excluding Bitcoin) was largely capped under USD $2B. That's nearly 3 years of consolidation, simmering and waiting patiently for the moment to break out again. That's an eternity if you consider the life of the Cryptospace in its entirety is roughly 8 years.

One thing we have learned is in growth markets, the longer a coin/sector simmers for, the larger the break out can be. And that moves us to 2017.

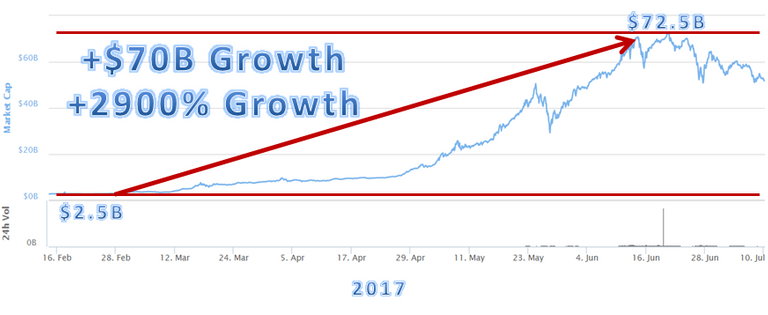

(2017) +2900% Growth in Altcoins Space

The Altcoin space grew from a mere USD $2.5B market cap to USD $72.5B within a span of 5 months! That's a growth of 29x from out of nowhere. Comparing this growth spurt to that in 2013, it dwarfs that boom entirely, in both absolute $ terms and in percentage growth.

For those who had invested before the boom in their respective coins, they're sitting pretty today for sure. It doesn't matter if the market tumbles 50%, if they're holding, they're still way in the profit. However, for the rest of us who may have started investing in May or June, we're definitely feeling the pinch right now. For us, the baseline is MUCH higher than those who invested in the space through 2016. And that is where the concern is coming from.

As in any market, the later an investor comes in, the more risk they are taking on themselves. Irrespective, we all come into this market because we believe in the long term (I'm hoping at least)

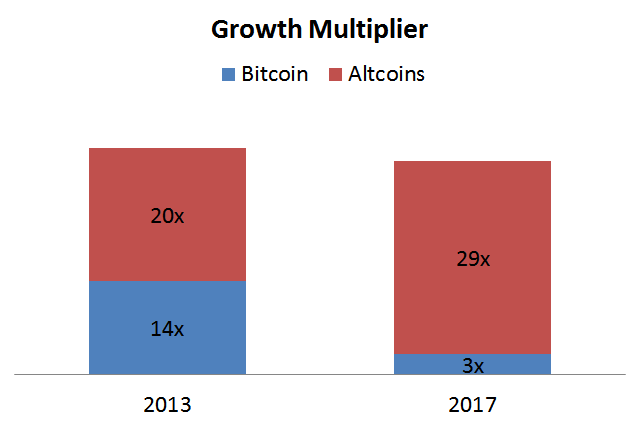

2013 vs 2017: Bitcoin vs Altcoins

There is a major difference between the boom in 2013 and in 2017. The growth multiplier in 2013 was shared between Bitcoin and the Altcoins with Bitcoin growing 14x and Altcoins 20x. Comparatively in 2017, Bitcoin grew "only" 3x, whereas the altcoin space grew 29x! Altcoins performed well (percentage wise) in both time frames, but in 2017 they have been the true stars of cryptospace's growth story.

However, looking at multipliers in an isolated manner can be deceiving of course, so let's look at the overall marketcap landscape in 2013 and 2017 below

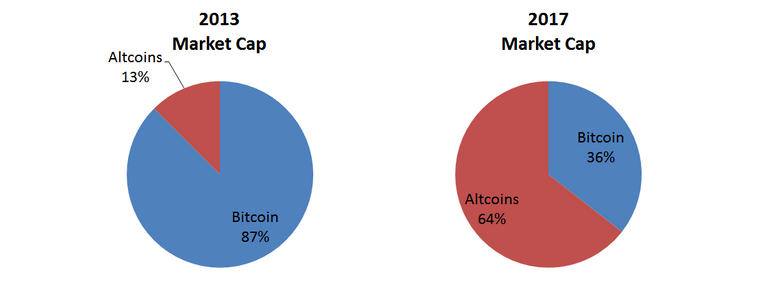

A striking difference, Bitcoin jumped from around $1B in total Marketcap to $14B within a month during the 2013-2014 boom, where Bitcoin represented 87% of the overall marketcap at its peak valuation.

Fast forward to 2017 and Bitcoin's growth was completely dwarfed by the altcoin space, pushing Bitcoin down from around 80% in total marketcap to well under 40% through early June.

(July 2017) Current Altcoin State

From our $72.5B high, we're down about 35%, hovering at around $50B in total Altcoin marketcap. And as we can see the $50B floor has established itself as our strongest support base since the end of May. We have already bounced off of it twice now, with every bounce carrying less momentum back upwards, marked by the declining red line.

We're at a stage where we'll know shortly whether we're going to continue in a downward trend for a longer period of time or if we're going to start moving up towards recovery.

Yes, Ok, But Up or Down though?

I get this A LOT! And the thing is, No, I don't have an answer on the direction we are going to move in, just that we're at a cross roads. Anyone who claims they do have foresight is either flipping a coin, lying or delusional. We can use technical analysis to give us signals, but there is no fortune teller to give us any truth.

It's a scary moment for sure for many investors who came in a bit late. But, never lose sight of the fact that everything moves in cycles. And in an overall bullish market like crypto is in today, we have to assume we're still moving in the right long term trajectory.

2017 is the Year of the Altcoin and Blockchain Technology at Large

Make no mistake about it, 2017 has really marked a milestone for the Altcoin space. And that is something we should all take away from this irrespective of where the market takes us this year.

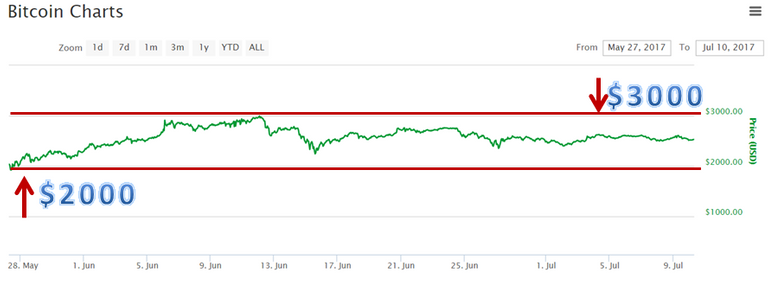

With that said, if we remove the Altcoin picture from Bitcoin, we'll notice that Bitcoin has largely been trading sideways between $2000 and $3000 since May. It may swing 20-30% up or down, but it has largely been stable.

Since the Altcoin space is what is facing the blunt end of the stick right now, this is where all of our collective eyes are. Yes, Bitcoin is going through a potential fork on August 1st, and that can impact both Bitcoin's and the Altcoin's valuation for sure. We will likely see further turbulence when that does happen too... or perhaps the turbulence we're feeling is already baked in and partly due to August 1st anyway.

But, the bigger picture is that Bitcoin is simply not the exclusive solution to disrupting currency anymore and is certainly not the solution to disrupting other industries that need it. Blockchain's potential is being identified as something that can solve problems beyond just currency, and the manifestation of that value is going into the Altcoin space for those coins that are looking to do just that.

Always remember that we're in a high risk space, with tremendous volatility. However, if you believe in it, and believe it is a disruptive force for the betterment of human kind (and our wallets) then we have to ride these downturns. If we believe there is a future in Crypto then the tides will turn again and we'll move back up, so there is nothing to worry about, since we're all in it for the long haul.

Preach brother! This is exactly what I was thinking. After a bust it will always land higher than the initial start. It may take months or years but the technology cannot be denied.

Absolutely. None of us want to be caught at the top when that bust starts, but sometimes we are unfortunately. Just gotta wait it out if we believe long term and leave it at that. :) We'll get to the moon eventually. Just need a wee bit of patience :)

Loved reading this mate! Resteemed your article for better exposure as well.

1 point though. if you bought at $50 LTC way back and it went to $4 then that's really baaad, but the others like Ripple would've made someone a fortune. Problem is you can't know for sure what will be the next LTC or Ripple so better widen your basket for more chances of winning.

Thank you so much for liking the post and resteeming it! And, TOTALLY, Litecoin at $50 was a crazy buy... and diversifying is the key in this space. Dedicating yourself to a single alt currency can be suicide during times like this.

And you know... looking at what's happened over the past few weeks, I'm sure we have some enthusiastic people who bought under similar enthusiastic conditions this time around too. Stratis was at $11.50! Now we just hit like $3.25... and who knows if it might go lower or rebound back. Very very hard to tell.

Stay safe in this crazy world if that's even doable ;-)

Your welcome mate! Glad to see your enthusiasm. Your articles are well written and you've got serious content here. Would love to read more of these in the next coming days. Tag me on your next post or send me a message so I can upvote and comment and maybe resteem it. Good luck!

Exactly! I hope people understand that fomoing is bad. Find a few picks that you believe in and HODL, Warren Bufett style!

Thanks Buddy for your in depth evaluation.

It is so well drafted that noob like me now has some idea after reading your post.

As always, most welcome trading views with you :) There is so much this space has to offer including exhilaration and absolute fear haha.

What's your stance of the correlation between fiat and cryptocurrencies? Given the current low-interest rate flooding the money market, I would assume some investors would diversify into asset classes such as cryptocurrencies due to spillover effect.

I would really love to hear your views.

There is a lot that could be said here, but I do agree with you that low interest rates will drive investors to seek out other investment vehicles including crypto and metals.

For example, the fact that it is an actual cost to keep money in a traditional savings account in Japan has moved investment into other areas, and it's likely one of the driving factors behind why Bitcoin was legalized there. Japan has been struggling to jump start their economy for far too long and crypto seems to be an area they are placing a bet on to drive it.

Well, the reason why the Japan is struggling to jump start the economy is because the country is suffering from deflation. People are hoarding cash because it makes sense to hoard, the value of your money is growing by hoarding. In an economy that values efficiency more than anything else, the unwilling to spend by the japanese people could be a way to remove "unvaluable" companies that waste resources. Spending for the sake of spending is just wasteful.

I see crypto as an alternative to move away from the systematic problem created by the inefficiency of money.

Right, deflation has been a major cause which has made everything from savings accounts a cost and Japanese Government Bonds nearly valueless.

There is also cultural context to why the Japanese are either willing to pay to have a savings account, maintain cash, or invest in low yielding bonds. There is tremendous risk aversion. One part is due to the post 80's stock market crash in Japan which convinced many that these markets are like casinos and you can only lose. Second many refuse to invest in foreign assets because there is the risk of exchange rates not working out in their favor. Third, Japanese Government Bonds are 'safe'.. again playing on general risk aversion. All of these ideas largely play to the older generation I believe.

Diversification was just not part of their strategy so crypto is a way to reset that mindset. And, I mean if you look at the crypto trading volumes now, Japan makes up a significant percentage. So perhaps that cultural shift is happening and legalizing Bitcoin is only going to help shake up that old school mindset.

So yes it seems Japan is starting to do exactly what you were initially asking about. Diversifying away from just Fiat :)

Sorry if that was a bit lengthy but happy to read your views and discuss more at any time of course :)

Well, I'm happy to discuss at length to learn more and to truly understand the real value of cryptocurrencies. Honestly, I'm more than willing to trade all my fiat for cryptos only if there are wider adoption and demand for them.

Let me try to make sense of your explanation to reevaluate what I've already understood.

I would assume you are talking about the opportunity cost of money. Capital that is not being put to productive use is essentially worthless. And because there's no actual demand for real value added technology in Japan which is why the government bonds are not valuable. The only way the government is supposed to meet the debt obligation is to simply print more money (inflationary) or charge a fee for holding onto money (deflationary). Besides, it cost plastic, ink, machines, and paper to print new money.

I feel that risk aversion is just a small part of the bigger picture. There's just no incentive for the older generation to change. If my fiat is still accepted and is more liquid than Bitcoin, then why should I be motivated to use cryptocurrency?

What you are arguing is a speculator mindset instead of using cryptocurrencies as real money. Cryptocurrencies are inherently valuable as a means of exchange and the value shouldn't be derived from their exchange with fiat. Essentially, if you can continue to buy goods using cryptocurrency without constant fluctuation in the price of goods, you shouldn't really care much about how Bitcoin is trading with Yen, or Bitcoin trading with US dollars.

I agree that the cultural shift is happening because the younger generation has no way to get their hands on fresh money. The old people are hoarding their cash and there are more old people than young people. To store physical cash, you need a vault, which of course is going to cost you some electricity and security guards.

Overall, I would say that cryptocurrencies are more efficient than the traditional fiat currencies. It's the efficiency of money which is why people are gradually moving towards crypto.

I think there's an extremely high probability that we see a few more of these cycle booms, most likely getting more selective with each successive cycle, and with Alts continuing to outperform BTC. Unfortunately, as you say, it's hard to tell when. Cyclically, we should start seeing something happen soon, but whether or not that will be something sustained intermediate term remains to be seen.

Great write-up! Upvoted and will Restream.

That's right. We will see... likely MANY more of these cycles. In 2016 alone we went through three of them with Bitcoin and 1 with Ethereum. Felt like the end of the world honestly, but that's when you reach the bottom of the bubble and realize... actually it's going back up :)

Based on what we're seeing today, the alt coin space has hemorrhaged hard. So many coins dropping to early or even pre May levels. The issue is without some kind of corrective mechanism along the way we're really sitting on top of a cliff without a base to stand on. And that's what seems to have happened here. It's not forever. Let's just hope that the way up again happens sooner than later :) But, even as you said, it remains to be seen when that actually happens.

Thank you for the Upvote and Resteem as well!

Excellent post, thanks very much for sharing your analysis. I think the fork that is supposed to happen later this month will answer many of the questions posed above. The entire market seems to follow BTC, and it could either rise or fall based on the outcome of segwit2x and or BIP148.

Also interesting to note, the bitcoin hash rate has risen 30% as of late. Check out my post below for more info:

https://steemit.com/bitcoin/@chivesz/bitcoin-hash-rate-jumps-30-possible-fork-or-price-break-imminent

Happy to know you liked the analysis. The upcoming fork is certainly on everyone's mind. Likely another reason why the alt coins are even more shaky at this stage even with all of the positive news coming out right now in every other respect (ironically).

Yeah the Hashrate has increased and certainly means we're on the move in some direction. The problem is knowing which!

Thank you very much for this super analysis. I will follow you because I am passionate about crypto and your articles are a gold mine.

I'm really glad this analysis and my earlier ones proved valuable to you. What an awesome compliment :) And absolutely appreciate the follow too! I'll keep trying to churn more out as the inspiration comes

Great analysis. Thanks.

Most welcome!

Excellent post.

One of the best I have read on Steem!

That's a huge compliment. Thank you

That is some great analysis loved the Insights

Thanks!

Thank you very much for this super analysis.

The whole ride is a roller coaster. Looking over your posts I see a detailed history of 2017. Thank you. These are still useful to see where we are today.