This article will teach you:

What OST is as a Company, What OST offers as a Company, How OST Token stands at and operates in the centre of all of this, What benefits there are for businesses using OST and how real world OST use cases take shape with two of OST’s partners.

First and foremost, let’s get one thing explained before we dive in. The core business solution (product) that ost.com revolves around is:

Making it possible and very simple for any company of any size, any form and any area of expertise to make their own custom digital currency in the form of Branded Tokens (more on this later)!

OST the Company

The whole OST organisation is basically made up of two large components:

The OpensST Foundation and OST.com Limited

OpenST Foundation is a non-profit organisation that ran the OST token sale, and looks after the OpenST protocol development, ecosystem, and overall economy developing around $OST. You can learn about the mission of OpenST at https://openst.org

OST.com Limited (formerly called The Simple Token Company) is a for-profit company building software and services on top of OpenST. It's solutions will be launched at https://ost.com

From a governance standpoint:

- Jason Goldberg is one of 5 board members of OpenST Foundation.

- He is the CEO of OST.com Limited.

- He is the only board member of OpenST who works for OST.com Limited. This is by design.

OpenST has contracted with OST.com Limited under a long term agreement to continue development of the OpenST protocol and to build software and solutions on top of OpenST as well as to conduct sales, marketing, PR, and more, to further the goals of OST.

They have monthly board meetings of OpenST and Jason Goldberg reports to the board of OpenST on how they are doing on topics such as product, sales, marketing, as well as token supply/demand.

OST.com Ltd will earn revenues for software sales and usage.

Now that you have an idea of how the organisation is constructed. Let’s look closer at what ost.com offers as a company..

What does OST offer as a Company?

As seen in their most recent roadmap (February 2018 here’s the link: https://goo.gl/Br3Gvo) they have 1 product already out the door and will offer up 4 more products (so far); 3 of which are core business solutions/services:

ostKIT

ostKYC (already released and being used)

ostVIEW

ostWALLET

ostCAMPAIGNS

Long story short: They will allow any company of any size and any area of expertise to make their own custom Digital Currency in the form of Branded Tokens. They aim to do so in such a user friendly way (you have to think in terms of what its like to make a website using Wordpress versus coding one yourself; or using Shopify)) that it will require no in-house blockchain developers from the company that seeks to make their own Branden Tokens (BT’s). They will be able to do so using an easy access and user friendly web interface that lets them create their Branded Tokens and set up the rules for their own token economy as well as monitor that economy.

Well.. what IS needed then?

1: Become a Partner: Partner up with ost.com ; go to their website, visit the partner page and fill in the details in the ‘contact form’ to get in touch.

2: OST Tokens: Buy OST Tokens on one of the exchanges (more on why they are needed later on)

3: Access to ostKIT: As soon as the post-beta release of ostKIT is out (a user friendly web interface/dashboard to create and manage your own Branded Token Economy; again think Wordpress or Shopify) you get access to all the SaaS (Software As A Service) features and off you go!

Apart from that core business solution (which is offered as ostKIT) they also create and keep adding other solutions for businesses (mainstream as well as blockchain orientated ones) like their homegrown blockchain explorer to keep track of the Branded Token transactions (ostVIEW), their consumer-facing wallet for transacting within and across OST-powered Branded Token economies (ostWALLET), tools for running KYC and AML for businesses that want to run an ICO (ostKYC) and solutions for enterprise grade e-mail campaigns (ostCampaigns). The first two are part of the ostKIT ‘package’ and the last two are separately offered up as services. (check out their February 2018 detailed roadmap to read more on this, here’s the link: https://goo.gl/Br3Gvo)

Let’s talk more about their core solution (ostKIT)

ostKIT (the core of ost.com): OST.com, provides a protocol (the OpenST Protocol), platform, api's and solutions for companies to launch their own Branded Tokens powered by OST Token as a master token. Again, all of this is presented in a user friendly web interface/dashboard that companies that seek to tokenise can make use of.

Part of their thesis is that most business will not be DAPPS (Decentralised Applications) but nearly every business could benefit from utilising a digital currency or being part of a digital currency ecosystem.

The closest competitors I've seen to OST are companies trying to get more companies to ICO and launch their own floated publicly tradable tokens on exchanges. That requires each of those companies to have blockchain developers working on their teams and to shift their business focus to supporting their fluctuating token economy. Meanwhile there are fewer than 13k blockchain developers in the world today.

They want to open tokenisation up to any company even without in-house blockchain developers, enable their teams to focus on their core technology and business while they take care of the blockchain infrastructure.

They also don't think it's realistic for 99% of the companies to have their own publicly traded tokens, which is what Waves is doing. Rather, they enable companies to build their tokens based on OST, and have it not on secondary markets.

How does OST Token stand at and operate in the centre of all of this?

From what you may have read, ost.com is centered around 1 core business solution: ostKIT (that runs on OpenST Protocol; currently at version 0.9)

That will allow business to tokenise in a very user friendly way and without the need for hiring any in-house blockchain developers of their own.

Let's focus on how the OST token stands at the centre of ostKIT and what the exact utility of the token is.

As you may have read, OST tokens are needed for companies to easily create their own Branded Tokens (to be named BT’s here after). What is required for a company to do that is:

- Sign up as a partner to ost.com

- A supply of OST Tokens purchased from an exchange

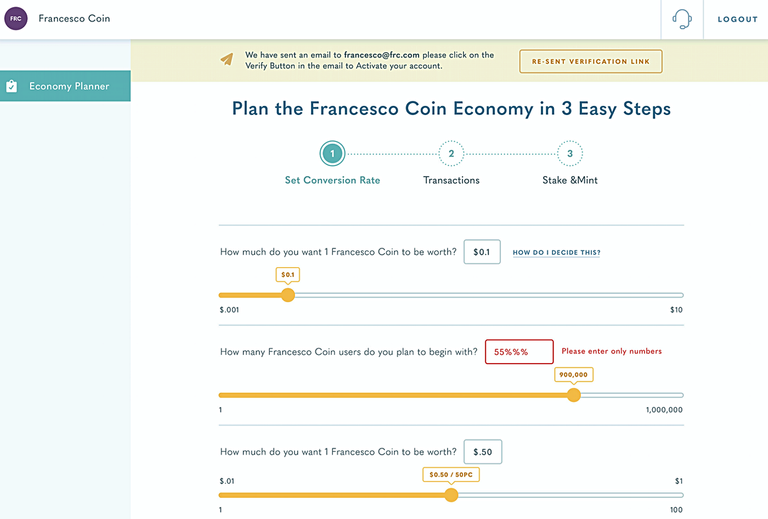

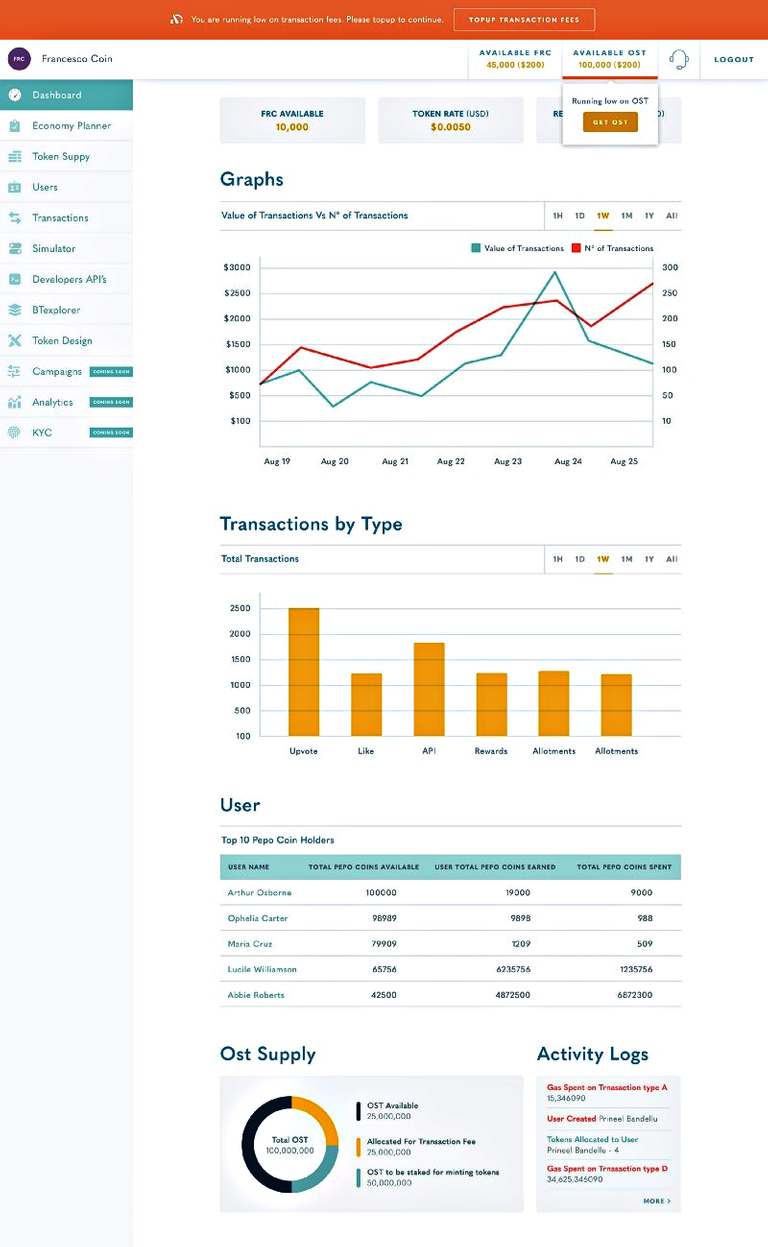

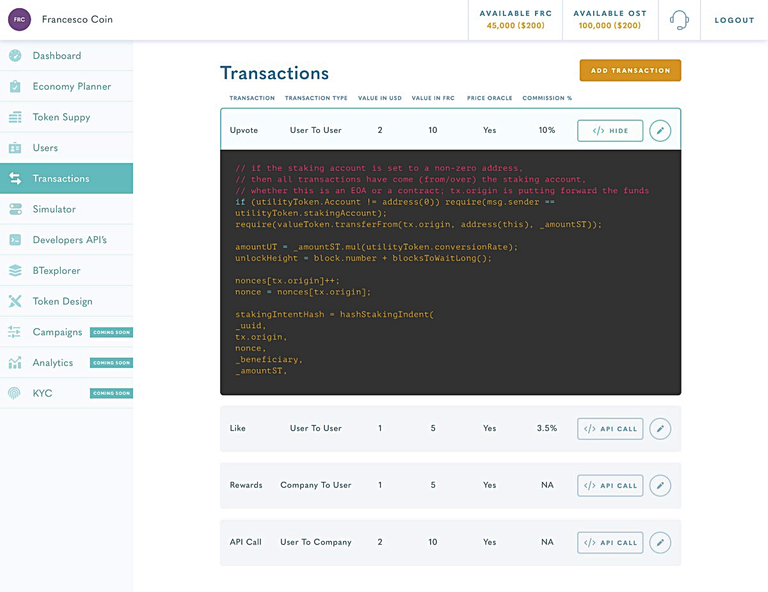

- Access to the ostKIT SaaS (Software As A Service) This is an easy to use web interface (a dashboard if you will) through which the company can arrange everything that is needed to mint their BT’s and set up their own Token Economy. (see the images below to see and example of the web interface and options)

And .. that ..is ALL! That’s right. That is all a company essentially needs to Tokenise through ost.com No in-house Blockchain developers required! You can focus on your business and your product (doing what you’re good at) and they provide the blockchain tech & solutions.

If it sounds like I have mentioned this numerous times now.. I have! And the reason is; I cannot stress enough what kind of easy access and user friendliness they are aiming for here; a simple web interface SaaS to tokenise for any business, any size, any background. Shopify anyone? Wordpress anyone?

As you can see by the pictures above that show examples of the web-interface; key features in ostKIT (alpha versions released early March 2018) include:

- Management Dashboard: Control panel, graphs, trends, monitor your token economy, supply/demand, top users.

- Token Economy Planner: Plan your token economy.

- Setup transaction types for your token: Peer-to-peer, Company-to-customers, Customers-to-Company.

- OST Price Oracle: Enabling transaction values to be set in fiat value, BT to auto-adjust.

- OST Pricer: Enabling companies to collect commissions/revenue for certain transactions.

- User setup, in dashboard and via APIs.

- Airdrop Branded Tokens tokens to selected users.

- Simulate transactions, in dashboard and via APIs.

- Analytics.

- Developer console.

- Developer APIs.

Now.. let’s get down to some of the nitty gritty..

OST Tokens required you say?

OST is an ERC-20 utility token that act as a form of currency within the ostEcosystem. As it stands now, any service offered up separately (separate from ostKIT) like ostKYC or ostCAMPAINGS will have to be paid in OST (not USD).

The crucial role that the OST Token plays in the ostKIT solution (tokenising for businesses) is the following:

OST tokens will be staked by the company that seeks to tokenise in order to mint their branded tokens and represent the value (in USD) of their BT Economy (like how gold used to back the USD)

Now is a good moment to point out the following:

- Staking of OST to back the BT’s is done on the Ethereum Main Net (the value chain) (any staking of OST will remove that OST from the circulating supply)

- Transactions of BT’s from businesses to customers and vice versa however will run across side chains to the Ethereum Main Net (the utility chain)

By having the transaction run through their own side chains instead of on the Ehtereum Main Net ensures that much faster transaction times can be achieved and transactions won’t suffer from any Ethereum network congestions (remember crypto kitties?). Multiple chains will be used to ensure a large scale high volume transaction throughput.

This is one of their key innovations; using open scalable side blockchains (blockchains that run parallel to the main blockchain network). OST tokens are staked on the public Ethereum Network against the Branded Tokens on side-chains.

The OpenST protocol enables the creation of utility tokens on a utility blockchain while the value of those tokens is backed by staked crypto-assets on a value blockchain.

The "side chains" in question are scalable Ethereum-based blockchains with all the benefits of public Ethereum, but without the scaling challenges.

OpenST is also ideally suited for DAPPS as they can run as Ethereum smart contracts, in parallel, with micro-transactions; deal for machine-to-machine, and at high transaction throughput (at least 100 tx/s per side-chain) OpenST can transfer value from Ethereum to and back the side chains (what happens to each OST that backs certain BT’s; how they transact, will be further detailed in OpenST Protocol version 1.0)

The branded tokens powered by OST are technically ERC-20 tokens but they are locked from being traded for anything but OST. So the more demand for BT’s, the more demand for OST. Users of the BT’s always have the right to the underlying OST supporting the BT’s.

Smart Contracts

So OST tokens are staked in order for the company to mint their BT’s. A company before minting their first branded tokens can set the exchange rate of OST to BT at any rate they desire, but once they set it, it is fixed and cannot change. That ensures that companies don't change the rules on their customers.

So, let's say OST is trading at $1, and you set your exchange rate to 1 OST = 1000 BT. Then, each of your BT is initially worth $0.001.

The price of the BT does not fluctuate on its own, as it is not tradable on secondary markets. So, each BT is always worth 1/1000th of and OST.

However, OST does fluctuate and could go to $2 or $10, or $50.

"Wait.. I as a company will want to keep the USD value of my Branded Token at the value I set in the smart contract"

Price Oracles

Although the ratio of OST to BT is set in the smart contract and cannot be changed. There are ways a company can keep the USD value per BT at a fixed rate.

A few factors come into play there.

First, price oracles could be used to set prices within the company's branded token economy so that even if OST goes up and down, the relative price of the good or service in the Token Economy does not change. For instance, let's say in the example above that you allow your users to earn $.01 each time someone likes someone else's product review. By setting the value of the service at $0.01 using the price oracle, it would start off at 10BT per liked review, but would auto-adjust to say 5BT per liked if OST rose to $2.

The other concept that can be deployed is price stabilisation mechanisms. The company could sign up for a 3rd party to provide price stabilisation to insulate its end users from price fluctuations. Imagine for instance if your user above earned 100,000 BT worth $100, and then the next day it was only worth $50 or suddenly was worth $250. The user would either lose faith in the system or could start hoarding or cashing out. With price stabilisation mechanisms, the company could insulate its end users from wild swings in OST price, while the company uses upside for reserves/buffer against downward swings, a swell as the company could retain some profits from OST increases.

Get it? Ok.. one more example..

Say OST trades at $5 a piece and the BurgerMcBurger inc. has set their BT (McBurgerToken) to:

1 OST = 10 McBurgerTokens.

Then 1 McBurgertoken (at the time of minting) would have a USD value of $0.50.

So one day, OST goes through the roof on the open market and is now $50 per OST. 10x!

Luckily BurgerMcBurger inc. has made use of a price oracle that automatically adjusts their BT Economy: Before, a single burger costs 1 McBurgerToken but now it only costs the customers 0.1 McBurgerToken.

In that example, the customer who had 1 McBurgerToken from when 1 OST was still $1,- now has 10x the value in McBurgerTokens. Now is that a problem? For most companies seeking to tokenise there is no way around that in the current market conditions as most tokens are subject to volatility.

But it certainly hasn't stopped the Steemit platform from doing very well. Being a tokenised economy, they have grown fast.

And every BT owner will always have a legal right to the OST that backs it. Branded Tokens will be interchangeable amongst customers (through use of ostWallet) as the underlaying value that is being exchanged is OST. However, BT's will not be tradable on any open exchanges as OST allows companies to easily mint BT's but it's not intended to launch and ICO.

ost.com has stated however that they are building an "ICO-on-ramp" so that BT's could request them to unlock the trading restriction if they want to sell some of their tokens to the public and put a price on them, so in that way they can use OST as an on-ramp to their own ICO: First prove out their token economic model within the safe confines of the OST ecosystem and then potentially spin-out on their own after some time (but now I’m getting a bit ahead of things!)

In general it would be nice to enable end users of BT to participate in at least some of the rewards of OST rising because of the community support for the various BT's, but at same time price stabilisation mechanisms could be used to guard against unintended consequences from wild swings.

Here’s a link to the official document on Stabilising Branded Tokens: https://goo.gl/vTs71j

So is unstaking OST Possible?

Once OST’s are staked against BT, any end user/customer who has earned or purchased or otherwise acquired one of those BT has a legal right to the staked OST against it. Any OST staked that are not backing up any such earned OST, could be unstaked at any time so long as the associated BT were also burned and removed from circulation. But wait, won't that happen automatically in the staking smart contract that holds the staked OST? No, the smart contract holds only staked OST, while BTs are redeemed by minting. In order to unstake OST, a sufficient amount of BTs should be sent to the smart contract to initiate the unstaking.

Benefits for Businesses Using OST

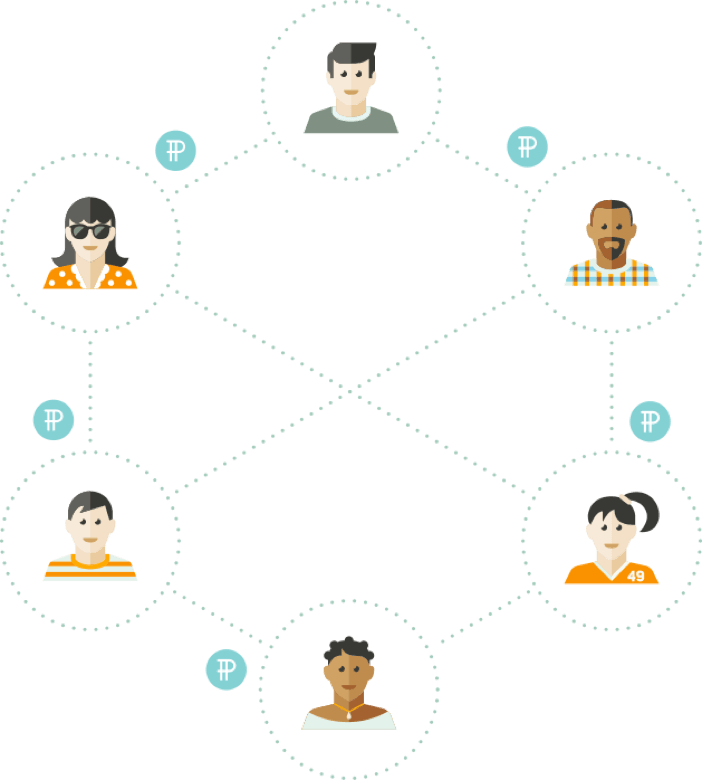

Engagement with Customers: New forms of engagement with customers based on new business models; a simple way for companies, apps and brands to create new forms of engagement and new business models based on reciprocity, exchange, and reward.

Cost Savings: No in-house block chain development team needed (there still are very few across the globe as it stands currently); So no overhead cost's in that respect. Also no costs to ICO (it takes quite a bit of money to run a successful ICO; OST's was around 2 million USD)

ICO Regulations Tightening Up: Many mainstream businesses do not even seek to ICO because having a branded token does not require it. The 'ICO to raise funds' that a lot of companies engage in for their app-level token is flawed. ICO's should be for minting protocol level utility tokens and not for fundraising. Regulations regarding ICO's are already coming along and companies that ICO'd just to fundraise and App Token could be in trouble later down the line.

Easy To Use: Sheer user-friendly ness for mainstream businesses; They make it simple and easy to look like a pro even if you’re just an old school business that is trying to find ways to incorporate token mechanics into your business. So the business can focus what they are good at and OST provides the tech and the support to enable each company to tokenise and support their Branded Token Economy

Affordable: Any company of any size (and budget) can join in due to the “pay as your grow” system; you just start with what you need and, like AWS, as your business is driving more revenue/demand, you use some of that to acquire more OST to mint more BT and put more fuel into your economy. ALSO, select OST partners can also receive OST token grants to help fund their development and incentivise their project teams.

New Economic Models: For many current online website based businesses (Youtube for instance) are based on old ad based models that are based on website traffic. New blockchain based models are based on distributed events; API calls, views, likes, downloads etc. (can you picture Medium building out Medium Claps on OST?!)

Partner Benefits: Early OST partners benefit by providing direct input into their features and roadmap, and helping shape the OST platform to ensure that it meets their unique business needs. Early partners also benefit from OST input on their products, token economics and blockchain technology integration.

Real World Use Cases

Alright, so you know the ins and outs of how tokenisation with OST works. But what about practical examples of it being used? How can a company benefit? For practical use cases, let's look at two companies that recently partnered with OST.

Wooshii

For some of you that may not know Wooshii; it is a platform where clients and freelancers in video production can find eachother and work on and manage a whole video project from start to finish within the Wooshii platform. Corporate clients include; Google, eBay, Virgin, Merck, and British Airways. (here's link:https://wooshii.com/)

Wooshii Tokenisation Practice #1

Because Wooshii is primarily a marketplace for freelancers to compete for work, there is administrative work that is required outside of doing actual video production. There's still a lot of work that goes on behind the scenes. For example, someone might contribute to writing a pitch, but not win the work. They will create there own Branded Tokens; Wooshii Tokens trough OST. Their tokens will allow members of the Wooshii community to gather recognition and rewards, which can then be powerful symbols of endorsement (more so than a mere like as each token has a monetary value).

Wooshii Tokenisation Practice #2

Finally, many video production teams will include members from different countries and the Wooshii Token can be used for quick and cheap cross-country payment processing.

Unsplash

For some of you that may now know Unsplash; it is a platform where anyone can download high quality photos to use for their projects, whether it be private of corporate. Photographers offer their work on there for free and (up till now) their work get's valued in likes and downloads. Which can get them exposure and lead to payed assignments. (here's a link: https://unsplash.com/)

Now, we have to keep in mind that a Token (ERC-20) token is no more than computer code. As it stands now JSON Web Tokens (JWT) or Auth0 Tokens (both computer coded tokens) are used to secure API calls (API = Application Program Interface; a set of procedures, protocols, and tools for building software applications). Think of API calls like this: Every time you make a call to a server in name of an application, it counts as an API request or API call. Logins, saves, queries are examples of operations counted as API requests among other types of operations.

Now.. why am I going on to make API calls clear? Because in the case of Unsplash's Tokenisation, we will see that and ERC-20 Token (like OST) can be used just like those tokens used to make API calls. And that opens up a whole new realm of possibilities. As we know from taking a peek at the ostKIT alpha preview is that developers will have access tot the OST API's to integrate into their apps and/or website. So they'll be able to call the OST API from within their app and/or website.

We know that Unsplash has 5.4 Billion photo views per month and 5 Billion API calls per month.

Now where are getting somewhere!

So old models, ad based models, are based on website traffic.

New models, blockchain models, are based on distributed events. 5.4 billion photo views per month, 5 billion api calls per month. Now... OST has not given out the exact details yet on what will be used or Unsplash, but it is clear now what application and utility OST can serve in the case of Unsplash; Tokenising, not just as a paywall, but per view, per download, per API call (now we're talking, new economic paradigm!)

Demand, demand & demand

I hope that by now it is clear how companies of any size can benefit from using OST and how every solution creates real market demand for the OST Token. But the business making use of OST are not the only ones creating that demand. Oh no! I dare say that even, in time, the ones that will be creating the largest demand will be the consumers using the BT’s.

A successfully run ost.com will mean expansion of the network, meaning ever increasing number of nodes into that network (OST based Apps, DApps and Businesses) until it reaches an exponential growth. The beauty of it for a member company is that, at first they will have to buy OST to be able to issue BT's to their consumers, but as the BT's get more broadly accepted, used and demand grows, the company can stimulate further demand for BT's rather than buy OST and distribute BT's themselves.

And the beauty is, ost.com is doing everything they can to provide that network expansion. Partners keep getting announced each week (23 so far in no more than 8 weeks) and many more are to come from start-ups to full on enterprises. And they have stated that for a long time to come every OST Token that get’s collected as payment for services will be reinvested into the growth of the ecosystem towards thousands of OST use cases and billions of OST powered transactions. OST.com is currently also investing in projects that will help create more utility and demand for OST. Like recently, ost.com had invested in the company Unsplash (link: https://goo.gl/1PZe5z) in 80% $USD cash and 20% OST tokens. They are now a partner of ost.com as well and will provide a large customer base for BT’s.

OST Grants

Now the ost.com is (as mentioned) a for-profit company. The OpenST Foundation is a non-profit organisation that also distributes what is known as ‘OST Network Accelerator Grants’

That goes like this:

27.2% of the total OST supply is being reserved for the OST Accelerator. This was purposefully planned out to provide for a $18M seed program to support promising projects developed on OST.

OST Accelerator grants are intended to support app developers and companies whose contributions benefit the entire OpenST ecosystem. Some examples of the types of OST Accelerator grants they envision could include:

To some of the first Member Companies who wish to launch their own Branded Tokens powered by OST. This could help them fund their development and implementations, incentivise and reward their developers, and provide some warm-up tokens to their users to spur the initial adoption.

To developers working to build on and expand the capabilities of the OpenST protocol.

To developers creating software modules to help companies manage their token economies, such as KYC-as-a-service, analytics, monitoring, notifications, and economy visualisations.

To designers offering proposals for wallet skins, token branding, and other user experience enhancements.

OST Accelerator grants can be provided to companies of all sizes, even startups with just an idea. Grants can be provided to the company, project teams, or directly to individuals in support of their contributions.

The OpenST Foundation will approve OST Accelerator grants on a regular basis. Criteria for issuing grants will be published openly and transparently by the Foundation, as well as the ledger of grant recipients (unless there is some agreed upon confidentiality with the specific project). All OST Accelerator grants will contain long term vesting schedules and conditions appropriate to the specific project.

They also plan to post developer bounties that will be provided through the program, and Member Companies could also propose developer bounties through the same platform in the future.

They currently have a rather sizeable pipeline of OST Accelerator proposals under review from potential Member Companies.

Lastly some numbers

Maximum Supply: 800,000,000 OST

Current Circulating Supply: 272,889,439 OST

Company workers, Founders, Early Backers and VC’s are all on vesting schedules

On that subject, ost.com has stated:

"We will publish the vesting schedules for all key participants, openly and transparently (and in smart contracts). Founders are all on a 3 year linear vesting schedule (1/N per month over the term) from the time they began working on the project, except for CEO Jason Goldberg who is on a 4 year linear vest). Advisors are all on a 2 year linear vesting schedule. Early backers are all on a 2 year linear vesting schedule."

The release of the early investor vesting schedules will be about 1/12 a month. The following breakdown is on the following schedules: 5.61% for early backers, on a 3 year vesting schedules. 10% for advisors, on a minimum 2 year vesting schedules. 10% for the founding team, on a minimum 3 year vesting schedules. Vested grant distributions are released in the first 5 working days of the month. So the slow release of the vest (which is all fixed and conducted by smart contracts so no one can tamper) is why the circulating supply will increase a bit up until about en 2018. By then the staking of OST by companies will reach a point that the circulating supply will be diminished further and further from that point on.

They are very transparent about it and I suggest everyone takes a look at this google doc that they have published about it (they will keep it updated on the regular to reflect more business coming in) Here’s the link: https://goo.gl/wtpwyj

I hope you now have a solid understanding of what ost.com is all about and see the massive potential for huge mainstream adoption in the long term.

If you want to stay updated please consider following me on:

Twitter

DTube

Youtube

SoundCloud

And feel free to stop by the

OSTonians Telegram Channel

Upvoted ☝ Have a great day!

Thanks for your support Mike!