Hi Steemians!

Today I wanted to share 3 promising trades that I will be making in the coming week, in hopes to receive critique/feedback, and that we as a community will make some good money together!

I will go over the analysis on why I think each of these will climb, and lay out my entry/exit prices along the way.

1). XLM / Stellar

Stellar has been front stage in the news lately: CNBC article, Cross-border Payments partnership with IBM, Reddit analysis, etc. In terms of fundamental analysis, Stellar looks great. Quoted from the Reddit, in lay-man's terms:

1) "Speeeeeeed. Extremely fast transactions with the consensus protocol.2) ICO's... This + speed = major threat to Ethereum, as far as ICO's are concerned. Most people don't even know that Stellar will be blooming with ICO's this year, such as Mobius, SureRemit, and KIN [...]3) Inflation. Ripple is deflationary by nature. This explains itself.4) Half the circulating supply of Ripple: ... ripple is currently overvalued, and anyone who doesn't think so is naive. Imagine what Stellar's price would be with the same market cap as Ripple.From an Elliot Wave's/Fibonacci perspective, XLM is looking quite juicy as well. It broke the 50% Fibonacci retracement which indicated a strong buy signal at a greatly discounted price. Additionally, as expert Technical Analyst @haejin has previously posted here, from an Elliot Wave POV, XLM has just finished its Wave 2 correction (amazing buy signal!).

Stellar's breakout (up 30%!) yesterday (1/11) signaled the end of the correction and the beginning of the bullish wave 3. (Pictured Above) [Source]

The breakout of the triangle is a sign of continued climbing of Elliot Wave 3. With @haejin's target price of $2.75 in the long term. In the short term we can expect to see at least a return to previous highs before a knee-jerk correction and then further heights. I entered earlier this week at ~0.000036 BTC and plan to exit half of my position at the previous ATH around ~0.00006BTC in the short term.

Recommended entry: ~0.000048 BTC at your discretion.

Recommended exits: ~0.000059 BTC take profits on half of position for a short term trade; HODL other half until 0.00009 or 0.00011BTC.

2). ICX / Icon

Icon has some big deadlines coming up, especially with Mainnet release set for January 28th (two weeks from now!). Relevant announcement info can be found here. After hitting an ATH at around $12 USD it did a recent ~50% fibonacci correction to ~$9.50 before climbing today back to $10. I am going to make the "Buy the Rumor, Sell the News" play on this. I think ICX has some great fundamentals and hype surrounding it, my only concern with ICX, TRX, and XLM is that they are all pretty high market cap as is-- fortunately the crypto space has lots of room to grow.

ICX's introductional video can be found here: [Youtube]

Recommended entry: ~0.000065 BTC to ~0.000070BTC at your discretion.

Recommended exits: ~0.000085 BTC take profits on two-thirds position "buy the rumor"; HODL other third and see what happens after "the news"

3). TRX / Tron

Tron is a very controversial coin, with some potentially shady fundamentals. I'm sure some of us have heard the "TRON copypasted whitepaper" claims. And personally I feel Justin Sun is hyping/shilling TRON on Twitter in a John McAfee sort of manner, which I don't prefer.

However, TRX has had a pretty major correction since its climb to spotlight (Top 5 Marketcap at one point!). It matches nicely with the 50% Fibonacci Retracement and has been trading extremely flat at 0.000008 BTC as of late. I think this provides a nice opportunity to do a quick +20% bounce-back trade, or for those who like higher risk, holding according to the Elliot Wave numbers.

Here we see TRX's spread thinning as it finds it's bottom. Will likely spike up/bounce back once the bears have finished their lunch. Personally I will only be doing a quick flip trade on TRX, because I am worried about the fundamentals and media house-of-cards collapsing.

Recommended entry: ~0.00000795 BTC at your discretion.

Recommended exit: ~0.0000092 BTC take some profits. Exit completely at ~0.000011

Bonus Trade). BTS / Bitshares

BTS has been looking quite excellent as well, and I have entered a small position at 0.0000435 BTC. Similar to XLM it has just about finished its Fibonacci Retracement and will likely climb to a new all time high.

Revelant reads: "BitShares (BTS): Pattern and Elliott Wave Analysis" by @haejin, and "Bitshares Price Forecast" by @bitgeek

These are my plays for the coming weekend/week! Thanks for taking the time to read this, and I hope we may prosper in our collective gains.

Disclaimer: These are my opinions and should not be taken without proper analysis and weighing of cost-benefit. I void all responsibility for any loss or gain that may result from following my writings, although I will be executing according to what I have written. Best of luck to us all.

Thank you for the informative and well-structured article! I guess that will start pumping soon and it will negatively affect the altcoin prices. Do you consider the BTCUSD movements in your analysis?

Thanks for the reply! That is definitely a very valid concern. I have personally noted that BTCUSD may have double bottomed, and may make a steep recovery, but it is a little early to tell.

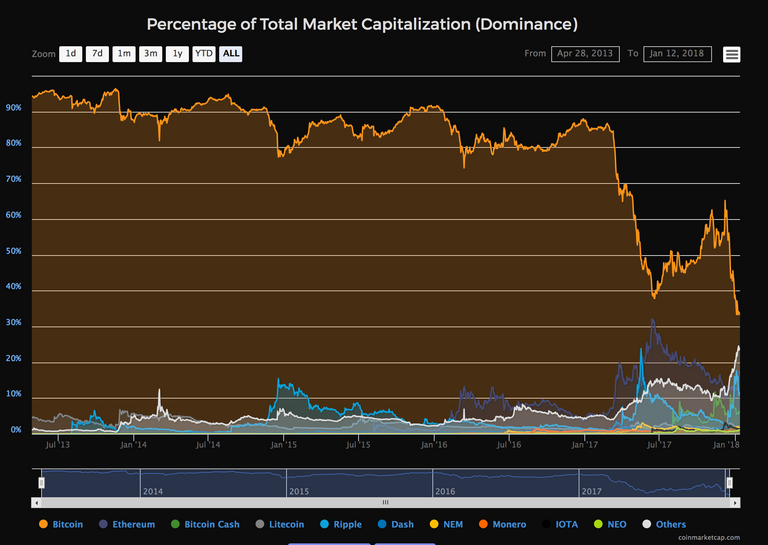

BTC dominance is also at an all time low, pictured here:

Thus one may surmise that a correction/return to BTC's strength may be due. In these senses I totally agree with your concern.

My thoughts is that the three coins listed above are strong enough that they will withstand or keep pace with the growth of BTC, if indeed BTC has double bottomed. Then the gains will be nullified but the losses will be as well. If everything works out perfectly (which it never does!) I hope to complete these swing trades before BTC's prospective run-up closer to the end of the month.

As always, it is a good idea to hold ~20-30% BTC and ~15% Fiat to balance out one's altcoin portfolio, and make discounted purchases during corrections.

I think it is always a good decision to hold some BTC in your portfolio. I'm a believer of alts, but if BTC has a bull run alts will likely lose out.

!originalworks

The @OriginalWorks bot has determined this post by @goingmerry to be original material and upvoted it!

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!