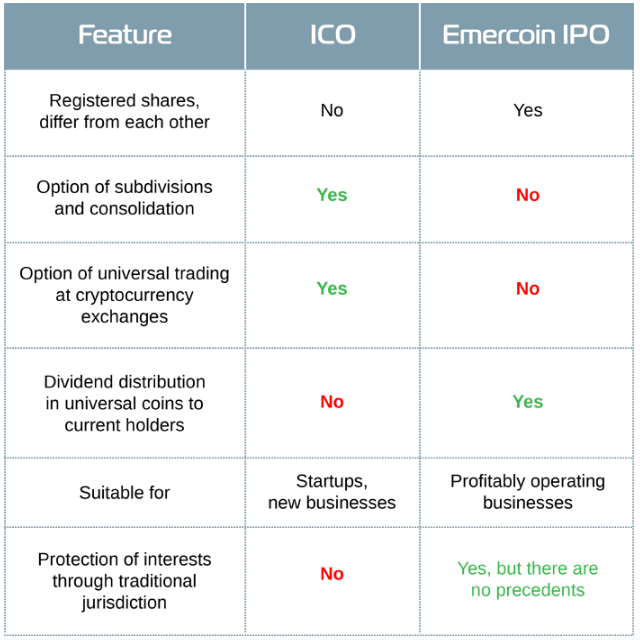

While an IPO is entirely different from an ICO, these two have some similarities on paper.

Let's examine the differences between them.

We'll discuss how they work and how each one gets started. Is one better or more effective than the other? - Let's find out.

What is an IPO?

Initial public offerings have been there before ICO's and cryptocurrencies in general. They allow new or expanding companies to raise funds by offering stocks (parts of the company) to the public. They are a bit similar to ICOs in this perspective, but that everthing else is not the same. Both new and established companies usually initiate an IPO at the time when they can create many interesting opportunities for all involved parties. Underwriting firms help them decide which type of security to issue as well as the best price to offer initially.

However, In an ICO, companies just sell as many tokens as they like for the best price they think is possible. The only objective is usually just to raise a lot of money. Most expenses can’t be justified immediately. The decision can be made within minutes, but setting up an IPO requires a lot more work. - Paperwork with some legal red tape involved. They need to follow a set of very specific steps, including establishing an external IPO team. Companies must also have a detailed financial report before even planning its IPO listing.

Companies without a proven track record can't possibly host an IPO, which is why they often choose to have an ICO. Also, companies starting an IPO must file the appropriate financial reports for the right independent audit and submit a prospectus to the SEC. This doesn’t make an IPO any less risk of an investment compared to an ICO, though. Nonetheless, it is evident that IPOs are much more “legitimate” than ICOs because of the lack of regulation and requirements for ICOs. In addition, there are far fewer IPOs compared to ICOs, and having so many initial coin offerings doesn't necessarily make them better either. Indeed, an ICO is very different from an IPO in many ways.

More About ICOs

Initial Coin Offer (ICO) is a term that has gained popularity in the last few months. It's highly associated with the cryptocurrency environment. It is used to refer to a process of raising funds for a particular project. Instead of traditional shares, the investors get coins for their investments (a kind of electronic token (through blockchain technology), confirming the investor’s part in the project and determines the investor’s share in the project's profit. Simply put, each kind of coin is issued for each corresponding Project. Coins, just like stocks have value only within the scope of a certain project. So, coins for a particular project do not affect the value of coins for another.

What are the useful features of ICOs?

ICO coins may be bought in portions. They can be consolidated or subdivided like established cryptocurrency coins. ICO coins offer the same anonymity as other cryptocurrencies and can be sold or bought at exchanges that naturally trade them.

Despite all the attractiveness of ICO, it has a considerable disadvantage though. ICOs are good for fund-raising and for project launches, but has no program/system for distributing the profits from the project’s business operations among the shareholders (no dividend distribution). This is at least not found in the white papers or ads they produce.

For some, it's scary because it appears that ICO proponents plan only to set up the stage to make money. After you have bought tokens, good luck to you! Your part is done. We have gathered money, much more than what was spent in advertising, and now we can go on vacation!

ICOs are conducted in a variety of different ways: some coins run on them for a certain length of time, some run them until they have raised a certain amount. The question is: "How can you tell which ICOs are not scams?" - Looking Back

Of course, there are really successful ICOs and not all of them are fraudsters. The only thing is that it's a venture-type project where everyone hopes it will take off, but there's no guarantee.

Often you send Bitcoin or Ethereum in exchange for these tokens, which means you are exchanging a solid coin for a token that may eventually lose value. Looking Back

When the company buys the coins back, there's usually a peak in price and speculators who manage to sell the tokens at the right time earn a lot. For real investors who will hold on to them, they might have a slimmer chance of success depending on the outcome of the project.

Conclusion

IPOs are rare compared to ICOs. IPOs may be perceived as safer due to strict government requirements, but that's not always the case. It seems easier for fraudsters to launch ICOs than IPOs. After all, they can't be interchangeably used and offer different ways of earning to investors. One can hardly ever be an expert on both.

With that being said, it’s very important to check that there is real value behind all of the hype. There should be, at the very least, an equal amount of energy put into the product as there is being put into the ICO project. Find a compromise: a large enough support base from people, to get the coin moving after the ICO is over, but realism and hard work behind all the shiny ads. Looking Back

Please upvote, resteem and follow me, thank you.

Great for sharing to steemians @hiroyamagishi

It's a pleasure. Thanks for reading!

Well, if I can summarize :

IPO = Past

ICO = Present & future

Nice one! I'm hoping to see a balance between freedom and regulation and ICOs will be better recognized by governments and trusted by more investors.

Great compering post. I like your activities. Thanks for sharing such a good post.

Thank you!

amazing post..thanks for sharing this post...

Are most ICOs basically ideas to invest in? Do they have plans for actual revenue?

Some ICOs are just experiments and are risky to invest in. That's why we need to research the project and the team responsible for each ICO before jumping in.

Wait. How do you buy into an ICO ?

That's one question I'm unable to find an answer to

Most companies have their own trading sites and they also partner with trading platforms.

Good post, Thanks for sharing. Very informative @hiroyamagishi.

Thanks too for reading.

You got a 11.39% upvote from @postpromoter courtesy of @hiroyamagishi!

Sneaky Ninja Attack! You have been defended with a 18.59% vote... I was summoned by @hiroyamagishi! I have done their bidding and now I will vanish...Whoosh

This post has received a 10.44 % upvote from @upmyvote thanks to: @hiroyamagishi. Send at least 1 SBD to @upmyvote with a post link in the memo field to promote a post! Sorry, we can't upvote comments.

You got a 8.22% upvote from @upme requested by: @hiroyamagishi.

Send at least 1.5 SBD to @upme with a post link in the memo field to receive upvote next round.

To support our activity, please vote for my master @suggeelson, as a STEEM Witness

This post has received gratitude of 4.69 % from @appreciator thanks to: @hiroyamagishi.

This post has received a 20.45 % upvote from @aksdwi thanks to: @hiroyamagishi.

This post has received a 7.91 % upvote from @buildawhale thanks to: @hiroyamagishi. Send at least 1 SBD to @buildawhale with a post link in the memo field for a portion of the next vote.

To support our daily curation initiative, please vote on my owner, @themarkymark, as a Steem Witness