A cryptocurrency (or crypto currency) is a digital asset designed to work as a medium of exchange using cryptography to secure the transactions and to control the creation of additional units of the currency.[1] Cryptocurrencies are a subset of alternative currencies, or specifically of digital currencies.

Bitcoin became the first decentralized cryptocurrency in 2009.[2] Since then, numerous cryptocurrencies have been created.[3] These are frequently called altcoins, as a blend of bitcoin alternative.[4][5] Bitcoin and its derivatives use decentralized control[6] as opposed to centralized electronic money/centralized banking systems.[7] The decentralized control is related to the use of bitcoin's blockchain transaction database in the role of a distributed ledger.[8]

Contents [hide]

1 Overview

2 History

2.1 Publicity

3 Legality

3.1 Concerns of an unregulated global economy

3.2 Arrests

3.3 Fraud

3.4 Darknet markets

4 Timestamping

4.1 Proof-of-work schemes

4.2 Proof-of-stake and combined schemes

5 Economics

5.1 Competition in cryptocurrency markets

5.2 Indices

5.2.1 Crypto index CRIX

6 List

7 Academic studies

7.1 Journals

8 Criticism

9 See also

10 References

11 Further reading

12 External links

Overview[edit]

Decentralized cryptocurrency is produced by the entire cryptocurrency system collectively, at a rate which is defined when the system is created and which is publicly known. In centralized banking and economic systems such as the Federal Reserve System, corporate boards or governments control the supply of currency by printing units of fiat money or demanding additions to digital banking ledgers. In case of decentralized cryptocurrency, companies or governments cannot produce new units, and have not so far provided backing for other firms, banks or corporate entities which hold asset value measured in it. The underlying technical system upon which decentralized cryptocurrencies are based was created by the group or individual known as Satoshi Nakamoto.[9]

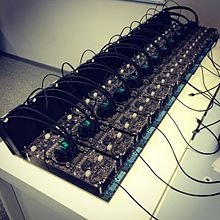

As of March 2015, hundreds of cryptocurrency specifications exist; most are similar to and derived from the first fully implemented decentralized cryptocurrency, bitcoin.[10][11] Within cryptocurrency systems the safety, integrity and balance of ledgers is maintained by a community of mutually distrustful parties referred to as miners: members of the general public using their computers to help validate and timestamp transactions adding them to the ledger in accordance with a particular timestamping scheme.[12]

The security of cryptocurrency ledgers is based on the assumption that the majority of miners are honestly trying to maintain the ledger, having financial incentive to do so.

Most cryptocurrencies are designed to gradually decrease production of currency, placing an ultimate cap on the total amount of currency that will ever be in circulation, mimicking precious metals.[1][13] Compared with ordinary currencies held by financial institutions or kept as cash on hand, cryptocurrencies are less susceptible to seizure by law enforcement.[1][14][not in citation given] Existing cryptocurrencies are all pseudo-anonymous, though additions such as Zerocoin and its distributed laundry[15] feature have been suggested, which would allow for true anonymity.[16][17][18]

History[edit]

In 1998, Wei Dai published a description of "b-money", an anonymous, distributed electronic cash system.[19] Shortly thereafter, Nick Szabo created "Bit Gold".[20] Like bitcoin and other cryptocurrencies that would follow it, Bit Gold was an electronic currency system which required users to complete a proof of work function with solutions being cryptographically put together and published. A currency system based on a reusable proof of work was later created by Hal Finney who followed the work of Dai and Szabo.

The first decentralized cryptocurrency, bitcoin, was created in 2009 by pseudonymous developer Satoshi Nakamoto. It used SHA-256, a cryptographic hash function, as its proof-of-work scheme.[12][21] In April 2011, Namecoin was created as an attempt at forming a decentralized DNS, which would make internet censorship very difficult. Soon after, in October 2011, Litecoin was released. It was the first successful cryptocurrency to use scrypt as its hash function instead of SHA-256. Another notable cryptocurrency, Peercoin was the first to use a proof-of-work/proof-of-stake hybrid.[22] IOTA was the first cryptocurrency not based on a block chain, and instead uses the Tangle.[23][24] Many other cryptocurrencies have been created though few have been successful, as they have brought little in the way of technical innovation.[25] On 6 August 2014, the UK announced its Treasury had been commissioned to do a study of cryptocurrencies, and what role, if any, they can play in the UK economy. The study was also to report on whether regulation should be considered.[26]

Publicity[edit]

Bitcoin ATM

Central bank representatives have stated that the adoption of cryptocurrencies such as bitcoin pose a significant challenge to central banks' ability to influence the price of credit for the whole economy.[27] They have also stated that as trade using cryptocurrencies becomes more popular, there is bound to be a loss of consumer confidence in fiat currencies.[28] Gareth Murphy, a senior central banking officer has stated "widespread use [of cryptocurrency] would also make it more difficult for statistical agencies to gather data on economic activity, which are used by governments to steer the economy". He cautioned that virtual currencies pose a new challenge to central banks' control over the important functions of monetary and exchange rate policy.[29]

Jordan Kelley, founder of Robocoin, launched the first bitcoin ATM in the United States on February 20, 2014. The kiosk installed in Austin, Texas is similar to bank ATMs but has scanners to read government-issued identification such as a driver's license or a passport to confirm users' identities.[30] By May 2017 1189 bitcoin ATMs were installed around the world with an average fee of 8.82%. An average of 3 bitcoin ATMs were being installed per day in May 2017.[31]

The Dogecoin Foundation, a charitable organization centered around Dogecoin and co-founded by Dogecoin co-creator Jackson Palmer, donated more than $30,000 worth of Dogecoin to help fund the Jamaican bobsled team's trip to the 2014 Olympic games in Sochi, Russia.[32] The growing community around Dogecoin is looking to cement its charitable credentials by raising funds to sponsor service dogs for children with special needs.[33]

Legality[edit]

The legal status of cryptocurrencies varies substantially from country to country and is still undefined or changing in many of them. While some countries have explicitly allowed their use and trade, others have banned or restricted it. Likewise, various government agencies, departments, and courts have classified bitcoins differently. China Central Bank banned the handling of bitcoins by financial institutions in China during an extremely fast adoption period in early 2014.[34] In Russia, though cryptocurrencies are legal, it is illegal to actually purchase goods with any currency other than the Russian ruble.[35]

On March 25, 2014, the United States Internal Revenue Service (IRS) ruled that bitcoin will be treated as property for tax purposes as opposed to currency. This means bitcoin will be subject to capital gains tax. One benefit of this ruling is that it clarifies the legality of bitcoin. No longer do investors need to worry that investments in or profit made from bitcoins are illegal or how to report them to the IRS.[36] In a paper published by researchers from Oxford and Warwick it was shown that bitcoin has some characteristics similar to the precious metals market more than to traditional currencies, hence in agreement to the IRS decision even if based on different reasons.[37]

Legal issues not dealing with governments have also arisen for cryptocurrencies. Coinye, for example, is an altcoin that used rapper Kanye West as its logo without permission. Upon hearing of the release of Coinye, originally called Coinye West, attorneys for Kanye West sent a cease and desist letter to the email operator of Coinye, David P. McEnery Jr. The letter stated that Coinye was willful trademark infringement, unfair competition, cyberpiracy, and dilution and instructed Coinye to stop using the likeness and name of Kanye West.[38]

Concerns of an unregulated global economy[edit]

As the popularity of and demand for online currencies increases since the inception of bitcoin in 2009,[39][40] so do concerns that such an unregulated person to person global economy that cryptocurrencies offer may become a threat to society. Concerns abound that altcoins may become tools for anonymous web criminals.[41]

Cryptocurrency networks display a marked lack of regulation that attracts many users who seek decentralized exchange and use of currency, however these very same lack of regulations have been critiqued as potentially enabling criminals who seek to evade taxes and launder money.

Transactions that occur through the use and exchange of these altcoins are independent from formal banking systems, and therefore can make tax evasion simpler for individuals. Since charting taxable income is based upon what a recipient reports to the revenue service, it becomes extremely difficult to account for transactions made using existing cryptocurrencies, a mode of exchange that is complex (and in some cases impossible) to track.[41]

Systems of anonymity that most cryptocurrencies offer can also serve as a simpler means to launder money. Rather than laundering money through an intricate net of financial actors and offshore bank accounts, laundering money through altcoins stands outside institutions and can be achieved through anonymous transactions.[41] Laundering services for cryptocurrency exist to service the bitcoin currency, in which multiple sourced bitcoins are blended to obscure the relationship between input and output addresses.[41]

Arrests[edit]

There have been arrests in the United States related to cryptocurrency. A notable case was the arrest of Charlie Shrem, the CEO of BitInstant.[42][43]

Fraud[edit]

On August 6, 2013, Magistrate Judge Amos Mazzant of the Eastern District of Texas federal court ruled that because cryptocurrency (expressly bitcoin) can be used as money (it can be used to purchase goods and services, pay for individual living expenses, and exchanged for conventional currencies), it is a currency or form of money. This ruling allowed for the SEC to have jurisdiction over cases of securities fraud involving cryptocurrency.[44]

GBL, a Chinese bitcoin trading platform, suddenly shut down on October 26, 2013. Subscribers, unable to log in, lost up to $5 million worth of bitcoin.[45][46]

In February 2014, cryptocurrency made national headlines due to the world's largest bitcoin exchange, Mt. Gox, declaring bankruptcy. The company stated that it had lost nearly $473 million of their customer's bitcoins likely due to theft. This was equivalent to approximately 750,000 bitcoins, or about 7% of all the bitcoins in existence. Due to this crisis, among other news, the price of a bitcoin fell from a high of about $1,160 in December to under $400 in February.[47]

On March 31, 2015, two now-former agents from the Drug Enforcement Administration and the U.S. Secret Service were charged with wire fraud, money laundering and other offenses for allegedly stealing bitcoin during the federal investigation of Silk Road, an underground illicit black market federal prosecutors shut down in 2013.[48]

On December 1, 2015, the owner of the now-defunct GAW Miners website was accused of securities fraud following his development of the cryptocurrency known as Paycoin. He is accused of masterminding an elaborate ponzi scheme under the guise of "cloud mining" with mining equipment hosted in a data center. He purported the cloud miners known as "hashlets" to be mining cryptocurrency within the Zenportal "cloud" when in fact there were no miners actively mining cryptocurrency. Zenportal had over 10,000 users that had purchased hashlets for a total of over 19 million U.S. dollars.[49][50]

On August 24, 2016, a federal judge in Florida certified a class action lawsuit[51] against defunct cryptocurrency exchange Cryptsy and Cryptsy's owner. He is accused of misappropriating millions of dollars of user deposits, destroying evidence, and is believed to have fled to China.[52]

Darknet markets[edit]

Main article: Darknet market

Cryptocurrency is also used in controversial settings in the form of online black markets, such as Silk Road. The original Silk Road was shut down in October 2013 and there have been two more versions in use since then; the current version being Silk Road 3.0. The successful format of Silk Road has been widely used in online dark markets, which has led to a subsequent decentralization of the online dark market. In the year following the initial shutdown of Silk Road, the number of prominent dark markets increased from four to twelve, while the amount of drug listings increased from 18,000 to 32,000.[41]

Darknet markets present growing challenges in regard to legality. Bitcoins and other forms of cryptocurrency used in dark markets are not clearly or legally classified in almost all parts of the world. In the U.S., bitcoins are labelled as "virtual assets". This type of ambiguous classification puts mounting pressure on law enforcement agencies around the world to adapt to the shifting drug trade of dark markets.[53]

Since most darknet markets run through Tor, they can be found with relative ease on public domains. This means that their addresses can be found, as well as customer reviews and open forums pertaining to the drugs being sold on the market, all without incriminating any form of user.[41] This kind of anonymity enables users on both sides of dark markets to escape the reaches of law enforcement. The result is that law enforcement adheres to a campaign of singling out individual markets and drug dealers to cut down supply. However, dealers and suppliers are able to stay one step ahead of law enforcement, who cannot keep up with the rapidly expanding and anonymous marketplaces of dark markets.[53]

Timestamping[edit]

Cryptocurrencies use various timestamping schemes to avoid the need for a trusted third party to timestamp transactions added to the blockchain ledger.

Proof-of-work schemes[edit]

The first timestamping scheme invented was the proof-of-work scheme. The most widely used proof-of-work schemes are based on SHA-256, which was introduced by bitcoin, and scrypt, which is used by currencies such as Litecoin.[22] The latter now dominates over the world of cryptocurrencies, with at least 480 confirmed implementations.[54]

Some other hashing algorithms that are used for proof-of-work include CryptoNight, Blake, SHA-3, and X11.

Proof-of-stake and combined schemes[edit]

Some cryptocurrencies use a combined proof-of-work/proof-of-stake scheme.[22][55] The proof-of-stake is a method of securing a cryptocurrency network and achieving distributed consensus through requesting users to show ownership of a certain amount of currency. It is different from proof-of-work systems that run difficult hashing algorithms to validate electronic transactions. The scheme is largely dependent on the coin, and there's currently no standard form of it.

Economics[edit]

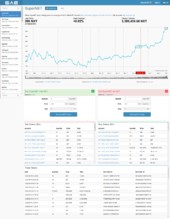

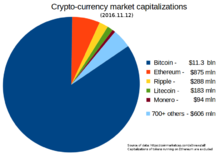

Crypto-currency market capitalizations as of 12 November 2016

Crypto-currency market capitalizations as of 29 June 2017

Cryptocurrencies are used primarily outside existing banking and governmental institutions, and exchanged over the Internet. While these alternative, decentralized modes of exchange are in the early stages of development, they have the unique potential to challenge existing systems of currency and payments. As of June 2017 total market capitalization of cryptocurrencies is bigger than 100 billion USD and record high daily volume is larger than 6 billion USD.[56]

Competition in cryptocurrency markets[edit]

As of July 2016, there were over 700[57] digital currencies in existence. Entry into the marketplace is undertaken by so many due to the low cost of entry and opportunity for profit making through the creation of coins.[citation needed]

Network effects play an important role in analyzing the development of cryptocurrency markets. Since any given currency gains use value as the number of its users increase, popularity of a certain currency is integral in that currency's success. Economists postulate that large competitors (such as the most popular cryptocurrency: bitcoin) will attract more new users due to the size of their growing exchange pools and as a result will effectively dominate the market.[citation needed]

Indices[edit]

In order to follow the development of the market of cryptocurrencies, indices keep track of notable cryptocurrencies and their cumulative market value.

Crypto index CRIX[edit]

The cryptocurrency index CRIX is a conceptual measurement jointly developed by statisticians at Humboldt University of Berlin, Singapore Management University and the enterprise CoinGecko and was launched in 2016.[58] The index represents cryptocurrency market characteristics dating back until July 31, 2014.[59][60] Its algorithm takes into account that the cryptocurrency market is frequently changing, with the continuous creation of new cryptocurrencies and infrequent trading of some of the existing ones.[61][62] Therefore, the number of index members is adjusted quarterly according to their relevance on the cryptocurrency market as a whole.[59] It is the first dynamic index reflecting changes on the cryptocurrency market.[citation needed]

List[edit]

Main article: List of cryptocurrencies

Academic studies[edit]

Journals[edit]

Main article: Ledger (journal)

In September 2015, the establishment of the peer-reviewed academic journal Ledger (ISSN 2379-5980) was announced. It will cover studies of cryptocurrencies and related technologies, and is published by the University of Pittsburgh.[63][64] The journal encourages authors to digitally sign a file hash of submitted papers, which will then be timestamped into the bitcoin blockchain. Authors are also asked to include a personal bitcoin address in the first page of their papers.[65][66]

Criticism[edit]

This section is in a list format that may be better presented using prose. You can help by converting this section to prose, if appropriate. Editing help is available. (September 2016)

In 2013, journalists Joshua Brustein and Timothy Lee expressed concern that bitcoin is problematic due to its high volatility.[67]

In December 2013, Jason O'Grady reported on various pump and dump schemes in altcoins distinct from bitcoin and Litecoin.[68]

Community refers to premining, hidden launches, or extreme rewards for the altcoin founders as a deceptive practice,[69] but it can also be used as an inherent part of a digital cryptocurrency's design, as in the case of Ripple.[70] Pre-mining means currency is generated by the currency's founders prior to mining code being released to the public.[71]

Most cryptocurrencies are duplicates of existing cryptocurrencies with minor changes and no novel technical developments. One such, Coinye West, a comedy cryptocurrency alluding to the rapper Kanye West, was served a cease-and-desist letter on 7 January 2014, for using West's name and implying a connection that did not exist.[72]

Banks generally do not offer services for cryptocurrencies and sometimes refuse to offer services to virtual-currency companies.[73]

There are ways to permanently lose cryptocurrency from local storage due to malware or data loss. This can also happen through the destruction of the physical media, effectively removing lost cryptocurrencies forever from their markets.[74]

There are many perceived criteria that cryptocurrencies must reach before they can become mainstream. For example, the number of merchants accepting cryptocurrencies is increasing, but still only a few merchants accept them.[75]

With technological advancement in cryptocurrencies such as bitcoin, the cost of entry for miners requiring specialized hardware and software is high.[76]

Cryptocurrency transactions are normally irreversible after a number of blocks confirm the transaction. One of the features cryptocurrency lacks in comparison to credit cards is consumer protection against fraud, such as chargebacks.[12] This is, however, a non-issue because third-party multisignature-based escrow can be used to mediate a transaction, this is effectively equivalent to enabling chargebacks. This is also much easier than performing an irreversible transaction using a system with native chargebacks, so this aspect is actually an advantage.

Some coins may be a project with little to no community backing and no visible developer.[77]

While cryptocurrencies are digital currencies that are managed through advanced encryption techniques, many governments have taken a cautious approach toward them, fearing their lack of central control and the effects they could have on financial security.[78]

Environmentally conscious people are concerned with the enormous amount of energy that goes into cryptocurrency mining with little to show in return, but it is important to compare it to the consumption of the legacy financial system.[79]

Traditional financial products have strong consumer protections. However, if bitcoins are lost or stolen, there is no intermediary with the power to limit consumer losses.[80]

Regulators in several countries have warned against their use and some have taken concrete regulatory measures to dissuade users.[81]

The success of some cryptocurrencies has caused multi-level marketing schemes to arise with pseudo cryptocurrencies, such as Onecoin.[82]

Not indicating that the content you copy/paste is not your original work could be seen as plagiarism.

Some tips to share content and add value:

Repeated plagiarized posts are considered spam. Spam is discouraged by the community, and may result in action from the cheetah bot.

Creative Commons: If you are posting content under a Creative Commons license, please attribute and link according to the specific license. If you are posting content under CC0 or Public Domain please consider noting that at the end of your post.

If you are actually the original author, please do reply to let us know!

Thank You!

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://en.wikipedia.org/wiki/Cryptocurrency

Congratulations @jalalkhan! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPgood text I followed you, please follow me back

Congratulations @jalalkhan! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard!

Participate in the SteemitBoard World Cup Contest!

Collect World Cup badges and win free SBD

Support the Gold Sponsors of the contest: @good-karma and @lukestokes

Congratulations @jalalkhan! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!