Bloodbath In Crypto Markets and Bitcoin Price on Fears of Government Crackdown

There is a bloodbath in cryptocurrency markets on fears of a crackdown by governments across the world. Apart from Tether (which has parity with the U.S. dollar), all other cryptocurrencies were in the red and had shed values in double-digits. At 14:19 UTC, the overall market valuation for cryptocurrencies tumbled to $566.2 billion, down by 20% from its value 24 hours ago.

At one point last morning, it crashed to $536.5 billion, down by 30% from its price 24 hours earlier. The price of a single bitcoin was $11,825.70, a decline of 17.27% from its price 24 hours ago.

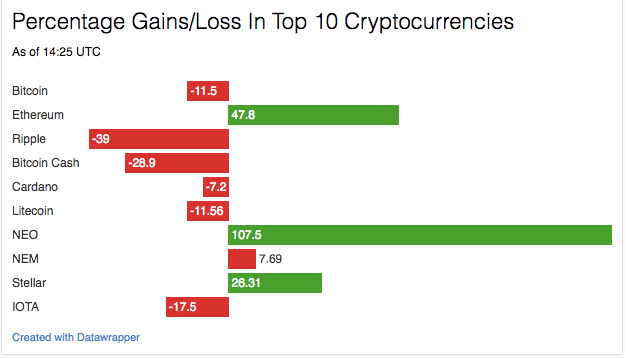

Stellar and Ripple were the biggest losers among the top 10 most-traded cryptocurrencies, as of this writing, down by 26.19% and 25.18%, respectively. The overall declines are not uniform as the chart below shows. Even with today's declines, three cryptocurrencies are still trading positive to their valuations last year.

Government Crackdown Spurs Declines

The prospect of a crackdown by governments in China and South Korea, among the largest trading venues for cryptocurrencies, is being cited as the primary reason for declines in prices. South Korea had threatened to ban cryptocurrency trading last year but backtracked from its stance on Sunday. Yesterday was another story, however. In a radio interview, the South Korean finance minister said shutting down cryptocurrency exchanges was still an option but that it needed “serious discussion” first.

After banning cryptocurrency exchanges in 2017, China is cracking down on other venues for trading of digital currencies. A Bloomberg report quotes unnamed sources as saying “the government plans to block domestic access to homegrown and offshore platforms that enable centralized trading.” But the report does not provide a proper definition or provide examples of such platforms.

South Korea is the world’s third-largest trading venue for cryptocurrencies after Japan and the United States. Ripple and Ethereum, the world’s second and third most-traded cryptocurrencies, owe recent spikes in their prices to trading on Bithumb, South Korea’s largest exchange.

Kerrie Walsh, assistant economist at Capital Economics, told the Wall Street Journal that moves by the governments had “clearly rattled” investors. “The more widespread Bitcoin becomes, the more likely it is that stricter regulations will be enforced,” she said.

Bitcoin Price Manipulation Flashback

Even as bitcoin’s price crashes today, perspective is necessary.

A new paper in the Journal of Monetary Economics sheds light on how two bots, run by a single person, pumped up bitcoin’s price from $150 to $1,000 in two months on Mt. Gox, an exchange that crashed back in 2013.

According to the paper, approximately 600,00 bitcoins valued at $188 million were “fraudulently acquired.” Its authors found that trading volumes spiked when Markus and Willy, the two bots, were in the game. The spike brought in other, human investors resulting in a virtuous cycle that drove up prices through artificial demand. The exchange profited by pocketing the transaction fees. Not surprisingly, the paper’s authors claim that thin markets (or markets without enough liquidity) made manipulation easy.

A similar situation exists today. There are 1,385 cryptocurrencies in the market today, and trading volumes, even for the largest cryptocurrencies, are susceptible to sharp spikes and dips. While multiple reasons are put forward as explanations for cryptocurrency price movement, none of the reasons is plausibly consistent. Bitcoin whales and automated bots are still in the game. (See also: Bot Activity Plays A Major Role In Cryptocurrency Price Swings.) More investors, especially institutional ones, will bring liquidity to bitcoin markets and stabilize its price. Increased government regulation should also help tamp down the effect of automated trading on bitcoin’s price.

Investing in cryptocurrencies and other Initial Coin Offerings ("ICOs") is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or other ICOs. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained herein. As of the date this article was written, the author owns small amounts of bitcoin. It is unclear whether he owns other bitcoin forks.

Warning! This user is on my black list, likely as a known plagiarist, spammer or ID thief. Please be cautious with this post!

To get off this list, please chat with us in the #steemitabuse-appeals channel in steemit.chat.