The dominance of bitcoin (or any cryptocurrency) is simply the percentage of its market capitalization value relative to the total market capitalization. For example, this Wednesday, the capitalization value of bitcoin, at 8 pm, was $ 110.28 billion, while the market capitalization value was $ 206.52 billion. When calculating the percentage, product of the division of the first figure between the second, the value of the dominance of bitcoin was obtained for this Wednesday: 53.4%.

When bitcoin was created, its capitalization value was the same as the total market, 100% dominance, since there were no other cryptocurrencies. When other assets began to be created, the dominance began to decrease, although the market capitalization value of these currencies remained very low.

For example, if the list of cryptocurrencies at the end of April 2013 - when the first data of that market began to be recorded - there were only seven cryptocurrencies, Litecoin was the most prominent after bitcoin. In a total market of $ 1.6 billion, the capitalization of bitcoin was $ 1.5 billion, or 93.75% dominance, followed by Litecoin with 4.65%, while the remaining five only represented 1, 4% .

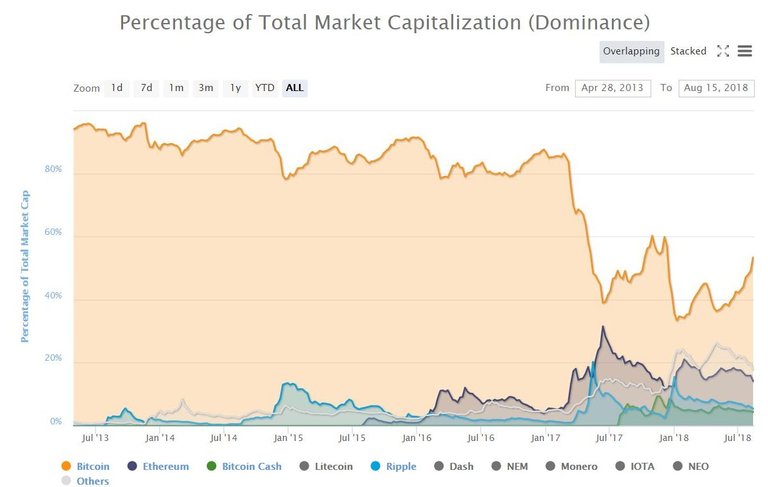

Dominance of the main cryptocurrencies, from April 28, 2013 to the present. Source: CoinMarketCap.

As shown in the graph, those high percentages of dominance for bitcoin were maintained for four years, until March 2017. The appearance of Ripple in July 2013 began to affect Bitcoin's domain a bit more, but it rarely fell 80% in that period. On December 29, 2014 was one of those times, when Ripple reaches 13.6% dominance and bitcoin drops to 78.6%. The altcoins achieved that day exceed 20% of the market.

With the appearance of Ethereum in mid-2015 a container of weight arrives to reinforce the altcoins and, when the bitcoin begins its biggest boom in 2017 and drags the rest of the market in that rise, the most favored of the altcoins, with respect to the dominance, are Ripple and Ethereum, which managed to accumulate 43% of the market on May 16 to give the predominance to the altcoins for the first time. That day the dominance of bitcoin reached 49% and down to 39% in June, when Ethereum records its record value in dominance (32%).

When in the second week of January the market reaches its historical maximum, above $ 800 billion, the dominance of bitcoin recorded its historical minimum, 32.6%, but as soon as the market decline begins, the opposite occurs: the bitcoin begins to grow in dominance, except for a blip between April and June clearly due to the bulk of the altcoins that do not make up the club of the notables, the category "other" that, as seen, achieved its maximum of 26% in that period After this, the bitcoin not only recovers its growth, but again managed to exceed 50%, 15 months after having lost that dominance.

It is important to note that the growth of the dominance of bitcoin in 2018 has occurred in the middle of a market decline. This dominance has caused some decoupling of the bitcoin from the rest of the market, both during the periods of low and in the periods of rise. For example, in times of rise, altcoins do not rise in the same proportion, and in periods of depression, bitcoin decreases more slowly than the rest of the market.

Did you enjoy reading this article?

Congratulations @jhonsonagc! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!