The past few days have been tough for bitcoin investors. The total cryptocurrency market cap fell by $80 billion last week, not long after recording its all time high during early September. With the bitcoin-US dollar exchange rate falling below $3,000, people have started to become restless and worrisome. These numbers can seem like the start of a dreadful era for those who aren’t familiar with the dynamics of the market.

What should investors do now?

First things first. Avoid making hasty decisions at all costs. Even though investment markets are time sensitive, it is vital that you think your decisions through before executing them.

You can either hodl or buy. The decision totally depends on your level of risk tolerance and the behavior of the market.

Therefore, the best way to deal with this flash crash is by exploiting it as an opportunity to learn more about the market. If you are a crypto investor trying to decide on your next move, here are a few things to keep in mind.

What caused this sudden crash in crypto?

There is no right answer to this. No one really understands why this massive drop took place. It was sudden and unexpected. However, there are several speculations about possible causation factors and events that may have lead to it.

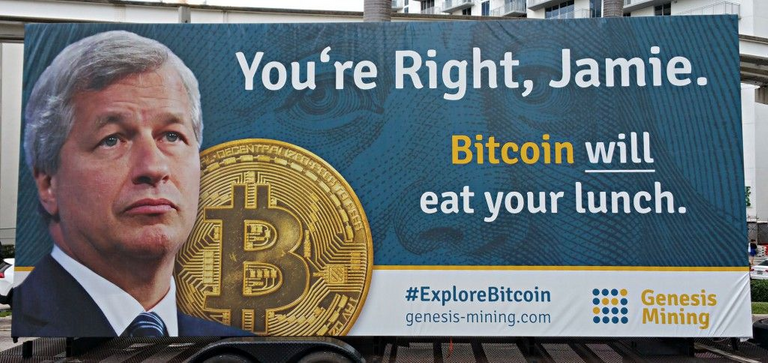

One of it is JP Morgan CEO, Jamie Dimon’s attack on bitcoin. He claimed that bitcoin is a fraud that will eventually blow up. He seemed convinced that the bitcoin community will completely close down before long.

This claim was made just before the plunge in the market took place. However, such blows aren’t new to the bitcoin investors and sellers. A number of investment banks have been calling bitcoin a scam since its very inception, despite its substantial growth in term of success, popularity, and evident use cases.

Another speculated reason for the plunge is the government regulations put forward by China with regards to bitcoin. News of the ban on bitcoin exchanges in China has been making its way through the industry. The chance of this news actually becoming true is quite high since the country also declared ICOs to be illegal earlier this month.

Regardless of why this mammoth plunge took place, it is important to know what exactly to do and what to avoid during this crisis.

Don’t hesitate to skim profits when you can

The value of cryptocurrency grows exponentially from year to year. This is exactly why digital currencies are gaining fast popularity. An investment you made five years ago can be more than ten times its original value today. However, in the case of a flash crash, there is always the possibility that you lose out, if all of your money is in crypto.

Therefore, it is important to sell off a fraction of your tokens when the time is right to ensure that you have gained some return on your original investment. This will give you a sense of reassurance about the unpredictable nature of the crypto market. Allocate an amount of money that you can afford to put at risk and keep it in the form of crypto tokens. Trade off the rest for fiat to put back in during the next dips. This way you allocate the two portions based on the level or risk that you are willing to take.

This, however, needs to be done before the market crashes. It is more of a method of mitigation rather than recovery.

HODL. Do not panic sell!

Referred by the industry as HODL, this strategy simply tells you to hold on to the cryptocurrencies that you have bought for a decent amount of time. Don’t let the fluctuations scare you. You may always feel like that it is better to trade off your tokens in return for cash before things worsen.

This notion can be further fuelled by the different opinions put forward by the market.

For instance, as previously mentioned, JP Morgan CEO, Jamie Dimon’s recently expressed his lack of faith in bitcoin. Does this mean that you have to sell your digital currencies right away and move towards traditional investment methods?

Not really. Don’t base your decision to sell on what others have to say. Chances are, those encouraging others to sell are probably on the lookout to buy bitcoin at record low rates.

Therefore, make sure you wait the right amount of time before selling your tokens.

Make the right investment choices. Coins with strong use cases are always better than speculative buys.

When investing on cryptocurrency it is vital to choose coins that have strong use cases and projects with multiple strengths. Startups such as Soma are always better to invest on since they use exclusive community tokens for transactions whilst having an extremely sellable product. Soma operates on blockchain technology with a solid business model synonymous to eBay and Amazon. This model has been proved to be successful for years, giving Soma a high chance of surviving fluctuations of the crypto market.

Hirematch is yet another strong project with a promising future. It uses a digital currency with a firm foundation to connect employers with employees. A number of different stakeholders participate in the transactions as agents who bridge the two segments together.

Buy the dip for better returns. But buy the dip with care.This strategy is one that comes with risk. However, it can also lead to extremely high returns. Experience is key to executing this strategy well. An investor should be familiar with the market to correctly identify a dip when it occurs. Investing on the dip becomes worthless if global trends reverse.

Therefore, don’t always buy tokens the moment a market crash takes places. Evaluate the potential direction of the market and make your decision accordingly.

Conclusion - Learn to play the crypto game the right way to make the most of it

Whether another flash crash takes place or the market changes in your favour, it is crucial that you learn how to observe and handle this evolving industry. Digital currencies can be highly profitable investments if you go about it the right way!

This information comes from Joaquim Miro, crypto enthusiast and marketing director at MLG Blockchain Consulting. If you enjoyed the article please follow my channel for up to date information on upcoming crypto trends, ICOs and underlying trends.

this post @jmiro1 - could not agree more - upvoted and followed.

People will act too hastily and sell and be put of cryptos for a long time but I am almost certain that they will soon regret it. Cryptos are still in their infancy and have to mature!

Follow me if you are interested in crypto news and honest opinions!

Alex

Play the game for more than you can afford to lose... only then will you learn the game.

- Winston Churchill

Congratulations @jmiro1! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard:

Congratulations @jmiro1! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!