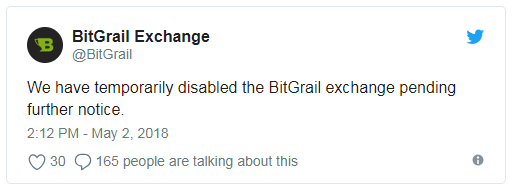

Another story, eerily reminiscent of the woes investors who lost funds in the famed BitConnect, Cryptsy and Kraken “exit scams” and hacks have come to fear, BitGrail attempted to re-open operations on May 2nd but was forced to close down indefinitely.

This is on account of a “Cease and Desist” notice cum “precautionary suspension request” made by the Bonelli law office on behalf of a client, in a court in Florence, Italy. Investors and customers had greeted the news of BitGrails reopening with excitement after close to a two-month shutdown following what has come to be known as the “BitGrail scam-hack”.

Firano "the bomber" Franciso - BitGrail Founder

In a dramatic chain of events on Twitter, the company announced it was opening for business only to announce that it would be closing indefinitely, at least, until a decision is made by the courts in Florence, Italy , all in the space of three hours.

And then a few hours later:

Further deliberations are scheduled for June 16, 2018.

Investors are particularly livid about the situation; while some have found some comic relief in it. However, the big question of happens to investors who lost money in what is shaping up to be a hoax-hack is still unanswered.

From our own preliminary investigation, no double spending was detected on the ledger and we have no reason to believe the loss was due to an issue in the Nano protocol. The problems appear to be related to BitGrail’s software.

A Recap of Events Leading to the Present

On the 8th of February, 2018, following the announcement of a major security breach at BitGrail, an obscure Italian Exchanger, the cryptocurrency and blockchain world was treated to yet another instance of a security breach with far-reaching consequences: more than $175 million worth of cryptocurrency, majorly of the Nano (XRB) token, formerly known as Raiblocks, stolen, according to Fortune.

A lot has happened since the hack was announced, but the major questions and counter-accusations of negligence on both the Nano team and Francisco “the bomber” Firano, 31, and founder of the exchange are still unanswered.

For one, investigations carried out by the Nano team allegedly revealed that a huge chunk of the stolen tokens had been moved as far back as October 2017 according to a statement it released: “From our own preliminary investigation, no double spending was detected on the ledger and we have no reason to believe the loss was due to an issue in the Nano protocol. The problems appear to be related to BitGrail’s software,” the team stated.

Many observers are of the opinion that there might not have been a hack and that “Firano concocted the story of a hack in order to remove the spotlight on himself.” Yet many others claimed that the exchanger had personally mismanaged funds in its repository and had paid old customers out of the funds of new customers on its platform.

Nano and team, in their action to introduce XRB to a wide market of investors, thoughtlessly made investors to open accounts and place their assets with an unknown and severely distressed, Italian cryptocurrency.

The Nano team has not been absolved of wrongdoing by its investors, either. One such investor brought, alongside the law firm of Silver Miller Law, a federal class-action lawsuit in the state of New York which alleges that, “Nano and team, in their action to introduce XRB to a wide market of investors, thoughtlessly made investors to open accounts and place their assets with an unknown and severely distressed, Italian cryptocurrency exchange, BitGrail, where around $170 million of the investors’ XRB allegedly “disappeared” in February 2018.

What Happens Next?

No one knows at this time. It is highly unlikely, going by precedents, that investors will receive their money back because cryptocurrency funds are not backed by the traditional security which the FDIC avails on traditional monetary instruments. Whatever happens, the likelihood of “the bomber” being held accountable for client’s losses increases by the day as audits have noticed incriminating trails of funds into his wallets from the period leading up to the alleged hack to the present day, and they are quite confident of making Firano relinquish control of those funds.

Nano market cap, at the time of this report, saw a positive and upward tick in its prices, closing at $8.62 USD.

This article was written by Ifeanyi N, a freelance blockchain writer from Upwork.com. Click here to view his profile.

Congratulations @kopt33! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!