Over the past 15 years, collectible cars have meaningfully outstripped many conventional indices like Dow Jones and S&P 500. However, not everyone can make use of this investment opportunity. Only elite investors are able to invest in collectible cars. This limitation is due to some barriers to entry to the markets. The barriers can be the high cost of selling rare cars and complicated paperwork and administration that need to be proceeded. Considering this problem. CurioInvest is present to make it possible for everyone to take part in investing in limited edition collectable vehicles. CurioInvest is launching a blockchain based digital platform which enable investors to buy tokens directly backed by rare collectible vehicles.

Problems Addressed By CurioInvest

Investing in collectible vehicles allow the investor to get almost 300% profit. The asset class is much more profitable than other alternative investments such as coins, watches, jewelry, and wine. However, the barriers has restricted lots of people to entry to the market. Only a small group of elite investors having adequate resources who can enter the market. The first problem commonly faced by investors is restricted access. Rare collectable cars are produced in limited numbers and these cars can only be purchased by those who are eligible. In order to be eligible, prospective buyers should prove that they have multiple other vehicles of the same brand. Other eligible buyers are those who belong to members of a club or vintage fan group.

The second problem is due to the high capital requirement that not everyone can afford. Everyone knows and realizes that valuable collectable cars have expensive initial purchase prices. But that’s not the only price buyers should pay. After it is purchased, the car needs to be maintained and insured. It of course requires additional costs before they gain the profit. The third problem has something to do with expertise. Specialist knowledge from an expert mechanic is required to assess the provenance and value of a vehicle especially if it is a secondhand vehicle. Dealing with the documents’ verification is not easy as it needs to be carried out in a complex procedure.

In addition to the aforesaid problems above, there are still other problems that contribute to the barriers to entry to the market. The problems are high transaction costs and limited diversification. Expensive transaction costs occur as a result of the lack of transparency and illiquidity. Meanwhile, limited diversification causes greater risk for both buyer and seller.

Solutions offered by CurioInvest

In order to address the aforementioned problems, CurioInvest uses tokenization to alleviate the barriers faced in investing in collectable cars. Asset tokenization is a process where a digital asset is backed by the car as a physical asset. Asset tokenization can address the problems dealing with liquidity and diversification. Besides, it requires lower costs and less bureaucracy. Moreover, the transaction can be carried out faster. By tokenizing investment-grade cars, it is highly possible for thousands of new investors to open up the collectable car market. In other words, CurioInvest enables them to invest in and get profit from the market. It is in line with the goal of CurioInvest that is to become the best platform in the world for everyone to purchase and trade collectable security tokens. With the proposed solutions, collectable cars market is opened up for everyone, not only limited to elite investors.

Core Team and Advisory Board

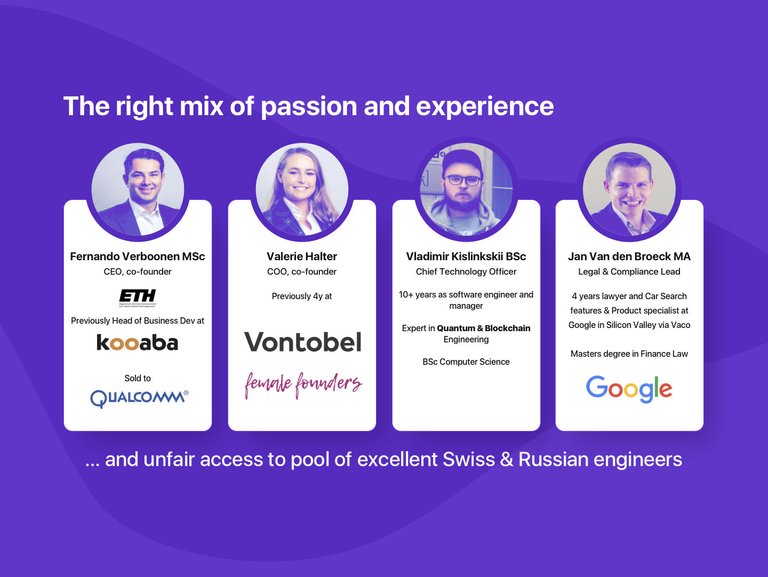

The core team of this project consists of four members. The first one is Fernando Verboonen who is the founder and CEO. Before handling the project, he had already had some experiences in the field. He began his career at Mercedes Benz. He graduated from ETH Zurich. He was the CEO at Mercuria Helvetica. It is a Fintech firm dealing with exotic cars investment. He also participated in the exit of Swiss portfolio firm CVC. Furthermore, Fernando, he had handled a number of venture capital projects specializing in software at Siemens VC. The mix of passion and experience among the core members ensure the success of the project.

The other CEO of CurioInvest is Valerie Halter who also serves as the cofounder. She is very passionate about cars. She started her career in a banking sector. However, due to her passion for cars, she decided to work in the fintech sector. She has worked at Vontobel and Mercuria for more than 8 years. There is also Jan Van den Broeck, who is in charge in ensuring regulatory compliance so that all investors can have a smooth onboarding process. He is given the responsibility to provide independent legal advice because of his extensive experience in the field and his education background in financial law. He is known as one of the consultant of car search features at Google in San Francisco. Before he moved to Silicon Valley, he worked as an in-house lawyer at a corporation law department in Belgium. The other member of CurioInvest core team is Vladimir Kislinkskii, the CTO. He is now focusing on the DAICO development for CurioInvest. Before participating in CurioInvest, he had led some tech development for lots of DLT projects.

In addition to the experienced core team, CurioInvest has a solid advisory board consisting of six exceedingly successful businessmen and industry experts. Tom Frey is one of them. He is the expert of civil procedural law focusing on litigation proceedings and legal matters concerning on blockchain technology. Other members of the board include Matthias Niedermuller, an expert of security law focusing on crypto exchange, Herald Steiger, a collector of exotic cars, Frank Rickert, the owner of the greatest gar garages in Europe, and Antoine Verdon, who is known as a highly successful entrepreneur.

CurioInvest’s Partners

CurioInvest has partnered with numerous firms and suppliers such as Mechatronik Fahrzeug, Mercuria Helvetica, and RABAG. Mechatronic and RABAG are firms providing an extensive range of services in restoration, storage, and maintenance of collectables. Meanwhile, Mercuria Helvetica provides services in the first-rate car sector particularly in advising clients on how to invest in premium cars effectively.

Ann Thread: https://bitcointalk.org/index.php?topic=5175820

Website: https://curioinvest.com/

White Paper: https://docs.google.com/document/d/16RBxiuPNhG7DkvTx9odzcQvPc9EdTKnmKaohURxrLTA/edit?usp=sharing

Social Media:

https://twitter.com/curio_invest

https://www.facebook.com/Curioinvest/

https://t.me/curiocarQA

https://www.linkedin.com/company/curio-capital-ag/

https://www.instagram.com/curioinvest/

Posted by kurniawan05

https://bitcointalk.org/index.php?action=profile;u=1187741

ETH address: 0x3946bc29197BF793CB796243109b39b019c3fC00