There are a lot of exchanges these days and every time we look, their's another group turned up an "exchange". The problem is most of them lack the technical backend to support the kind of major transactions that are required to truely perform at a level that industrial institutions can consider for major volume transactions. With the launch of BitMAX, the team hopes to be able to provide an avenue toward true institutional trading volume at rates unheard of in the crypto industry.

Launching a new exchange in 2018 requires more than just a solid team, it requires things like enhanced support for the FIX protocol and an API designed to interface with various transaction types utilized by professional traders like GTT, GTC, FOK and even ICO's all tailored to handle over 200,000 transactions per second. Even the most demanding of traders will be able to find a hole in a platform capable of handling whatever trade volume they can imagine generating, even at an institutional level. It requires a team of professional FinTech engineers and entrepreneurs willing to put in the time to see a business develop from the ground up. BitMAX's team with more than 10 years of professional experience is doing just that.

The BitMAX team put major thought into the performance demands, but have also put a great deal of thought into setting their platform ahead of the rest. As I've mentioned CryptoExchanges are a dime a dozen lately, and just offering unmatched performance is only part of what BitMAX's team is looking to offer traders and investors alike. With the issuance of the BMAX token as the primary unit of exchange on the platform, they are creating a new cryptocurrency ecosystem that they can use to leverage their platform to both reward and incentivize usage.

Thing's for examples like withdrawals and listing fees can be based in BMAX tokens, so that there is a strong demand for the BMAX token amongst new token listers, as well as general traders as the team offers more and more ways to use the BMAX tokens to streamline the functionality of the system. Having a demand ensures that the BMAX tokens traded on the platform will have a solid and consistent, if not increasing value as the platform gains momentum with investors. Incentivizing users to continue to consume and use the BMAX tokens through preferential transaction fees and listing fees are just the initial ways that the team plan to put a solid value on their internal token.

After creating demand for their internal cryptocurrency, the next step is allowing a realistic way for users to acquire the BMAX. The teams answer to that is a unique Trading/Mining mechanism that rewards people who are active on the trading platform with an equal amount of BMAX as a reward for the volume of trades that they completed on a daily basis. This closed loop ecosystem of paying dedicated traders with BMAX, but also allowing traders to use BMAX to pay for their trading, allows for an effective way for miners to trade for near 0 cost, something not possible in other exchanges.

High-Performance backend API performance, along with ways to minimize transactional costs, to me, spells a huge possibility for institutional day traders to really tie into the BMAX platform and not just make huge gains potential on the open crypto market but on the BMAX token itself. The team's dedication to seeing the BMAX token, as well as the exchange, grow in value to its users is pretty obvious with their decision to distribute as much as 80% of the platform's transaction fee revenue to members that hold their BMAX. Traders and investors will have to decide if they want to hold BMAX as it's price rises, or use the coin to trade for minimal fees, or perhaps a combination of the 2 along with giving token and coin feedback to the platform to earn a chunk of the 80% transactional fee payouts the team is offering to help with growth.

Lastly one of the most important things' I discovered in my deep dive into the BitMAX platform and what I think is one of the biggest selling points, is that not only will BMAX be a form of listing fee, but at the same time investors and holders of BMAX will be able to leverage their BMAX holdings to cast deciding votes on just what coins and tokens get listed on the BitMAX exchange, giving a huge level of influence to investors across the social community that surrounds the exchange itself. Traders that trade and earn BMAX, can take that opportunity to grow the BitMAX exchange and add coins they want to be able to trade with over time.

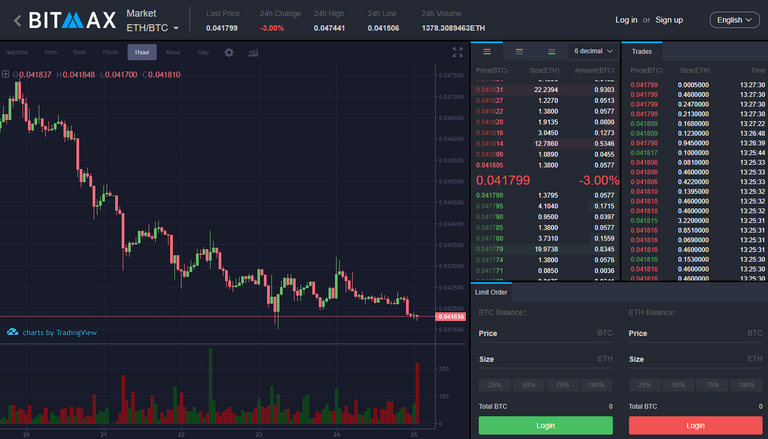

For more information on the platform and how it differs from many other Centralized Exchanges, you should definitly take a look at the team's whitepaper or perhaps take a look at the CryptoCurrency Exchange itself.